Account Opening

Demat, Trading, & Platform Fees

| Funding Amount | Total Exposure | Quantity |

|---|---|---|

Don't have an account yet? Register now

Cash Balance

₹10,000

MTF Leverage

₹30,000

Buy stocks in delivery for upto

₹40,000

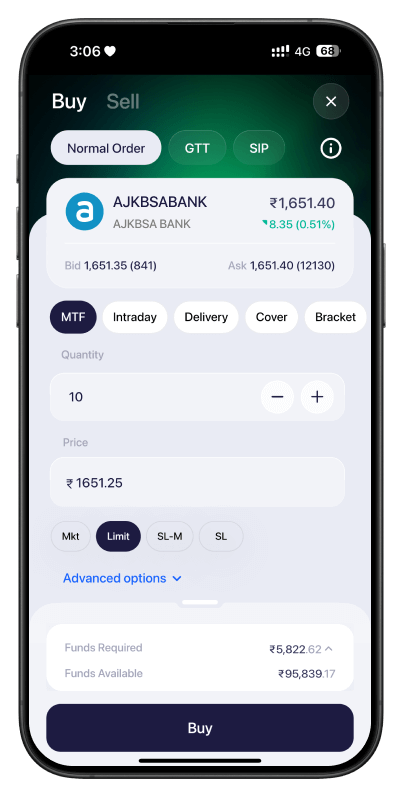

Click on buy button of your preferred equity stock

Enter quantity and select “MTF” under the product type

Click on ‘Quick Trade’ to place your MTF orders

| S/no | Stock | CMP | Leverage | Margin% | Action |

|---|---|---|---|---|---|

| 1 | 360ONE | 1035.1 | 2x | 50 | |

| 2 | 3IINFOLTD | 12.99 | 1.11x | 90 | |

| 3 | 3MINDIA | 33445 | 3x | 33.33 | |

| 4 | 5PAISA | 296.8 | 2.86x | 35 | |

| 5 | AADHARHFC | 481.7 | 2.5x | 40 | |

| 6 | AARTIDRUGS | 348.95 | 2x | 50 | |

| 7 | AARTIIND | 409.25 | 2x | 50 | |

| 8 | AARTIPHARM | 681.05 | 2.5x | 40 | |

| 9 | AAVAS | 1199.6 | 3x | 33.33 | |

| 10 | ABB | 5982.5 | 2x | 50 | |

| 11 | ABBOTINDIA | 27185 | 2x | 50 | |

| 12 | ABCAPITAL | 324.3 | 1.67x | 60 | |

| 13 | ABDL | 459.9 | 2.5x | 40 | |

| 14 | ABFRL | 60.58 | 2x | 50 | |

| 15 | ABREL | 1189.4 | 2.5x | 40 | |

| 16 | ABSLAMC | 872.15 | 1.25x | 80 | |

| 17 | ABSLBANETF | 57.16 | 3.33x | 30 | |

| 18 | ABSLLIQUID | 1000 | 5x | 20 | |

| 19 | ACC | 1450.5 | 2.86x | 35 | |

| 20 | ACCELYA | 1186.2 | 3.33x | 30 | |

| 21 | ACE | 848.85 | 1.25x | 80 | |

| 22 | ACI | 531.2 | 1.25x | 80 | |

| 23 | ACMESOLAR | 219.46 | 2x | 50 | |

| 24 | ACUTAAS | 2154.6 | 2.5x | 40 | |

| 25 | ADANIENSOL | 981.4 | 1.18x | 85 | |

| 26 | ADANIENT | 1999.2 | 1.67x | 60 | |

| 27 | ADANIGREEN | 854.15 | 1.11x | 90 | |

| 28 | ADANIPORTS | 1421.3 | 1.67x | 60 | |

| 29 | ADANIPOWER | 139.11 | 1.11x | 90 | |

| 30 | ADFFOODS | 183.66 | 2.5x | 40 | |

| 31 | ADSL | 102.24 | 2x | 50 | |

| 32 | ADVENZYMES | 291 | 2x | 50 | |

| 33 | AEGISLOG | 649.25 | 2.5x | 40 | |

| 34 | AEROENTER | 70.3 | 2.5x | 40 | |

| 35 | AEROFLEX | 215.69 | 2.5x | 40 | |

| 36 | AETHER | 986.65 | 3x | 33.33 | |

| 37 | AFCONS | 278.15 | 2x | 50 | |

| 38 | AFFLE | 1391 | 1.54x | 65 | |

| 39 | AGARIND | 456.45 | 2.5x | 40 | |

| 40 | AGARWALEYE | 449.3 | 3.33x | 30 | |

| 41 | AGI | 488.95 | 2.5x | 40 | |

| 42 | AGIIL | 306.5 | 2.22x | 45 | |

| 43 | AHLUCONT | 757.55 | 2.86x | 35 | |

| 44 | AIAENG | 3600.5 | 2x | 50 | |

| 45 | AIIL | 405.3 | 2.5x | 40 | |

| 46 | AJANTPHARM | 2936.4 | 3x | 33.33 | |

| 47 | AJAXENGG | 477.8 | 3x | 33.33 | |

| 48 | AJMERA | 119.85 | 2x | 50 | |

| 49 | AKUMS | 479.6 | 2.86x | 35 | |

| 50 | AKZOINDIA | 2714.5 | 2x | 50 | |

| 51 | ALEMBICLTD | 85.39 | 2x | 50 | |

| 52 | ALIVUS | 919.75 | 2.86x | 35 | |

| 53 | ALKEM | 5460 | 4x | 25 | |

| 54 | ALKYLAMINE | 1305.9 | 2x | 50 | |

| 55 | ALLDIGI | 764.4 | 3x | 33.33 | |

| 56 | ALOKINDS | 13.12 | 2x | 50 | |

| 57 | ALPHA | 46.2 | 5x | 20 | |

| 58 | ALPHAETF | 24.03 | 5x | 20 | |

| 59 | ALPL30IETF | 26.6 | 5x | 20 | |

| 60 | AMBER | 7310.5 | 1.43x | 70 | |

| 61 | AMBIKCO | 1361 | 3x | 33.33 | |

| 62 | AMBUJACEM | 451.95 | 2.86x | 35 | |

| 63 | AMRUTANJAN | 557.2 | 3x | 33.33 | |

| 64 | ANANDRATHI | 3151 | 3x | 33.33 | |

| 65 | ANANTRAJ | 473.2 | 1.54x | 65 | |

| 66 | ANDHRAPAP | 63.49 | 3x | 33.33 | |

| 67 | ANDHRSUGAR | 73.01 | 1.25x | 80 | |

| 68 | ANGELONE | 218.96 | 3.33x | 30 | |

| 69 | ANUP | 1449.6 | 2.5x | 40 | |

| 70 | ANURAS | 1254.4 | 3x | 33.33 | |

| 71 | APARINDS | 10142 | 1.25x | 80 | |

| 72 | APCOTEXIND | 362 | 3x | 33.33 | |

| 73 | APEX | 345.5 | 2x | 50 | |

| 74 | APLAPOLLO | 2097.9 | 4x | 25 | |

| 75 | APLLTD | 705.65 | 2.86x | 35 | |

| 76 | APOLLOHOSP | 7779 | 2.22x | 45 | |

| 77 | APOLLOPIPE | 395.8 | 1.67x | 60 | |

| 78 | APOLLOTYRE | 430.6 | 2x | 50 | |

| 79 | APTUS | 221.29 | 1.25x | 80 | |

| 80 | ARE&M | 786.05 | 2.5x | 40 | |

| 81 | ARIHANTCAP | 71.07 | 2.22x | 45 | |

| 82 | ARIHANTSUP | 236.65 | 2.5x | 40 | |

| 83 | ARKADE | 107.2 | 2.86x | 35 | |

| 84 | ARMANFIN | 1339.2 | 2.5x | 40 | |

| 85 | ARTEMISMED | 226.18 | 2.5x | 40 | |

| 86 | ARVIND | 331.4 | 2.5x | 40 | |

| 87 | ARVINDFASN | 407.2 | 2.86x | 35 | |

| 88 | ARVSMART | 501.35 | 2.5x | 40 | |

| 89 | ASAHIINDIA | 835.7 | 1.25x | 80 | |

| 90 | ASAL | 437.7 | 2x | 50 | |

| 91 | ASHAPURMIN | 514.15 | 2x | 50 | |

