In this article, we will discuss

What is Vega

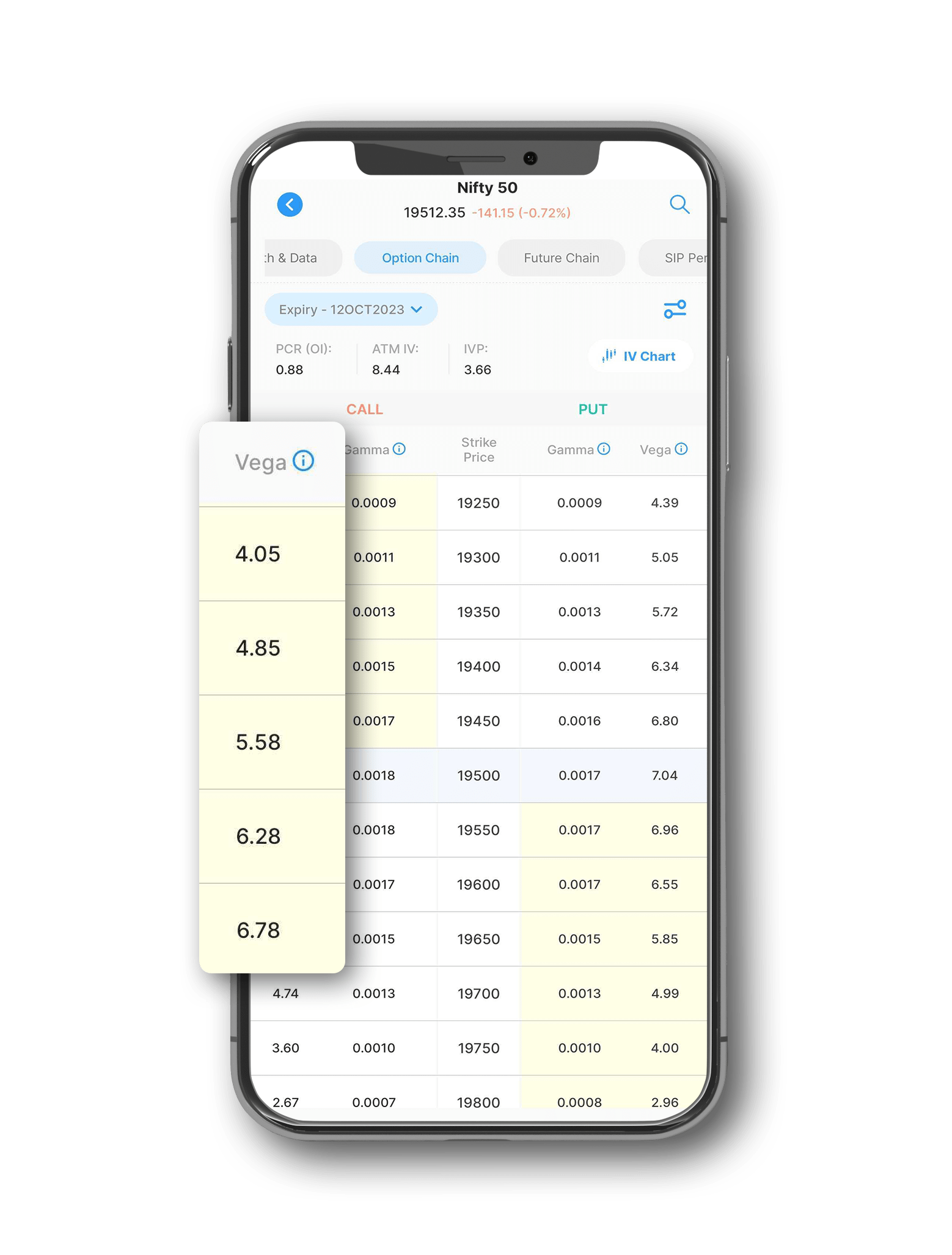

Vega reflects the change of an option's price to changes in Implied Volatility (IV) of the underlying. It indicates how much the option's price might change with a 1% change in IV.

Interpretations

Before we understand Vega interpretation, lets first understand what IV is.

IV or ‘Implied Volatility’ means the expected future volatility percentage which is embedded in the option prices. If the volatility is high the option prices are also inflated but if the volatility is low then the option prices are fairly cheaper.

If the expected volatility (Implied Volatility) is very high then the chances of huge swings/ moves in the underlying are also high, therefore the option sellers demand a much higher premium to hedge the option buyer. For instance, before the Budget announcement every year on 1st February, the expected volatility is very high as the market can move in huge swings. Therefore, the option premiums before the Budget tend to be inflated.

If the Implied volatility (IV) is low then the market participants do not expect huge market swings in the near short term period, therefore the option sellers do not demand a much higher premium to hedge the option buyer.

Therefore, understanding vega is important to gauge the impact of IV on option prices.

Helping us become a options trader

Since Vega greek is a non directional measure of option price, we shall look at this from an option buyer and sellers point of view:

Option buyers who believe that the underlying asset will experience substantial price swings can use options with high vega to potentially benefit from changes in implied volatility. These buyers might capitalize on market events or news that could lead to increased volatility. As the IV starts to rise, the value of the option will keep on increasing and since the option is with high vega, the price of the option will increase with every 1% change in IV.

Option sellers who believe that volatility will decrease can benefit from vega. If implied volatility decreases, the prices of options with high vega will likely decline. This allows sellers to potentially buy back the options they sold at a lower price or let them expire worthless. Sellers can sell options right after the market event or news that led to increase in IV is priced in.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?