Steel is one of those few metals that have managed to survive for centuries. It is also one of the most important sectors of the Indian economy. Almost every other sector is dependent on steel as a raw material. The construction sector uses maximum steel, followed by railways, automobiles, consumer, and capital goods etc. It wouldn’t be an exaggeration if I said that the entire economy will crumble without the steel sector. This is one of the reasons why steel stocks are always in demand. JSW Steel is the biggest steel stock in India with a market capitalisation of Rs 1,59,923 crore (March 12, 2022). In the last one year, the stock has rallied by nearly 54%. The second biggest steel stock in India is Tata Steel Ltd. Its market capitalisation is a mammoth Rs 1,57,206 crore. This steel stock has also had a stellar year as it is up by almost 75% (as of March 12, 2022). And the story continues for a majority of other steel stocks. This is despite a lockdown, which had paralysed the construction business. Yet, the demand for steel and steel stocks were at its peak. Now it isn’t a rocket science that investing in steel stocks is one of the best long-term investment strategies. After all, you are betting on India’s development, which will not be possible without the steel sector. This makes steel stocks evergreen stocks for investment. So, as long as India keeps on developing, steel stocks will stay in flavour. But which steel stocks should you invest in? Which steel stocks will be able to match India’s growth projection? Now there are a total of 106 steel stocks in India, listed across the NSE and BSE. Don’t worry, you don’t have to study or even invest in all of these 106 steel stocks. We have shortlisted five of the best steel stocks in 2025. But first, a word on India’s steel sector and what the future of steel sector looks like.

The Future of the Indian Steel Sector

Did you know that India is the second largest producer of steel in the entire world? Yes, as of October 2021, India produced nearly 9.8 metric tonnes of steel. This puts us ahead of Japan but behind China. Apart from catering to global steel demand, the steel sector in India also contributes to nearly 2% to our gross domestic product (GDP). It also provides employment to nearly 25 lakh individuals. Since 2008, the production of steel in India has gone up by 75% and the demand for domestic steel is up by 80%. And this demand is expected to increase further in the coming years. Why? Well there are a few reasons why steel is the sector to watch out for in the coming years –

- The average per capita consumption of steel in India is 69 kgs. This is 67% lower than the global average of 208 kgs.

- The construction sector accounts for nearly 60% of the demand for steel. The government is launching smart cities and affordable housing projects across the country. Who will fulfil this demand? The Indian steel industry, of course. This will also increase India’s per capita consumption of steel.

- The major focus of the government in the coming years is on the defence, infrastructure, real estate and shipbuilding sectors. All of these sectors use steel as a crucial raw material. So, all the incentives and allocations that the government makes in these sectors are indirectly helping steel companies.

- The government has also approved of the PLI scheme for speciality steel. They are planning to spend Rs 6,322 crore between FY 2024 to FY 2030. This investment will boost the domestic steel market in India.

We believe that the steel sector in India is going to have a huge growth spurt in the coming years. But which steel stocks look the most promising? We will discuss the top four steel stocks in India as per market capitalisation shortly. But before that, here’s the list of all the steel stocks in 2022 listed on Indian stock exchanges.

| We have segregated this list of steel stocks in Four categories – Large Steel Stocks Medium to Small Steel Stocks Sponge Iron Steel Stocks Pig Iron Steel Stocks 4 Top Steel Stocks in 2022 Steel Stock #1: JSW Steel Ltd. Steel Stock #2: Tata Steel Ltd. Steel Stock #3: Jindal Steel and Power Ltd. Steel Stock #4: Steel Authority of India Ltd. |

List of Steel Stocks in 2025

– Large Cap Steel Stocks in 2022

List of Steel Stocks in 2025

– Medium & Small Steel Stocks in 2025

| Name | Current Price | Market Capitalization | DE Ratio | PE Ratio | ROE | ROCE | Dividend yield | PB Ratio |

| Ratnamani Metals | ₹ 2,184.85 | 10,209 | 0.08 | 31.91 | 14.93 | 18.64 | 0.64 | 5 |

| Shyam Metalics | ₹ 307.00 | 7,831 | 0.06 | 4.63 | 26.08 | 26.67 | 1.44 | 1.56 |