| 92 | ASHIANA | 304.85 | 2.86x | 35 | |

| 93 | ASHOKA | 117.39 | 2.5x | 40 | |

| 94 | ASHOKLEY | 186.94 | 4x | 25 | |

| 95 | ASIANENE | 266.6 | 2x | 50 | |

| 96 | ASIANPAINT | 2220.8 | 2.5x | 40 | |

| 97 | ASKAUTOLTD | 380.1 | 2.86x | 35 | |

| 98 | ASTEC | 625.75 | 2x | 50 | |

| 99 | ASTERDM | 658.3 | 2.5x | 40 | |

| 100 | ASTRAL | 1605.9 | 2x | 50 | |

| 101 | ASTRAMICRO | 1007.8 | 1.25x | 80 | |

| 102 | ASTRAZEN | 8667.5 | 1.67x | 60 | |

| 103 | ATGL | 467.9 | 2.5x | 40 | |

| 104 | ATUL | 6136.5 | 2x | 50 | |

| 105 | ATULAUTO | 422.3 | 2.5x | 40 | |

| 106 | AUBANK | 931.65 | 2.5x | 40 | |

| 107 | AURIONPRO | 849.6 | 2x | 50 | |

| 108 | AUROPHARMA | 1247.3 | 1.54x | 65 | |

| 109 | AUTOAXLES | 1948.4 | 1.67x | 60 | |

| 110 | AUTOBEES | 267.46 | 3.33x | 30 | |

| 111 | AUTOIETF | 26.71 | 3x | 33.33 | |

| 112 | AVADHSUGAR | 399.95 | 1.25x | 80 | |

| 113 | AVALON | 904.8 | 1.25x | 80 | |

| 114 | AVANTEL | 140.13 | 2.5x | 40 | |

| 115 | AVANTIFEED | 1163.1 | 2.5x | 40 | |

| 116 | AVL | 460.15 | 2.5x | 40 | |

| 117 | AWFIS | 254 | 2.5x | 40 | |

| 118 | AWHCL | 456.25 | 2.5x | 40 | |

| 119 | AWL | 175.6 | 2x | 50 | |

| 120 | AXISBANK | 1288.3 | 1.82x | 55 | |

| 121 | AXISBNKETF | 575.1 | 3.33x | 30 | |

| 122 | AXISBPSETF | 13.25 | 3.33x | 30 | |

| 123 | AXISGOLD | 132.33 | 3.33x | 30 | |

| 124 | AXISILVER | 255.69 | 3x | 33.33 | |

| 125 | AXISNIFTY | 264.82 | 5x | 20 | |

| 126 | AZAD | 1605.5 | 2.5x | 40 | |

| 127 | BAJAJ-AUTO | 9383 | 2.86x | 35 | |

| 128 | BAJAJCON | 371.05 | 2x | 50 | |

| 129 | BAJAJELEC | 354.95 | 3x | 33.33 | |

| 130 | BAJAJFINSV | 1841.5 | 2x | 50 | |

| 131 | BAJAJHCARE | 313.4 | 2.22x | 45 | |

| 132 | BAJAJHFL | 82.9 | 2.5x | 40 | |

| 133 | BAJAJHIND | 16.41 | 1.25x | 80 | |

| 134 | BAJAJHLDNG | 10250 | 2.5x | 40 | |

| 135 | BAJFINANCE | 938.05 | 2x | 50 | |

| 136 | BALAMINES | 1003.6 | 2x | 50 | |

| 137 | BALKRISIND | 2242.8 | 3x | 33.33 | |

| 138 | BALMLAWRIE | 174.83 | 2.5x | 40 | |

| 139 | BALRAMCHIN | 492.6 | 2x | 50 | |

| 140 | BANARISUG | 3595.3 | 3x | 33.33 | |

| 141 | BANDHANBNK | 174.12 | 1.67x | 60 | |

| 142 | BANKBARODA | 288.05 | 1.54x | 65 | |

| 143 | BANKBEES | 579.4 | 2.5x | 40 | |

| 144 | BANKBETA | 57.78 | 3x | 33.33 | |

| 145 | BANKIETF | 57.43 | 3x | 33.33 | |

| 146 | BANKINDIA | 151.29 | 2x | 50 | |

| 147 | BANKNIFTY1 | 58 | 3.33x | 30 | |

| 148 | BANSALWIRE | 244.9 | 2.5x | 40 | |

| 149 | BASF | 3312.8 | 1.11x | 90 | |

| 150 | BATAINDIA | 717.55 | 3.33x | 30 | |

| 151 | BAYERCROP | 4463.9 | 2x | 50 | |

| 152 | BBETF0432 | 1316.46 | 3x | 33.33 | |

| 153 | BBL | 2303.7 | 2.5x | 40 | |

| 154 | BBTC | 1538.2 | 2.5x | 40 | |

| 155 | BCLIND | 27.58 | 2.5x | 40 | |

| 156 | BDL | 1335.5 | 2.5x | 40 | |

| 157 | BECTORFOOD | 191.45 | 1.43x | 70 | |

| 158 | BEL | 457.35 | 2.22x | 45 | |

| 159 | BEML | 1577.9 | 1.67x | 60 | |

| 160 | BEPL | 77.3 | 2.86x | 35 | |

| 161 | BERGEPAINT | 434.2 | 2.5x | 40 | |

| 162 | BFSI | 26.85 | 3x | 33.33 | |

| 163 | BHAGCHEM | 196.37 | 2.86x | 35 | |

| 164 | BHARATFORG | 1862.3 | 2.22x | 45 | |

| 165 | BHARATWIRE | 157.15 | 2.22x | 45 | |

| 166 | BHARTIARTL | 1866.7 | 2.22x | 45 | |

| 167 | BHARTIHEXA | 1582.2 | 2.5x | 40 | |

| 168 | BHEL | 255.4 | 1.43x | 70 | |

| 169 | BIKAJI | 605.85 | 3x | 33.33 | |

| 170 | BIOCON | 389.7 | 2x | 50 | |

| 171 | BIRLACORPN | 823.6 | 3x | 33.33 | |

| 172 | BIRLANU | 1396 | 2x | 50 | |

| 173 | BLAL | 174.97 | 2.86x | 35 | |

| 174 | BLISSGVS | 204.25 | 1.43x | 70 | |

| 175 | BLKASHYAP | 47.34 | 2.5x | 40 | |

| 176 | BLS | 246 | 2.5x | 40 | |

| 177 | BLUEDART | 5300 | 3x | 33.33 | |

| 178 | BLUEJET | 375.6 | 2x | 50 | |

| 179 | BLUESTARCO | 1875.1 | 4x | 25 | |

| 180 | BODALCHEM | 44.03 | 2.86x | 35 | |

| 181 | BOMDYEING | 101.9 | 1.82x | 55 | |

| 182 | BOROLTD | 225.38 | 2.86x | 35 | |

| 183 | BORORENEW | 410.95 | 2.5x | 40 | |

| 184 | BOSCH-HCIL | 1301 | 2.5x | 40 | |

| 185 | BOSCHLTD | 31600 | 2.5x | 40 | |

| 186 | BPCL | 331.15 | 1.67x | 60 | |

| 187 | BRIGADE | 663 | 2.5x | 40 | |

| 188 | BRITANNIA | 5890 | 2.5x | 40 | |

| 189 | BSE | 2768.9 | 2.86x | 35 | |

| 190 | BSE500IETF | 37.26 | 5x | 20 | |

| 191 | BSLNIFTY | 28.05 | 5x | 20 | |

