What is IPO? Listen to What is IPO Summary here

While flipping through the pages of a newspaper you might have come across advertisements of many upcoming IPOs. But have you ever wondered what is IPO? If not, then in this article we will explore everything about IPO’s.

In this article:

- What is IPO?

- IPO Process

- Grey Market IPO

- What is Grey Market Premium?

- What is IPO Kostak Rate?

- What is Subject to Sauda?

- Investing in an IPO

- Why Does a Company Offer an IPO?

- Are IPO Investments Risky?

What is IPO?

The full form of IPO is Initial Public Offering. In an IPO, a privately owned company decides to go public. It is a process where the shares are listed on the stock exchanges and the general public can easily trade in them. As these days the markets are flooded with upcoming IPOs, smart investors can make generous amount of money by diligently investing in them. Here is a list of ongoing and upcoming IPOs:

Ongoing IPO

| IPO Name | Issue size | Price Band | Market Lot | Open Date | Close Date | Min Application Amount | Review |

| One 97 Communications Limited (PayTM IPO) | Rs.18,300 Cr | Rs. 2,080 – 2,150 per share | 6 shares | 8th November 2021 | 10th November 2021 | Rs 12,900 | |

| Sapphire Foods India Limited IPO | Rs 2,070 Cr | Rs. 1,120 to Rs. 1,180 per share | 12 shares | 9th Nov, 2021 | 11th November, 2021 | Rs. 13,440- Rs. 14,160 | NA |

| Latent View Analytics | Rs 600 crores | Rs. 190 to Rs. 197 per share | 76 shares | Nov 10, 2021 | Nov 12, 2021 | ₹14,972 | NA |

Upcoming IPOs in 2021

| Adani Wilmar | Utkarsh Small Finance Bank | Life Insurance Corporation of India Ltd. | ESAF Small Finance Bank Ltd |

| PharmEasy | Fincare Small Finance Bank | Pavan Hans | AnandRathi Wealth Management Ltd |

| Arohan Financial | Bajaj Energy Ltd | HDB Financial Services Ltd | Go Airlines |

| Mobikwik Ltd | Seven Islands Shipping |

Now that you know what is IPO, let’s move ahead and understand the process of IPO.

IPO Process

Once a private company decides to go public, it begins with the process of IPO. The process usually takes nine months to a year. The following steps should give you a good idea of how the IPOs are listed on the stock exchanges.

Step 1: Selecting an Investment Bank

The main motive of issuing an IPO is to raise the highest possible capital. The company approaches an investment bank which also acts as an underwriter. Who is an underwriter? Underwriter helps in the process of issuing shares. During this IPO process, investment bank gives suggestions to the company for a fee. They collect data to understand the financial situation of the company and suggests how much issue they will have to raise to meet their future plans. The underwriter can make two types of commitments with the company. Firm commitment is where the underwriter guarantees the company that a certain amount would be raised. The underwriter buys the shares from the company and sells it to their prospects. Best effort agreement is where the underwriter sells the securities for the company and but does not guarantee any amount to be raised. Both parties sign an underwriting agreement. This contract has all the details about the deal and the amount that will be raised by issuing shares. In case of large issues multiple investment banks are involved.

Step 2: Registration with the Securities Exchange Board of India

During this phase, the company and the team of underwriters submit a draft to SEBI. This draft clarifies the reason why the company wants to raise money from the public. SEBI scrutinizes this report and does a background check on the company. If the data is compliant with the guidelines of SEBI, the draft is approved or else rejected.

Step 3: Red Herring Prospectus is Prepared

While awaiting approval from SEBI, a preliminary draft is prepared by the underwriters. It consists details about the company like,

- Financial statements

- Management background

- Legal issues of the company

- Insider holdings

- Proposed ticker symbol that the company will use at the stock exchange.

This prospectus is very useful for investors who want to invest in the company. This draft is submitted to SEBI and the cooling off period is introduced. Here, the regulatory body verifies that all the material information about the company has been duly submitted. Once this draft is approved, the company can come up with an IPO. Recommended watch: Five important things you must check in a Red Herring Prospectus.

Step 4: Go on a Road Show

Before the IPO goes public, the executives of the company promote the IPO. They travel all around the country and spread the word about upcoming IPO to potential investors, mostly to qualified institutional buyers (QIB). The promotions that company does before the IPO is known as road show.

