Patterns have played an important role in human evolution. The discovery of pattern of stars or constellation changed our understanding of the galaxy. A similar discovery of patterns has changed the way the world creates wealth. I’m referring to Candlestick Patterns.

The story of candlestick patterns started in the 17th century. A rice farmer, Homma Munehisa used candlestick patterns to predict uptrends or reversals in the rice futures market. It is said that his networth was equivalent to today’s 300 Billion Dollars!

However, Steve Nison introduced candlestick patterns to the western world in the 1980s. Since then, candlestick patterns have become a favourite among traders and technical analysts. One of the key reasons for the popularity of candlesticks is its simplicity and ability to display multiple information about a stock’s price. This is what sets candlestick apart from a line chart.

A line chart only shows the closing price of a stock on a particular trading day. You cannot make out whether the stock hit a high or a low or was flat. Hence, line charts are one-dimensional. But candlestick displays four key information about a stock at one go – OHLC.

Patterns have played an important role in human evolution. The discovery of pattern of stars or constellation changed our understanding of the galaxy. A similar discovery of patterns has changed the way the world creates wealth. I’m referring to Candlestick Patterns.

The story of candlestick patterns started in the 17th century. A rice farmer, Homma Munehisa used candlestick patterns to predict uptrends or reversals in the rice futures market. It is said that his networth was equivalent to today’s 300 Billion Dollars!

However, Steve Nison introduced candlestick patterns to the western world in the 1980s. Since then, candlestick patterns have become a favourite among traders and technical analysts. One of the key reasons for the popularity of candlesticks is its simplicity and ability to display multiple information about a stock’s price. This is what sets candlestick apart from a line chart.

A line chart only shows the closing price of a stock on a particular trading day. You cannot make out whether the stock hit a high or a low or was flat. Hence, line charts are one-dimensional. But candlestick displays four key information about a stock at one go – OHLC.

- Open (O)

- High (H)

- Low (L)

- Close (C).

What is Candlestick?

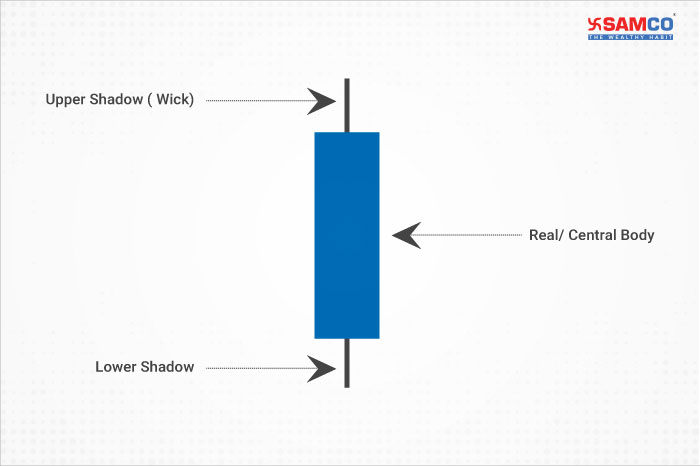

While the name sounds fancy, a candlestick is simply a type of chart used to display the open, high, low and close prices of a stock. It is named such because it resembles an actual wax candle. It has a body with wick on the top. And it casts a shadow below it.

- Bullish Candlestick

- Bearish Candlestick

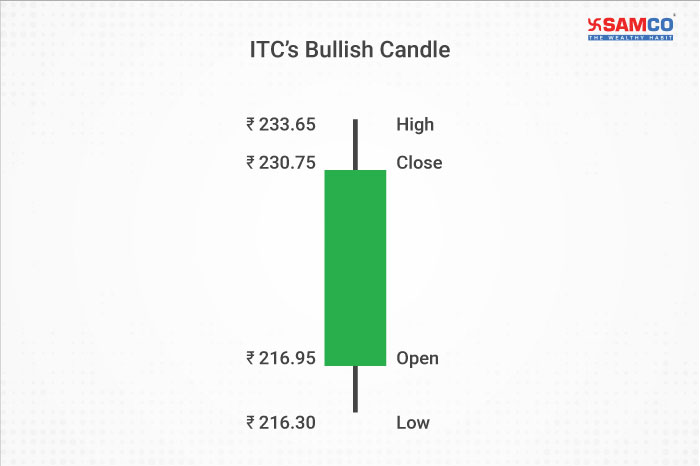

Constructing a Bullish Candle

The table below shows the OHLC of ITC Ltd on 16th September 2021.| Open | Rs. 216.95 |

| High | Rs. 237.30 |

| Low | Rs 229.10 |

| Close | Rs 231.15 |

| Open Price < Close Price = Bullish Candle |

- The rectangular body of the candle connects a stock’s closing price (Rs 230.75) with its opening price (Rs 216.95).