| 192 | BSOFT | 368.55 | 1.67x | 60 | |

| 193 | BUTTERFLY | 585.1 | 2.86x | 35 | |

| 194 | CAMPUS | 239.65 | 1.43x | 70 | |

| 195 | CAMS | 649.1 | 1.82x | 55 | |

| 196 | CANBK | 139.91 | 1.43x | 70 | |

| 197 | CANFINHOME | 813.15 | 1.33x | 75 | |

| 198 | CANTABIL | 237.85 | 2.5x | 40 | |

| 199 | CAPACITE | 216.87 | 2.5x | 40 | |

| 200 | CAPITALSFB | 249.35 | 3.33x | 30 | |

| 201 | CAPLIPOINT | 1670.6 | 2x | 50 | |

| 202 | CARBORUNIV | 796.3 | 3x | 33.33 | |

| 203 | CARERATING | 1588.2 | 2.86x | 35 | |

| 204 | CARYSIL | 825.45 | 1.18x | 85 | |

| 205 | CASTROLIND | 185.46 | 2x | 50 | |

| 206 | CCAVENUE | 14.94 | 2x | 50 | |

| 207 | CCL | 1031.4 | 2.5x | 40 | |

| 208 | CDSL | 1210.5 | 1.25x | 80 | |

| 209 | CEATLTD | 3316.8 | 1.67x | 60 | |

| 210 | CEIGALL | 271.35 | 2.5x | 40 | |

| 211 | CELLO | 394.45 | 3x | 33.33 | |

| 212 | CEMPRO | 547.05 | 2.5x | 40 | |

| 213 | CENTENKA | 404.1 | 2.86x | 35 | |

| 214 | CENTRALBK | 35.78 | 2x | 50 | |

| 215 | CENTUM | 2776.4 | 2.22x | 45 | |

| 216 | CENTURYPLY | 679.25 | 2x | 50 | |

| 217 | CERA | 4549.5 | 1.67x | 60 | |

| 218 | CESC | 150.21 | 2x | 50 | |

| 219 | CGCL | 155.74 | 1.18x | 85 | |

| 220 | CGPOWER | 697.55 | 1.43x | 70 | |

| 221 | CHALET | 734.8 | 3x | 33.33 | |

| 222 | CHAMBLFERT | 412.25 | 1.43x | 70 | |

| 223 | CHEMCON | 153.16 | 2.5x | 40 | |

| 224 | CHEMPLASTS | 236.15 | 2.86x | 35 | |

| 225 | CHOICEIN | 650.6 | 3x | 33.33 | |

| 226 | CHOLAFIN | 1583 | 1.67x | 60 | |

| 227 | CHOLAHLDNG | 1531.6 | 2.86x | 35 | |

| 228 | CIEINDIA | 447.05 | 2.5x | 40 | |

| 229 | CIGNITITEC | 1152.6 | 2.86x | 35 | |

| 230 | CIPLA | 1325 | 2.86x | 35 | |

| 231 | CLEAN | 737.5 | 1.43x | 70 | |

| 232 | CLSEL | 243.45 | 2.5x | 40 | |

| 233 | CMSINFO | 295.15 | 3x | 33.33 | |

| 234 | COALINDIA | 437.65 | 2.86x | 35 | |

| 235 | COCHINSHIP | 1454.6 | 1.67x | 60 | |

| 236 | COFORGE | 1168.5 | 3.33x | 30 | |

| 237 | COHANCE | 282.55 | 2.5x | 40 | |

| 238 | COLPAL | 2156.3 | 2.86x | 35 | |

| 239 | CONCOR | 473.75 | 2x | 50 | |

| 240 | CONCORDBIO | 1175.3 | 2.5x | 40 | |

| 241 | CONFIPET | 28.81 | 1.25x | 80 | |

| 242 | CONSUMBEES | 122.13 | 3x | 33.33 | |

| 243 | CONTROLPR | 620.55 | 2.86x | 35 | |

| 244 | COROMANDEL | 1999.4 | 2x | 50 | |

| 245 | COSMOFIRST | 671.75 | 2.5x | 40 | |

| 246 | CPSEETF | 102.2 | 3.33x | 30 | |

| 247 | CRAFTSMAN | 7287.5 | 2.86x | 35 | |

| 248 | CREDITACC | 1154.2 | 2.5x | 40 | |

| 249 | CRISIL | 4174.2 | 3x | 33.33 | |

| 250 | CROMPTON | 241.3 | 1.67x | 60 | |

| 251 | CSBBANK | 355.55 | 2.5x | 40 | |

| 252 | CUB | 246.65 | 2x | 50 | |

| 253 | CUMMINSIND | 4691.3 | 2x | 50 | |

| 254 | CYIENT | 858.3 | 2x | 50 | |

| 255 | CYIENTDLM | 288.05 | 1.18x | 85 | |

| 256 | DABUR | 466.7 | 2.86x | 35 | |

| 257 | DALBHARAT | 1840.2 | 4x | 25 | |

| 258 | DAMCAPITAL | 130.81 | 2.5x | 40 | |

| 259 | DATAMATICS | 665.35 | 1.43x | 70 | |

| 260 | DATAPATTNS | 3493.2 | 1.43x | 70 | |

| 261 | DBCORP | 205.2 | 2.86x | 35 | |

| 262 | DBL | 437.55 | 2.5x | 40 | |

| 263 | DBREALTY | 101.01 | 1.18x | 85 | |

| 264 | DCBBANK | 167.98 | 1.82x | 55 | |

| 265 | DCMSHRIRAM | 964 | 2.5x | 40 | |

| 266 | DCMSRIND | 34.46 | 2.86x | 35 | |

| 267 | DCW | 40.76 | 2.5x | 40 | |

| 268 | DCXINDIA | 196.05 | 2x | 50 | |

| 269 | DEEDEV | 299.8 | 2.5x | 40 | |

| 270 | DEEPAKFERT | 932.15 | 1.67x | 60 | |

| 271 | DEEPAKNTR | 1478 | 1.82x | 55 | |

| 272 | DEEPINDS | 347.6 | 2.5x | 40 | |

| 273 | DELHIVERY | 415.65 | 1.43x | 70 | |

| 274 | DELTACORP | 55.11 | 2x | 50 | |

| 275 | DEN | 27.37 | 2.86x | 35 | |

| 276 | DEVYANI | 109.98 | 1.54x | 65 | |

| 277 | DHAMPURSUG | 126.82 | 2x | 50 | |

| 278 | DHANUKA | 962.6 | 2.5x | 40 | |

| 279 | DIAMONDYD | 956.6 | 2.86x | 35 | |

| 280 | DIVISLAB | 6330 | 4x | 25 | |

| 281 | DIXON | 9804 | 1.67x | 60 | |

| 282 | DLF | 574.95 | 2x | 50 | |

| 283 | DLINKINDIA | 389.25 | 1.25x | 80 | |

| 284 | DMART | 3966.2 | 2.5x | 40 | |

| 285 | DODLA | 1040 | 1.25x | 80 | |

| 286 | DOLATALGO | 75.53 | 2.5x | 40 | |

| 287 | DOLLAR | 254.85 | 3x | 33.33 | |

| 288 | DOMS | 2055.8 | 2.86x | 35 | |

| 289 | DPABHUSHAN | 1008.9 | 2.86x | 35 | |

| 290 | DPSCLTD | 8.61 | 2.5x | 40 | |

| 291 | DRREDDY | 1287 | 2.5x | 40 | |

