What is P&L statement?

Statement of profit and loss captures the revenues and expenses a company has incurred from both operating and non-operating activities over a specific period of time, say a quarter or a given financial year as specified in the heading. [caption id="attachment_2582" align="aligncenter" width="655"]| Jan | Feb | Mar | |

|---|---|---|---|

| Goods sold to XYZ (in Rs.) | 130 | 140 | 150 |

| Cost of computer parts procured from LMN (in Rs.) | 60 | 70 | 80 |

| Payments made by XYZ to ABC (in Rs.) | 0 | 0 | 420 |

| Payments made by ABC to LMN (in Rs.) | 0 | 0 | 210 |

| Jan | Feb | Mar | |

|---|---|---|---|

| Revenue (in Rs.) | 130 | 140 | 150 |

| Costs (in Rs.) | 60 | 70 | 80 |

| Profits (in Rs.) | 70 | 70 | 70 |

| Jan | Feb | Mar | |

|---|---|---|---|

| Revenue (in Rs.) | 0 | 0 | 420 |

| Costs (in Rs.) | 0 | 0 | 210 |

| Profits (in Rs.) | 0 | 0 | 210 |

Gross Profit - P&L Statement[/caption]

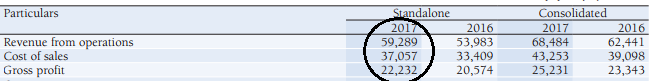

For year ended March 31, 2017 for Infosys:

Net revenue = Rs. 59,289Cr

Cost of sales (COGS) = Rs. 37,057Cr

Gross Profit = 59,289 - 37,057 = Rs.22,232Cr

Other Income: This head typically includes income from ancillary activities of the company (Computer assembly company selling mouse pads) or one time profits that may be incurred due to sale of assets, etc.

Operating and Direct Expenses: This represents expenses beyond procurement of goods such as Selling Expenses (Commissions given to agents selling products), Packaging Costs, Transport Costs, etc.

General and Administrative Expenses (G&A) : These include overheads such as Office Rent, Electricity, Water Charges, Maintenance Charges, Municipal Charges, Facilities for employees such as Tea, Coffee, etc.

Employee Benefit Expenses: This includes expenses incurred for wages, bonuses and retirement benefits of company employees.

Other Expenses: Other expenses of a recurring nature such as Research & Development Expenses etc.

The total expenses (operational) of the company are calculated by adding all the above expense heads to COGS

Operating Profit / Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): EBITDA is calculated by adding Other Income to Gross Profit and deducting Operating, Direct, G&A, Employee, Other expenses. EBITDA is a measure that helps analysts understand the profitability of a company from core activities of the business.

Depreciation and Amortization: These expenses typically represent the charge of using assets of the company such as tables and fixtures, equipment, etc. For example – If the company has purchased a table for Rs. 2400 meant to be used for 2 years, then the monthly depreciation charge for the table would be 2400/24 = Rs. 100

Profits before Interest and Taxes (PBIT): EBITDA less Depreciation and amortization gives PBIT

Interest Expenses: Interest expense incurred on bank loans, credit facilities, etc. Since nonpayment of interest can result in litigation from banks seeking closure of company or liquidation of assets, investors analyze the Interest Coverage Ratio which is the Ratio of PBIT / Interest to calculate ability of company to service interest payments

Profit Before Taxes (PBT): This is calculated by deducting interest and depreciation/amortization expenses from EBITDA. It helps investors analyse whether company is profitable as a whole

Taxes: This represents taxes levied by the government on profits of the company. This does not include indirect taxes levied by government such as GST, Service Tax, etc.

Profit After Tax (PAT): This represents the final profit that accrues to shareholders. Calculated by deducting taxes from PBT. PAT divided by the number of shares outstanding for the company provides the basic Earnings Per Share (Basic EPS) which is the profit available to each shareholder. Profits divided by the outstanding shares plus convertible debentures (loans which can be converted to equity) plus employee stock options provides the Diluted Earnings Per Share (Diluted EPS)

For Infosys:

