Why Is Diversifying Your Portfolio Important?

Let’s take an example. Meet two best friends, Mr. Flex and Mr. Stiff. Both works at the same place but have different eating habits. Mr. Flex prefers eating a balanced diet which includes dal, veggies, and rice. Whereas, Mr. Stiff only has pizzas for every meal. Because of a balanced diet, Mr. Flex manages to lead a healthy life. Whereas, Mr. Stiff eventually became obese. This pattern was repeated in their investments as well. Both of them had Rs 1 Lakh to invest. Mr. Flex decided to diversify his investments across different asset classes. Whereas, Mr. Stiff only invested in Fixed Deposits. Mr. Flex’s Diversified Portfolio:- Rs 10,000 in Fixed Deposits

- Rs 45,000 in Shares

- Rs 25,000 in Mutual Funds

- Rs 20,000 in Gold

- Rs 1 Lakh in Fixed Deposit

| Mr Flex’s Rs 1,00,000 | Returns after 2 years | Principal + Returns | Mr Stiff’s Rs 1,00,000 | Returns after 2 years | Principal + Returns |

| Rs 10,000 Fixed Deposit | 5 % per annum | Rs 11,025 | Rs 1,00,000 Fixed Deposit | 5% | Rs 1,10,250 |

| Rs 45,000 Equity Shares | 20% | Rs 64,800 | |||

| Rs 25,000 Mutual Funds | 17% | Rs 34,222 | |||

| Rs 20,000 Gold | 8% | Rs 23,328 | |||

| Total | Rs 1,33,375 | Rs 1,10,250 |

How Can You Diversify Across Different Asset Classes?

When you build a portfolio, think of it as if you are building a cricket team. If you have a team of only eleven batsmen, No bowler. Will you win the match? Absolutely Not! A great team has a balance of batsmen and bowlers. The same rule applies to your portfolio. You must invest in asset classes which are different from each other. These can include:1. Equity shares

Investing directly in shares of listed companies is a great investment option for investors with high risk appetite. But even in shares, you can diversify across different sectors such as: To explore more about equity shares - Click here.2. Bonds and Debentures of Companies and Government.

Bonds and debentures are a form of fixed income securities. It is an ideal investment option for low risk investors. They offer you a fixed income and you get the principal amount on maturity. You can club a high-risk investment like shares with a moderate-low risk investment such as bonds and debentures to reduce overall risk. To explore more about bonds - Click here. To explore more about debentures - Click here.3. Mutual funds

Mutual funds are self diversified. When you invest in a mutual fund, the fund manager will invest the collected corpus in various stocks or bonds or both. For example, if you invest in an equity mutual fund scheme, you are buying units of different stocks in different proportions. Here is an example of Axis ESG Equity Fund.| Holdings | % Weight | Value |