| 292 | DSSL | 891.35 | 2.5x | 40 | |

| 293 | DVL | 211.03 | 2.5x | 40 | |

| 294 | DWARKESH | 39.44 | 2.86x | 35 | |

| 295 | DYNAMATECH | 10286 | 2.5x | 40 | |

| 296 | EASEMYTRIP | 7.21 | 1.54x | 65 | |

| 297 | EBBETF0430 | 1566.01 | 3.33x | 30 | |

| 298 | EBBETF0431 | 1402.19 | 3.33x | 30 | |

| 299 | EBBETF0433 | 1276.23 | 3x | 33.33 | |

| 300 | ECLERX | 2998.7 | 2x | 50 | |

| 301 | EDELWEISS | 105.66 | 2x | 50 | |

| 302 | EICHERMOT | 7266 | 4x | 25 | |

| 303 | EIDPARRY | 795.15 | 3x | 33.33 | |

| 304 | EIEL | 137.14 | 2x | 50 | |

| 305 | EIHAHOTELS | 313.55 | 2.86x | 35 | |

| 306 | EIHOTEL | 314.95 | 2.5x | 40 | |

| 307 | EIMCOELECO | 1523.8 | 2x | 50 | |

| 308 | EKC | 102.42 | 2.5x | 40 | |

| 309 | ELECON | 405.45 | 2.5x | 40 | |

| 310 | ELECTCAST | 61.1 | 1.11x | 90 | |

| 311 | ELGIEQUIP | 504.95 | 2.5x | 40 | |

| 312 | EMAMILTD | 443.05 | 2x | 50 | |

| 313 | EMCURE | 1521.1 | 3x | 33.33 | |

| 314 | EMIL | 89.92 | 2x | 50 | |

| 315 | EMSLIMITED | 257.75 | 2.5x | 40 | |

| 316 | EMUDHRA | 415.1 | 2.86x | 35 | |

| 317 | ENDURANCE | 2424 | 3x | 33.33 | |

| 318 | ENGINERSIN | 195.18 | 2x | 50 | |

| 319 | ENTERO | 1029.6 | 2.5x | 40 | |

| 320 | EPIGRAL | 867.9 | 2.5x | 40 | |

| 321 | EPL | 192.96 | 2.86x | 35 | |

| 322 | EQUAL50ADD | 327.74 | 5x | 20 | |

| 323 | EQUITASBNK | 58.14 | 3x | 33.33 | |

| 324 | ERIS | 1328.4 | 3x | 33.33 | |

| 325 | ESABINDIA | 5314.5 | 3x | 33.33 | |

| 326 | ESAFSFB | 24.92 | 3x | 33.33 | |

| 327 | ESCORTS | 3203.4 | 1.43x | 70 | |

| 328 | ESTER | 93.83 | 2x | 50 | |

| 329 | ETERNAL | 229.56 | 1.54x | 65 | |

| 330 | ETHOSLTD | 2194.5 | 2.86x | 35 | |

| 331 | EVEREADY | 305.15 | 2.86x | 35 | |

| 332 | EVINDIA | 28.92 | 3x | 33.33 | |

| 333 | EXCELINDUS | 876.9 | 2.5x | 40 | |

| 334 | EXICOM | 84.28 | 2.5x | 40 | |

| 335 | EXIDEIND | 308.9 | 2.5x | 40 | |

| 336 | FACT | 662.1 | 1.11x | 90 | |

| 337 | FAIRCHEMOR | 545.15 | 2.5x | 40 | |

| 338 | FCL | 21.7 | 2.5x | 40 | |

| 339 | FDC | 371.9 | 2x | 50 | |

| 340 | FEDERALBNK | 273.3 | 2x | 50 | |

| 341 | FEDFINA | 120.82 | 1.18x | 85 | |

| 342 | FIEMIND | 2040 | 2.86x | 35 | |

| 343 | FILATEX | 39.94 | 2.5x | 40 | |

| 344 | FINCABLES | 962.5 | 2.86x | 35 | |

| 345 | FINEORG | 4278.8 | 1.67x | 60 | |

| 346 | FINOPB | 174.4 | 2.5x | 40 | |

| 347 | FINPIPE | 181.07 | 1.67x | 60 | |

| 348 | FIRSTCRY | 211.24 | 2.5x | 40 | |

| 349 | FIVESTAR | 384.1 | 2.5x | 40 | |

| 350 | FLAIR | 299.05 | 1.18x | 85 | |

| 351 | FLUOROCHEM | 3289.7 | 3x | 33.33 | |

| 352 | FMCGIETF | 52.64 | 3x | 33.33 | |

| 353 | FMGOETZE | 378.8 | 2.86x | 35 | |

| 354 | FORTIS | 878.45 | 2x | 50 | |

| 355 | FSL | 211.45 | 2.5x | 40 | |

| 356 | FUSION | 166.38 | 2.5x | 40 | |

| 357 | GAEL | 130.5 | 2.86x | 35 | |

| 358 | GAIL | 148.98 | 2x | 50 | |

| 359 | GALAPREC | 715.05 | 2.5x | 40 | |

| 360 | GALAXYSURF | 1862.9 | 2x | 50 | |

| 361 | GANDHAR | 127.43 | 3x | 33.33 | |

| 362 | GANDHITUBE | 802.45 | 1.18x | 85 | |

| 363 | GANECOS | 705.35 | 2.5x | 40 | |

| 364 | GANESHBE | 76.22 | 2.5x | 40 | |

| 365 | GANESHHOU | 633.3 | 2.5x | 40 | |

| 366 | GARFIBRES | 621.4 | 2.86x | 35 | |

| 367 | GARUDA | 165.3 | 2x | 50 | |

| 368 | GATEWAY | 56.41 | 3x | 33.33 | |

| 369 | GENESYS | 270.85 | 2x | 50 | |

| 370 | GEOJITFSL | 58.57 | 2.5x | 40 | |

| 371 | GESHIP | 1338.5 | 1.43x | 70 | |

| 372 | GHCL | 456.15 | 2.5x | 40 | |

| 373 | GHCLTEXTIL | 71.62 | 2.86x | 35 | |

| 374 | GICHSGFIN | 147.35 | 2.5x | 40 | |

| 375 | GICRE | 366.4 | 1.82x | 55 | |

| 376 | GILLETTE | 8025 | 2x | 50 | |

| 377 | GILT5YBEES | 64.18 | 5x | 20 | |

| 378 | GIPCL | 130.82 | 2x | 50 | |

| 379 | GLAND | 1677.5 | 3x | 33.33 | |

| 380 | GLAXO | 2519.2 | 2x | 50 | |

| 381 | GLENMARK | 2117.6 | 1.54x | 65 | |

| 382 | GLOBUSSPR | 836.7 | 2.5x | 40 | |

| 383 | GMDCLTD | 530.05 | 2.5x | 40 | |

| 384 | GMMPFAUDLR | 861.2 | 3x | 33.33 | |

| 385 | GMRAIRPORT | 92.07 | 2x | 50 | |

| 386 | GMRP&UI | 104 | 2.5x | 40 | |

| 387 | GNA | 430.4 | 2.86x | 35 | |

| 388 | GNFC | 409.35 | 2.5x | 40 | |

| 389 | GOACARBON | 324.75 | 1.11x | 90 | |

| 390 | GOCLCORP | 243.05 | 2.5x | 40 | |

| 391 | GOCOLORS | 289.6 | 1.18x | 85 | |

