What is Interest Coverage Ratio? Formula, Meaning and Analysis

Why do you invest in stocks? To make money, right? But wouldn’t you agree that there’s an equal chance that you can also lose money? After all, there is no mathematical formula to decide which stock will make money and which will not. It is impossible to predict the future of a stock. Look at Suzlon Energy Ltd for example. It was a popular stock in 2008. Its market capitalisation was a whopping Rs 67,110 Crores. But today, it’s market capitalisation is down by 94% to 3,000 Crores. It’s share price fell from Rs 406 to Rs 4.65. The reason behind this was its Debt. Debt can be both a boon as well as a bane for companies. Use it wisely and you can be the next Indian Energy Exchange Ltd. Or else we all know the fate of Suzlon Energy Ltd. If only there was a way for investors to know a company’s credit risk beforehand. Well, there is. You can check a company’s credit quality using Interest Coverage Ratio. Interest coverage ratio is a type of solvency ratio. It is used by investors and creditors to analyse a company’s ability to pay timely interest on loans. It also tells you about a company’s short-term financial health. Is the company financially stable? Is it close to bankruptcy? Has the time come for investors to sell the stock and move to greener pastures? Interest coverage ratio answers all these questions and much more. In this article we will learn everything about interest rate coverage ratio including:- What is Interest Coverage Ratio?

- What is Interest Coverage Ratio Formula?

- Ideal Interest Coverage Ratio

- Interpretation of Interest Coverage Ratio

- How to evaluate whether a stock is close to bankruptcy?

What is Interest Coverage Ratio? – Meaning of Interest Coverage Ratio

Coverage means a period of time. Company’s interest coverage ratio is the period for which a company can pay interest on its outstanding loans with its current earnings. It is also known as Times Interest Earned (TIE). Knowing this is extremely important for creditors and investors. Ask yourself… will you give loan to a company that cannot even pay interest? Absolutely not! This is why interest coverage ratio is crucial while analysing stocks. Let us take a simple example to understand what is interest coverage ratio. Company ABC Ltd borrows Rs 10 Lakhs @10% interest. The company’s net profit for the year is Rs 4 Lakhs. It pays Rs 1 lakh as interest (10% of Rs 10 Lakhs). ABC’s interest coverage ratio = Earnings / Interest Payable = 4 Lakhs / 1 Lakh = 4 A ratio of 4 means the company has four rupees of earnings for every one rupee in interest payment. It can also mean the company can pay four times the interest with its current earnings.What is the Formula of Interest Coverage Ratio?

A company can raise debt capital by either taking a loan from financial institutions or by issuing bonds. In both the cases, it has a dual debt burden:- Make timely interest payments

- Repay the principal on maturity.

- Liberal formula – using earnings before interest, tax, depreciation and amortisation (EBITDA)

- Conservative formula – Using EBIT

- Strict formula – Using Earnings Before Interest After Tax (EBIAT)

Interest Coverage Ratio Interpretation

| Stock | Interest Coverage Ratio | Meaning |

| Reliance Industries | 4.68 | The company has four rupees in earnings for every one rupee in interest payable. |

| Bajaj Auto Ltd | 2,083 | The company has Rs 2,083 in earnings for every one rupee in interest payable. This signals a debt free company. |

| Adani Power Ltd | 1.08 | The company has almost equal earnings to interest payable. This is a possible red flag. Even a small fall in earnings can lead to defaults. |

| Atul Auto Ltd | -1.60 | The company does not have sufficient income to pay interest on loans. Investors and creditors must avoid such loss-making companies. |

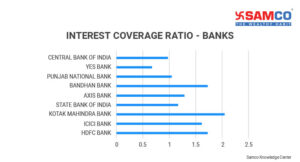

- Different sectors have drastically different interest coverage ratios. For example: The average interest coverage ratio of top 5 banks in India is 1.5. Whereas for FMCG companies its 73.36! Capital intensive sectors like power, infrastructure, banks have low interest coverage ratio. Companies with regular cash flows like FMCG has high interest coverage ratio. Hence industry and peer comparison are must to find ideal interest coverage ratio.

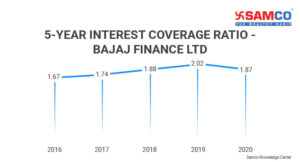

- Trend analysis is extremely important. There should be a year-on-year growth in interest coverage ratio. Here is the 5-year interest coverage trend for Bajaj Finance Ltd.

Bajaj Finance Ltd.’s interest coverage ratio has increased over the 5-year period. This can either mean good sales or lower operating expenses.

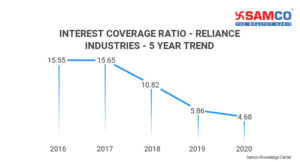

Let us also look at the 5-year interest coverage ratio trend for Reliance Industries Ltd.

