In this article, we will discuss

- Option Greeks – A Deeper Dive

- What Are the Types of Options Greeks?

- Take Your Trading Game to the Next Level With Samco

- Conclusion

- FAQs

When trading options contracts, traders usually perform technical analysis using various tools and charts. This helps them make a fair estimation of the underlying asset’s future price movements and make informed decisions. Now, they also use mathematical measures to assess their risk and return.

They are called Option Greeks and serve a crucial role in helping them decide which contracts to trade, along with their appropriate time. Find out more by reading this article.

Option Greeks – A Deeper Dive

Option Greeks are a set of calculations which can help traders calculate the sensitivity of an options contract’s price to various factors like changes in the underlying security's value, implied volatility, interest rate and the time left for contract expiry.

Now, when talking about an options contract’s price, we are also including its premium. This is the amount traders pay or receive when they buy or sell options. It is based on the contract’s pricing model, which leads to its fluctuations in value. Usually, they are viewed in conjunction with an options contract’s pricing model as it helps in assessing the associated risks.

What Are the Types of Options Greeks?

Option Greeks are mainly of 5 types. They are as follows:

Delta

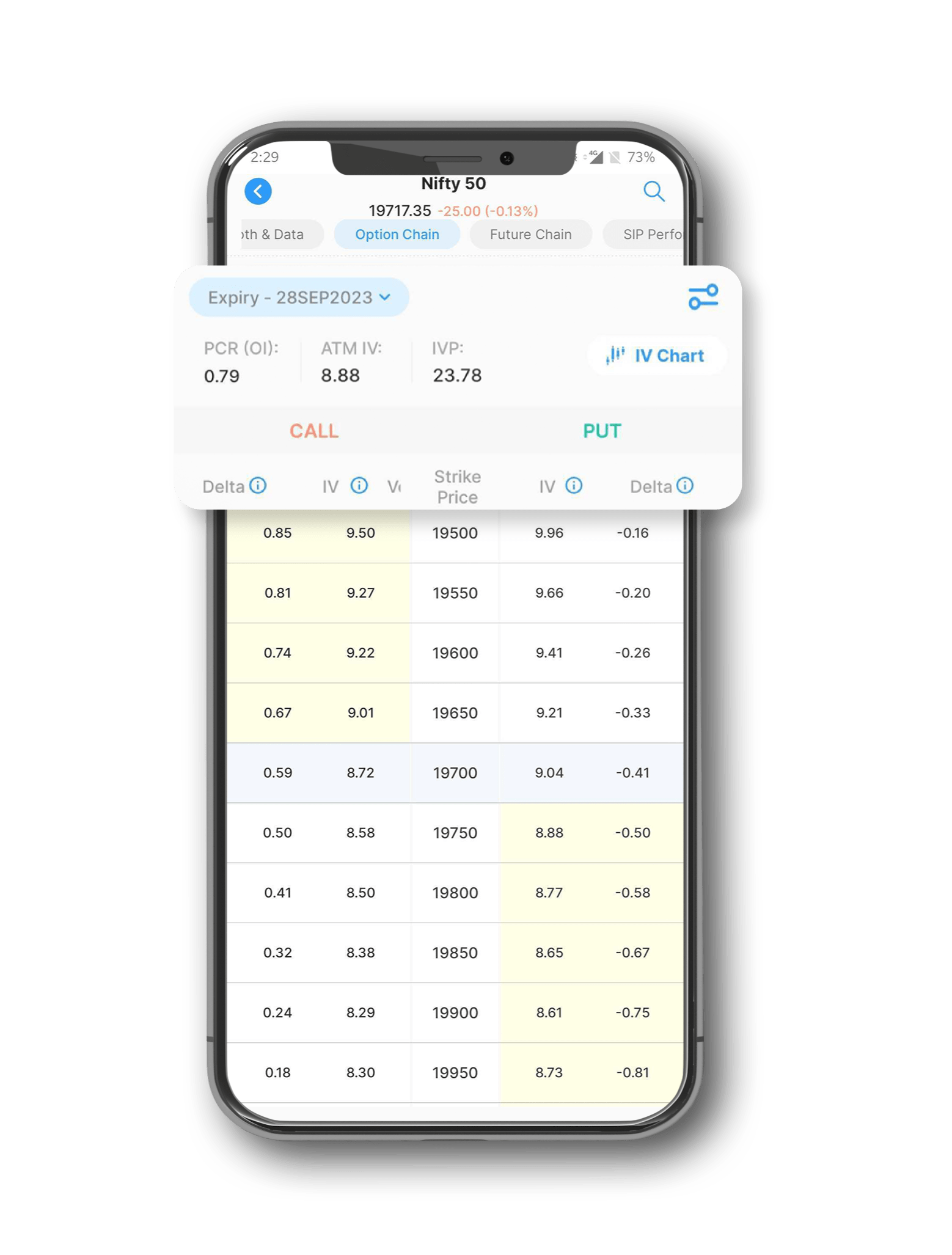

Delta can help traders analyse the probability of an option expiring In The Money (ITM). It measures the change in an option’s price with respect to the underlying asset’s price movements. The Option Greeks formula for Delta is ∂V/AS.

Where:

- ∂ = the first derivative

- V = the option's price

- S = the underlying asset's price

Now, option greeks Delta gives a value between -1 to 1. Call options get values ranging from 0 to 1, while Delta values of put options are between -1 to 0. The closer an option’s Delta is to 1 or -1, higher will be the chances of it being ITM.

The Delta of an options portfolio is called a hedge ratio. It is the weighted average of the Delta values of all the options contracts, enabling traders to decide whether they should hedge their positions by shorting or buying the underlying securities multiplied by Delta.