Step 5: Type and Price of IPO is Decided

After the SEBI approves the red herring prospectus, the company and the underwriters decide on the price band of the shares and the type of issue.

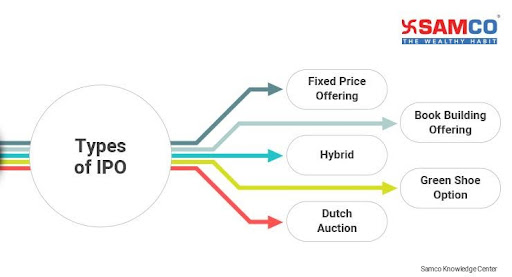

There are five types of IPOs for a company to choose from.

- Fixed Price Offering

As the name suggests, in a fixed price offering the prices of the issue is fixed by the company. The issue price is disclosed to the investors well in advance. Investors pay a fixed amount when the shares are allotted. For example, if Orange Ltd comes up with a fixed price offering and you apply for 100 shares of Rs 100 each. At the time of allotment Rs 10,000 would be blocked in your account. Usually small and medium enterprises (SMEs) issue fixed price IPOs.

- Book Building Offering

In a book building issue, the company offers a price band to the investors. Here, the investors are free to bid on a particular price at which they want to buy the share. The lowest price in the price band is referred to as the floor price and the highest price in the band is referred to as cap price. The difference between the floor price and the cap price is not more than 20%. If Orange Ltd comes up with an issue with a price range between Rs 100 and Rs 120. You can place your bids at any price within this range. It is recommended to apply at the cut off price, it increases your chances of allotment. Previously, Zomato IPO, Burger King IPO, Paras Defence IPOs and a lot other companies have come up with book building offerings.

- Green Shoe Option

Green shoe option is an over-allotment option. In this option, the underwriter is under a provision and can issue 15% more shares at the same price. This happens when there is high demand for the share in the market.

- Dutch Auction

In a Dutch auction, the investors are free to bid for the required amount of shares and the price they are willing to pay. Here, all the bids are arranged in a descending order. Later, a cut-off price is decided. Shares are issued to everyone who bid at or above the cut-off price. Rest of the bids are rejected.

- Hybrid Option

The hybrid option is a mix of two or more of the above strategies. The most common one among the five types is the book building offering.

Step 6: Shares are Made Available to the Public

On the specified date, the company makes shares available to the public. These application process is kept open for three to five working days. Investors can fill out the IPO applications using the ASBA Process (application supported by a blocked amount). They can specify the price at which they wish to make the purchase and submit the application. If the application is a book building issue, then the retail investor must apply at the cut off price.

Step 7: Issue Price is Decided & Share are Allotted

The underwriters wait till the subscription period is over. Later they discuss with the company and decide the price at which shares are to be allotted. This price would be determined by the demand of share and the price quoted by the applicants. Once the IPO allotment price is finalized, shares are allotted to investors.

Step 8: Listing and Unblocking of Funds

The last step is the listing of shares on the stock exchanges. The investors who had subscribed to the IPO get the allotment of shares in their Demat account and equivalent amount is debited from their bank accounts. If the issue is oversubscribed, then shares are not allotted to all the applicants. The funds of investors are unblocked who do not receive an allotment. Ringing the Bell ceremony is held on listing day. This ceremony is conducted by the promoters of the company. It is a symbol which declares that the company is available for trading on the secondary markets.

Grey Market IPO

Grey market is an unofficial market also known as dabba market. Here, individuals buy and sell IPO shares before they are listed on the stock exchanges. Grey market trading is done by a small set of individuals. It is an over the counter market and the transactions are settled on a cash basis. Trading in the grey market is risky and illegal. We strongly recommend investors to avoid trading in the grey market. Usually, investors test the demand of shares through the grey market for upcoming IPOs. Many investors refer to the grey market to analyse what could be the listing price of an upcoming IPO. The three most popular terms used in the IPO grey market are:

- Grey Market Premium (GMP)

- Kostak rate

- Subject to Sauda

Let us understand this in detail.

What is Grey Market Premium?

Grey market premium (GPM) is a premium amount at which IPO shares are traded above the issue price before listing. This premium can be positive or negative.