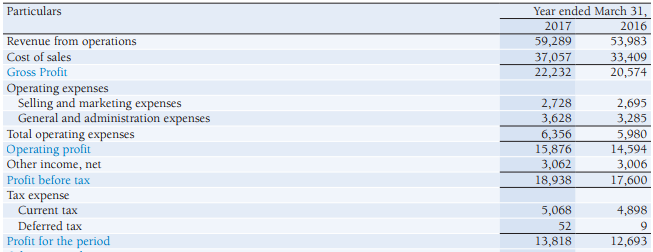

[caption id="attachment_2584" align="aligncenter" width="653"]

Gross Profit - P&L Statement[/caption]

For year ended March 31, 2017 for Infosys:

Net revenue = Rs. 59,289Cr

Cost of sales (COGS) = Rs. 37,057Cr

Gross Profit = 59,289 - 37,057 = Rs.22,232Cr

Other Income: This head typically includes income from ancillary activities of the company (Computer assembly company selling mouse pads) or one time profits that may be incurred due to sale of assets, etc.

Operating and Direct Expenses: This represents expenses beyond procurement of goods such as Selling Expenses (Commissions given to agents selling products), Packaging Costs, Transport Costs, etc.

General and Administrative Expenses (G&A) : These include overheads such as Office Rent, Electricity, Water Charges, Maintenance Charges, Municipal Charges, Facilities for employees such as Tea, Coffee, etc.

Employee Benefit Expenses: This includes expenses incurred for wages, bonuses and retirement benefits of company employees.

Other Expenses: Other expenses of a recurring nature such as Research & Development Expenses etc.

The total expenses (operational) of the company are calculated by adding all the above expense heads to COGS

Operating Profit / Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): EBITDA is calculated by adding Other Income to Gross Profit and deducting Operating, Direct, G&A, Employee, Other expenses. EBITDA is a measure that helps analysts understand the profitability of a company from core activities of the business.

Depreciation and Amortization: These expenses typically represent the charge of using assets of the company such as tables and fixtures, equipment, etc. For example – If the company has purchased a table for Rs. 2400 meant to be used for 2 years, then the monthly depreciation charge for the table would be 2400/24 = Rs. 100

Profits before Interest and Taxes (PBIT): EBITDA less Depreciation and amortization gives PBIT

Interest Expenses: Interest expense incurred on bank loans, credit facilities, etc. Since nonpayment of interest can result in litigation from banks seeking closure of company or liquidation of assets, investors analyze the Interest Coverage Ratio which is the Ratio of PBIT / Interest to calculate ability of company to service interest payments

Profit Before Taxes (PBT): This is calculated by deducting interest and depreciation/amortization expenses from EBITDA. It helps investors analyse whether company is profitable as a whole

Taxes: This represents taxes levied by the government on profits of the company. This does not include indirect taxes levied by government such as GST, Service Tax, etc.

Profit After Tax (PAT): This represents the final profit that accrues to shareholders. Calculated by deducting taxes from PBT. PAT divided by the number of shares outstanding for the company provides the basic Earnings Per Share (Basic EPS) which is the profit available to each shareholder. Profits divided by the outstanding shares plus convertible debentures (loans which can be converted to equity) plus employee stock options provides the Diluted Earnings Per Share (Diluted EPS)

For Infosys:

[caption id="attachment_2584" align="aligncenter" width="653"] Profit and Loss statement - Sample - Infosys[/caption]

Interpreting the P&L Statement

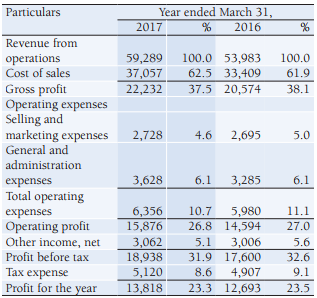

Smart investors interpret financial statements through Common Size Analysis. In Common Size Analysis, each line item on the P&L is converted to a % of revenue. This allows investors to compare results of companies within the same industry without considering their size, as shown below for Infosys:

[caption id="attachment_2585" align="aligncenter" width="317"]

Profit and Loss statement - Sample - Infosys[/caption]

Interpreting the P&L Statement

Smart investors interpret financial statements through Common Size Analysis. In Common Size Analysis, each line item on the P&L is converted to a % of revenue. This allows investors to compare results of companies within the same industry without considering their size, as shown below for Infosys:

[caption id="attachment_2585" align="aligncenter" width="317"] Common Size P&L Analysis[/caption]

P&Ls should never be analyzed in isolation. To better understand the nature and quality of a business, investors should do a time series as well as a cross sectional analysis of the statement.