| 392 | GODFRYPHLP | 2006.2 | 1.33x | 75 | |

| 393 | GODIGIT | 329.85 | 2.5x | 40 | |

| 394 | GODREJAGRO | 601.75 | 1.82x | 55 | |

| 395 | GODREJCP | 1080.3 | 4x | 25 | |

| 396 | GODREJIND | 915.9 | 2.86x | 35 | |

| 397 | GODREJPROP | 1645.6 | 2x | 50 | |

| 398 | GOKEX | 593.5 | 1.25x | 80 | |

| 399 | GOKULAGRO | 160.75 | 2.5x | 40 | |

| 400 | GOLD1 | 132.5 | 3.33x | 30 | |

| 401 | GOLDADD | 154.2 | 3x | 33.33 | |

| 402 | GOLDBEES | 131.35 | 3.33x | 30 | |

| 403 | GOLDBETA | 133.75 | 3.33x | 30 | |

| 404 | GOLDCASE | 24.97 | 3x | 33.33 | |

| 405 | GOLDETF | 153.84 | 3x | 33.33 | |

| 406 | GOLDIAM | 313.15 | 1.18x | 85 | |

| 407 | GOLDIETF | 136.09 | 3.33x | 30 | |

| 408 | GOODLUCK | 1043.9 | 2.22x | 45 | |

| 409 | GOPAL | 283.05 | 2.5x | 40 | |

| 410 | GPIL | 248.7 | 1.18x | 85 | |

| 411 | GPPL | 157.61 | 2x | 50 | |

| 412 | GPTHEALTH | 121.56 | 2.5x | 40 | |

| 413 | GPTINFRA | 106.03 | 2.5x | 40 | |

| 414 | GRANULES | 559.3 | 1.67x | 60 | |

| 415 | GRAPHITE | 627.75 | 1.43x | 70 | |

| 416 | GRASIM | 2681.2 | 2x | 50 | |

| 417 | GRAVITA | 1496.7 | 1.25x | 80 | |

| 418 | GREAVESCOT | 147.94 | 1.67x | 60 | |

| 419 | GREENLAM | 227.86 | 2.5x | 40 | |

| 420 | GREENPANEL | 196.26 | 1.25x | 80 | |

| 421 | GREENPLY | 189.35 | 2.86x | 35 | |

| 422 | GREENPOWER | 8.86 | 2.5x | 40 | |

| 423 | GRINDWELL | 1524.4 | 2x | 50 | |

| 424 | GRINFRA | 919.05 | 3x | 33.33 | |

| 425 | GROWWEV | 28.92 | 3x | 33.33 | |

| 426 | GROWWGOLD | 15.49 | 3x | 33.33 | |

| 427 | GROWWLIQID | 108.14 | 5x | 20 | |

| 428 | GRSE | 2471.1 | 2.22x | 45 | |

| 429 | GSFC | 150.42 | 1.11x | 90 | |

| 430 | GSPL | 271.55 | 2x | 50 | |

| 431 | GUFICBIO | 277.6 | 2.86x | 35 | |

| 432 | GUJALKALI | 429.7 | 2.5x | 40 | |

| 433 | GUJGASLTD | 372.05 | 2.5x | 40 | |

| 434 | GULFOILLUB | 979 | 2.86x | 35 | |

| 435 | GULPOLY | 157.6 | 2x | 50 | |

| 436 | HAL | 3989.9 | 2.5x | 40 | |

| 437 | HAPPSTMNDS | 340.55 | 3x | 33.33 | |

| 438 | HAPPYFORGE | 1216.8 | 3.33x | 30 | |

| 439 | HARIOMPIPE | 334.25 | 2.5x | 40 | |

| 440 | HARSHA | 354.75 | 3x | 33.33 | |

| 441 | HATHWAY | 10.03 | 3x | 33.33 | |

| 442 | HATSUN | 908.9 | 2.86x | 35 | |

| 443 | HAVELLS | 1331.4 | 2x | 50 | |

| 444 | HBLENGINE | 650.95 | 1.11x | 90 | |

| 445 | HCG | 562 | 2x | 50 | |

| 446 | HCLTECH | 1358.6 | 2.5x | 40 | |

| 447 | HDFCAMC | 2461.1 | 4x | 25 | |

| 448 | HDFCBANK | 840.7 | 2.86x | 35 | |

| 449 | HDFCGOLD | 135.51 | 3.33x | 30 | |

| 450 | HDFCLIFE | 653.75 | 4x | 25 | |

| 451 | HDFCLIQUID | 1051.14 | 5x | 20 | |

| 452 | HDFCNIFTY | 269.41 | 5x | 20 | |

| 453 | HDFCPVTBAN | 27.11 | 3x | 33.33 | |

| 454 | HDFCSILVER | 247.24 | 1.11x | 90 | |

| 455 | HDFCSML250 | 151.92 | 1.11x | 90 | |

| 456 | HEALTHIETF | 151.66 | 3x | 33.33 | |

| 457 | HEG | 511.45 | 1.43x | 70 | |

| 458 | HEIDELBERG | 151.66 | 3.33x | 30 | |

| 459 | HEMIPROP | 134.92 | 1.25x | 80 | |

| 460 | HERITGFOOD | 297.95 | 1.11x | 90 | |

| 461 | HEROMOTOCO | 5480 | 2.86x | 35 | |

| 462 | HEXT | 456.05 | 3x | 33.33 | |

| 463 | HFCL | 68.4 | 1.43x | 70 | |

| 464 | HGINFRA | 480.4 | 2.86x | 35 | |

| 465 | HGS | 347.2 | 3x | 33.33 | |

| 466 | HIKAL | 173.96 | 1.67x | 60 | |

| 467 | HIMATSEIDE | 85.91 | 1.67x | 60 | |

| 468 | HINDALCO | 945.35 | 2x | 50 | |

| 469 | HINDCOPPER | 540.55 | 2.5x | 40 | |

| 470 | HINDOILEXP | 165.34 | 1.11x | 90 | |

| 471 | HINDPETRO | 384.55 | 2.5x | 40 | |

| 472 | HINDUNILVR | 2194.6 | 4x | 25 | |

| 473 | HINDWAREAP | 209.71 | 2.5x | 40 | |

| 474 | HINDZINC | 575 | 1.43x | 70 | |

| 475 | HIRECT | 1418.6 | 2x | 50 | |

| 476 | HITECH | 77.7 | 2.5x | 40 | |

| 477 | HLEGLAS | 309.3 | 2.22x | 45 | |

| 478 | HLVLTD | 7.46 | 2x | 50 | |

| 479 | HMAAGRO | 24.11 | 1.18x | 85 | |

| 480 | HNDFDS | 469.95 | 3x | 33.33 | |

| 481 | HNGSNGBEES | 502.82 | 4x | 25 | |

| 482 | HOMEFIRST | 1038.9 | 2.5x | 40 | |

| 483 | HONAUT | 29700 | 1.67x | 60 | |

| 484 | HPAL | 32.84 | 2.86x | 35 | |

| 485 | HPL | 305.55 | 2.22x | 45 | |

| 486 | HSCL | 440.15 | 2.86x | 35 | |

| 487 | HUDCO | 174.14 | 1.67x | 60 | |

| 488 | HUHTAMAKI | 167.56 | 2.86x | 35 | |

| 489 | HYUNDAI | 2084.2 | 2x | 50 | |

| 490 | ICEMAKE | 823.5 | 2.5x | 40 | |

| 491 | ICICIB22 | 121.34 | 3.33x | 30 | |

