Let me tell you once you separate the fact from fiction, you will have a much better idea about investing and things would be easier to achieve.

So if you too are considering investing in the stock markets but are held back because of such myths then this article is for you.

Let’s debunk some of the most common stock market investing myths.

Let me tell you once you separate the fact from fiction, you will have a much better idea about investing and things would be easier to achieve.

So if you too are considering investing in the stock markets but are held back because of such myths then this article is for you.

Let’s debunk some of the most common stock market investing myths.

Stock market investment myth #1: The stock market is a Casino.

This is the most common myth you will hear from people who refrain from investing. It is like saying, ‘Driving a car is extremely dangerous.’ Yes, if you drive a car at the highest speed with a blindfold on. It is indeed risky. But if you follow all the traffic rules and drive safe, you will have a smooth and risk-free ride. The stock market has the same philosophy. Investing in a stock blindly to try your luck is gambling. But if you invest diligently with proper research and pick good quality stocks, it will surely help you create wealth in the long run. As Warren Buffet said, ‘Risk comes from not knowing what you're doing.’Stock market investment myth #2: You need to have a lot of money to invest in stocks.

Common investors have made billions by investing in the stock markets such as Warren Buffet, Rakesh Jhunjhunwala, George Soros, etc. While looking at their net worth today, people often think that you need to have money to create wealth. Yes, it’s certainly true to some extent. But you don’t need to have lots of money to create wealth in the stock market. The legendary investor Warren Buffet bought his first stock at $38 and today his net worth is a whopping $85 billion which is around Rs 6.10 lakh crore! Rakesh Jhunjhunwala started his investment with just Rs 5,000. Today his net worth is a whopping $3.2 billion which is around Rs 23,350 crores! Both of these investors started their investment from scratch and made it to billions. This proves that you can start small and create wealth in the long term.Stock market investment myth #3: The stock market makes you rich overnight.

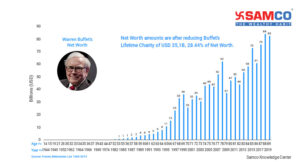

Stock market CANNOT make you rich overnight or in a day or even in a week. A stock is a part of ownership in a company. As and when the company makes profits, the stock prices appreciate. It is practically impossible for it to grow overnight. If we take the example of the legendary investor Warren Buffet’s net worth. Warren Buffet has been investing since he was 13. But, most of the fortune you see today was made after the age of 50.

Hence, not just investing but patience to hold is also an important aspect of investing.

Warren Buffet has been investing since he was 13. But, most of the fortune you see today was made after the age of 50.

Hence, not just investing but patience to hold is also an important aspect of investing.

Stock market investment myth #4: Buy stocks that are in the news.

Blindly buying stocks in the news can easily get hyped because of increasing demand as everyone is trying to buy the share. This strategy may perform well in the short term. But the stock might see profit booking in the near future. However, you can always keep an eye on what’s in the news, do some homework and make a decision. It’s not wise to simply follow the masses.Stock market investment myth #5: A Rs 100 stock is cheaper than Rs 200 stock.

You must have come across people saying, ‘Ye stock mehenga hai’. But the same person will happily buy a share that has recently crashed thinking it is an ‘undervalued’ stock. Let’s take an example.| Company X | Company Y | |

| Share price | Rs 2,000 | Rs 10 |

| Earnings per share | Rs 200 | Rs 0.5 |

| Price-to-earnings (P/E) ratio | 10x | 20X |

Stock market investment myth #6: You need to be smart and intelligent to invest in the stock market.

If you want to invest in the stock market but are backing off thinking that the stock market is for smart and intelligent people, then you are missing out on a great opportunity. Warren Buffet once mentioned, ‘You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.’ To invest in the stock market, you need these 4 things.- Research thoroughly about the company.

- Be patient as you will see results over time.

- Don’t get caught up in the hype and invest with discipline.

- Open a Demat account with a recognised broker like Samco.

Easy & quick

Easy & quick

Leave A Comment?