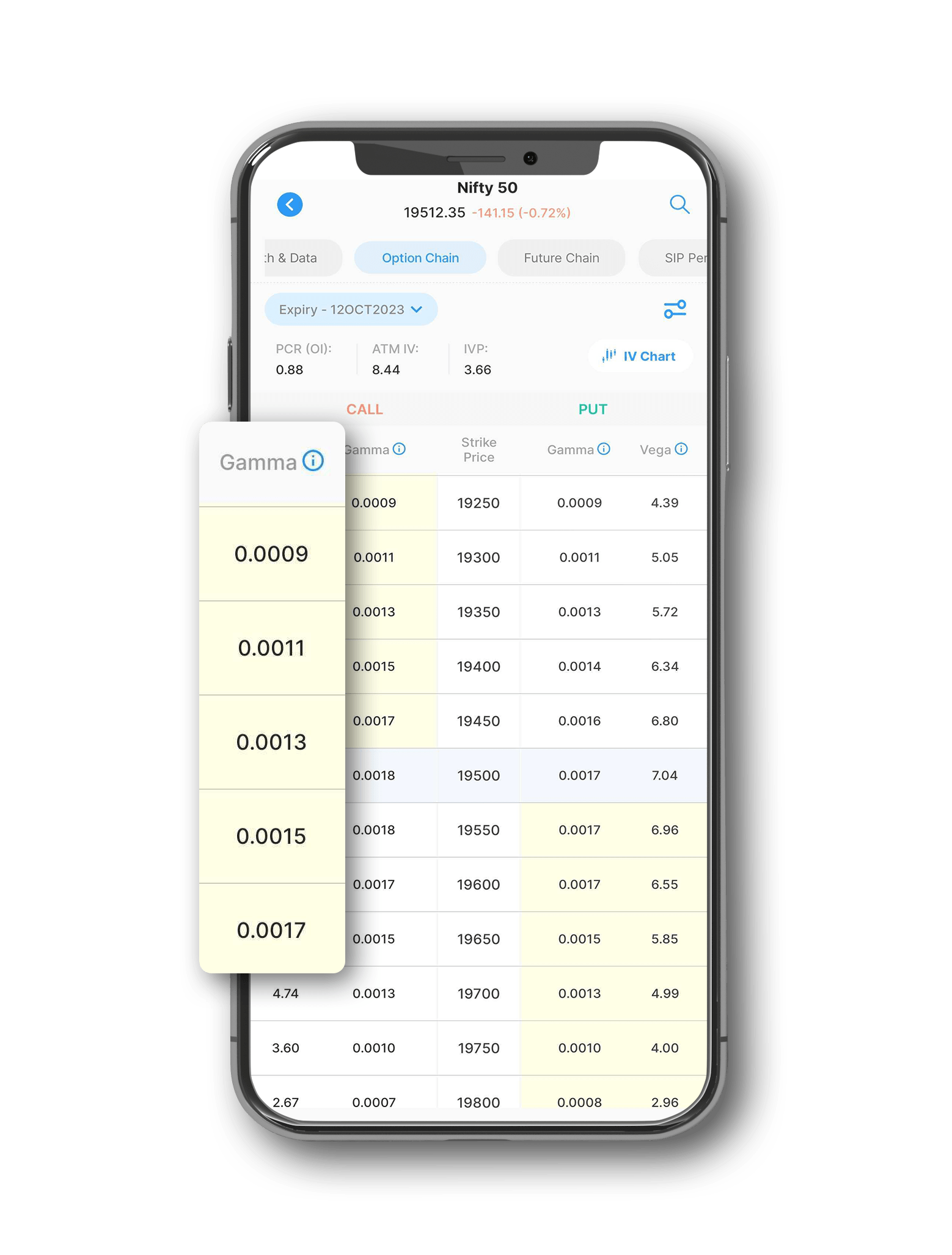

Gamma

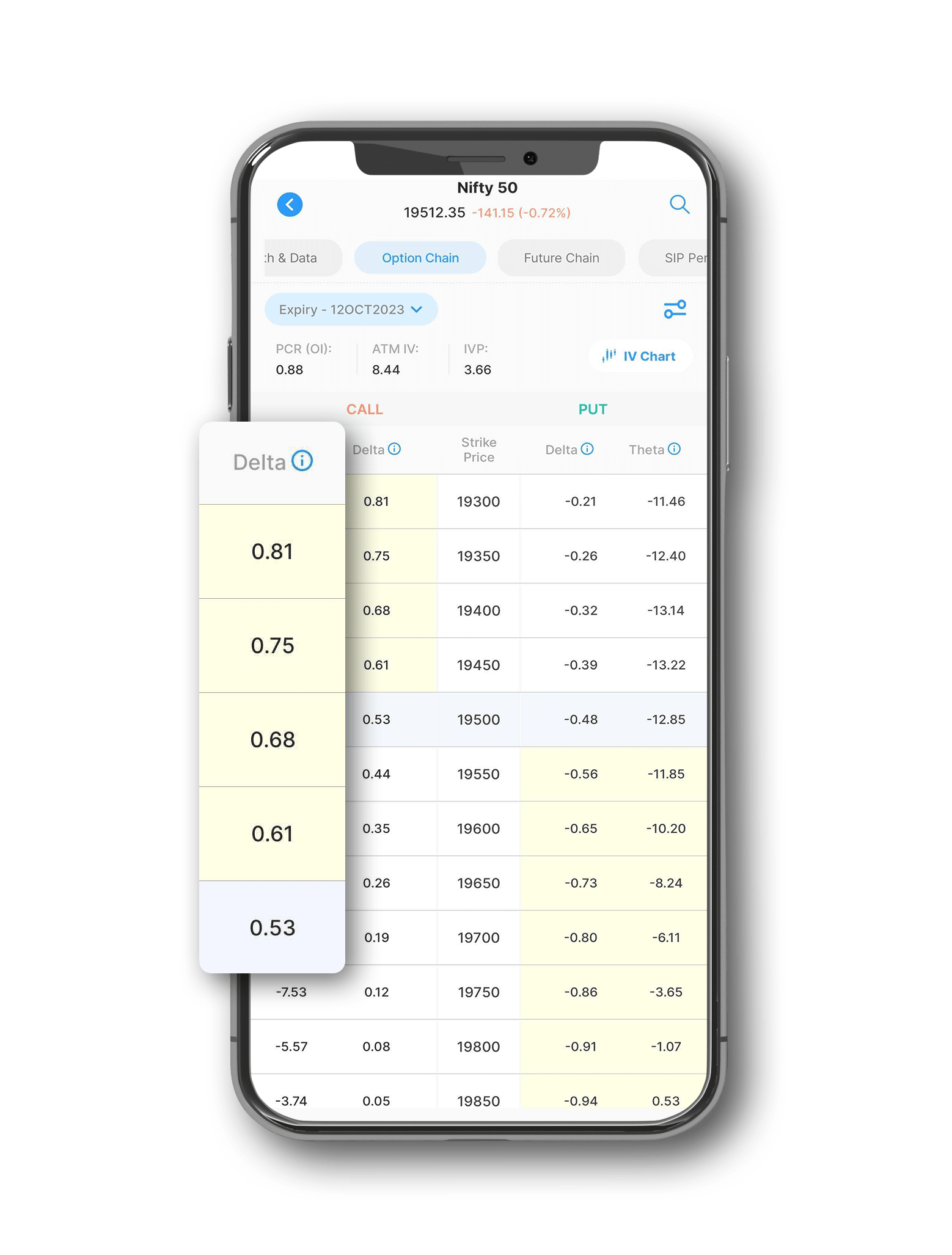

Gamma is an Option Chain Greek that helps traders identify the rate of change in Delta with respect to the underlying asset’s price movements. When its value appreciates, option Greek Delta will also increase as per the Gamma value.

Long call and put options always have positive Gamma. An option’s Gamma is at its maximum when it is At The Money (ATM). However, when its value moves to ITM or Out of The Money (OTM), Gamma starts to decrease.