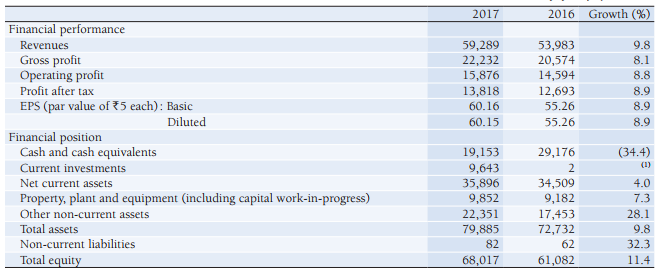

Time Series analysis entails analysis of the business over multiple accounting periods. This could help identify trends such as say reducing COGS on account of strong R&D or an increase in employee expenses due to increased unionization. For Infosys, year -on-year time series for two years:

[caption id="attachment_2586" align="aligncenter" width="656"]

Common Size P&L Analysis[/caption]

P&Ls should never be analyzed in isolation. To better understand the nature and quality of a business, investors should do a time series as well as a cross sectional analysis of the statement.

Time Series analysis entails analysis of the business over multiple accounting periods. This could help identify trends such as say reducing COGS on account of strong R&D or an increase in employee expenses due to increased unionization. For Infosys, year -on-year time series for two years:

[caption id="attachment_2586" align="aligncenter" width="656"] Time Series P&L Analysis[/caption]

Cross Sectional analysis entails analysis of a business vis-à-vis its competitors. This could help analysts identify stronger companies, for example a company with a well-integrated supply chain and a strong technology team, could have a higher EBITDA margin. It could also help identify whether a particular trend is limited to a company or applies to the entire sector. For example – If time series analysis reveals an increased tax burden, is it due to an overall tax incidence increase for the sector or it could be on account of the involvement of the company in a tax litigation.

Red Flags:

Good, stable businesses should display a consistency in their P&L statements with respect to various income and expense heads. Spikes in revenues and costs should be analyzed to check whether these are one-off instances or whether they reflect the underlying change in the business conditions.

Similarly, heads such as Other Income, Non-recurring / Exceptional Income should be analyzed to see if these are positive for the company in the long run. For example – A company may sell a highly profitable business or a valuable asset which could have negative repercussions on future profitability. Alternatively, exceptional income could arise from items such as a waiver of future tax repayments, etc.

Heads such as Write Offs should also be checked to see whether they reflect any anomalies. For example – Extremely large write offs could be a sign of bad investments/loans provided by the company, bad customers who have not paid their dues on time, etc.

Conclusion: The primary objective of any business is to profitably grow its revenues. The best way to check how successful a company is at this is to read their P&L statement. A simple analysis of P&L will reveal not just the revenue growth but also what makes the company profitable. Both these factors play an important role in deciding whether or not to invest in a company.

Time Series P&L Analysis[/caption]

Cross Sectional analysis entails analysis of a business vis-à-vis its competitors. This could help analysts identify stronger companies, for example a company with a well-integrated supply chain and a strong technology team, could have a higher EBITDA margin. It could also help identify whether a particular trend is limited to a company or applies to the entire sector. For example – If time series analysis reveals an increased tax burden, is it due to an overall tax incidence increase for the sector or it could be on account of the involvement of the company in a tax litigation.

Red Flags:

Good, stable businesses should display a consistency in their P&L statements with respect to various income and expense heads. Spikes in revenues and costs should be analyzed to check whether these are one-off instances or whether they reflect the underlying change in the business conditions.

Similarly, heads such as Other Income, Non-recurring / Exceptional Income should be analyzed to see if these are positive for the company in the long run. For example – A company may sell a highly profitable business or a valuable asset which could have negative repercussions on future profitability. Alternatively, exceptional income could arise from items such as a waiver of future tax repayments, etc.

Heads such as Write Offs should also be checked to see whether they reflect any anomalies. For example – Extremely large write offs could be a sign of bad investments/loans provided by the company, bad customers who have not paid their dues on time, etc.

Conclusion: The primary objective of any business is to profitably grow its revenues. The best way to check how successful a company is at this is to read their P&L statement. A simple analysis of P&L will reveal not just the revenue growth but also what makes the company profitable. Both these factors play an important role in deciding whether or not to invest in a company.

Easy & quick

Easy & quick

Leave A Comment?