Price to Earnings ratio or simply PE ratio is one of the most popular financial ratios used by investors to determine a stock’s fair value. This is done by comparing a stock’s market price to its earnings. When you buy a stock, you earn the right to a company’s future earnings and profits. But how do you know if you are buying a stock at a discount or premium? This is where PE ratio comes to the rescue. PE ratio tells you whether you are buying the stock at its fair value.

Price to Earnings ratio or simply PE ratio is one of the most popular financial ratios used by investors to determine a stock’s fair value. This is done by comparing a stock’s market price to its earnings. When you buy a stock, you earn the right to a company’s future earnings and profits. But how do you know if you are buying a stock at a discount or premium? This is where PE ratio comes to the rescue. PE ratio tells you whether you are buying the stock at its fair value.

Let us understand what is PE ratio using the beloved childhood game, Monopoly. In monopoly, you get a fixed amount of cash to buy properties, cities, stations etc. Every property has a price and earns a rental income. For example: To buy Zaveri Bazaar, you will need to pay Rs 5,500. In exchange, you will earn a rental income of Rs 700. Your decision to buy this card is dependent on the future earnings you will derive from it.

This is exactly how investors analyse stocks. Their buying decision is dependent on the stock’s future earning capabilities, measured using the stock’s PE ratio.

As the name suggests, Price to Earnings ratio is the price investors pay for a share in the company’s earnings. Hence it is also known as Price Multiple ratio or Earnings Multiple ratio.

Watch our detailed video on What is PE Ratio and How to Use it in Stock Analysis

Let us understand what is PE ratio using the beloved childhood game, Monopoly. In monopoly, you get a fixed amount of cash to buy properties, cities, stations etc. Every property has a price and earns a rental income. For example: To buy Zaveri Bazaar, you will need to pay Rs 5,500. In exchange, you will earn a rental income of Rs 700. Your decision to buy this card is dependent on the future earnings you will derive from it.

This is exactly how investors analyse stocks. Their buying decision is dependent on the stock’s future earning capabilities, measured using the stock’s PE ratio.

As the name suggests, Price to Earnings ratio is the price investors pay for a share in the company’s earnings. Hence it is also known as Price Multiple ratio or Earnings Multiple ratio.

Watch our detailed video on What is PE Ratio and How to Use it in Stock Analysis

What is PE Ratio? – Meaning of PE Ratio

PE ratio is the price an investor is willing to pay for the company’s earnings. There is no set range for PE ratio. PE ratio of Adani Transmission Ltd is 6,114.69! This means that investors are willing to pay 6,114 times for the company’s earnings. Likewise, the PE ratio of Ashapura Minechem Ltd is only 2.52. As a rule of thumb, undervalued stocks have low PE ratio. Whereas a high PE ratio means the stock is overvalued. Value investors like Warren Buffett advice investing in low PE stocks as these stocks have high growth potential and are available cheaply in the market. [Read More: List of 200 Low PE Stocks in India] PE Ratio Formula = Current Market Price (CMP) Earnings Per Share (EPS) PE ratio is calculated by dividing a stock’s current market price by its earnings per share. EPS is the profit earned per share. It is calculated by dividing a company’s profits after tax (PAT) by its total outstanding shares. Earnings Per Share (EPS) Formula = Profit after Tax (PAT) Total number of outstanding sharesLet us understand PE ratio and EPS with a simple example.

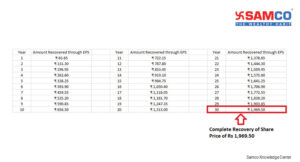

The current share price of Reliance Industries is Rs 1,982.05. Its EPS is 65.65 and PE ratio is 30.24. This means that you will need to spend Rs 1,982.05 to buy one share of Reliance Industries. Your earning per share is Rs 65.65. This means you are willing to pay 30.24 times the cost to participate in the earnings of Reliance Industries. There is another interesting interpretation of PE ratio. It is also the number of years it takes to recover the stock’s purchase price. In the above example, PE ratio of Reliance Industries is 30.24. This means it will take more than 30 years to recover your purchase price of Rs 1,982.05. This is assuming EPS of Reliance Industries stays the same Rs 65.65 throughout 30.24 years. This interpretation isn’t reliable as a company’s EPS keeps on changing as its profits increases or decreases over a period of time.

