If you’ve ever been grocery shopping, then you are aware that everything comes with an expiry date. Green leafy vegetables expire within 1 day. Vegetables like tomatoes, brinjal remain fresh for 3-4 days. Onions and potatoes can remain fresh for months.

Debt funds behave in the same manner. The debt mutual fund universe can be roughly divided into:

If you’ve ever been grocery shopping, then you are aware that everything comes with an expiry date. Green leafy vegetables expire within 1 day. Vegetables like tomatoes, brinjal remain fresh for 3-4 days. Onions and potatoes can remain fresh for months.

Debt funds behave in the same manner. The debt mutual fund universe can be roughly divided into:

This article focuses on Short Term Debt Funds. We will understand everything about short term debt funds – It’s meaning, types, advantages and risks.

So, let us start with understanding what are short term debt funds?

This article focuses on Short Term Debt Funds. We will understand everything about short term debt funds – It’s meaning, types, advantages and risks.

So, let us start with understanding what are short term debt funds?

What are Short Term Debt Funds?

Short term debt funds are open-ended debt funds that invest in papers maturing between 1 day to 3 years. Maturity is nothing but an expiry date. Like green leafy vegetables, some short term fund papers expire within 1 day. While some are like your onions and potatoes, having a long maturity period. The goal of the fund manager is to generate superior returns by taking advantage of short-term changes in interest rates. Short term debt funds have become a popular alternative to bank fixed deposits. They offer superior returns, tax benefit and come with no lock-in period. [Read More: Mutual Funds Vs Bank FD] Short term debt funds are also known as short duration funds. They are in high demand during a rising interest rate scenario. But should investors invest in short term debt funds? Let us find out by understanding the advantages of short term debt funds.Advantages of Investing in Short Term Debt Funds

1. Perfect for 1-3 Years Investment Horizon: Short term debt funds are perfect for investors who have an investment horizon of 1-3 years. Short term funds help investors take advantage of short-term interest rate changes. Also, investors reduce the risk of a fund manager making poor interest rate calls (like in dynamic bond funds). 2. Helps in Portfolio Balancing: Short term debt funds can be a great alternative to balanced funds. Balanced funds are a mix of equity and debt. They carry an element of risk from the equity portion. So, when you invest in a balanced fund, you are only increasing your equity allocation and risk! A much better way to balance the portfolio is to invest in short term debt funds. These funds provide stability to the portfolio without the risk of equities. 3. Superior Tax Benefits: Another advantage of investing in short term debt funds is that they offer superior tax benefits. This is the reason why investors prefer short term debt funds over bank fixed deposits. Short term debt funds qualify for indexation if held for more than 3 years. No such facility is provided in a bank FD. In a bank FD, if you fall in the highest tax bracket, then you need to pay highest tax on FD. But in a short term bond fund, you can claim indexation and save taxes! 4. Flexibility in case of Emergency: Flexibility is a great advantage that sets short term debt funds aside from medium- and long-term debt funds. You can redeem from short term debt funds anytime without any exit load penalties. Exit load is a penalty that the fund house charges when you redeem from a fund before a specific time period. Some debt funds like credit risk debt funds have an exit load of up to 540 days! This stops you from using your own money during emergencies. Fortunately, short term debt funds have no exit load and you can redeem from the fund anytime. So, we agree that short term debt funds are a great investment option. But which type of short term debt fund should you invest in?What are the Types of Short Term Debt Funds?

Ideally any debt funds with papers maturing in less than 3 years is known as short term debt funds. But like your vegetables, even Short Term Debt Funds come with varying maturities. Short term debt funds are divided into various categories based on the maturity of its underlying papers. As discussed earlier, maturity is nothing but the expiry date of the underlying bonds. So, based on the maturity of the underlying papers, the various types of short term debt funds are:

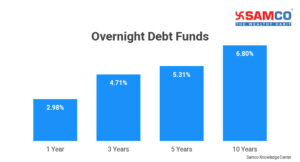

Overnight Debt Funds

Overnight debt funds are like the green leafy vegetables which expire within 1 day. Overnight debt funds invest in papers which mature in just 1 day. Typically, they invest in call money instruments. Call money instruments are used by banks for inter-bank lending. These papers are extremely safe but they carry very low rate of returns. Here is the performance of overnight debt funds in the last 10 years.

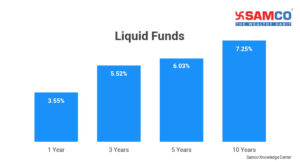

Liquid Funds

Liquid funds invest in papers which mature within 91 days. Liquid mutual funds invest in commercial papers, certificates of deposits, treasury bills. Mostly they invest in papers carrying AAA rating (highest stability) and hence are considered to be very safe. Liquid mutual funds are the perfect alternative to bank FDs. Liquid mutual funds have historically generated superior returns than bank FDs and overnight debt funds. [Read More: Best Liquid Mutual Funds for 2021]

[Read More: Best Liquid Mutual Funds for 2021]

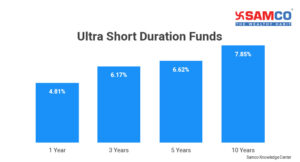

Ultra-Short Duration Fund

Ultra-short-term debt funds are open-ended debt funds which invest in papers maturing between 3 months to 6 months. Ultra-short-term funds face negligible interest rate risk since the holding tenure is very less. But since the maturity of the papers is higher, they do generate better returns than liquid and overnight funds.