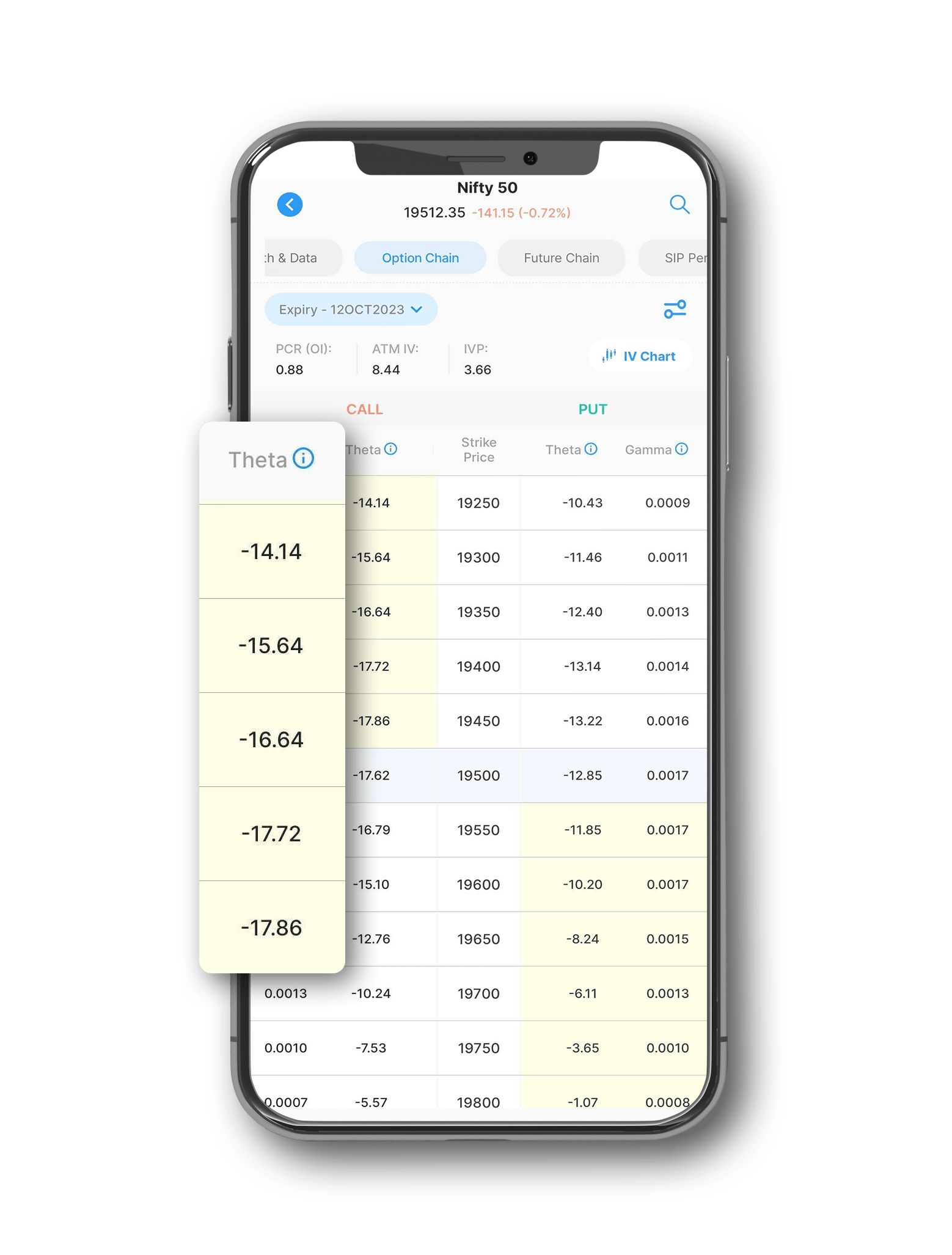

Theta

We all know that as an options contract nears expiry, its premium starts losing value. This factor is known as time decay and is represented by Theta, which indicates a change in an options contract’s price with respect to the time left for expiry.

As the time left for a contract’s maturity decreases by a certain amount, Theta’s value also depreciates by the same level. Option Greeks Theta is usually negative for a majority of options. It shows the highest negative value when the option is At The Money (ATM).