PE ratio is a tool which helps you analyse how much you are paying for a share in a company’s earnings. Standalone PE ratio is useless for investors. In the above example what can you conclude from Reliance Industries PE ratio of 30.24? Is it undervalued? Overvalued? Fairly priced?

PE ratio analysis works only when you are comparing the PE ratios of a company against its competitors, industry PE or with its own historical PE.

This interpretation isn’t reliable as a company’s EPS keeps on changing as its profits increases or decreases over a period of time.

PE ratio is a tool which helps you analyse how much you are paying for a share in a company’s earnings. Standalone PE ratio is useless for investors. In the above example what can you conclude from Reliance Industries PE ratio of 30.24? Is it undervalued? Overvalued? Fairly priced?

PE ratio analysis works only when you are comparing the PE ratios of a company against its competitors, industry PE or with its own historical PE.

Use of PE Ratio in Peer & Industry Comparison

Let us go back to Reliance Industries. Its top two competitors are Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL). The below table shows the share price, EPS, PE and sector PE of these three companies.| Parameters | Reliance Industries | BPCL | HPCL |

| Share Price (Rs) | 1,982.05 | 404.70 | 234.80 |

| EPS (Rs) | 65.55 | 18.51 | 49.97 |

| PE | 31.20 | 15.50 | 3.94 |

| Sector PE | 14.00 | 14.00 | 40.64 |

- Reliance Industries is the costliest among all three stocks. But it also generates highest earnings (EPS).

- PE of Reliance Industries is very high compared to industry PE of 14. The stock is highly overvalued.

- The EPS to PE ratio of HPCL is the best. Investors recover their share price in 4.7 years. This is way less compared to Reliance Industries 30 years and BPCL’s 22 years.

- HPCL has the lowest PE ratio, meaning the stock is undervalued.

Reasons for Low PE Ratio

Low PE ratio can be a result of the following factors:- Slow industry growth rate

- High Debt to Equity ratio

- Declining profits

- Poor future prospects.

- Poor corporate governance

- Inefficient management

- Weak market sentiments

Reasons for High PE Ratio

- High growth prospects

- Low Earnings per Share

- Efficient management and corporate governance

- Company has economic moat.

3 Major Limitations of PE Ratio

PE ratio does have its own set of limitations.- PE ratio only looks at a company’s earnings. It does not consider its Debt to Equity ratio. Debt to Equity ratio measures a company’s debt against its equity. A high debt to equity ratio means a company’s growth is fuelled by its high debt not cashflow or assets. A company can have low PE but might come with high debts. These are value traps. It is better to avoid such companies.

- PE ratio is market price of the company to its earnings. To calculate PE ratio, we use earnings of a company. These earnings are calculated every quarter whereas the share prices fluctuate every day. Hence PE ratio might not reveal the latest picture.

- PE Ratio can be easily manipulated. An unethical management can manipulate a company’s earnings by changing their accounting standards or underreporting expenses. This increases the bottom line of the company and reduces the PE ratio. Investors interpret this low PE ratio as a buy signal and get trapped.

- If PEG ratio is greater than stock’s growth rate, the stock is overvalued.

- If PEG ratio is less than stock’s growth rate, the stock is undervalued.

Types of PE Ratio

There are three main types of PE Ratios:

There are three main types of PE Ratios:

- Trailing PE Ratio: Trailing Twelve Months PE ratio or simply TTM PE is calculated using historical data of past 12 months. It is much more authentic than forward PE ratio.

- Forward PE Ratio: Forward PE ratio is the expected PE that the stock will generate in the coming 12 months. It is dependent on future earnings expectations, which can be misleading.

- Justified PE Ratio: This type of PE ratio considers the dividends paid by companies. The relationship between Justified PE and Forward PE is as follows:

- If Justified PE > Forward PE, the stock is undervalued.

- If Justified PE < Forward PE, the stock is overvalued.

- If Justified PE = Forward PE, the stock is fairly priced.