- The wick or upper shadow connects the stock’s closing price (Rs 230.75) to its day’s high (Rs 233.65).

- The lower shadow connects the stock’s opening price (Rs 216.95) to its day’s low (Rs 216.30).

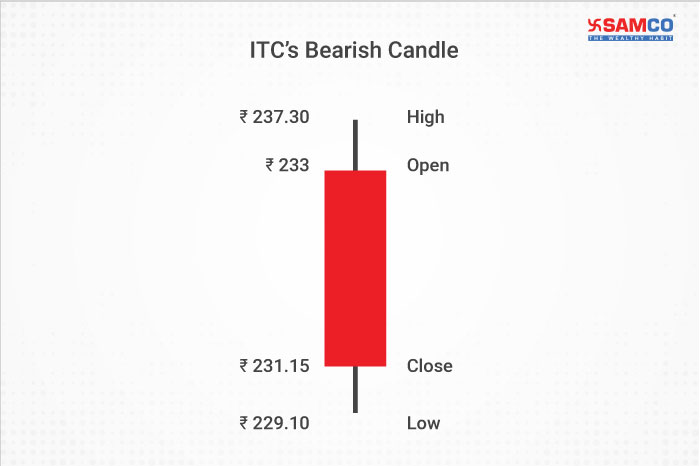

Constructing a Bearish Candle

Let us now look at how a bearish candle is constructed for ITC Ltd for 17th September 2021.| Open | Rs. 233 |

| High | Rs. 237.30 |

| Low | Rs 229.10 |

| Close | Rs 231.15 |

| Open Price > Close Price = Bearish Candle |

- The rectangular body of the candle connects a stock’s opening price (Rs 233) with its closing price (Rs 231.15).

- The upper shadow connects the stock’s opening price (Rs 233) to its day’s high (Rs 237.30).

- The lower shadow connects the stock’s closing price (Rs 231.15) to its day’s low (Rs 229.10).

8 Basic Candlestick Patterns to Predict Market Trends

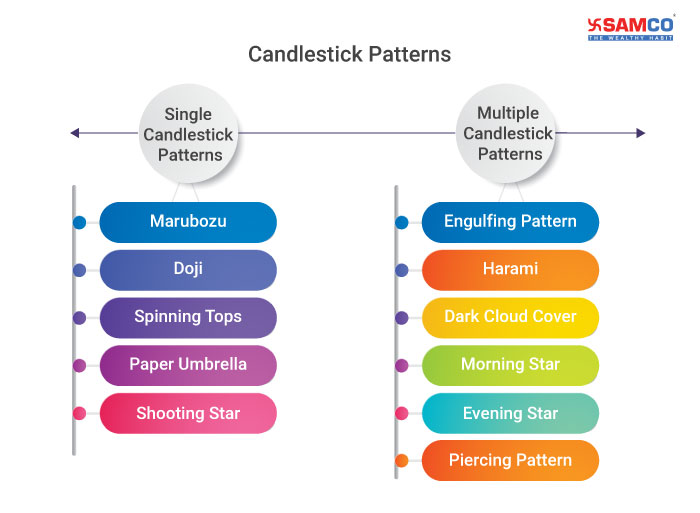

Now that you understand how a bullish and bearish candlestick is formed, let us understand the eight basic candlestick patterns. Candlestick Patterns can be divided into –- Single Candlestick Patterns

- Multiple Candlestick Patterns

Candlestick Pattern #1: Long Day Candle

An important thing to note about candlesticks is the length of the candle’s real body. This indicates the intensity of buying or selling by bulls and bears. The first basic candlestick pattern that we will explore is the Long Day Candle. A long day candle is formed when there is a substantial difference between the open and close price of a stock. It typically indicates a big upward or downward movement in the market. A long day candle can be both bullish (green) or bearish (red). A green long day candle means the stock or market is bullish. This means that the bulls were in total control of the stock and hence there is a big difference between the stock’s open and close price. The chart below shows a bullish long day candle formed in ITC Ltd on 16th September 2021. When you look at this candle, you will be able to understand what happened to ITC Ltd on 16th September 2021 –

- ITC Ltd opened for trading at Rs 216.95.

- It hit a high of Rs 233.65 and a low of Rs 216.30.

- It finally closed at Rs 230.75.