| 492 | ICICIBANK | 1278.4 | 2.22x | 45 | |

| 493 | ICICIGI | 1889.7 | 2x | 50 | |

| 494 | ICICIPRULI | 601.55 | 1.82x | 55 | |

| 495 | ICIL | 252.9 | 1.18x | 85 | |

| 496 | ICRA | 5360.5 | 1.43x | 70 | |

| 497 | IDBI | 99 | 1.82x | 55 | |

| 498 | IDEA | 9.91 | 2x | 50 | |

| 499 | IDEAFORGE | 448.2 | 1.25x | 80 | |

| 500 | IDFCFIRSTB | 66.76 | 1.67x | 60 | |

| 501 | IEX | 120.26 | 1.82x | 55 | |

| 502 | IFBIND | 1034.4 | 2.5x | 40 | |

| 503 | IFCI | 52.06 | 1.33x | 75 | |

| 504 | IGARASHI | 314.2 | 2.5x | 40 | |

| 505 | IGL | 154.76 | 2x | 50 | |

| 506 | IGPL | 329.4 | 1.18x | 85 | |

| 507 | IIFL | 471.4 | 2x | 50 | |

| 508 | IIFLCAPS | 296.8 | 1.67x | 60 | |

| 509 | IKIO | 132 | 2.5x | 40 | |

| 510 | IKS | 1305.2 | 3x | 33.33 | |

| 511 | IMAGICAA | 39.73 | 2.5x | 40 | |

| 512 | IMFA | 1178 | 2.5x | 40 | |

| 513 | INDBANK | 31.97 | 2.22x | 45 | |

| 514 | INDGN | 452.15 | 2.5x | 40 | |

| 515 | INDHOTEL | 611.7 | 2x | 50 | |

| 516 | INDIACEM | 368 | 1.33x | 75 | |

| 517 | INDIAGLYCO | 851.25 | 2x | 50 | |

| 518 | INDIAMART | 2183.5 | 3x | 33.33 | |

| 519 | INDIANB | 898.9 | 1.67x | 60 | |

| 520 | INDIANHUME | 303.65 | 2.5x | 40 | |

| 521 | INDIASHLTR | 682.8 | 3x | 33.33 | |

| 522 | INDIGO | 4236.7 | 2x | 50 | |

| 523 | INDIGOPNTS | 838.3 | 3x | 33.33 | |

| 524 | INDOAMIN | 97.44 | 2.5x | 40 | |

| 525 | INDOCO | 194.44 | 2.5x | 40 | |

| 526 | INDOSTAR | 208.49 | 2.5x | 40 | |

| 527 | INDRAMEDCO | 392.45 | 2x | 50 | |

| 528 | INDUSINDBK | 881.2 | 1.18x | 85 | |

| 529 | INDUSTOWER | 438.5 | 1.67x | 60 | |

| 530 | INFRABEES | 935.45 | 3x | 33.33 | |

| 531 | INFRAIETF | 93.64 | 3x | 33.33 | |

| 532 | INFY | 1315 | 2.5x | 40 | |

| 533 | INGERRAND | 3873.4 | 3.33x | 30 | |

| 534 | INNOVACAP | 680.75 | 2.86x | 35 | |

| 535 | INOXINDIA | 1160.2 | 3x | 33.33 | |

| 536 | INOXWIND | 81.74 | 1.54x | 65 | |

| 537 | INSECTICID | 599.85 | 2.86x | 35 | |

| 538 | INTELLECT | 674 | 2x | 50 | |

| 539 | INTLCONV | 72.89 | 2.5x | 40 | |

| 540 | IOB | 33.03 | 2x | 50 | |

| 541 | IOC | 161.22 | 2.5x | 40 | |

| 542 | IOLCP | 71.27 | 2x | 50 | |

| 543 | IONEXCHANG | 336.85 | 2.86x | 35 | |

| 544 | IPCALAB | 1502.6 | 3x | 33.33 | |

| 545 | IPL | 149.71 | 1.11x | 90 | |

| 546 | IRB | 40.46 | 1.67x | 60 | |

| 547 | IRCON | 138.89 | 2.5x | 40 | |

| 548 | IRCTC | 539.8 | 2x | 50 | |

| 549 | IREDA | 114.35 | 2x | 50 | |

| 550 | IRFC | 97.57 | 1.43x | 70 | |

| 551 | IRMENERGY | 205.79 | 2.5x | 40 | |

| 552 | ISGEC | 897.95 | 2.5x | 40 | |

| 553 | ITBEES | 33.3 | 1.11x | 90 | |

| 554 | ITC | 306 | 2.5x | 40 | |

| 555 | ITCHOTELS | 164.16 | 3x | 33.33 | |

| 556 | ITDC | 464.05 | 2.5x | 40 | |

| 557 | ITETF | 31.79 | 3x | 33.33 | |

| 558 | ITI | 250.8 | 2x | 50 | |

| 559 | ITIETF | 33.24 | 3x | 33.33 | |

| 560 | IVZINGOLD | 13813.95 | 3x | 33.33 | |

| 561 | IXIGO | 167.7 | 2.5x | 40 | |

| 562 | J&KBANK | 111.94 | 1.67x | 60 | |

| 563 | JAGRAN | 63.26 | 3.33x | 30 | |

| 564 | JAGSNPHARM | 168.27 | 2x | 50 | |

| 565 | JAIBALAJI | 59.93 | 2x | 50 | |

| 566 | JAICORPLTD | 96.38 | 2.22x | 45 | |

| 567 | JAMNAAUTO | 122.28 | 1.67x | 60 | |

| 568 | JASH | 370.5 | 2.5x | 40 | |

| 569 | JBCHEPHARM | 2071.6 | 2.5x | 40 | |

| 570 | JBMA | 509.25 | 2x | 50 | |

| 571 | JGCHEM | 352.35 | 2.5x | 40 | |

| 572 | JINDALPOLY | 812.85 | 2.5x | 40 | |

| 573 | JINDALSAW | 162.58 | 2.5x | 40 | |

| 574 | JINDALSTEL | 1144.1 | 4x | 25 | |

| 575 | JINDRILL | 568.25 | 2.5x | 40 | |

| 576 | JINDWORLD | 22.38 | 2.5x | 40 | |

| 577 | JIOFIN | 232.25 | 1.18x | 85 | |

| 578 | JISLJALEQS | 32.92 | 1.25x | 80 | |

| 579 | JKCEMENT | 5055.5 | 2x | 50 | |

| 580 | JKIL | 474.15 | 2.86x | 35 | |

| 581 | JKLAKSHMI | 610.45 | 2x | 50 | |

| 582 | JKPAPER | 327.05 | 2x | 50 | |

| 583 | JKTYRE | 425.1 | 2x | 50 | |

| 584 | JLHL | 1251.1 | 3.33x | 30 | |

| 585 | JMFINANCIL | 115.73 | 1.67x | 60 | |

| 586 | JPPOWER | 13.37 | 1.11x | 90 | |

| 587 | JSFB | 341.85 | 2.5x | 40 | |

| 588 | JSL | 709 | 2.86x | 35 | |

| 589 | JSWENERGY | 478.9 | 1.43x | 70 | |

| 590 | JSWINFRA | 263.1 | 1.11x | 90 | |

| 591 | JSWSTEEL | 1192.6 | 2.5x | 40 | |

| 592 | JTEKTINDIA | 129.22 | 2.5x | 40 | |

| 593 | JTLIND | 51.56 | 2.5x | 40 | |