| Godawari Power | ₹ 358.15 | 5,048 | 0.18 | 3.6 | 37.38 | 37.42 | 1.29 | 1.95 |

| Apollo Tricoat | ₹ 822.20 | 4,999 | 0.14 | 34.91 | 41.69 | 43.9 | 0 | 13.13 |

| Sarda Energy | ₹ 1,065.65 | 3,842 | 0.58 | 5.26 | 18.29 | 15.29 | 0.7 | 1.4 |

| Welspun Corp | ₹ 145.80 | 3,805 | 0.33 | 8.21 | 16.07 | 18.28 | 3.39 | 1 |

| Mah. Seamless | ₹ 551.70 | 3,696 | 0.23 | 9.72 | 6.07 | 9.41 | 0.63 | 1.08 |

| Mishra Dhatu Nig | ₹ 169.55 | 3,176 | 0.14 | 18.64 | 16.37 | 20.54 | 1.62 | 2.88 |

| Usha Martin | ₹ 103.60 | 3,157 | 0.3 | 12.6 | 11.33 | 12.67 | 0 | 2.08 |

| Technocraf.Inds. | ₹ 1,014.00 | 2,480 | 0.36 | 10.94 | 12.12 | 12.26 | 0 | 2.03 |

| Mukand | ₹ 133.95 | 1,894 | 3.21 | 27.71 | -161.64 | -18.15 | 0.71 | 3.5 |

| ISMT | ₹ 61.15 | 1,838 | -3.66 | 0 | ||||

| Lloyds Steels | ₹ 16.17 | 1,453 | 0 | 421.21 | 0.44 | 1.29 | 0 | 12.68 |

| JTL Infra | ₹ 221.45 | 1,311 | 0.43 | 29.18 | 28.15 | 27.06 | 0.18 | 10.41 |

| Kalyani Steels | ₹ 298.00 | 1,301 | 0.18 | 5.2 | 17.97 | 22.9 | 2.48 | 1.04 |

| Prakash Industri | ₹ 67.85 | 1,215 | 0.18 | 7.21 | 3.28 | 4.88 | 0 | 0.43 |

| Sunflag Iron | ₹ 66.85 | 1,205 | 0.35 | 4.71 | 9.64 | 10.88 | 0 | 0.74 |

| Vardhman Special | ₹ 238.70 | 968 | 0.6 | 9.91 | 10.64 | 13.47 | 0.64 | 1.88 |

| Welspun Special. | ₹ 16.70 | 885 | 13.61 | -71.33 | -13.72 | 0 | 61.15 | |

| Beekay Steel Ind | ₹ 406.00 | 774 | 0.22 | 5.09 | 15.34 | 18.06 | 0.25 | 1.23 |

| Goodluck India | ₹ 294.40 | 766 | 1.14 | 13 | 8.28 | 10.72 | 0.51 | 1.81 |

| Raghav Product. | ₹ 611.10 | 665 | 0.06 | 37.94 | 17.19 | 22.76 | 0.08 | 6.72 |

| Salasar Techno | ₹ 230.90 | 660 | 0.78 | 19.62 | 12.8 | 14.82 | 0.42 | 2.47 |

| BMW Industries | ₹ 28.20 | 635 | 0.49 | -28.96 | 5.74 | 0 | 1.17 | |

| Hi-Tech Pipes | ₹ 513.30 | 603 | 1.34 | 16.92 | 12.18 | 12.61 | 0 | 2.56 |

| Rajratan Global | ₹ 548.55 | 557 | 0.7 | 5.03 | 26.56 | 23.15 | 1.48 | 10.42 |

| Kamdhenu | ₹ 204.00 | 549 | 0.46 | 17.18 | 11.88 | 14.94 | 0.39 | 2.66 |

| Rama Steel Tubes | ₹ 324.55 | 545 | 0.91 | 19.73 | 13.19 | 12.58 | 0.15 | 4.79 |

| Gallantt Metal | ₹ 65.80 | 535 | 0.07 | 5.73 | 11.7 | 12 | 0 | 0.7 |

| Pennar Industrie | ₹ 36.60 | 520 | 0.89 | 11.84 | -1.64 | 5.06 | 0 | 0.75 |

| Man Industries | ₹ 82.35 | 470 | 0.09 | 4.64 | 12.65 | 17.35 | 0 | 0.53 |

| D P Wires | ₹ 344.25 | 467 | 0.15 | 15.38 | 21.76 | 28.88 | 0 | 3.43 |

| Bharat Wire | ₹ 68.15 | 431 | 0.63 | 12.54 | -6.99 | 1.61 | 0 | 1 |

| Gandhi Special Tubes | ₹ 344.25 | 418 | 0 | 9.74 | 22.56 | 29.72 | 2.62 | 2.3 |

