In this article, we will discuss

- What are Strategy Legs In A Short Call Strategy?

- What will be the Payoff Of The Strategy?

- Who can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Understanding Strategy Greeks

- Things to Keep In Mind

- Conclusion

Options trading is a popular way of speculating on the price movements of various assets, such as stocks, commodities, currencies, etc. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) before or on a certain date (expiration date). The seller of the option, on the other hand, has the obligation to fulfil the contract if the buyer exercises it.

One of the advantages of options trading is that it allows traders to create various strategies that can suit different market conditions and risk preferences. One of these strategies is the short call strategy.

What are Strategy Legs In A Short Call Strategy?

In a short call strategy, you sell one call option. The call option can be in the money, at the money or out of the money. An in the money call option has a strike price lower than the current price of the underlying asset, an at the money call option has a strike price equal to the current price of the underlying asset, and an out of the money call option has a strike price higher than the current price of the underlying asset.

By selling a call option, you are essentially betting that the price of the underlying asset will not rise above the strike price before the expiration date. You collect the premium from the buyer of the option as your income. However, if the price of the underlying asset rises above the strike price, you will have to deliver the underlying asset to the buyer at the strike price, which will result in a loss for you.

What will be the Payoff Of The Strategy?

Your maximum loss can be unlimited in this strategy. Your breakeven will be strike price plus premium received on selling the call option. You will be profitable if the price of underlying stays below the breakeven on expiry date. As the price increases from the strike price, your profits will start decreasing but you will be in loss as the price starts to move in the upward direction from breakeven on expiry date.

Who can Deploy This Strategy?

This strategy can be deployed by veterans with a moderate approach as it requires high capital. Selling a call option is a risky strategy as it exposes you to unlimited losses if the price of the underlying asset rises significantly. Therefore, you need to have enough capital to cover the margin requirements and the potential losses. You also need to have a good understanding of the market conditions and the factors that affect the price of the option. This strategy is not suitable for beginners or conservative traders.

When Should This Strategy Be Deployed?

This strategy is deployed when you have identified a resistance level and you expect the underlying stock to stay below that resistance level. In this scenario, you can choose a strike price just above that resistance level and sell a call option. This way, you can earn the premium as long as the price of the stock does not break above the resistance level. You can also use this strategy when you have a neutral or slightly bearish outlook on the underlying stock and you want to generate some income from it.

