In this article, we will cover

- Crude Oil Futures Definition

- What is crude oil futures?

- Usage of Crude oil Futures

- Factors driving Crude Oil Commodity Prices

- Quick Facts on Crude Oil Commodity Trading

- Trading Crude Oil Futures Live on the SAMCO Trading Platforms

- Brokerage for trading Crude Oil Futures

- Other Charges applicable while trading Crude Oil Futures

Crude Oil Futures Definition

Crude oil is arguably one of the most traded commodities in the world. All major exchanges in the world offer Crude Oil Futures. In India MCX – Multi Commodity Exchange and NCDEX are popular commodity exchanges. But only MCX offers crude oil futures trading. On MCX, Crude oil can be traded in 2 variants – Crude oil and Crude oil mini. But what is crude oil futures? How can you trade in crude oil MCX? In this article, we will take an in-depth look at crude oil futures and crude oil MCX trading.What is crude oil futures?

A futures is a derivative contract which derives its value from the value of the underlying asset. In case of gold futures, the underlying asset is physical gold. Similarly, in case of crude oil futures, the underlying asset is crude oil. The value of crude oil futures is derived and dependent on crude oil. It has no value of its own. Unlike other commodities like gold futures and silver futures which derive their value from multiple factors, in case of crude, price isn’t determined only by demand and supply forces but also by speculators influencing price determination. Commodity markets exhibit cyclical movement in price curve and crude shows a correlation to the same. Trading in crude oil futures is similar to trading in equity futures. Crude oil futures are nothing but exchange-traded standardized contracts between a buyer and a seller in which buyer is bound by an obligatory contract to take delivery of specific quantity of crude oil (lot) at certain pre-decided price on future date.Usage of Crude oil Futures

Crude oil explorers and crude oil consumers i.e. refiners, oil marketing companies, energy companies, etc. use crude oil futures to hedge their price risk in the spot market.- Crude oil producers can also lock in their selling price by shorting crude oil futures against inventory.

- Similarly, crude oil consumers can fix their purchasing price by going long on crude oil futures.

Factors driving Crude Oil Commodity Prices and Crude Oil Futures Contracts

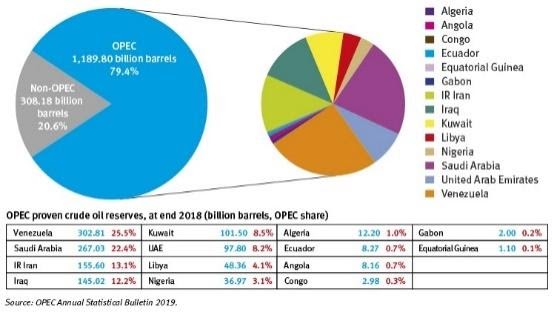

- Dominance of OPEC: Every country in the world does not produce oil. In fact, majority of the world countries import crude oil. This includes biggest world economies like the China, India and other European nations. While the demand for oil is endless, the supply of oil is regulated by a few countries. These oil producing countries are split as –

- Organisation of Petroleum Exporting Countries (OPEC) – Saudi Arabia, Qatar, Kuwait, United Arab Emirates (UAE) etc.

- Non-OPEC countries – Brazil, Russia, Canada, Mexico etc.

- Availability of cheaper alternatives: One of the major reasons for the crude oil crash between 2014 and 2016 was the availability of cheaper alternative to crude oil – American shale. USA was once one of the biggest importers of crude oil. But as American shale became cheaper and technologically more accessible, the demand for crude oil automatically fell. So, as cheaper alternatives to crude oil get discovered, the demand and price of crude oil will automatically fall.

- Demand from Emerging markets and geopolitical situation in the World: Apart from the USA, China and India are two of the biggest oil importers from the emerging markets. A decline in economic growth in these countries as seen during the COVID19 pandemic, severely affects the demand for crude oil and the price of crude oil futures.

Quick Facts on Crude Oil Commodity Trading and MCX Crude Oil Contract Specifications –

Crude Oil Trading Symbol – CRUDEOILDDMMMYYYY Instrument Type – COMMODITY FUTURES Lot Size (Units) – 100 Barrels and the Max single order size is 10,000 Barrels Initial Margin – The margin applicable is the higher of SPAN Margin or 4%. To check crude oil margin requirements for trading in the MCX, check the commodity span calculator. ELM Margin – 1% Lot Size (Value) – Price of 100 Barrels crude oil. Tick Size – Re. 1 per barrel Underlying – Crude oil Expiry – 19th or 20th of every month Delivery units – 50,000 barrels Physical delivery – Mumbai / JNPT Port Trading Time – Crude Oil can be traded during the normal MCX market timings. The lot size for crude oil mini contract is 10 barrels. The delivery, settlement and expiry remains the same as crude oil futures contract.Trading Crude Oil Futures Live on the SAMCO Trading Platforms

Learn everything about commodity trading in India – Must Watch for BeginnersBrokerage for trading Crude Oil Futures

With Samco Securities, India’s leading discount broker, crude oil futures and crude oil mini contracts can be traded at Flat Rs. 20 per executed order or 0.05% of turnover whichever, is lower.Calculate your savings for trading crude oil futures on the commodity brokerage calculator. Open a FREE commodity trading account with Samco today!Other Charges applicable while trading Crude Oil Futures

- CTT

- Stamp Duty

- Service Tax

- Exchange Transaction Charges for MCX

Easy & quick

Easy & quick

Leave A Comment?