What is Forward Contract? – How Forward Contract Works & Payoff

While forward contracts are not popular among investors and traders today, it is still important for you to understand what are forward contracts as they form the base of futures and options trading. So, what are forward contracts? A forward contract is a customised agreement between two parties, the buyer and the seller to exchange the underlying asset at a pre-decided price and time in the future. Let us understand what is forward contract with this simple example. It’s a special occasion and you hire a local cab in advance to travel from one point to another. You and the local cab driver are two parties agreeing to exchange the service for a fee. You agree on the fees, weeks before the actual trip. This is an example of forward contract. Let us now take a look at the key features of a forward contract.Key Features of Forward Contracts

- There are two parties to a forward contract. The buyer and the seller interact with each other directly without the exchange as a counterparty. In the above example, you were in direct contact with the local cab driver. You did not book the cab via a third party like Ola or Uber.

- Both the parties must have opposite views on the underlying asset.

- This agreement between the buyer and the seller is customised. For example, if you buy one lot of Infosys futures contract, you are agreeing to buy 300 shares of Infosys Ltd. But in case of a forward contract, there is no fixed lot size. The lot size can be 100 shares, 200 shares or even one share.

- Due to this direct contact between the buyer and the seller, forward contracts are not traded on a stock exchange. Hence, forward contracts are also known as Over-the-Counter (OTC) derivative contracts.

- The third thing to note in this definition of forward contract is the underlying asset. Like a futures or options contract, even a forward contract has no value of its own. It derives its value from the value of the underlying asset. The underlying asset in a forward contract can be stocks, indices like Nifty, commodities, currencies

- While the underlying asset is exchanged at a future date, the price at which it will be bought and sold is decided today itself.

Example of Forward Contract

I am a coffee lover and there is a well-known coffee shop close to my place. I have been visiting it for a while now. Two things haven’t changed much. The flavour of my coffee and its price. I always wondered why or how this coffee shop managed to keep the price same even though the price of coffee beans keeps on fluctuating. So, I spoke with the owner of the coffee shop and discovered that the secret to their consistent price was a forwards contract. Here is what the coffee chain does. To keep their input costs stable they have joined hands with several coffee bean farmers. Every year before the harvest they mutually decide the quantity and selling prices of the beans. The company purchases the beans at mutually agreed prices after the harvest. It doesn’t matter whether prices have shot up or fallen as the company pays as per the pre-decided prices. So basically, the company has entered into a forward contract with coffee bean farmers.How Does a Forward Contract Work?

As we learnt earlier, there are two parties in a forward contract – Buyer and Seller. Individuals or companies enter into forward contracts to hedge against price fluctuations. Hedging is a way to protect yourself from sudden price volatility. In the above story, both the coffee company and the farmers are hedging their price risk. The company wants to hedge against a rise in prices of coffee beans. The farmers want to protect themselves from a fall in coffee bean prices. So, both of them enter in to a forward contract to reduce their respective risks. Let us build on the earlier example and understand how forward contracts work – Scenario 1 – Let’s assume that the company enters into an agreement to buy 100 kgs of coffee beans at Rs 1,000 per kg. The agreement value is Rs 1 Lakh. At the time of harvest, the demand for coffee beans rises and the price per kg increases to Rs 1,200. In this case, since the coffee company’s view has come true, they make a profit. So, even though the farmer will make a loss of Rs 200 per kg (Rs 1,200-Rs 1,000) he must still obey the contract and sell the beans at a pre-decided price of Rs 1,000 per kg. Now you may be wondering the farmer is at a loss here. But that’s not the case. On the contrary, a forward contract has helped him mitigate future uncertainties. A forward contract has acted as an excellent risk mitigation tool for him. Scenario 2 – Now let’s look at the other side of the picture. Let’s assume the supply of coffee beans rises due to abundant harvest. The price per bag falls to Rs 800. Now the farmer has made a profit of Rs 200 per kg as he has already entered into a forward contract at Rs 1,000 per kg. The company pays the price decided at the time of entering into the agreement and the farmer delivers the beans. This means the contract is settled with physical delivery of goods on the specified date. This is known as physical settlement. There is also another way to settle a forward contract – cash settlement. The company and farmer can mutually decide to settle the contract without any physical delivery. They can settle the difference in cash based on the price of coffee beans at that point. For ex. If the price falls to Rs 950 per kg, then the company can pay Rs 5,000 (Rs 1,000-Rs 950 * 100 kgs) to the farmer. He can then take his produce to the local market and sell it for Rs 95,000. The farmer still gets the same Rs 100,000 he was promised at the time of entering the forward contract. We hope you have understood how a forward contract works. Let us now look at the payoffs for a forwards contract.Forward Contract Payoff Diagram with Example