| Supershakti Met. | ₹ 340.00 | 392 | 0.16 | 30.12 | 10.91 | 14.07 | 0.15 | 3.12 |

| Bajaj Steel Inds | ₹ 722.00 | 375 | 0.3 | 6.81 | 44.59 | 44.99 | 0.41 | 2.06 |

| Panchmahal Steel | ₹ 155.00 | 296 | 0.39 | 5.4 | 8.47 | 11.47 | 0 | 2.32 |

| Manaksia Steels | ₹ 44.90 | 294 | 0.18 | 9 | 12.52 | 13.18 | 0 | 1.24 |

| Bedmutha Indus. | ₹ 68.30 | 220 | 3.1 | 0.87 | 71.18 | 0 | 2.81 | |

| Visa Steel | ₹ 17.65 | 204 | -7.18 | 0 | ||||

| Manaksia Coated | ₹ 30.05 | 197 | 1.41 | 29.44 | 6.04 | 11.2 | 0.1 | 1.88 |

| Shah Alloys | ₹ 96.30 | 191 | 12.83 | 2.96 | 20.16 | 0 | 15.5 | |

| Guj.Nat.Resour. | ₹ 23.45 | 188 | 0.16 | -4.47 | -2.54 | 0 | 1.55 | |

| Scan Steels | ₹ 34.65 | 181 | 0.34 | 3.64 | 9.51 | 13.93 | 0 | 0.55 |

| Sh. Bajrang All. | ₹ 197.40 | 178 | 0.14 | 2.8 | 22.69 | 3.85 | 0 | 0.92 |

| India Steel | ₹ 4.44 | 177 | 1.03 | -11.74 | -3.06 | 0 | 1.45 | |

| Natl. Gen. Inds. | ₹ 316.05 | 175 | 0.09 | 32.67 | -3.45 | -3.13 | 0 | 6.01 |

| Ahlada Engineers | ₹ 117.15 | 151 | 0.3 | 18.91 | 8.91 | 11.29 | 1.2 | 1.24 |

| Electrotherm(I) | ₹ 111.10 | 142 | 2.61 | 8.66 | 0 | |||

| Suraj | ₹ 65.65 | 126 | 0.64 | 42.86 | 1.48 | 6.75 | 0 | 1.4 |

| Incredible Indus | ₹ 23.95 | 112 | 0.41 | 47.25 | 3.12 | 6.62 | 0 | 0.94 |

| Mahamaya Steel | ₹ 73.90 | 109 | 0.51 | 20.79 | 0.77 | 4.85 | 0 | 0.97 |

| Kanishk Steel | ₹ 37.35 | 106 | 0.13 | 4.72 | 10.1 | 11.11 | 0 | 1.49 |

| Prakash Steelage | ₹ 5.72 | 100 | 2.19 | 0 | ||||

| Uttam Galva Stee | ₹ 6.00 | 85 | -6.02 | 0 | ||||

| Rudra Global | ₹ 33.25 | 83 | 0.67 | 4.56 | -33.15 | -4.4 | 0 | 1.12 |

| Bansal Roofing | ₹ 62.40 | 82 | 0.13 | 36.39 | 14.77 | 19.22 | 0.4 | 5.05 |

| Gyscoal Alloys | ₹ 4.38 | 69 | -121.39 | 0 | ||||

| Kritika Wires | ₹ 36.70 | 65 | 0.48 | 83.53 | 1.21 | 4.23 | 0 | 1 |

| Unison Metals | ₹ 38.65 | 62 | 1.49 | 18.43 | 8.84 | 12.14 | 0 | 3.26 |

| Hisar Met.Inds. | ₹ 107.00 | 58 | 1.41 | 5.89 | 18.1 | 13.74 | 0.93 | 1.59 |

| Supreme Engg. | ₹ 2.00 | 50 | 2.2 | 192.26 | -9.9 | 3.21 | 0 | 1.12 |

| Rathi Bars | ₹ 30.40 | 50 | 0.63 | 17.53 | 2.76 | 5.11 | 0 | 0.58 |

| Remi Edelstahl | ₹ 44.95 | 49 | 0.42 | 21.36 | 0.38 | 2.28 | 0 | 1.18 |

| Oil Country | ₹ 10.68 | 47 | -29.79 | 0 | ||||

| Gujarat Intrux | ₹ 120.00 | 41 | 0.03 | 15.67 | 7.75 | 10.75 | 2.5 | 0.8 |

| Aanchal Ispat | ₹ 18.65 | 39 | 1.59 | -10.13 | 0.31 | 0 | 0.82 | |

