The trend is your friend …This is something we all have heard of when we enter the stock markets. But, the question is, how do you analyse the trend of a stock? Simple. Use trendlines . It doesn’t matter whether you are a day trader, swing trader or even a positional trader. Anyone can use a trendline. It helps you analyse the right entry and exit points and place profitable trades in the market. So, if you are a beginner and you wish to learn everything about trading using trendlines then this article is for you. Let’s begin. In this article:

- What is a trend?

- What is a trendline?

- How to not draw a trendline?

- The correct way to draw a trendline

- What is merger or confluence of trendlines?

- Indicators you can use along with trendlines to place early trades in the markets

- The advanced version of trendlines: Curved trendlines

Before we understand what is a trendline, we must first understand what is a trend?

What is a Trend?

A trend is a direction in which the share price is moving. There are three types of trends.

- Uptrend

- Downtrend

- Sideways trend

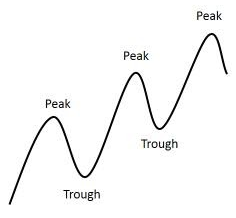

Take a look at the illustration below. It illustrates how a share price fluctuates.

The highs hit by a stock is called the peak. Whereas the lows of a stock are called troughs.

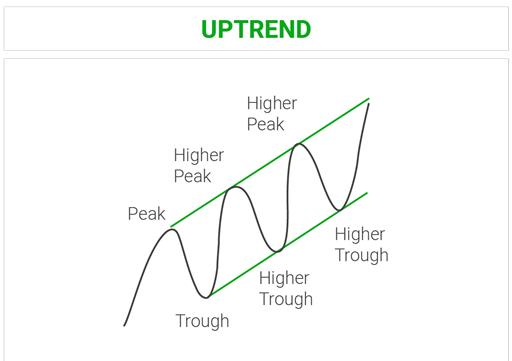

- If a stock consistently hits high peaks and high troughs, it is said to be in an uptrend.

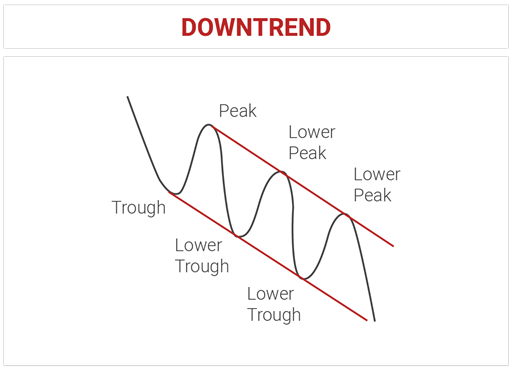

- If a stock consistently hits low peaks and low troughs, it is said to be in a downtrend.

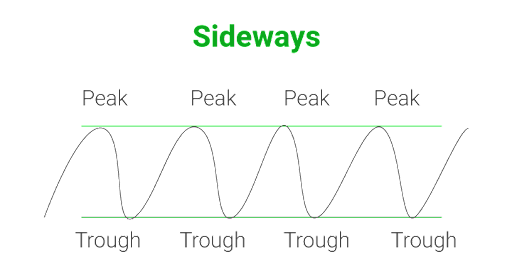

- If a stock makes flat peaks and troughs, it is said to be in a sideways trend.

What is a Trendline?

As the name suggests, a trendline is a line which indicates the trend or the direction of a stock. It is drawn by joining three or more points on a chart. With the help of this trendline, you can easily analyse whether the stock is in an uptrend, downtrend or sideways trend. Now, the most common mistake people make while drawing a trendline is that they follow the basic rule of geometry and draw a line with the help of two points. But, when we draw a trendline, we must always look for a third point which will validate the trendline. Confusing? Don’t worry. Let’s simplify this with the help of an example.

This is a chart of

Nifty 50

where we could see that the trend of the index was bullish between February 2016 to March 2019. Now, if a beginner was asked to plot a trendline for this timeframe, then this is how the trendline would look like. Simply joint point A and point B. So, this line would act as a support line and when the index was close to the trendline, you would expect a bounce back. But in this case, the index didn’t work according to the trendline. That’s because this was a weak trendline and we didn’t have a third point to validate it.

Always remember the basic rule of trendlines -

The probability of bounce-back increases if the trendline touches more than three points.

So, what is the correct way to draw a trendline? Let’s find out.

Recommended watch: The right way to draw trendlines

Here is an example of a valid trendline in

Axis bank

.

If you carefully see,

Axis bank

is hitting higher highs and higher lows. It indicates that the stock is in an uptrend. So

in an uptrend, you must join at least three significant lows

hit by the stock and draw a trendline. Here the trendline will act as a support level. So, whenever the share price is close to the trendline, you might see a pullback in the stock.

Another possibility is that the share price will break the trendline. This is called a

breakdown

.

Most of the time, you might observe that the stock price dips below the trendline during intraday and closes above the trendline. In such situations, the trendline is still valid. But if the stock closes below the trendline and trades and closes below the trendline for the next two to three days then we say that the trend has reversed and the trendline will act as the first level of resistance.

Recommended watch: What is support and resistance?

