In this article:

- What are preference shares?

- Why does a company issue preference share?

- What are the types of preference shares?

- Advantages of preference shares

- Disadvantages of preference shares

- How does a company issue preference share?

- Who can buy preference shares?

- What are the key differences between equity shares, preference shares and debt instruments?

- Recent preference shares issued in India

- FAQs on preference shares

What are Preference Shares?

Preference shares are a special type of equity shares. A preference shareholder gets the first claim on a company’s profits and dividends after creditors. Like debt instruments, preference shares also provide fixed income in the form of preference dividends. While the dividend income is assured, it is important to note that preference shareholders do not get voting rights. When you are investing in preference shares, keep in mind that they are not risk-free like bonds. Like common equity shares, even preference shares experience fluctuations and the principal amount is not secured.Why Does a Company Issue Preference Shares?

There are three crucial reasons why companies issue preference shares:- To Keep the Debt to Equity Ratio in Check: Companies always try their best to avoid excess debt on their balance sheets. This is because both analysts and investors monitor a company’s Debt to Equity ratio. Too much debt on a balance sheet can lead to poor credit rating which in turn acts as a big red flag for equity shareholders. To avoid all this negativity, companies prefer issuing preference shares instead of adding fresh debt. And the best way to raise fresh capital without affecting the debt to equity ratio is by issuing preference shares.

- To Retain Voting Rights: Another reason why companies prefer preference shares over equity shares is voting rights. When a company issues equity shares, each shareholder gets voting rights and a say in management decisions. But the best thing about preference shares is that preference shareholders do not get any voting rights.

- To Avoid Sharing Profits: When you buy equity shares of a company, there is no cap on the dividend income that you can earn. If the company performs exceptionally well, then you will earn more dividends. But that’s not the case with preference shareholders. If the dividend rate for preference shareholder is fixed at 10%, then irrespective of the profits earned, their share will remain fixed at 10%. It is not compulsory for a company to share its entire profits with preference shareholders like in the case of equity shares.

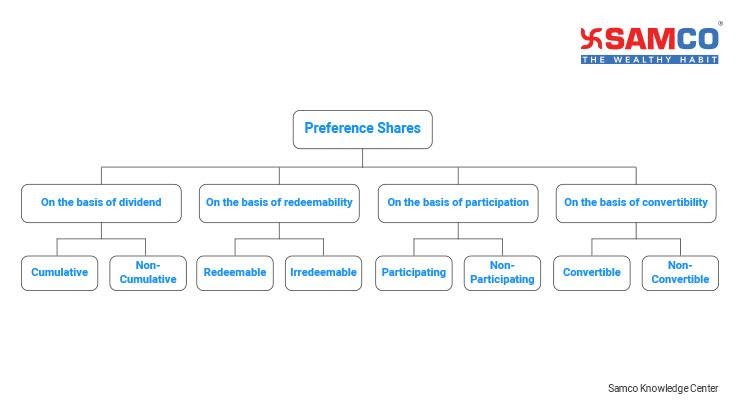

What are the Types of Preference Shares?

Types of Preference Shares Based on Dividends

1. Cumulative Preference Shares This is the most common type of preference shares. Cumulative preference shares have an added advantage over ordinary preference shares as they have the right to earn dividends even when the company does not make any profit. Unpaid dividends keep on accumulating and are carried forward as arrears. 2. Non-Cumulative Preference Shares A non-cumulative preference share does not accumulate unpaid dividends. In case the company does not pay dividends for a few years, then the amount overdue cannot be claimed in subsequent years.Types of Preference Shares Based on Redeemability

1. Redeemable Preference Shares In case of redeemable preference shares, the issuing company can purchase the preference shares back from the holder before maturity. These are also known as callable preference shares. 2. Irredeemable Preference Shares These preference shares can only be redeemed if the company shuts its operations or liquidates itself.Types of Preference Shares Based on Participation

1. Participating Preference Shares Usually dividends are paid out at a fixed rate. But if equity shareholders get a higher dividend, then participating preference shareholders can also get a chance to earn higher dividends. This is usually done when the company earns huge profits in a particular year. 2. Non-Participating Preference Shares In non-participating preference shares, the rate of dividend payout is fixed. So even if the company earns huge profits, the preference shareholder will be paid fixed dividends only.Types of Preference Shares Based on Convertibility

1. Convertible Preference Shares Here shareholders are allowed to convert their preference shares into common equity shares. This can be done after a certain time period and at a certain conversion ratio. For example, if a preference share has a conversion ratio of 2:1, then you will get two equity shares in exchange for one preference share. 2. Non-Convertible Preference Shares These preference shareholders do not get the right to convert their preference shares into equity shares.Advantages of Preference Shares

Advantages of Preference Shares to Investors

- If you hold preference shares of a company, then you are entitled to earn fixed dividends as per pre-defined rates.

- Preference shares provide higher rate of returns than bonds.

- Preference shares have lower risk than equity shares and are suitable for medium risk investors.

- If the company goes bankrupt, preference shareholders are paid before equity shareholders.

- As per the Income Tax Act 1961, dividends earned from preference shares are tax free up to Rs 10 lakh.

Advantages of Preference Shares to Issuing Company

- The cost of raising capital from preference shares is less than equity shares.