| Avenue Supermarts Limited | 9.92% | 190.250 Cr |

| Bajaj Finance Limited | 8.19% | 157.059 Cr |

| Tata Consultancy Services Limited | 7.64% | 146.395 Cr |

| HDFC Bank Limited | 7.08% | 135.718 Cr |

| Nestle India Limited | 6.95% | 133.179 Cr |

| Wipro Limited | 6.74% | 129.278 Cr |

| Housing Development Finance Corporation Limited | 6.14% | 117.653 Cr |

| Info Edge (India) Limited | 6.12% | 117.383 Cr |

| Kotak Mahindra Bank Limited | 4.84% | 92.700 Cr |

| Torrent Power Limited | 3.52% | 67.543 Cr |

| HDFC Life Insurance Company Limited | 2.92% | 55.891 Cr |

| Microsoft Corp | 1.39% | 26.650 Cr |

| Alphabet Inc A | 1.30% | 24.962 Cr |

| Symphony Limited | 1.09% | 20.831 Cr |

| Recruit Holdings Co. Ltd | 0.97% | 18.660 Cr |

| Booking Holdings Inc | 0.93% | 17.861 Cr |

| Assa Abloy Ab | 0.91% | 17.498 Cr |

| Schneider Electric SE | 0.89% | 16.999 Cr |

| Texas Instruments Inc | 0.89% | 16.997 Cr |

| Taiwan Semiconductor Manufacturing Co Ltd | 0.87% | 16.665 Cr |

| Roche Holding Ltd | 0.85% | 16.210 Cr |

| Bunzl PLC | 0.83% | 15.940 Cr |

| ASML Holding NV | 0.81% | 15.606 Cr |

| The Toronto-Dominion Bank | 0.81% | 15.576 Cr |

| First Republic Bank | 0.80% | 15.336 Cr |

| Banco Bilbao Vizcaya Argentaria | 0.80% | 15.334 Cr |

| AIA Group Ltd | 0.77% | 14.816 Cr |

| Thermo Fisher Scientific Inc | 0.77% | 14.702 Cr |

| Tencent Holdings Ltd | 0.77% | 14.688 Cr |

| Bank Central Asia | 0.76% | 14.632 Cr |

| Visa Inc | 0.76% | 14.625 Cr |

| Nestle Ltd | 0.76% | 14.595 Cr |

| Vertiv Holdings Co | 0.75% | 14.442 Cr |

| Trane Technologies Plc | 0.73% | 13.901 Cr |

| Unilever PLC | 0.72% | 13.840 Cr |

| Unitedhealth Group Inc | 0.71% | 13.529 Cr |

| Anthem Inc | 0.70% | 13.341 Cr |

| Sona BLW Precision Forgings Limited | 0.61% | 11.763 Cr |

| Adobe Inc | 0.60% | 11.590 Cr |

| Vestas Wind Systems AS | 0.56% | 10.788 Cr |

| Mastercard Incorporated | 0.56% | 10.749 Cr |

| Adidas | 0.55% | 10.528 Cr |

| Kerry Group PLC | 0.53% | 10.128 Cr |

| Kingfisher PLC | 0.49% | 9.386 Cr |

| Xylem Inc/NY | 0.47% | 8.952 Cr |

| Raia Drogasil | 0.42% | 8.062 Cr |

| Dexcom Inc | 0.38% | 7.349 Cr |

| Tomra Systems ASA | 0.34% | 6.493 Cr |

| Spirax-Sarco Engineering PLC | 0.32% | 6.147 Cr |

| Greggs PLC | 0.30% | 5.798 Cr |

| Oak Street Health Inc | 0.22% | 4.299 Cr |

- Equity funds

- Hybrid funds

- Debt funds

- Money market funds

- Growth funds

- Value funds

- Sectorial funds

- Thematic funds

- Exchange Traded Funds (ETFs)… and a lot more.

4. Gold

Allocating a portion towards gold is always a good idea as it acts as a hedge against inflation. But investing in physical gold is not a good idea as its making charges are too high. Instead, you can invest in gold ETFs or Sovereign Gold Bond (SGB) Scheme offered by the Government. SGBs provides you 2.5% annualised interest rates + capital appreciation as well.5. Bank Fixed Deposits, Post Office Saving Schemes, National Saving Certificate

These investments are ideal for risk-averse investors as they are very safe. But the interest earned on these investments are barely able to beat inflation. So, you can club these investments with different asset classes to make the most out of your portfolio. Investing in NSC is a good idea to save taxes. They provide deductions up to Rs 1,50,000 under section 80C of the Income Tax Act. With a well-diversified portfolio, you get two main benefits.- Risk mitigation

- Capital preservation

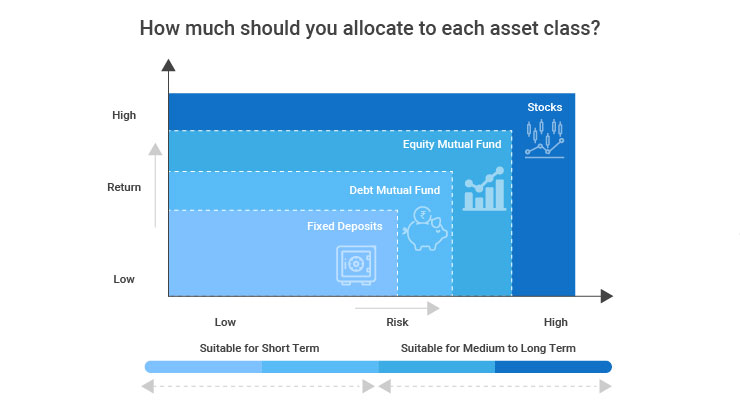

Now The Question Arises, How Much Should You Allocate to Each Asset Class?