Understanding Strategy Greeks

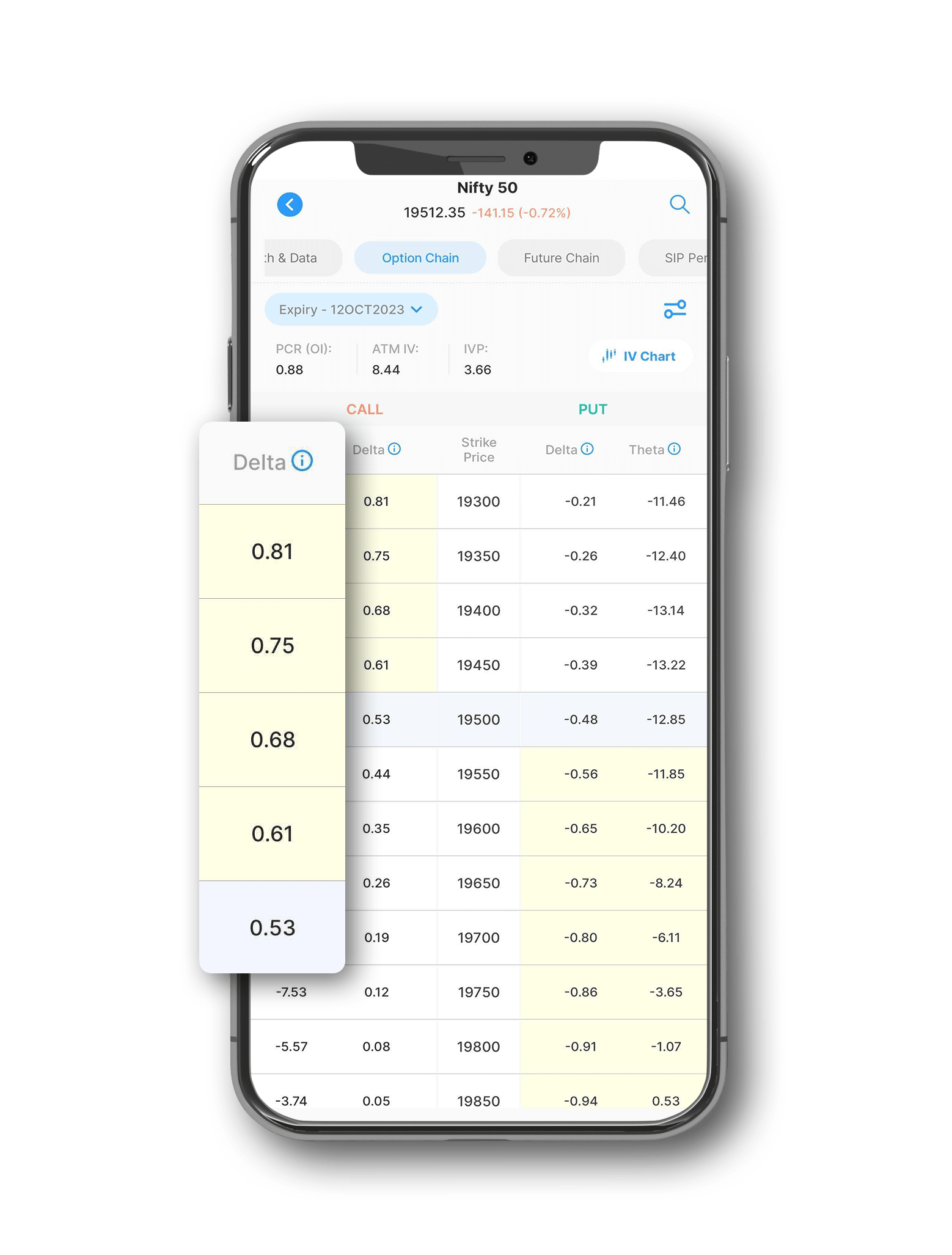

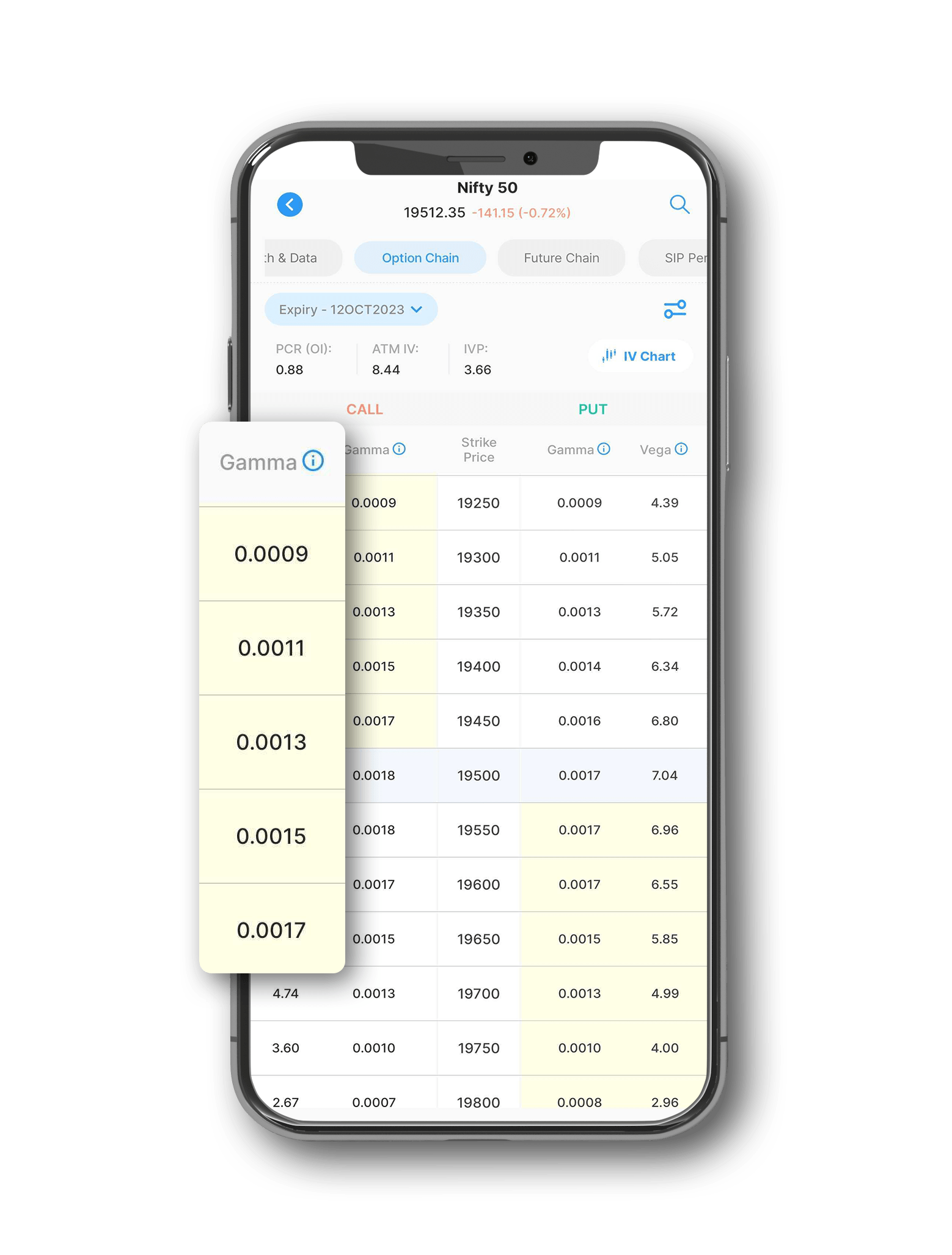

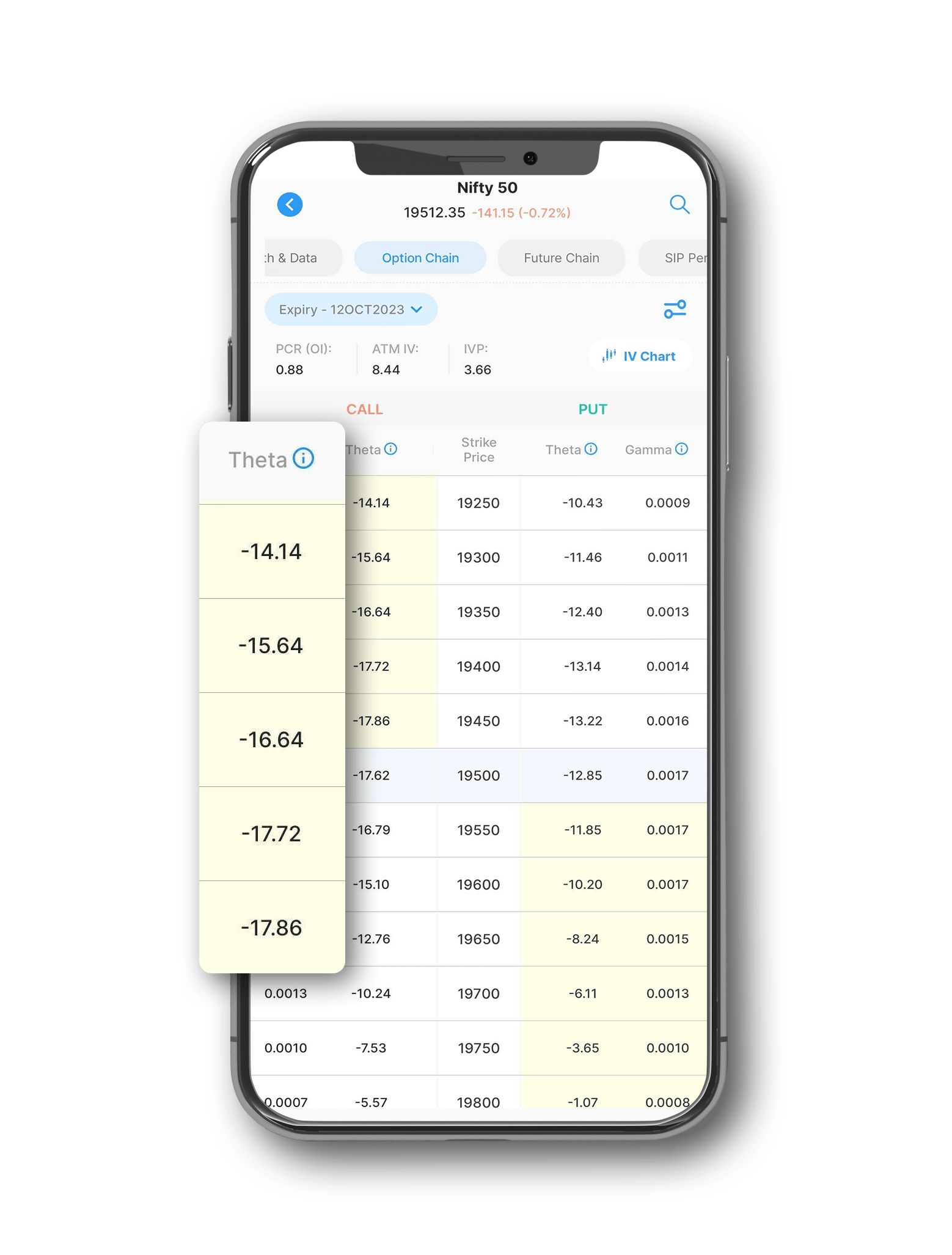

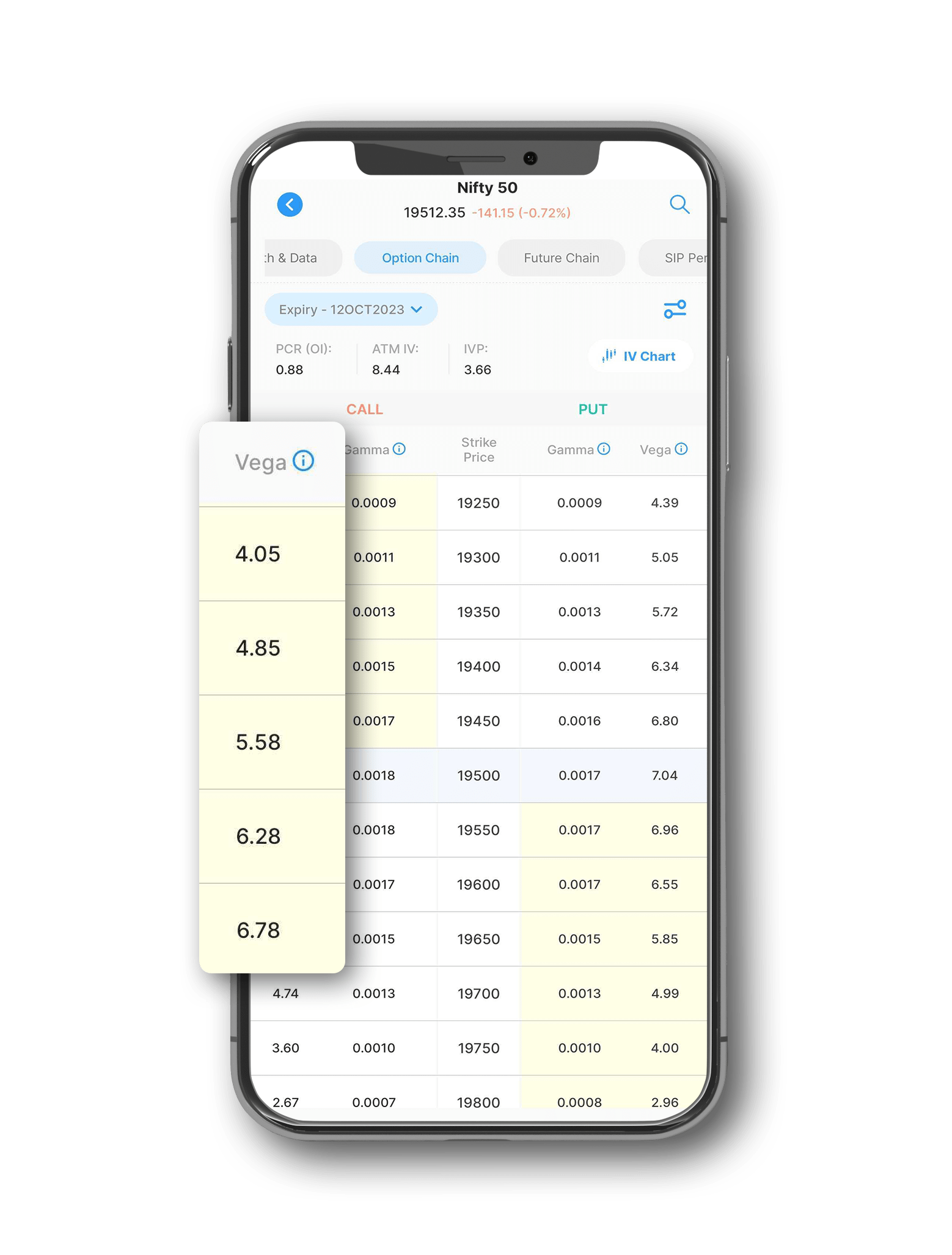

Strategy Greeks are the measures of the sensitivity of the option price to various factors, such as the price of the underlying asset, the time to expiration, the volatility of the underlying asset, the interest rate, etc. The most common strategy Greeks are delta, gamma, theta, vega and rho. Here is how they affect the short call strategy:

Delta measures the change in the option price for a unit change in the price of the underlying asset. For a short call strategy, delta is negative, meaning that the option price decreases as the price of the underlying asset increases. As the price of the underlying asset starts to move upwards, delta will increase your losses exponentially.

Gamma measures the change in the delta for a unit change in the price of the underlying asset. For a short call strategy, gamma is positive, meaning that the delta becomes more negative as the price of the underlying asset increases. This means that your losses will accelerate as the price of the underlying asset moves further away from the strike price.