Scenario 1: Positive Grey Market Premium

Suppose there is an upcoming IPO of BlueCherry Mobiles. Let’s assume the issue price for stock is Rs 200. If the grey market premium of BlueCherry is Rs 100, it means that people are ready to buy the shares of the company by giving Rs 100 more than the issue price. So the value of shares in the grey market is Rs 300 (100+200). This means grey market participants expect the stock to list at Rs 300 on the exchanges.

Scenario 2: Negative Grey Market Premium

Suppose the grey market premium of BlueCherry Mobiles is Rs -50. The issue price of the share is Rs 200. Now since the grey market price is negative, it means that the IPO does not have high demand in the market and the investors are expecting it to list at discount. It is important to note that grey market premium keeps fluctuating with change in demand and supply of the IPO and also the overall market sentiments.

What is IPO Kostak Rate?

IPO Kostak rate is the profit a seller makes by selling his IPO application in the grey market before listing of shares. This is usually done by investors who want to secure their profits before the listing day. The seller gets a fixed amount irrespective of getting an allotment. Let’s say someone applies for 1 lot (70 shares) of Bluecherry Mobiles and sells it to a buyer in grey market. The Kostak rate mutually agreed by them was Rs 750 per lot. The seller will get Rs 750 from the buyer irrespective of allotment. If shares are allotted, then the seller keeps Rs 750 plus his original investment amount of Rs 14,000 (200 *70). The buyer will keep the profits or bear the losses that may arise depending on where the stock lists.

What is Subject to Sauda?

In the above example of kostak rate, the seller would get Rs 750 even if he does not get an allotment which is a risk to the buyer. Whereas, in subject to sauda, the buyer gets in an agreement with the seller that the decided premium amount will be paid only if the seller gets an allotment. Hence, the premium amount paid by the buyer is usually higher than kostak rate. Both, kostak and subject to sauda is usually done by the seller to lock-in the profit before the shares are listed on the exchange. Whereas, the buyer is quite positive about the issue and purchases the application to earn high listing gains. Recommended watch: Everything about grey market IPO

Investing in an IPO

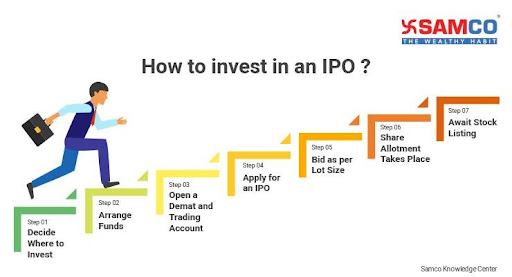

Before you invest in IPO you need to ensure that you are following the right path. Here are few steps that investors need to consider before applying: 1. Decision IPOs are gaining a lot of traction from retail investors. As everyone is rushing to apply for all the upcoming IPOs. Should you do the same? Are all IPOs worth investing? Let me tell you. IPOs are not always successful. There are many reputed companies which had failed IPOs such as Cafe Coffee Day, Adlabs Entertainment, Reliance Power, etc. Hence, before investing in any upcoming IPO you can read the Red Herring Prospectus (RHP) which has all the information about the issue. However, the RHP could run in to 300 to 400 pages and you may not have so much time to review it. Well, don’t worry as our research analysts provides their expert review on each upcoming IPO and also recommends if you should subscribe or avoid the IPO. To get this exclusive data all you need to do is subscribe to our YouTube channel so you don’t miss out on any of our videos. 2. Arranging Funds To apply for an IPO online, you need to have sufficient balance in your bank account. Once you ensure there are adequate funds in your account you can apply for the IPO. 3. Open a Demat and Trading Account Investors who do not have a demat account cannot apply for an IPO online. A demat account will help you store shares after allotment and a trading account will help you buy and sell shares with ease. By opening an account with Samco you get to apply for an IPO online in less than 2 minutes. 4. Applying for an IPO with ASBA Once your trading and Demat account is opened, you can quickly apply for an IPO through the ASBA process. ASBA stands for Application Supported by Blocked Account. The amount is temporarily blocked in your bank account. It is debited only if the shares are allotted to you. If the shares are not allotted to you, then the amount is unblocked. Recommended watch: What is ASBA and how to apply for IPOs in just a few minutes using this process.

Learn more about how to apply for an IPO using ASBA through different banks by clicking on the respective links.

- How to apply for Online IPO through ASBA using HDFC Bank?