| Surani Steel Tub | ₹ 46.50 | 39 | 0.8 | 9.9 | 18.73 | 15.14 | 0 | 1.7 |

| Bombay Wire | ₹ 68.50 | 37 | 0 | -0.95 | -0.95 | 0 | 4.27 | |

| Bonlon Industrie | ₹ 23.50 | 33 | 0.05 | 17.01 | 2.94 | 4.14 | 0 | |

| Eastcoast Steel | ₹ 61.40 | 33 | 0.13 | 37.26 | -126.67 | -8.49 | 0 | 1.74 |

| Sharda Ispat | ₹ 65.25 | 33 | 0.29 | 8.01 | 10.55 | 13.59 | 0 | 1.1 |

| Metal Coatings | ₹ 44.30 | 32 | 0.09 | 8.94 | 8.5 | 9.45 | 0 | 0.99 |

| Riddhi Steel | ₹ 29.75 | 25 | 2.29 | 18.82 | 2.85 | 8.76 | 0 | 0.53 |

| Modern Steels | ₹ 16.80 | 23 | -109.95 | 0 | ||||

| Natl. Steel&Agro | ₹ 4.65 | 21 | -19.47 | 0 | ||||

| Ashiana Ispat | ₹ 21.50 | 17 | 2.38 | 16 | 3.56 | 6.45 | 0 | 0.51 |

| Zenith Steel | ₹ 1.15 | 16 | 5.14 | 0 | ||||

| Pact Industries | ₹ 2.67 | 15 | 1.13 | 1479 | 2.88 | 5.5 | 0 | 1.58 |

| Grand Foundry | ₹ 4.60 | 14 | 0 | |||||

| Garg Furnace | ₹ 34.35 | 14 | 0.98 | 8.67 | -14.75 | -5.73 | 0 | 1.43 |

| Alliance Integ. | ₹ 11.80 | 14 | -12.49 | 0 | ||||

| Rish.Digh.Steel | ₹ 23.10 | 13 | 0.06 | -3.29 | -3.4 | 0 | 1.77 | |

| Narayani Steels | ₹ 8.87 | 10 | -27.96 | 0 | ||||

| Umiya Tubes | ₹ 9.50 | 10 | 0.2 | 86.45 | 0.16 | 2.08 | 0 | 0.67 |

| Ahm. Steelcraft | ₹ 20.75 | 8 | 0 | -0.91 | -1.27 | 0 | 0.33 | |

| Rajas. Tube Mfg | ₹ 18.45 | 8 | 2.29 | 15.13 | 7.22 | 10.8 | 0 | 1.27 |

| Sh. Steel Wire | ₹ 24.45 | 8 | 0 | 269.64 | 7.12 | 10.11 | 0 | 0.64 |

| Mukat Pipes | ₹ 5.15 | 6 | 0 | |||||

| P.M. Telelinnks | ₹ 5.90 | 6 | 0 | 0.78 | 1.4 | 0 | 0.92 | |

| Real Strips | ₹ 9.44 | 6 | -9.11 | 0 | ||||

| Aditya Ispat | ₹ 9.22 | 5 | 2.49 | 10.28 | 4.06 | 5.99 | 0 | 0.49 |

| Mahalaxmi Seam. | ₹ 9.25 | 5 | 8.89 | 15.74 | 0 | |||

| Aryavan Enter. | ₹ 11.98 | 5 | 0.15 | -3.89 | -3.21 | 0 | 1.41 | |

| T N Steel Tubes | ₹ 8.92 | 5 | 1.23 | -7.97 | 1.12 | 0 | 0.53 | |

| Gopal Iron Stl. | ₹ 7.95 | 4 | 0.66 | -88 | -18.68 | 0 | 4.95 | |

| Crimson Metal | ₹ 8.50 | 4 | 4.78 | 11.75 | 7.1 | 8.97 | 0 | 0.66 |

| Vallabh Steels | ₹ 6.92 | 3 | -192.41 | -36.53 | 0 | |||

| Indian Bright St | ₹ 21.00 | 2 | 0.27 | -20.51 | -17.02 | 0 | 7 | |

| Heera Ispat | ₹ 3.00 | 2 | -48.8 | -7.95 | 0 |

*Data as on March 15, 2022

List of Steel Stocks in 2025

– Pig – Iron Steel Stocks in 2025

| Name | Current Price | Market Capitalization | DE Ratio | PE Ratio | ROE | ROCE | Dividend yield | PB Ratio |