| 594 | JUBLFOOD | 488.65 | 2x | 50 | |

| 595 | JUBLINGREA | 541.3 | 2.5x | 40 | |

| 596 | JUBLPHARMA | 821.15 | 2.5x | 40 | |

| 597 | JUNIORBEES | 711.54 | 3.33x | 30 | |

| 598 | JUNIPER | 202.14 | 2.86x | 35 | |

| 599 | JUSTDIAL | 527.85 | 1.67x | 60 | |

| 600 | JWL | 287.4 | 2x | 50 | |

| 601 | JYOTHYLAB | 241.05 | 2x | 50 | |

| 602 | JYOTICNC | 772.75 | 2.5x | 40 | |

| 603 | KAJARIACER | 935.6 | 2x | 50 | |

| 604 | KALAMANDIR | 102.75 | 2.5x | 40 | |

| 605 | KALYANKJIL | 389 | 2x | 50 | |

| 606 | KAMDHENU | 21.8 | 2.5x | 40 | |

| 607 | KANSAINER | 185.33 | 3.33x | 30 | |

| 608 | KARURVYSYA | 292.35 | 2x | 50 | |

| 609 | KAYNES | 3701.8 | 1.43x | 70 | |

| 610 | KCP | 151.89 | 2.86x | 35 | |

| 611 | KDDL | 2327.5 | 2.5x | 40 | |

| 612 | KEC | 525.25 | 2x | 50 | |

| 613 | KECL | 80.57 | 2x | 50 | |

| 614 | KEI | 4789.5 | 2.5x | 40 | |

| 615 | KELLTONTEC | 16.63 | 2.22x | 45 | |

| 616 | KFINTECH | 910.25 | 3x | 33.33 | |

| 617 | KIMS | 693.05 | 3x | 33.33 | |

| 618 | KIRIINDUS | 384.45 | 1.25x | 80 | |

| 619 | KIRLOSBROS | 1570.5 | 2.5x | 40 | |

| 620 | KIRLOSENG | 1454.8 | 2x | 50 | |

| 621 | KIRLOSIND | 2821.8 | 2.86x | 35 | |

| 622 | KIRLPNU | 1104.5 | 2.5x | 40 | |

| 623 | KKCL | 458.25 | 3x | 33.33 | |

| 624 | KMEW | 1556.2 | 2x | 50 | |

| 625 | KNRCON | 120.52 | 2x | 50 | |

| 626 | KOKUYOCMLN | 75.82 | 2.86x | 35 | |

| 627 | KOLTEPATIL | 325.25 | 2.86x | 35 | |

| 628 | KOTAKBANK | 386.35 | 2.22x | 45 | |

| 629 | KOTARISUG | 24.94 | 2.5x | 40 | |

| 630 | KOTHARIPET | 113.08 | 2.5x | 40 | |

| 631 | KPEL | 246.75 | 2x | 50 | |

| 632 | KPIL | 1091 | 2x | 50 | |

| 633 | KPITTECH | 688.9 | 1.82x | 55 | |

| 634 | KPRMILL | 831.55 | 2.86x | 35 | |

| 635 | KRBL | 305.7 | 1.43x | 70 | |

| 636 | KRISHANA | 477.2 | 2x | 50 | |

| 637 | KRN | 918.8 | 2.5x | 40 | |

| 638 | KRONOX | 109.98 | 2.86x | 35 | |

| 639 | KROSS | 183.6 | 2.5x | 40 | |

| 640 | KRSNAA | 588.1 | 2.86x | 35 | |

| 641 | KSB | 753.6 | 3x | 33.33 | |

| 642 | KSCL | 767.45 | 2x | 50 | |

| 643 | KSL | 697.2 | 2.5x | 40 | |

| 644 | KTKBANK | 205.81 | 1.33x | 75 | |

| 645 | LALPATHLAB | 1363.8 | 1.82x | 55 | |

| 646 | LANDMARK | 357.55 | 2.5x | 40 | |

| 647 | LAOPALA | 191.4 | 2x | 50 | |

| 648 | LATENTVIEW | 303.65 | 1.43x | 70 | |

| 649 | LAURUSLABS | 1021 | 4x | 25 | |

| 650 | LAXMIDENTL | 173.92 | 2.5x | 40 | |

| 651 | LEMONTREE | 107.75 | 3x | 33.33 | |

| 652 | LGBBROSLTD | 1772.1 | 2.86x | 35 | |

| 653 | LICHSGFIN | 500.2 | 2.22x | 45 | |

| 654 | LICI | 805.4 | 1.43x | 70 | |

| 655 | LICMFGOLD | 142 | 3x | 33.33 | |

| 656 | LICNETFGSC | 28.82 | 5x | 20 | |

| 657 | LIKHITHA | 143.82 | 2.5x | 40 | |

| 658 | LINCOLN | 616.6 | 2.86x | 35 | |

| 659 | LINDEINDIA | 6572 | 1.43x | 70 | |

| 660 | LIQUID | 999.99 | 5x | 20 | |

| 661 | LIQUID1 | 1094.43 | 5x | 20 | |

| 662 | LIQUIDADD | 1116.56 | 5x | 20 | |

| 663 | LIQUIDBEES | 999.99 | 5x | 20 | |

| 664 | LIQUIDBETF | 1072.09 | 5x | 20 | |

| 665 | LIQUIDCASE | 113.05 | 5x | 20 | |

| 666 | LIQUIDETF | 1000 | 5x | 20 | |

| 667 | LIQUIDIETF | 999.99 | 5x | 20 | |

| 668 | LIQUIDPLUS | 1075.7 | 5x | 20 | |

| 669 | LIQUIDSBI | 1000 | 5x | 20 | |

| 670 | LIQUIDSHRI | 1095.03 | 5x | 20 | |

| 671 | LLOYDSENT | 47.01 | 2x | 50 | |

| 672 | LLOYDSME | 1162.3 | 2.86x | 35 | |

| 673 | LMW | 14562 | 3x | 33.33 | |

| 674 | LODHA | 888.85 | 1.43x | 70 | |

| 675 | LOWVOLIETF | 21.5 | 5x | 20 | |

| 676 | LT | 3842.1 | 2.5x | 40 | |

| 677 | LTF | 266.2 | 1.43x | 70 | |

| 678 | LTFOODS | 379.8 | 2.5x | 40 | |

| 679 | LTGILTBEES | 29.32 | 1.54x | 65 | |

| 680 | LTM | 4317.2 | 4x | 25 | |

| 681 | LTTS | 3113.8 | 2x | 50 | |

| 682 | LUMAXIND | 5233 | 2x | 50 | |

| 683 | LUMAXTECH | 1476.7 | 1.67x | 60 | |

| 684 | LUPIN | 2303.1 | 2.5x | 40 | |

| 685 | LUXIND | 868.6 | 1.43x | 70 | |

| 686 | LXCHEM | 116.69 | 1.11x | 90 | |

| 687 | M&M | 3187.6 | 2.86x | 35 | |

| 688 | M&MFIN | 347.85 | 1.67x | 60 | |

| 689 | MADRASFERT | 59.75 | 2.5x | 40 | |

| 690 | MAHABANK | 65.69 | 2x | 50 | |

| 691 | MAHLIFE | 348.55 | 1.82x | 55 | |

| 692 | MAHLOG | 390.6 | 1.67x | 60 | |

| 693 | MAHSEAMLES | 542.15 | 2.5x | 40 | |

| 694 | MAITHANALL | 928.1 | 2.86x | 35 | |