Nifty PE Ratio Analysis

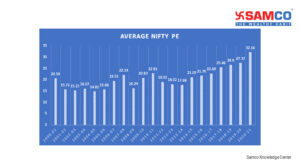

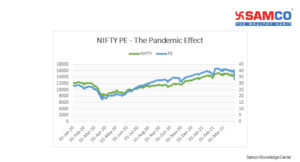

NIFTY50 is a collection of the 50 most traded stocks in India. NIFTY PE is the average PE of all 50 stocks in the index. It helps in deciding if the market is overvalued or undervalued. Here’s the PE Ratio of Nifty for the last 21 years (1st April 2000 – 1st April 2021) We can conclude the following about the NIFTY PE Ratio:

We can conclude the following about the NIFTY PE Ratio:

- The average PE ratio of Nifty for the past 21 years is 20.55

- Whenever Nifty’s PE ratio goes above 22, there is a correction in the market.

- The PE ratio of Nifty has strong support near 12-14 levels.

- The current PE of the market is at a record high of 32.16. This signals an extremely expensive market.

- The current market is 56.61% more expensive than the last 21 years’ average.

- The markets are overvalued when Nifty PE is equal or higher than 22. This can be a SELL signal for the market.

- The markets are undervalued when Nifty PE is equal or less than 16. This can be a BUY signal for the market.

- The markets quickly bounce back after corrections as witnessed during 2008-2009. (Refer the below chart). Notice how the markets have corrected every time Nifty PE crossed 22 levels.

This is how Nifty’s PE ratio looks now.

This is how Nifty’s PE ratio looks now. In January 2020, PE ratio of Nifty was as high as 28.33. As a national lockdown was imposed, NIFTY PE crashed to 17.15 in March 2020. This was the perfect buying opportunity for investors. However, very few investors capitalised on this opportunity.

[Read More: Best Multibagger Stocks to Buy now in India]

An interesting point to note here is that if you had invested Rs 1 Lakh in Nifty Index on 23rd March 2020, its value today would be a whopping Rs 1.71 Lakhs! That’s a gain of 71.30%! Talk about an investment opportunity!

We saw a reversal from historical low PE in June 2020. Despite the pandemic, Nifty was in the overvalued zone with a PE ratio of 23.31. As greed took over, the PE ratio rose as high as 41.60 in March 2021. In one year, market valuations jumped 143%!

The best way to manoeuvre such pricey markets is by investing in fundamentally strong stocks for the long term. Some of them include well known stocks like Bajaj Finance Ltd and hidden gems like Alembic Pharma, Caplin Point Labs etc. Find the complete list of best long-term stocks to buy in India here.

PE ratio might be the most popular financial ratio but it is not the holy grail of investing. PE ratio is of very little help while analysing banking stocks. Similarly, for asset heavy businesses, Earnings Before Interest Tax and Depreciation (EBITDA) is way better than PE ratio. Hence investors must analyse a company through various lenses before investing. Learn how to make 3X returns from the market by market expert Jimeet Modi.

https://youtu.be/dA0omng7_o8

In January 2020, PE ratio of Nifty was as high as 28.33. As a national lockdown was imposed, NIFTY PE crashed to 17.15 in March 2020. This was the perfect buying opportunity for investors. However, very few investors capitalised on this opportunity.

[Read More: Best Multibagger Stocks to Buy now in India]

An interesting point to note here is that if you had invested Rs 1 Lakh in Nifty Index on 23rd March 2020, its value today would be a whopping Rs 1.71 Lakhs! That’s a gain of 71.30%! Talk about an investment opportunity!

We saw a reversal from historical low PE in June 2020. Despite the pandemic, Nifty was in the overvalued zone with a PE ratio of 23.31. As greed took over, the PE ratio rose as high as 41.60 in March 2021. In one year, market valuations jumped 143%!

The best way to manoeuvre such pricey markets is by investing in fundamentally strong stocks for the long term. Some of them include well known stocks like Bajaj Finance Ltd and hidden gems like Alembic Pharma, Caplin Point Labs etc. Find the complete list of best long-term stocks to buy in India here.

PE ratio might be the most popular financial ratio but it is not the holy grail of investing. PE ratio is of very little help while analysing banking stocks. Similarly, for asset heavy businesses, Earnings Before Interest Tax and Depreciation (EBITDA) is way better than PE ratio. Hence investors must analyse a company through various lenses before investing. Learn how to make 3X returns from the market by market expert Jimeet Modi.

https://youtu.be/dA0omng7_o8

Easy & quick

Easy & quick

Leave A Comment?