Candlestick Pattern #2: Short Day Candle

A short day candle shows a small movement in the market or stock. It is formed when there is a small difference between the close and open price of a stock. This type of candle is usually seen when there is less activity or volatility in the markets. A short day candle can be seen during December, which is a holiday season for the foreign institutional investors (FIIs). A red short day candle means the bears were in charge but couldn’t drag the prices down much since there was less volume. A green short day candle means the bulls were in control but couldn’t pull the stock prices up due to low volumes. A short day candle typically shows a consolidation stage in stock prices after a rally. The screenshot below shows the green and red short day candles in Reliance Industries Ltd between March – June 2018.

Candlestick Pattern #3: White / Green Marubozu

In Japanese, Marubozu means bald. This simply means a candle with no wick (high) or lower shadow (low). Only a real body. Marubozu can also be bullish Marubozu or bearish Marubozu. In case of a bullish Marubozu;| High Price = Close Price & Low Price = Open Price |

Candlestick Pattern #4: Black / Red Marubozu

On the other hand, a black or red Marubozu shows extreme bearishness or pessimism in the markets. Here the bears are in charge and don’t allow the bulls to take the stock price up since opening. In case of a bearish Marubozu;| High Price = Open Price & Low Price = Close Price |

Candlestick Pattern #5: Doji

Doji candlestick pattern is a sign of extreme confusion among bulls and bears in the market. A doji candle resembles a cross. In a doji, there is very little difference between the open and close price of a stock. Hence, a real body is not created. In a doji candle:| Close Price = Open Price |

| Open | Rs 806.30 |

| Close | Rs 806.20 |

| High | Rs 812 |

| Low | Rs 802.30 |

Candlestick Pattern #6: Spinning Top

Like doji, even spinning top tells you that there is indecision and confusion in the market. Neither bulls nor bears are able to dominate the markets. Named after a toy, spinning tops have a small body (though bigger than body of a doji). The upper shadow and lower shadow of a spinning top are similar. The below candlestick chart shows the formation of a spinning top and Doji in Sequent Scientific Ltd.

Green Spinning Top in Blue Star Ltd.

In the below candlestick chart, a green spinning top can be spotted on 30th August 2021.

| Open | Rs 768 |

| High | Rs 777.80 |

| Low | Rs 758 |

| Close | Rs 769.75 |

- Real body = Close – Open = Rs. 769.75 – Rs. 768 = Rs. 1.75.

- The wick or upper shadow = High – Close = Rs. 777.80 – Rs 769.75 = Rs. 8.05

- The lower shadow = Open – Low = Rs. 768 – Rs 758 = Rs. 10

Red Spinning Top in Blue Star Ltd.

In the candlestick chart below, a red spinning top can be spotted on 27th September 2021.

| Open | Rs 904.80 |

| High | Rs 917 |

| Low | Rs 885 |

| Close | Rs 902.05 |

- Real body = Open – Close = Rs. 904.80 – Rs. 902.05 = Rs. 2.75

- The wick or upper shadow = High – Open = Rs. 917 – Rs. 904.80 = Rs. 12.20

- The lower shadow = Close – Low = Rs. 902.05 – Rs. 885 = Rs 17.05

Candlestick Pattern #7: Opening Marubozu

The stock market is nothing but a constant fight between the bulls and bears to take the stock price up or down. Hence, in all the candlestick patterns we saw above, there is both an upper shadow and a lower shadow. This means that irrespective of the closing price, both bulls and bears tried to take the stock up or down. This is why the shadows are created. But what if the bulls are so strong that the bears cannot take the stock price down? This is when an opening Marubozu is formed. Opening Marubozu can be both bullish (green) and bearish (red). Now we know that a green candle is formed when the closing price is more than the opening price. In case of a green opening Marubozu, it means that the stock’s price did not go down after opening. The bulls were so aggressive that as soon as the market opened, the stock price shot up. The bears did not get the chance to bring the stock down. A green (bullish) opening Marubozu is formed when –| Open Price = Low Price |

| Open | Rs 1,486.50 |

| High | Rs 1,519.80 |

| Low | Rs 1,486.05 |

| Close | Rs 1,514.75 |

| Open Price = High Price |

| Open | Rs 423.90 |

| High | Rs 423.90 |

| Low | Rs 402.65 |

| Close | Rs 412.90 |

Candlestick Pattern #8: Closing Marubozu

The last basic candlestick pattern is the Closing Marubozu. A green Marubozu candle shows that the stock’s closing price and high was the same. So, there is no upper shadow only a lower shadow. In a green closing Marubozu –| High Price = Close Price |

| Open | Rs 684.05 |

| High | Rs 719.90 |

| Low | Rs 673.85 |

| Close | Rs 719.05 |

| Low Price = Close Price |

| Open | Rs 1,246.24 |

| High | Rs 1,287.79 |

| Low | Rs 1,151.48 |

| Close | Rs 1,155.30 |

Easy & quick

Easy & quick

Leave A Comment?