- What are corporate actions?

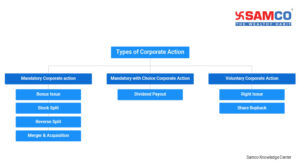

- What are the types of corporate actions?

- Mandatory Corporate Action

- Mandatory with Choice Corporate Action

- Voluntary Corporate Action

- Purpose of corporate actions

- What are some most common types of corporate actions?

What are corporate actions?

Corporate action implies action at management level which has a significant impact on the stakeholders and the financial structure of the company.What are the different types of corporate actions?

The three basic types of corporate actions are:

The three basic types of corporate actions are:

1. Mandatory Corporate Action

A mandatory corporate action is decided by the company’s board of directors and it affects all shareholders once implemented. There is nothing much a shareholder can do when it comes to mandatory corporate actions. Some examples of mandatory corporate actions include stock splits, mergers, bonus issues, and spinoffs, etc.2. Mandatory with Choice Corporate Action.

In ‘mandatory corporate action with choice’, shareholders are given an alternative to choose among several options. For example, they can choose to either get a cash dividend or stock dividend. If case shareholders don't submit their preference in the given time then the default option is applied.3. Voluntary Corporate Action

In a voluntary corporate action, the shareholders are given the option to elect or participate in the action. A tender buyback offer is an example of voluntary corporate action.The Purpose of corporate actions

The two primary reasons for corporate actions are: 1. Corporate Restructuring: Corporate actions such as spinoffs, mergers and acquisition etc take place when a company wants to restructure its business to increase profitability. 2. Impacting Share Price: The liquidity of the stock is greatly impacted if the stock price is too high or low. If the stock price is too high, it becomes unaffordable for small investors. On the other hand, if the stock price is too low, it may be looked upon as a penny stock. In such situations corporate actions like Stock Splits, Reverse Stock Split or Buyback are used to influence the stock price.What are the most common types of corporate actions?

Let us take a look at the most common types of corporate action.1. Mandatory corporate actions

- Bonus Issue

- Stock Split and Reverse Stock Split

- Mergers and Acquisition

- Spinoffs

2. Mandatory with Choice Corporate Action

- Dividend Payout

3. Voluntary Corporate Actions

- Right Issue

- Share Buyback

Summary of Different Types of Corporate Actions:

| Types of Corporate Actions | Examples of Corporate Actions |

| Mandatory corporate actions | Bonus Issue Stock Split and Reverse Stock Split Mergers and Acquisition Spinoffs |

| Mandatory with Choice Corporate Action | Dividend payout |

| Voluntary Corporate Actions | Right Issue Buyback |

Conclusion

As an investor and shareholder, it is very essential to have an in-depth understanding of the different types of corporate actions and how it affects you. This will help you decide the type of corporate action to partici[ate in. All types of corporate actions have an impact on the stock price and helps investors understand the mindset of the management. You can participate in all these corporate actions online, without the hassles of physical paperwork, by opening the best Demat account in India with Samco and investing in the best stocks for long-term wealth creation.Happy Investing

Easy & quick

Easy & quick

Leave A Comment?