| Kirloskar Ferrous Industries Ltd | ₹ 193.65 | ₹ 2,686.30 | 0.17 | 5.6 | 35.09 | 33.4 | 2.56 | 2.21 |

| Tata Metaliks | ₹ 801.45 | ₹ 2,530.79 | 0.11 | 9.76 | 20.32 | 25.18 | 0.5 | 1.76 |

| Mideast Int. Stl | ₹ 9.99 | ₹ 137.74 | 4.86 | -74.82 | -15.81 | 0 | 1.3 | |

| Sathavaha. Ispat | ₹ 3.15 | ₹ 16.03 | -10.7 | 0 |

*Data as on March 15, 2022

List of Steel Stocks in 2025

– Sponge Iron Steel Stocks in 2025

| Name | Current Price | Market Capitalization | DE Ratio | PE Ratio | ROE | ROCE | Dividend yield | PB Ratio |

| JSW Steel | ₹ 636.60 | ₹ 1,53,880 | 1.16 | 7.07 | 18.97 | 15.53 | 1.02 | 2.56 |

| Tata Steel | ₹ 1,246.90 | ₹ 1,52,277 | 0.85 | 4.08 | 10.85 | 12.65 | 2.01 | 1.67 |

| S A I L | ₹ 95.65 | ₹ 39,508 | 0.47 | 2.95 | 9.51 | 11.19 | 4.16 | 0.75 |

| APL Apollo Tubes | ₹ 917.05 | ₹ 22,952 | 0.28 | 44.71 | 23.61 | 27.78 | 0 | 11.63 |

| Jindal Stain | ₹ 184.15 | ₹ 9,286 | 0.78 | 6.66 | 12.16 | 16.51 | 0 | 2.32 |

| Jindal Stain. Hi | ₹ 348.00 | ₹ 8,211 | 0.4 | 4.8 | 25.35 | 24.54 | 0 | 2.15 |

| Jindal Saw | ₹ 87.65 | ₹ 2,803 | 0.78 | 5.98 | 4.64 | 8.02 | 2.28 | 0.41 |

| Surya Roshni | ₹ 421.20 | ₹ 2,292 | 0.48 | 12.71 | 12.02 | 12.64 | 0.7 | 1.67 |

*Data as on March 15, 2022 Let us now take a look at the four top steel stocks in India in 2022 as per market capitalisation. These best steel stocks can help you get quality exposure to the potential growth in Indian steel sector.

4 Top Steel Stocks in 2025 as per Market Capitalisation

Steel Stock #1: JSW Steel Ltd.

JSW Steel Ltd. is the biggest steel stock in India. The company’s market capitalisation is a mammoth Rs. 1,59,923 crore as of March 12, 2022. JSW Steel Ltd. is one of the leading steel manufacturers in India with a steel production capacity of 18 MTPA. It is also present in the Energy, Infrastructure, Cement, and Paints sector. JSW Steel Ltd has managed to scale its crude steel capacity from 2.5 MTPA in FY 2006 to 18 MTPA in FY 2020. To further scale up, JSW Steel Ltd acquired Bhushan Power and Steel Ltd. in March 2021. This steel stock has seen a growth of 96.30% in its net profit. So, its net profit has increased from Rs. 4,030 crore in March 2020 to Rs. 7,911 crore in March 2021. The company has generated a consistent return on equity (ROE) of 18% in the last three years. JSW Steel Ltd. is having a great time in the markets. It has rallied straight upwards between March 30, 2020 and May 2021. Its share price went from Rs 140 to Rs 757 in less than two years!

| Market Cap (Cr): Rs 1,59,923 | Face Value (₹): 1 | EPS (₹): 89.47 |

| Book Value (₹): 252 | ROCE (%): 15.5 | Debt to Equity: 1.17 |

| Stock P/E: 7.49 | ROE (%): 19 | Dividend Yield (%): 0.97 |

| Revenue (Cr): 126,410 | Earnings (Cr): 38,263 | Cash (Cr): 15,002 |

| Total Debt (Cr): 70,867 | Promoter’s Holdings (%): 44.07 |

Steel Stock #2: Tata Steel Ltd.

