In this article, we will discuss

- What is Theta?

- Understanding Intrinsic Value & Time Value

- To Summarise:

- Interpretations:

- How can Theta help you become a options trader:

What is Theta?

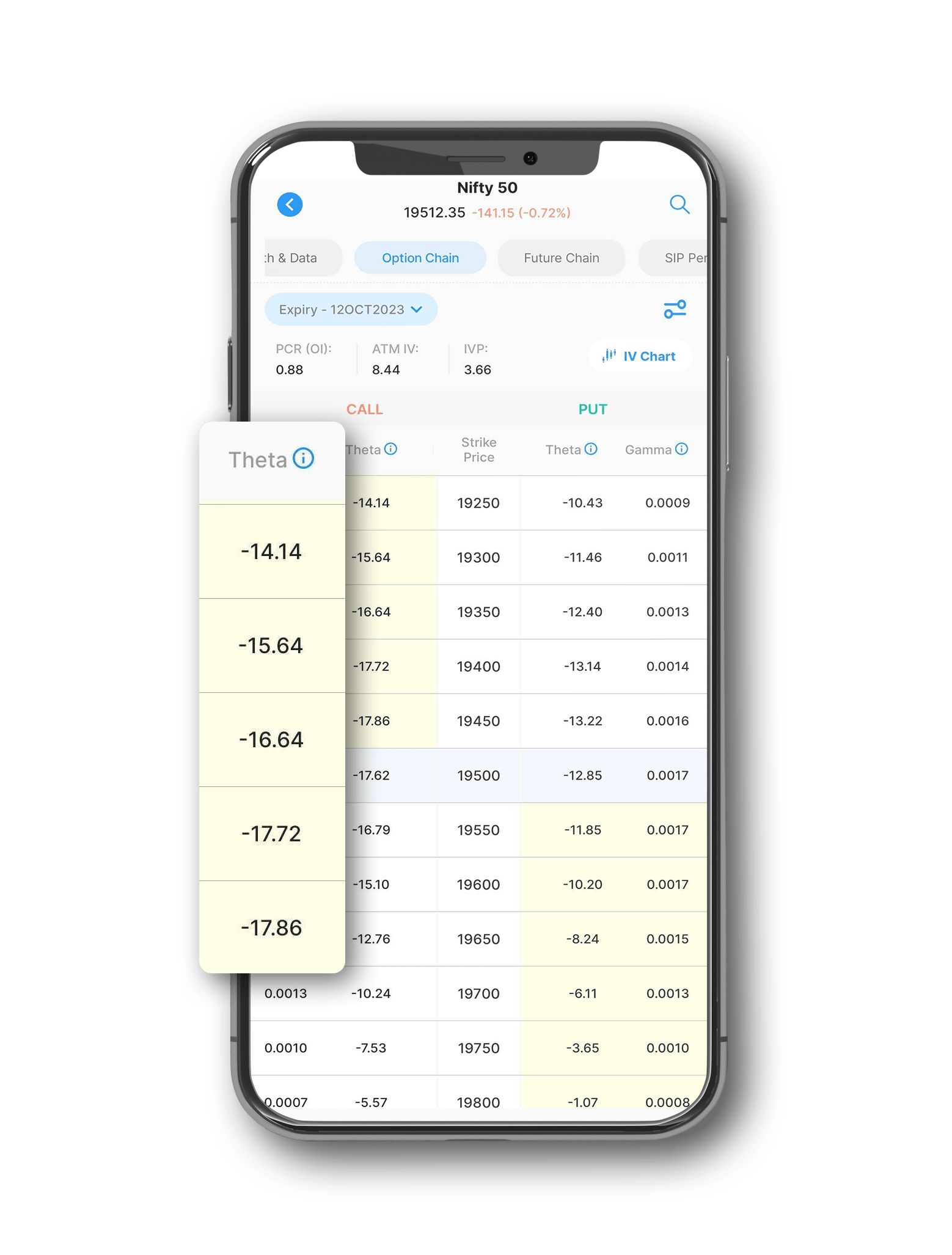

Theta, often referred to as "time decay," is one of the Greek letters used to quantify the impact of time on the value of an options contract.Theta helps option traders measure how much value an option might lose each day as it approaches the expiry day. To understand Theta better, let's first understand how is the total value of an option determined using the below given example.

Understanding Intrinsic Value & Time Value

Total value of an option = Intrinsic Value + Time Value

Intrinsic value is the portion of an option's price that is directly related to the difference between the current price of the underlying asset and the option's strike price. It represents the immediate value that the option holder would gain if they were to exercise the option immediately.

Time value is the premium that an option buyer is willing to pay for the potential future movement of the underlying asset's price, based on the expectation that favorable price movements may occur before the option's expiration.

Let’s say a stock is trading at Rs 1000 and its Call option with a strike of 950 is priced at Rs 65. Here, the intrinsic value will be Rs. 50 (1000 - 950). So if the option is priced at Rs. 65, the balance Rs. 15 represents the time value of money. Any surplus value beyond the intrinsic value is the time value.

ITM options have relatively higher Instrince Value, OTM options have no Intrinsic value and derive their value entirely from Time Value while ATM options have minimal Intrinsic Value and highest time value.

As the time passes, the OTM options to become ITM keeps on reducing and hence their time value keeps on reducing. Theta helps us understand the decrease in value of options premium as we move closer and closer to expiry.

To Summarise:

Options lose value as we move closer to expiry date of the contract, this is because the uncertainty of the option being ITM or OTM keeps on decreasing as the time passes. Example, chances of a stock moving 10% in a month is much higher than the chances of a stock moving 10% in 1 week.

Interpretations

Options contract with highest theta signifies that, keeping all things the same, this contract will lose most value as we near the date of expiry. As the time to expiry reduces, the price of the option contract also reduces. Eventually on the date of expiry:

- - the option price of ITM is nothing but the Intrinsic Value

- - all OTM options expire worthless at 0 since they have 0 intrinsic value and 0 time value

How can Theta help you become a options trader

Since Theta greek is a non directional measure of option price, we shall look at this from an option buyer and sellers point of view:

Theta is known as a friend of option sellers. Option sellers collect premiums from option buyers in exchange for assuming certain risks. Theta benefits option sellers by allowing them to earn income from the time decay component of options. As time passes, the time value of the options decreases, allowing sellers to potentially buy back the options they sold at a lower price or even 0 for OTM options.

Option buyer has to be very careful while evaluating which option contracts he wants to buy as theta is a non-directional element of the option which will constantly reduce the price of the options. Therefore, irrespective of the fact that the underlying moves in the favour of the trader, in certain cases when the time value or theta erodes significantly, the option buyers can still incur losses.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?