- How to apply for Online IPO through ASBA using ICICI Bank?

- How to apply for IPO through ASBA using Kotak Bank?

- How to Apply for Online IPO through ASBA using SBI?

5. Applying for an IPO with UPI Previously, applying for an IPO was a cumbersome process. You either had to fill an offline form or you had to fill an online form. But, at Samco you can simply apply for an IPO your UPI ID in less than 2 minutes. To know the process of subscribing to an IPO through UPI – Click here. 6. Bidding Process While applying for an IPO, you need to bid for the specific number of shares you wish to avail. It is done according to the lot size mentioned in the company’s prospectus. A lot size is the minimum number of shares that an investor must apply. You can even apply for more share but only in multiples of lot size. Please note: While you bid for a IPO consider bidding at the cut-off price or the highest bid price. It will increase your chances of IPO allotment. 7. IPO Allotment After the bids are received, the company assigns the shares to the applicants. Getting an allotment in an oversubscribed IPO is a matter of luck. If the shares are allotted to you, they will be credited into your Demat account. But many a time investors are not fortunate enough to get an allotment. Hence, Our Chief Markets Editor, Apurva Sheth has brought a simple yet effective way to make money from upcoming IPOs without an allotment. More than 8,000 viewers like this video. We are certain you too will like it. To know the strategy, check out our video below:

Listing of Stock

The shares are listed within 6 to7 days of bidding process on the stock exchanges. You are free to buy and sell the shares of the company in the secondary market. A lot of people apply in IPO’s only for listing gains.

Why Does a Company Offer an IPO?

Let’s understand this with a simple example. Suppose you have recently started a company with a unique idea by introducing electric cycles and named it ‘Electro Racer Cycles’. To set up initial stores of Electro Racer Cycles, you decide to borrow money from banks. You must pay a pre-decided fixed interest on a monthly basis. After a few years, the idea of electric cycles becomes popular in major metro cities of India like Mumbai and Delhi. Hence, you decide to expand your business. But taking a loan will lead to more debt on your balance sheet. Hence, you approach professional investors and ask them to invest in your company. With rising pollution, the government also starts to promote electric vehicles. These investors find the idea unique and profitable and hence they decide to invest in your business. In return, they own a part of your company. These investors are known as Angel Investors or Venture Capitalists. This is how early-stage companies raise funds to grow their businesses. Before an IPO, a company is considered private. Raising money privately is helpful in the initial stages of the business. The company does not publicly disclose information. The management has tight control. It does not worry about market volatility. But this shield comes at a cost for its investors. It’s hard for angel investors and venture capitalists to exit from the company. IPO’s offers these investors an exit route. With an IPO a company goes public and a portion of its shares becomes available for trade on stock exchanges. The general public participates in the IPO’s and even trade in stocks once they are listed. From the story above we understand that companies issue IPOs for: 1. Raising Cheaper Capital for Business Raising capital is the primary motive of a company issuing an IPO. As we just saw, when a company raises capital from a bank it must pay interest on the amount borrowed. The general public become partial owners after listing. So they don’t receive any interests. Only profits are shared among the shareholders in the proportion of shares held by them. When profits are distributed to them it is known as dividends.

There are 2 ways in which shareholders benefit if a company makes profits.

- Dividend Pay-out

- Capital Appreciation (Rise in the share price)

2. Reduction in Cost of Capital for the Company When the company is private, it raises funds by borrowing from a bank or by other private investors. But as the company goes public, a much higher amount can be raised and the company is not obliged to pay interests. This reduces borrowing cost for companies. Further as the company is now in the public eye and is constantly inspected and has regulations to follow. This translates into improved credit rating and lower interest rates on any debts the company may issue. 3. Liquidity Increases Coming up with an IPO provides an exit route to initial investors. IPO’s enable them to exit and book profits on their investments. After the listing on stock exchanges these share can be bought and sold with ease since liquidity increases. 4. Branding & Visibility With an IPO, the company’s gets lot of free publicity in the press and media. Investors and general public gets to know about the company and its business. 5. Expansion The funds accumulated by issuing an IPO can help the company expand its business.

Are IPO Investments Risky?