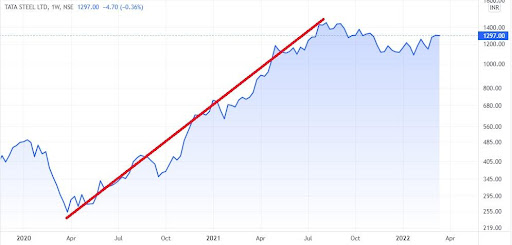

Tata Steel Ltd. is probably the most loved steel stock in India. It comes from the trusted Tata group of companies and has been instrumental in India’s growth. The company has a massive market capitalisation of Rs 1,58,969 crore (as of March 12, 2022). Tata Steel was set up in 1907. It is Asia’s first integrated private steel company. It offers a wide range of value added products like hot rolled, cold rolled, coated steel, wire rods, etc. Tata Steel Ltd. has a steel producing capacity of approximately 33 MTPA. Tata Steel Ltd. acquired the Corus Group for $12 billion, which was the second largest producer of steel in the entire Europe at the time. Even during the pandemic, Tata Steel Ltd. has managed to grow its net profit from Rs 1,557 crore in March 2020 to Rs 7,490 crore in March 2021. It has generated a decent return on equity of 10% in the last three years. This beloved steel stock is up by nearly 75% in the last one year. In fact, it experienced a strong bull run between March 2020 and August 2021. The stock price rose from Rs 252 in March 2020 to Rs 1,462 by August 2021.

| Market Cap (Cr): Rs 1,58,969 | Face Value (₹): 10 | EPS (₹): 307.06 |

| Book Value (₹): 749 | ROCE (%): 12.6 | Debt to Equity: 0.87 |

| Stock P/E: 4.22 | ROE (%): 10.8 | Dividend Yield (%): 1.92 |

| Revenue (Cr): 224,519 | Earnings (Cr): 62,644 | Cash (Cr): 5,822 |

| Total Debt (Cr): 78,163 | Promoter’s Holdings (%): 34.41 |

Steel Stock #3: Jindal Steel and Power Ltd.

Jindal Steel and Power Ltd. is a dominant player in steel, power, mining and infrastructure sector in India. Its iron making capacity is 10 MTPA. Jindal Steel’s Raigarh Plant is the world’s largest coal based sponge iron manufacturing plant in the entire world! It also produces track rails and structural steel products like beams, columns, angles etc. In fact, Jindal Steel is the preferred supplier of rail products to Indian railways. While we are on Indian railways, check out this article on the Top Railway Stocks in 2022. In the last five years, starting from March 2016, Jindal Steel has managed to reduce its loss. And it finally posted a profit of Rs 4,012 crore for the FY 2021. Even the company’s ROE has improved from 4% in three years to 15% in the last one year. Like majority of its peers, this steel stock has also rallied since March 2020. Its share price jumped from Rs 62.80 in March 2020 to Rs 482.80 in May 2021.

| Market Cap (Cr): Rs 48,888 | Face Value (₹): 1 | EPS (₹): 62.89 |

| Book Value (₹): 323 | ROCE (%): 15.8 | Debt to Equity: 0.51 |

| Stock P/E: 7.62 | ROE (%): 14.9 | Dividend Yield (%): 0.21 |

| Revenue (Cr): 47,340 | Earnings (Cr): 17,407 | Cash (Cr): 4,312 |

| Total Debt (Cr): 16,630 | Promoter’s Holdings (%): 60.47 |

Steel Stock #4: Steel Authority of India Ltd.

This next big steel stock is a government owned Navratna. It is also the 20th largest steel producer in the world with an annual steel production of 16.30 million metric tonnes. SAIL produces the following products – Structural, TMT, railway products, pipes, stainless steel products etc. In FY 2021, SAIL generated a net profit of Rs 4,148 crore. This is a 95.56% increase from its FY 2020 performance. It also managed to generate a ROE of 8% in the last three years. In the last one year, SAIL’s share price is up by 29.53% as of March 12, 2022. Key Financials of Steel Authority of India Ltd. as on March 12, 2022

| Market Cap (Cr): Rs 41,161 | Face Value (₹): 10 | EPS (₹): 32.04 |

| Book Value (₹): 128 | ROCE (%): 11.2 | Debt to Equity: 0.50 |

| Stock P/E: 3.02 | ROE (%): 9.51 | Dividend Yield (%): 4.01 |

| Revenue (Cr): 96,003 | Earnings (Cr): 23,158 | Cash (Cr): 964 |

| Total Debt (Cr): 24,702 | Promoter’s Holdings (%): 75 |

Easy & quick

Easy & quick

Leave A Comment?