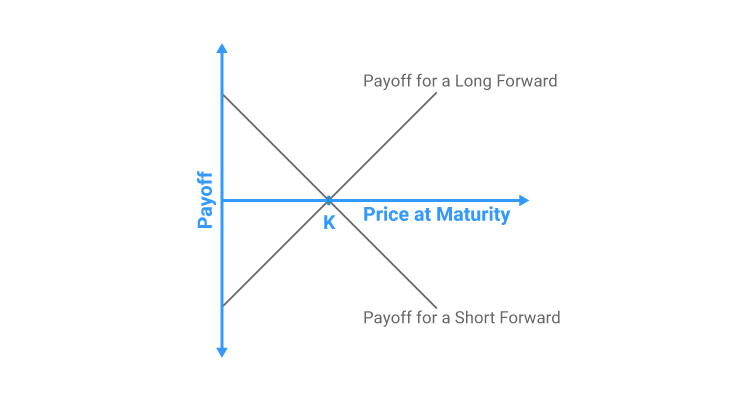

By now you know that the parties in a forward contract have opposite views on the price of the underlying asset. The buyer expects the price to go up in the future and hence he wants to lock-in a lower purchase price today. The seller expects the price to fall in the future and wants to lock-in a higher sale price today. This brings us to an interesting concept – Payoffs in Forward Contract. The buyer of a forward contract will benefit when the spot price of the underlying asset is more than the strike price of a forward contract. Assuming spot price as ST and strike price (agreed price as per forwards contract) as K, the payoff for forward contract buyer and seller will be as follows:- Payoff for Long Position in a Forward Contract = ST – K

- Payoff for Short Position in a Forward Contract = K – ST

Limitations of Forward contracts

1. Default risk – Default risk is the risk of the buyer or seller refusing to honour their end of the contract. In the above example, imagine if the price of beans doubles after harvesting. In this case, the seller can decide to not honour the agreement and leave the buyer with nowhere to go. This happens because there is no unbiased third party to settle the contract like in a futures or options contract. Since there is no regulatory body involved, default risk is very high in case of forward contracts. Want to Learn Options Trading? Watch this Dedicated Playlist on Options Trading for BeginnersForward Contract Vs Futures Contract – What is the Difference Between Forward Contract and Futures Contract?

| Forwards Contract | Futures Contract | |

| Contract | Forward contracts are non-standardised and can be tailor-made for each transaction. | A futures contract is standardised in nature. |

| Trading Mechanism | Forward contracts are traded over-the-counter on a one-on-one basis. | Futures are traded on stock exchanges. |

| Parties to the contract | There are only two parties in a forward contract – the buyer and the seller. | There are three parties in a futures contract – the buyer, the seller and the exchange. |

| Counterparty risk | Since there is no unbiased third party, chances of default are very high. | With the exchange as a counterparty, default risk is eliminated in a futures contract. |

| Initial and maintenance margins | Since they are not traded on stock exchanges, initial or maintenance margins are not required. | All futures and options contracts have initial and maintenance margin requirements. |

| Ease of finding counterparty | Since these contracts are traded OTC, finding a counterparty can take weeks or months. | Trades on stock exchanges are settled within seconds. |

Easy & quick

Easy & quick

Leave A Comment?