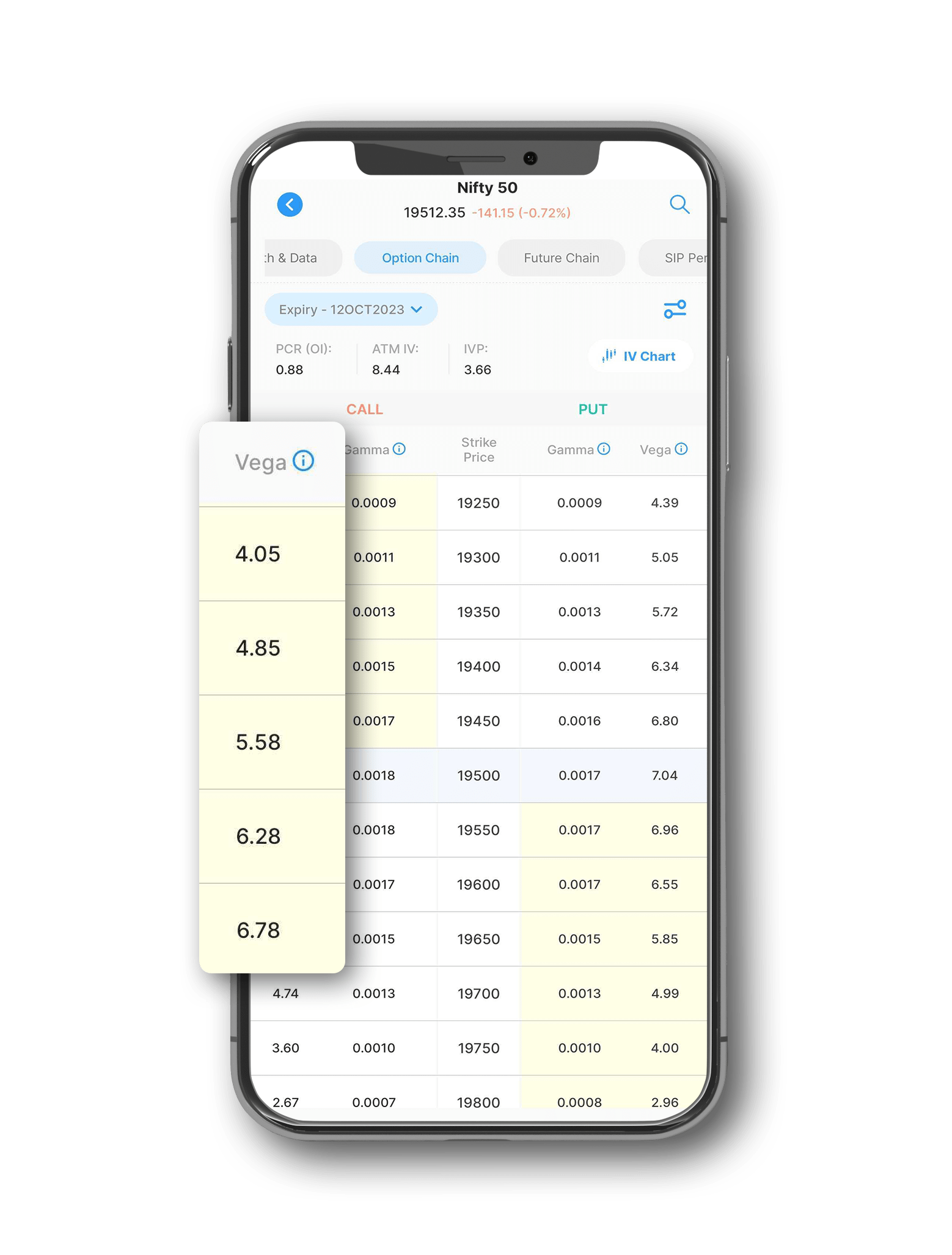

Vega

The sensitivity of an option’s price in relation to the volatility of its underlying asset’s market value is measured by Vega. In case volatility of the security rises or falls by a certain percentage, the Vega amount will exhibit that change in tandem.

Thus, it can be said that the value of an options contract has a positive correlation with its Option Greeks Vega value. A rise in value in one will cause an increase in the other and vice versa.

Additionally, an increase in volatility results in a rise in options premium values. Thus, traders consider Vega as one of the most important trading Option Greeks when it comes to determining options value.

Rho

Rho measures the changes in an option’s price in relation to the interest rates. It represents the amount of change in the contract’s value if the benchmark (risk-free interest rate) rises or falls.

Usually, when the interest rate rises, call options appreciate in value, while the put options fall. Thus, calls always have a positive Rho, while puts have a negative one.

Now, traders consider Rho as the least significant among all other Option Greeks. This is because options prices are usually less sensitive in comparison to changes in the asset price, time decay and volatility.

However, analysing Rho is important for traders using long-term options strategies. This is because interest rates usually change in the long term, increasing their chances of impacting the option contract’s value.

Take Your Trading Game to the Next Level With Samco

As much as knowing how to analyse risks is important, using the right brokerage platform also plays a major role in profitability. The New-Gen Samco App’s unique engine analyses all your past transactions and provides personalised insights to help improve your future trades.