- The company is not bound to pay dividend if its profits in a particular year are insufficient. Except for cumulative preference shares.

- Preference shareholders do not get any voting rights. Hence it does not lead to dilution of management’s control on a company.

Disadvantages of Preference Shares

Disadvantages of Preference Shares to Investors

- Preference shareholders do not get voting rights. Hence, they cannot raise issues to the management or control the company’s decisions.

- Preference shareholders are only paid fixed dividends. Hence, they do not enjoy the excess profits of the company. The only exception is participating preference shareholders.

- Preference shares cannot be easily bought and sold as equity shares.

- Dividend income of more than Rs 10 lakhs is taxed at 10%.

Disadvantages of Preference Shares to Issuing Company

- Paying yearly dividend can be a financial burden to the company. Unpaid accumulated dividends only add to a company’s liabilities.

- Unlike equity capital, a company cannot use preference share capital perpetually. It has to be repaid on maturity.

- Preference shares are to be redeemed compulsorily within 20 years. Hence the company would require huge cash for this purpose.

- The rate of dividend paid to preference shareholders is generally higher than common equity shareholders. This is done to attract conservative retail investors.

How Does a Company Issue Preference Shares?

- The company needs to ensure if issuing preference shares are authorised under the Articles of Association (AOA) of the company.

- Later in an Annual General Meeting (AGM) with the help of an explanatory statement relevant facts are discussed such as:

- Size of the issue, number of preference shares, nominal value of the shares

- Nature of the shares

- Objective of the issue.

- Terms of issue, rate of dividend and tenure of redemption.

- Current shareholding pattern of the company

- Expected dilution of equity shares upon conversion (in case the nature of shares is convertible)

- After the resolution is passed the company files a statement with the Registrars of Companies (ROC) within 30 days.

Here are a few key points to note before issuing preference shares.

- A company shall redeem its preference shares within 20 years from the date of issue.

- The minimum application size for each investor should not be less than Rs 10 lakh.

- Issuing companies must obtain at least AA or AAA ratings from a credit rating agency.

Who can Buy Preference Shares?

Preference shares are not traded on the stock exchanges. Hence, they are not available for retail investors. Usually companies issue these shares under private placement. These are issued to financial institutions, Hindu Undivided Family (HUF) and other lending firms. Retail investors are rarely offered preference shares.What are the key differences between equity shares, preference shares and debt instruments?

| Area of Difference | Equity Shares | Preference Shares | Debt instruments |

| Meaning | Equity shares signify ownership in a company. | Preference shares are a type of equity shares which guarantee its holder a fixed rate of dividend. | Debt instruments signify a loan between lenders and borrowers. The borrowers have to pay a fixed rate of interest and return the principal on maturity. |

| Dividend and interest | Equity shareholders receive dividend at a fluctuating rate. They are the last ones to get paid. | Preference shareholders have fixed dividend rates. They are always paid before equity shareholders. | Interest on debt is paid before preference and equity shareholders. |

| Voting Authority | Equity shareholders have voting rights. | Preference shareholders do not carry voting rights. | Debt holders do not have any right on the company’s management or management decisions. |

| Convertibility | Equity shares cannot be converted. | Only convertible preference shares can be converted into equity shares. | Only convertible debentures are converted to equity shares. |

| Dividend Overdue | Equity shareholders do not get outstanding payment of dividends. | Cumulative Preference shareholders get unpaid dividends as arrears. | Debt holders get regular interest instead of dividends. |

| Risk | Risk associated with equity shares is high. | Risk associated with preference shares is less compared to equity shares. | Debt instruments which are AAA rated are considered less risky as there is low to no risk of defaults. |

| Who should invest? | Investors who are ready to take risk should invest in equity shares. | Medium risk investors who wish to earn fixed returns can invest in preference shares. | Conservative investors who wish to invest in safe investments should opt for AAA rated bonds |

Recent Preference Shares Issued in India

In the past years many reputed companies such as Tata Capital, L&T Finance Holding company, IL&FS transportation networks ltd, have issued preference shares under private placement. Dividend rates of these securities are very lucrative and tax free up to Rs 10 lakh.| Security | Issue date | Maturity | Type of issue | Dividend rate | Dividend payment date | Tax free returns |

| TATA capital preference shares | 22/04/2015 | 21/04/2022 | Fully Paid up Non- Convertible Cumulative Redeemable Non- Participating Preference Shares | 8.33% | 30th June annually | 8.25% |

| L&T finance holdings ltd. | 12/10/2018 | 12/10/2021 | Non-convertible cumulative redeemable preference shares | 9% | 26th March annually | 8.95% |

| IL&FS transportation networks ltd. | 16/05/2014 | 16/05/2021 | Non-convertible Redeemable Cumulative Preference Shares | 16% | 30th May annually | 15.99% |

FAQs on Preference Shares

- What are preference shares?

- Do preference shareholders get voting rights?

- Why do companies issue preference shares?

- To avoid weakening their debt to equity ratio.

- To avoid dilution of voting rights.

- To avoid sharing of profits.

- Are dividends guaranteed in preference shares?

- What is the tax payable on preference shares?

- Are preference shares risk-free?

- The dividend income is assured and fixed even if the company does not make money.

- Even if a company goes bankrupt, preference shareholders will be paid before common equity shareholders.

Easy & quick

Easy & quick

Leave A Comment?