Theta measures the change in the option price for a unit change in the time to expiration. For a short call strategy, theta is positive, meaning that the option price decreases as the time to expiration decreases. This is because the time value of the option erodes as the expiration date approaches. This is the only factor that works in your favour in this strategy. If the price does not move upwards, you will still make profits as the time passes due to the theta decay.

Vega measures the change in the option price for a unit change in the volatility of the underlying asset. Short options, whether calls or puts, incur losses when volatility goes up. Vega, a component of options, measures how their prices react to changes in volatility. It shows how sensitive an option's price is to volatility changes in the underlying asset.

Rho

Rho measures the change in the option price for a unit change in the interest rate. For a short call strategy, rho is negative, meaning that the option price decreases as the interest rate increases. This is because the higher the interest rate, the higher the opportunity cost of holding the underlying asset. This reduces the demand for the option and lowers the premium.

Things to Keep In Mind

Since this strategy involves risk of unlimited losses, you should have a predefined exit strategy. If the trade goes against your view, either you can maintain strict stop losses and cut the position or buy further out of the money call option to hedge yourself from the unlimited loss potential of this strategy. This is known as a short call spread strategy, which limits your losses but also reduces your profits.

This strategy can reward you better in a higher IV environment. IV stands for implied volatility, which is the market's expectation of the future volatility of the underlying asset. The higher the IV, the higher the premium you can collect by selling the option. In this scenario, while there's no inherent risk, traders can capitalise on significant gains.

Probability of profit can be very high in this strategy but if the stock price starts to move upwards sharply, the amount of losses can be very high. In other words, your strike rate (number of profitable trades out of total trades) will be high but your average loss (your average loss in the loss making trades) will also be very high. Therefore, you should be careful about your position size and risk management.

Conclusion

Short call strategy is a simple but risky option strategy that involves selling a call option and collecting the premium. It is suitable for veterans with a moderate approach and high capital. Options B.R.O. integrated into the Samco trading app, aids traders in selecting optimal options strategies aligned with their market outlook, risk tolerance, and return objectives. By conducting intricate mathematical analyses and evaluating numerous options contracts, including short call strategies, it furnishes recommendations for the top three strategies tailored to the trader's requirements. Additionally, it assesses market insights and Options Greeks to rate and rank each strategy effectively.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?