Bajaj Finance Ltd.’s interest coverage ratio has increased over the 5-year period. This can either mean good sales or lower operating expenses.

Let us also look at the 5-year interest coverage ratio trend for Reliance Industries Ltd.

Notice how the ability to pay interest has gone down since 2016. However, since this is a capital-intensive sector, a ratio above 3 is good enough.

Notice how the ability to pay interest has gone down since 2016. However, since this is a capital-intensive sector, a ratio above 3 is good enough.

Reasons for Low Interest Coverage Ratio

- High Debt: The main reason for low interest coverage ratio is high debt. Capital-intensive companies have to take high debts to fund new projects. But revenues from these projects don’t start immediately. For example: An infrastructure company takes a loan to construct a highway. They need to pay interest from first year itself. But the actual revenue i.e. toll collection will happen after several years. During this period, the company will show low interest coverage ratio. This is typical for infrastructure and power companies.

- Banks: A bank’s core business is lending. For this it takes loans (deposits) on which interest is payable. Some banks have high non-performing assets (NPAs). High NPAs directly impact bank’s operating income. This reduces its interest coverage ratio. Hence a low interest coverage ratio for banks is normal. However, investors should ensure that its in line with its peers.

Notice that State Bank of India, Central Bank of India and Punjab National Bank have lower interest coverage ratio than their peers.

[Read More: Best Banking Stocks in India 2021]

Notice that State Bank of India, Central Bank of India and Punjab National Bank have lower interest coverage ratio than their peers.

[Read More: Best Banking Stocks in India 2021]

- Rise in interest rates: A sudden increase in interest rates can also result in low interest coverage ratio. Suppose a company ABC Ltd.’s 7.75% bond has matured. The company wants to raise new debt. But the interest rates in the market has gone up to 8%. The company has no option but to raise debt at 8%. The operating profit remains the same but the interest payment has increased. This indirectly reduces interest coverage ratio.

- Start-ups: Start-ups usually have low interest coverage ratio. This is because they do not have steady revenues. Companies with steady revenues have extremely high interest coverage ratio. For example, FMCG companies have strong revenue streams since their products are always in high demand. The interest coverage ratio of Procter & Gamble Hygiene Health Care Ltd is 154. Small cap stocks have low interest coverage ratio. Afterall, they are heavily dependent on funding and do not have a steady income flow. This doesn’t mean all small cap stocks will go bankrupt. In case of small cap stocks, you should other financial ratios like Debt to Equity (DE) and Price to Equity (PE) ratio.

- High Operating Leverage: Companies with high operating leverages can also have low interest coverage ratio. Operating leverage analyses the relationship between a company’s sales and its fixed cost. When operating leverage increases without increase in sales, it leads to low interest coverage ratio.

Difference between Interest Coverage Ratio and Debt to Equity Ratio

DE ratio tells you how much debt a company has per equity holding. It does not say anything about its ability to repay the debt. Whereas interest coverage ratio tells you whether the company is capable enough to pay interest on loans. They have an inverse relationship.- Low Debt to Equity Ratio = High Interest Coverage Ratio

- High Debt to Equity Ratio = Low Interest Coverage Ratio

Difference between Interest Coverage Ratio, Current and Quick Ratio

A company has two types of debt –- Short term debt

- Long-term debt

How to Use Interest Coverage Ratio?

Interest coverage ratio is mostly used to identify companies on verge of bankruptcy. The goal is to avoid such companies. No one wants to invest in the next Dewan Housing Finance Ltd or Reliance Communications Ltd. Interest coverage ratio shows the financial health of a company. For comprehensive analysis, it should be used along with the following:- Shareholding Pattern: This is probably the most overlooked aspect in stock analysis. After all, why should you care about a company’s shareholding pattern, right? Wrong! Analysis of shareholding patterns may give clues to promoter’s trust and commitment to the company. You should also study holding pattern of –

- Domestic Institutional Investors (DIIs)

- Foreign Institutional Investors (FIIs)

- Sales Growth: Profit and sales growth is a key indicator of the financial health of the company. Without sales and profit growth, a company will not be able to sustain itself. Without cash, it will be unable to pay interest. Eventually, the company will go bankrupt. Hence investors must pay close attention to a company’s year-on-year sales and profits growth numbers. Instead of analysing one-year figures, check 5-year sales growth numbers.

- Debt to Equity Ratio (DE): When sales and profit growth falls, companies try to delay bankruptcy by adding more debt. Hence it is important to check its DE ratio. Any abnormal deviation from 5-year trend without new projects in the pipeline can be a potential red flag.

- Liquidity Ratios: Current ratio and quick ratio should be used with interest coverage ratio. Most investors stop their analysis if a company has high interest coverage ratio. However, you must dig deeper. Check a company’s ability to meet even its short-term and ultra-short-term liabilities. A good company will have high interest coverage, current and quick ratio.

Easy & quick

Easy & quick

Leave A Comment?