The platform also has a unique options value calculator that lets you enumerate options contract prices based on factors like changes in the underlying security’s value, implied volatility, time decay and interest rates. So, even if you are not an expert in using Option Greeks, Samco has you covered.

Additionally, Samco provides zero-balance margin trading facilities and up to 20X leverage for trading options contracts. What’s more, this platform has the lowest brokerage charges in the industry, which is ₹20 per executed order, irrespective of its size.

Conclusion

These were the major Option Greeks that you must know in order to predict changes in an option's value based on various parameters. However, there are several other minor Greeks like lambda, vomma, epsilon, speed, vera, etc., which you can consider researching.

Additionally, experts recommend using other analysis tools like charts, technical indicators, etc., in combination with option Greeks to make a better estimation of an option’s price movements.

FAQs

Are Option Greeks completely accurate?

Ans. Option Greeks enable investors to theoretically estimate an options contract’s value due to changes in the underlying asset’s value, implied volatility, expiration time and interest rates. Thus, they should use it only as a reference while making trade decisions.

How do Option Greeks benefit traders?

Ans. Option Greeks help traders mitigate losses by predicting the nature of price sensitivity which can affect the value of their options contract. They enable individuals to take calculated risks and thereby increase their chances of profitability.

Can Option Greeks be useful in intraday trading?

Ans. Yes, as Option Greeks help determine the price movement of a certain trade based on various factors like asset fluctuations in value, volatility and time value, they can be effective tools in intraday trading.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?