Let’s take a look at how to draw a trendline when the stock is in a downtrend.

This is a chart of

Lupin Ltd

. This stock has been in a downtrend since 2015. So, when the share is in a

bearish trend you must join at least three lower highs of stock

and that would act as a downtrend line. By drawing the trendlines you can easily analyse the ongoing trend of a stock and place your trades accordingly. Here, the trendline will act as a level of resistance. Whenever the share price is close to the resistance level you will see a dip in the share price.

Sometimes you might also see that the share price has surpassed the resistance line. This is called a

breakout

.

So, if the share price trades and closes above the trendline for the next three days then it is said that the trend of the stock is reversed. Now, the previous resistance level will act as a support level.

Note : Volume recorded on a particular date also signifies a lot about the stock. You might notice that when the share price is close to the trendline, the volume recorded will also be high. This is because more traders are buying the stock which will push the share price up. Similarly, when the stock breaks down or breaks out of the trendline, volume plays an important role as it indicates the strength or the willingness of market players to either buy or sell a stock.

Recommended watch: Volume analysis in the stock market.

Another important point to note here is that you should never try to force a trendline which is hard to identify. You must draw the most obvious line to which the share price reacts the most. Let’s move ahead and understand the merger of tendlines.

What is merger or confluence of trendlines?

As we just saw, a trendline acts as a support and resistance. But apart from this, there is another big advantage of drawing a trendline. We all know that the share price fluctuates according to the demand and supply of shares. So, when two or more key trendline levels intersect each other at a point, it is called the merger or confluence . This merger acts as a very crucial point from which either the stock will see high demand or high supply. Take a look at this example.

Here is a chart of

State Bank of India

. The stock had a previous resistance level and a support level. Both the lines intersect at a point G which is a crucial level. When the stock price was close to price G, we saw a reversal. So at crucial levels, you might see high demand or supply in the stock.

These intersections are usually formed when:

- A support or a resistance level intersects the leg line or the horizontal line on a chart.

- Intersection of two trend lines or channels, one ascending and the other descending.

Indicators you can use along with trendlines to place early trades in the markets

Now, there are many indicators which you can use along with trendlines to place early trades in the markets.

In technical analysis we have various indicators which are used along with trendlines such as rate of change indicator (ROC),

Relative Strength Index indicator (RSI)

and a lot more. But among all the indicators RSI is one such indicator which can help you analyse how strong the current trend of a stock is. Moreover, it also indicates if the trend is going to reverse with the help of RSI divergence.

Recommended reading:

What is Relative strength Index indicator (RSI)?

So, along with the trendline if you use an indicator such as RSI, it will help you analyse how the trend is going to perform next with the help of divergence for short term trades as well as long term trades.

What is RSI divergence?

Usually, the RSI Indicator moves in synchronisation with the stock price. So, when there is an upward trend, the RSI would move upwards and vice versa. But sometimes, you might come across situations where the stock price is moving up but the RSI is moving down. It indicates that the strength of the trend is weak. Take a look at this example.

This is a chart of

Nifty 50

where the index is in an uptrend but the RSI does not move in synchronisation with the share price. This is called divergence and it gives you an early signal that we might see a trend reversal in a particular stock or index.

To learn more about RSI we invited Mr. Vishal Malkhan on our show,

The Right Choices with Oracles of Dalal Street

where he shared his 5 star strategy of using RSI indicator. He believes that RSI acts as a speedometer of a car which helps you in gauging the market situation and act accordingly.

RSI Trading with Mr. Vishal Malkan:

Grandfather-Father-Son Strategy:

Now RSI is one way which can help you analyse a trend reversal to get early entry and exits in the market. But there is also an advanced form of trendline which helps you get early entry and exits from the markets. This trendline is called a curved trendline or a parabolic trendline . With the help of a parabolic trendline you can predict the entry and exit points much earlier than a flat trendline. Curved trendline is a tool which is drawn with the help of three points to find the fourth point of support or resistance.

This is an example of Reliance Ltd . In this chart we have drawn a curved trendline by first joining point A and point B and then dragging the trendline to touch point C to find point D. And if you carefully see, with the help of points A, B and C we discovered a point D which was a perfect support point and the share price reversed from that point. To learn everything about curved trendlines in detail you must watch these two insightful episodes of The Right Choices with Oracles of Dalal Street . In these episodes, Sanket Thakar has explained everything about how to draw parabolic trendlines using various examples.

Bottom line

Trendlines are essential and a very basic tool which you must master before you start trading. Learning to draw trendlines is indeed a skill. But, you must also have the ability to predict a strong trendline and a weak trendline. A strong trendline is a line where the share price bounces back when it touches the trendline.

A weak trendline is the one which constantly has false breakouts and most often the stock price fluctuates above and below the trendline. Also remember, when the share price breaks the trendline, it is recommended that you must use tools such as RSI to predict the next market move. We hope you found this guide on trendline trading helpful. To learn more about technical analysis you must check out our playlist on technical analysis . Tagged: trading trendline breakstrendlinetrendline breakout trading strategytrendline tradingtrendline trading strategy

Easy & quick

Easy & quick

Leave A Comment?