As we had discussed in the earlier example of an electro racer cycle, every company in its initial stage raises capital from venture capitalists and angel investors. They invest with the motive of making money when the business flourishes in the future. So IPO’s are a great way to liquidate a part of their holding and books profits. But generally it is observed that there is a significant decline in prices for two to three months after listing. This usually happens because IPO’s are generally priced at hefty valuations. Remember the job of investment banker is to raise as much capital as possible. Apart from this shares also see selling pressure once the lock in period expires. A lock in period is the duration for which the employees and the officials are not permitted to sell their shares. At the end of the lock in period these associates try to book profits by selling shares of the company. This leads to more supply and decline in stock prices. Investors who did not get the right opportunity to invest in the company can invest at this stage for the long term. So if you wish to invest in the company, it’s often best to wait before buying a company’s share that has recently gone public. Doing that gives time for the market to settle down. It also gives investors the benefit of seeing a few quarters of results. So if you are willing to take risk then you could invest in IPO’s for listing gains. But if you want to invest for the long term then we recommend to wait for a dip.

Performance of Recent IPOs

| IPO Name | Offer price | Face value | Open date | Close date | Listing day(Gain/loss) | Review |

| PB Fintech Ltd | 940 | 2 | 01 Nov 2021 | 03 Nov 2021 | – | |

| Fino Payments Bank Ltd | 560 | 10 | 29 Oct 2021 | 02 Nov 2021 | – | NA |

| FSN E-Commerce Ventures Ltd | 1085 | 1 | 28 Oct 2021 | 01 Nov 2021 | – | |

| Aditya Birla Sun Life AMC Ltd | 712 | 5 | 29 Sep 2021 | 01 Oct 2021 | 0.42% | NA |

| Paras Defence And Space Technologies Ltd | 175 | 10 | 21 Sep 2021 | 23 Sep 2021 | 185% | NA |

| Sansera Engineering Ltd | 744 | 2 | 14 Sep 2021 | 16 Sep 2021 | 10.04% | NA |

| Vijaya Diagnostic Centre Ltd | 531 | 1 | 01 Sep 2021 | 03 Sep 2021 | 16.63% | NA |

| Ami Organics Ltd | 610 | 10 | 01 Sep 2021 | 03 Sep 2021 | 53.2% | NA |

| Chemplast Sanmar Ltd | 541 | 5 | 10 Aug 2021 | 12 Aug 2021 | -1.13% | NA |

| Aptus Value Housing Finance India Ltd | 353 | 2 | 10 Aug 2021 | 12 Aug 2021 | -1.84% | NA |

| Nuvoco Vistas Corporation Ltd | 570 | 10 | 09 Aug 2021 | 11 Aug 2021 | -6.79% | NA |

| Cartrade Tech Ltd | 1618 | 10 | 09 Aug 2021 | 11 Aug 2021 | -7.29% | |

| Windlas Biotech Ltd | 460 | 5 | 04 Aug 2021 | 06 Aug 2021 | -11.59% | NA |

| Devyani International Ltd | 90 | 1 | 04 Aug 2021 | 06 Aug 2021 | 37.06% | NA |

| Krsnaa Diagnostics Ltd | 954 | 5 | 04 Aug 2021 | 06 Aug 2021 | 3.85% | NA |

| Exxaro Tiles Ltd | 120 | 10 | 04 Aug 2021 | 06 Aug 2021 | 10.21% | NA |

| Rolex Rings Ltd | 900 | 10 | 28 Jul 2021 | 30 Jul 2021 | 29.62% | NA |

| Glenmark Life Sciences Ltd | 720 | 2 | 27 Jul 2021 | 29 Jul 2021 | 3.92% | |

| Tatva Chintan Pharma Chem Ltd | 1083 | 10 | 16 Jul 2021 | 20 Jul 2021 | 113.32% | NA |

| Zomato Ltd | 76 | 1 | 14 Jul 2021 | 16 Jul 2021 | 65.59% | |

| Clean Science & Technology Ltd | 880 | 1 | 07 Jul 2021 | 09 Jul 2021 | – | |

| GR Infraprojects Ltd | 828 | 5 | 07 Jul 2021 | 09 Jul 2021 | – | |

| Dodla Dairy Limited | 428 | 10 | 16 Jun 2021 | 18 Jun 2021 | 42.31% | NA |

| Krishna Institute of Medical Sciences Limited | 825 | 10 | 16 Jun 2021 | 18 Jun 2021 | 20.72% | |