Low-Duration Funds

Low Duration debt funds invest in papers which mature between 6 months to 1 year. These papers can be issued by private companies, public companies or the government. Because of this low duration debt funds which invest in AA and below rated papers carry higher credit risk.

Money Market Debt Funds

These are the allrounders of short term debt funds. They invest in papers which can have a maturity of 1 day or even 1 year. But not more than 1 year.Short Term Debt Fund

Short Term Debt Funds invest in papers with a maturity of less than 3 years. These funds are free to invest in debt papers issued by private and public companies. They are also free to invest in papers with different credit ratings. This is the main difference between short term bond funds and corporate bond funds. Corporate bond funds have to compulsorily invest 80% of their corpus in AAA rated papers.

Short term debt funds do not have such rules. The fund manager has the freedom to invest in papers with different credit ratings. But this is a risky proposition.

This brings us to the risks in short term debt funds.

This is the main difference between short term bond funds and corporate bond funds. Corporate bond funds have to compulsorily invest 80% of their corpus in AAA rated papers.

Short term debt funds do not have such rules. The fund manager has the freedom to invest in papers with different credit ratings. But this is a risky proposition.

This brings us to the risks in short term debt funds.

Risks in Short Term Debt Funds

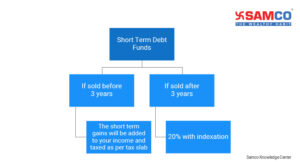

1. Credit Risk: Credit risk is when the borrower fails to repay the principal or interest amount. Short term bond funds have the freedom to invest in papers with different credit ratings. So, it is not compulsory that the fund manager will invest in only AAA rated (highly stable) papers. This increases the credit risk of the fund. For example: Aditya Birla Sun Life Short Term Fund has 16.59% exposure to AA rated papers. This makes the fund prone to credit risks. 2. Interest Rate Risk: Short term debt funds carry high interest rate risks. Interest rates and bond prices have an inverse relationship. A short-term change in interest rate impacts the returns generated by short term debt funds. In a rising interest rate scenario, short term debt funds are in high demand. Whereas in a falling interest rate scenario, long term debt funds are in high demand. 3. Reinvestment Risk: Reinvestment risk is the risk you face when the interest rates fall post maturity. Let us understand this with an example. Suppose you invested Rs 10,000 in a bond that gives you 7% interest. This bond will mature after a year. After a year, interest rates fell. The current coupon rate on bonds is only 6%. Now you are forced to reinvest your maturity proceeds in a lower interest-bearing bond. This is known as reinvestment risk. Since the underlying papers of short term bond funds mature within 1-3 years, they do face high reinvestment risk especially in a falling interest rate scenario. Taxation of Short Term Debt Funds Taxation is one of the most important aspects that has put short term debt funds ahead of bank fixed deposits. Let us see how short term debt funds are taxed. Short Term Capital Gains Tax (STCG): When you redeem from a short term debt fund before 3 years, the gains you make are known as ‘short term capital gains’.

These gains are added to your income and then taxed as per your tax slab. This means that if you fall in 10% tax slab, you pay 10% STCG tax.

Ideally, investors who fall in the highest tax bracket should stay invested in the fund for a minimum of 3 years to avoid STCG taxation.

Long Term Capital Gains Tax (LTCG): Unfortunately, even if you stay invested in the fund for 3 years, you are still liable to pay tax. But you do get the benefit of indexation.

The LTCG tax payable on short term debt funds is 20% with indexation.

It is recommended to stay invested in short term debt funds for a minimum of 3 years to get superior tax-adjusted returns.

Short Term Capital Gains Tax (STCG): When you redeem from a short term debt fund before 3 years, the gains you make are known as ‘short term capital gains’.

These gains are added to your income and then taxed as per your tax slab. This means that if you fall in 10% tax slab, you pay 10% STCG tax.

Ideally, investors who fall in the highest tax bracket should stay invested in the fund for a minimum of 3 years to avoid STCG taxation.

Long Term Capital Gains Tax (LTCG): Unfortunately, even if you stay invested in the fund for 3 years, you are still liable to pay tax. But you do get the benefit of indexation.

The LTCG tax payable on short term debt funds is 20% with indexation.

It is recommended to stay invested in short term debt funds for a minimum of 3 years to get superior tax-adjusted returns.

Final Verdict on Short Term Debt Funds

Short term debt funds are a perfect way for you to balance and diversify your equity funds portfolio. But before investing in short term debt fund, you need to keep two things in mind –- Match your investment horizon with the average maturity of the fund.

- Invest in only those short term debt fund which invest in AAA rated or sovereign papers.

Easy & quick

Easy & quick

Leave A Comment?