What is Debt Financing?

Debt financing means when a company raises money for funding its operations by issuing debt instruments like bonds, debentures, bills and notes. The lender provides a debt or loan to the company for a fixed period of time and in return earns an interest or coupon on the loan provided. Lenders can be institutional investors or retail investors.

Short-term debt financing vs. Long-term debt financing

Debt financing can be:- Short-term debt financing.

- Long-term debt financing.

Types of Debt Financing

Debt Financing can be funded by:- Bank Loans

- Bonds

- Debentures

- Bearer Bonds

- Secured Loans

- Unsecured Loans

Advantages of Debt Financing

- Retain ownership of the company: In debt financing, you are only taking a loan from the lender. The lender has no right to interfere in the working or decision-making aspect of the company. You are the owner of the company. The lender-borrower relationship ends once the loan is paid back.

- Tax Advantage: The interest payable by the company on the loan is deductible from the company’s tax return. This reduces the overall tax liability and cost of debt financing for the company.

- Easy Financial Planning: Since the rate of interest is fixed, the company knows exactly how much interest is to be paid each month. It also becomes easier for the company to forecast its future expenses and engage in efficient financial planning and budgeting.

Disadvantages of Debt Financing

- Compulsory Repayment: A loan or debt is an expense which needs to be compulsorily repaid to the lenders. If the company goes bankrupt, the lenders have to be paid first, even before the equity shareholders.

- Collaterals: Lenders require collateral assets to be maintained against the loan. If the company’s assets are not sufficient, lenders might demand even personal assets to be attached as collaterals.

- Credit Rating: Large debt financing can affect your credit rating. A cut in the company’s credit rating can increase the cost of borrowing, due to increased risk to the lenders. Even a small delay in interest payment can adversely affect the company’s reputation and credit ratings.

How much Debt Financing is Ideal?

A company’s capital structure is made up of both equity and debt. In equity financing, a company issues shares to the shareholders in return for capital. The cost of equity financing is the dividends paid to the shareholders. The cost of debt financing is the interest payable by the company on the loan. The cost of equity financing and debt financing is the total cost of capital for the company. Cost of capital is the minimum return that a company should make to cover the cost of equity financing and debt financing. If the company generates returns less than the cost of capital then the company is generating negative returns for its investors. The formula to calculate the cost of debt financing is: Cost of debt financing = Interest expense x (1-tax rate)How to measure the cost of debt financing?

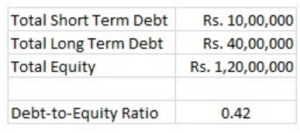

Investors rely on the debt-to-equity ratio to measure and compare the percentage of a company's capital financed by debt. Debt to equity ratio or (D/E) ratio = Total Debt (short-term + long-term) / Total Equity For example, ABC Ltd has a total short-term debt of Rs 10 Lakhs, long-term debt of Rs 40 Lakhs and the total shareholder’s equity is Rs 1.20 Crores. The debt-to-equity ratio of ABC Ltd is 0.42

A debt-to-equity ratio of 0.42 means that for every rupee in equity, ABC has 42 paise financed by debt.

A good debt-to-equity ratio is between 1 - 1.5 but varies with industry type as some industries work on high debt like Infrastructure and construction industry.

For example, ABC Ltd has a total short-term debt of Rs 10 Lakhs, long-term debt of Rs 40 Lakhs and the total shareholder’s equity is Rs 1.20 Crores. The debt-to-equity ratio of ABC Ltd is 0.42

A debt-to-equity ratio of 0.42 means that for every rupee in equity, ABC has 42 paise financed by debt.

A good debt-to-equity ratio is between 1 - 1.5 but varies with industry type as some industries work on high debt like Infrastructure and construction industry.

Head straight to www.samco.in/knowledge-center and search for topics you want to know more about.

To open a demat account with Samco visit Click here

Easy & quick

Easy & quick

Leave A Comment?