Asset allocation depends on four major components.

Asset allocation depends on four major components.

1. Risk Appetite

When it comes to investing your hard earn money, you must determine how much risk you are willing to take to earn higher returns. If you can afford to take high risks and be patient during short term fluctuations, then high-risk investments are suitable for you. Whereas, if you are a risk averse investor and capital preservation is your first goal, then low risk investments are ideal for you.| High risk | Medium risk | Low risk | |

| Tenure | 10 years + | 3 – 5 years | 1 – 3 years |

| Risk-Reward ratio | High | Moderate | Low – Moderate |

| Investment options | Small-cap, mid-cap and large cap stocks | Large-cap mutual funds, balanced funds, debentures | Government bonds, government schemes, Bank Fixed deposits, liquid funds |

2. Return requirement

According to your risk appetite and the investment option you choose, your return also varies.- If you invest in a high risk investment option, then you earn high returns.

- If you invest in a low risk investment option, then you earn low returns.

3. The time horizon of your investment

You must decide for how long you are willing to hold the investment. For example, you have a high risk appetite and you decide to invest in stocks. But if you don’t hold it for an adequate period of time then it won’t work for you. High risk of stocks is neutralized only when you hold them for a longer time horizon. So defining your holding period is a must.- If you have a short term goal, then you must invest in short term investment options like liquid funds, debt funds

- If you have a long term goal, then you can invest in long term investment options like stocks, mid cap mutual funds and small cap mutual funds

4. Age

Diversification across asset classes needs to change with your age. When you are young, you can choose to be more aggressive to grow your wealth. On the other hand, as you grow older, you must focus on preserving wealth and hence choose medium-low risk investment options.How to Tell If Your Portfolio is Well Diversified?

A well diversified portfolio should look like a Christmas tree. More green and less red. It is very obvious that when you invest in multiple investment options, they may perform differently. So, not all your investment options will be profitable. But if any of your investment is underperforming at the moment, the loss will get compensated with the profitable investment option. So, diversification does provide a cushion for your investments. But many times investors who have experienced the harmful effects of under diversification mistakenly believe that more diversification is better. That’s not true. Over diversifying your portfolio by adding too many stocks or too many mutual funds of the same type is not a good idea. Hence, you must make a conscious choice of selecting diverse asset classes which are uncorrelated. But, selecting the right mix is hard. Don’t worry as we have found a way out. The answer is investing in mutual funds. It offers an inexpensive way of diversification. You can easily diversify your portfolio at a broad level by investing in an multi asset fund or a dynamic fund which invests in equity mutual funds and debt mutual funds. By doing so you are dedicating a chunk of portfolio towards low risk investment option and a chunk towards high risk investment option. So, you will be able to reap maximum benefits with medium to low risk. But choosing the best mutual funds is not easy. Retail investors do not have the time nor the resources to analyse mutual funds. Hence, RankMF has come up with the list of best mutual funds in India after analysing over 20 million data points! RankMF also provides goal based investment baskets. These baskets are well diversified. You can invest according to your goals. Such as tax saving basket, retirement focus basket, risk appetite and time horizon basket and a lot more… RankMF rates and ranks all mutual fund schemes in India. It also provides the most honest answer to, kaunsa mutual fund sahi hai? So, RankMF is the ultimate one-stop shop for you! Open a FREE RankMF account today and start diversifying your portfolio!

Easy & quick

Easy & quick

Leave A Comment?