| Shyam Metalics and Energy Limited | 306 | 10 | 14 Jun 2021 | 16 Jun 2021 | 22.83% | NA |

| Sona BLW Precision Forgings Limited | 291 | 10 | 14 Jun 2021 | 16 Jun 2021 | 24.69% | |

| Powergrid Infrastructure Investment Trust | 100 | 100 | 29 Apr 2021 | 03 May 2021 | 2.98% | NA |

| Macrotech Developers Ltd. | 486 | 10 | 7th April 2021 | 9th April 2021 | -4.7% | |

| Barbeque-Nation Hospitality Ltd | 498 | 5 | 24 Mar 2021 | 26 Mar 2021 | 18.08% | |

| Nazara Technologies Ltd | 1101 | 4 | 17 Mar 2021 | 19 Mar 2021 | 81% | |

| Suryoday Small Finance Bank Ltd | 305 | 10 | 17 Mar 2021 | 19 Mar 2021 | -9.44% | |

| Kalyan Jewellers India Ltd | 87 | 10 | 16 Mar 2021 | 18 Mar 2021 | -13.45% | |

| Anupam Rasayan India Ltd | 555 | 10 | 12 Mar 2021 | 16 Mar 2021 | -5.24% | |

| Easy Trip Planners Ltd | 187 | 2 | 08 Mar 2021 | 10 Mar 2021 | 11.39% | NA |

| MTAR Technologies Ltd | 575 | 10 | 03 Mar 2021 | 05 Mar 2021 | 88.22% | |

| Heranba Industries Ltd | 627 | 10 | 23 Feb 2021 | 25 Feb 2021 | 29.55% | |

| Railtel Corporation Of India Ltd | 94 | 10 | 16 Feb 2021 | 18 Feb 2021 | 29.15% | |

| Nureca Ltd | 400 | 10 | 15 Feb 2021 | 17 Feb 2021 | 66.66% | NA |

| Stove Kraft Ltd | 385 | 10 | 25 Jan 2021 | 28 Jan 2021 | 15.83% | NA |

| Indigo Paints Ltd | 1490 | 10 | 20 Jan 2021 | 22 Jan 2021 | 109.31% | |

| Indian Railway Finance Corporation Ltd | 26 | 10 | 18 Jan 2021 | 20 Jan 2021 | -4.42% | |

To conclude, IPO’s can bring lot of opportunities for retail investors. But there can be pitfalls too. You must do a thorough research before applying. If you don’t have time for it then you could simply follow our views and recommendations on upcoming IPO’s. Just subscribe to our YouTube channel and look out for IPO Reviews Playlist. You will find all our IPO reviews there. At Samco you can even apply for an IPO via UPI or ASBA with ease. You can open a 3-in-1 account with Samco and apply for Upcoming IPOs in less than 2 minutes.

FAQs

Where can I Check the Status of Upcoming IPOs? You can check all the upcoming IPOs on our Samco Upcoming IPO page by clicking here. How can I check IPO allotments? You can check your IPO allotment through NSE and BSE websites. To check from BSE website – Click here To check from NSE website – Click here To check from KFinTech website – Click here To check from Linkin Time website – Click here What is Follow on Public Offering or FPO? Investors often get confused between IPOs and FPOs. As we already know, IPO is when a company raises money for the first time. FPO (Follow on Public offer) is the method to raise additional capital by issuing more shares of the company in the secondary market. Read more about FPOs here. What is the Difference Between RII, NII, QIB and Anchor Investor category? RII stands for Retail Individual Investor. RII are the investors who apply for less than 2 Lakhs in an IPO. This application is made in Retail category and they are allowed to bid at cut off prices. NII (Non-institutional Investors) and HNI (High net worth investors) are the ones who apply for more than 2 lakhs in an IPO. Qualified Institutional Bidders (QIB’s) are banks, mutual funds and foreign portfolio investors who can bid under QIB category. Anchor investors make an application of more than 10 Crores. All the categories except RIIs are not allowed to bid at cut off prices. Read more about each category here. Can I Apply for Multiple Applications Under the Same Name? No, one person cannot apply multiple times through the same PAN details for an IPO. If you would like to place order for multiple applications, you can place it through your family member’s Demat account.

Easy & quick

Easy & quick

Leave A Comment?