| 695 | MANALIPETC | 49.8 | 2.5x | 40 | |

| 696 | MANAPPURAM | 256.85 | 1.67x | 60 | |

| 697 | MANGLMCEM | 822.25 | 3x | 33.33 | |

| 698 | MANINDS | 392.6 | 2x | 50 | |

| 699 | MANINFRA | 96.92 | 1.11x | 90 | |

| 700 | MANKIND | 2163.3 | 1.54x | 65 | |

| 701 | MANYAVAR | 358.35 | 1.43x | 70 | |

| 702 | MAPMYINDIA | 983.6 | 2.86x | 35 | |

| 703 | MARATHON | 413.35 | 2.5x | 40 | |

| 704 | MARICO | 778 | 2.86x | 35 | |

| 705 | MARKSANS | 168.44 | 1.43x | 70 | |

| 706 | MARUTI | 13508 | 2.5x | 40 | |

| 707 | MASFIN | 301.25 | 3x | 33.33 | |

| 708 | MASTEK | 1557.5 | 1.11x | 90 | |

| 709 | MASTERTR | 79.3 | 2x | 50 | |

| 710 | MATRIMONY | 400.3 | 1.18x | 85 | |

| 711 | MAXESTATES | 385.5 | 2.5x | 40 | |

| 712 | MAXHEALTH | 1041.5 | 1.54x | 65 | |

| 713 | MAYURUNIQ | 500.45 | 3x | 33.33 | |

| 714 | MAZDOCK | 2387 | 2.5x | 40 | |

| 715 | MCX | 2577.1 | 2x | 50 | |

| 716 | MEDANTA | 1089.7 | 3x | 33.33 | |

| 717 | MEDIASSIST | 299.65 | 2.86x | 35 | |

| 718 | MEDPLUS | 825.35 | 3x | 33.33 | |

| 719 | METROBRAND | 953.4 | 3x | 33.33 | |

| 720 | METROPOLIS | 1783 | 1.82x | 55 | |

| 721 | MFSL | 1707.6 | 1.43x | 70 | |

| 722 | MGL | 1042.3 | 2x | 50 | |

| 723 | MHRIL | 270.95 | 2x | 50 | |

| 724 | MID150BEES | 214.71 | 5x | 20 | |

| 725 | MIDCAPETF | 21.21 | 5x | 20 | |

| 726 | MIDCAPIETF | 21.47 | 5x | 20 | |

| 727 | MIDHANI | 337.2 | 1.54x | 65 | |

| 728 | MIDSMALL | 45.43 | 5x | 20 | |

| 729 | MINDACORP | 497.65 | 2.86x | 35 | |

| 730 | MMFL | 438.15 | 2.86x | 35 | |

| 731 | MMTC | 54.62 | 1.18x | 85 | |

| 732 | MODEFENCE | 91.71 | 3x | 33.33 | |

| 733 | MOIL | 280.75 | 2x | 50 | |

| 734 | MOL | 43.81 | 2.86x | 35 | |

| 735 | MOLDTKPAC | 538.9 | 3x | 33.33 | |

| 736 | MOM100 | 60.67 | 5x | 20 | |

| 737 | MOM30IETF | 30.04 | 5x | 20 | |

| 738 | MOMENTUM50 | 49.04 | 5x | 20 | |

| 739 | MON100 | 219.24 | 4x | 25 | |

| 740 | MONARCH | 249.9 | 2.86x | 35 | |

| 741 | MONTECARLO | 509.6 | 2.86x | 35 | |

| 742 | MOREPENLAB | 39.09 | 1.43x | 70 | |

| 743 | MOTHERSON | 117.98 | 1.82x | 55 | |

| 744 | MOTILALOFS | 692.95 | 1.67x | 60 | |

| 745 | MOVALUE | 116.52 | 5x | 20 | |

| 746 | MPHASIS | 2187.7 | 4x | 25 | |

| 747 | MPSLTD | 1366.7 | 2.5x | 40 | |

| 748 | MRF | 134925 | 2.5x | 40 | |

| 749 | MRPL | 190.03 | 1.33x | 75 | |

| 750 | MSTCLTD | 418.3 | 2.5x | 40 | |

| 751 | MSUMI | 40.12 | 3x | 33.33 | |

| 752 | MTARTECH | 3613.2 | 1.43x | 70 | |

| 753 | MTNL | 25.34 | 2x | 50 | |

| 754 | MUFIN | 102.63 | 2.5x | 40 | |

| 755 | MUKANDLTD | 121.33 | 2.5x | 40 | |

| 756 | MUKKA | 21.61 | 2.5x | 40 | |

| 757 | MUNJALSHOW | 123.39 | 2.86x | 35 | |

| 758 | MUTHOOTFIN | 3241.9 | 1.54x | 65 | |

| 759 | MUTHOOTMF | 152.55 | 2.86x | 35 | |

| 760 | MVGJL | 147.86 | 2.5x | 40 | |

| 761 | NAM-INDIA | 833.6 | 1.54x | 65 | |

| 762 | NATCOPHARM | 1002.7 | 2x | 50 | |

| 763 | NATIONALUM | 388.1 | 1.43x | 70 | |

| 764 | NAUKRI | 979.3 | 2x | 50 | |

| 765 | NAVA | 545.25 | 1.11x | 90 | |

| 766 | NAVINFLUOR | 6387.5 | 2.5x | 40 | |

| 767 | NAVKARCORP | 86.56 | 1.11x | 90 | |

| 768 | NAVNETEDUL | 137.91 | 1.67x | 60 | |

| 769 | NAZARA | 239.8 | 1.43x | 70 | |

| 770 | NBCC | 84.44 | 2x | 50 | |

| 771 | NCC | 140.37 | 2x | 50 | |

| 772 | NCLIND | 181.65 | 2.5x | 40 | |

| 773 | NELCAST | 115.16 | 1.18x | 85 | |

| 774 | NELCO | 578.7 | 2.5x | 40 | |

| 775 | NEOGEN | 1400 | 2.5x | 40 | |

| 776 | NESCO | 1068.5 | 1.67x | 60 | |

| 777 | NESTLEIND | 1235.8 | 4x | 25 | |

| 778 | NETWORK18 | 32.34 | 1.11x | 90 | |

| 779 | NEULANDLAB | 12593 | 2x | 50 | |

| 780 | NEWGEN | 460.65 | 2x | 50 | |

| 781 | NEXT50 | 678.17 | 5x | 20 | |

| 782 | NEXT50BETA | 70.97 | 5x | 20 | |

| 783 | NEXT50IETF | 69.62 | 5x | 20 | |

| 784 | NFL | 69.87 | 2.5x | 40 | |

| 785 | NH | 1758.2 | 2.5x | 40 | |

| 786 | NHPC | 73.04 | 1.33x | 75 | |

| 787 | NIACL | 134.77 | 2.5x | 40 | |

| 788 | NIF100BEES | 261.41 | 5x | 20 | |

| 789 | NIFTY1 | 265.31 | 5x | 20 | |

| 790 | NIFTYADD | 252.02 | 5x | 20 | |

| 791 | NIFTYBEES | 272.42 | 3.33x | 30 | |

| 792 | NIFTYBETA | 264.98 | 5x | 20 | |

| 793 | NIFTYETF | 259.92 | 5x | 20 | |

| 794 | NIFTYIETF | 271.14 | 5x | 20 | |

| 795 | NIITLTD | 62.37 | 2.5x | 40 | |

| 796 | NIITMTS | 312.35 | 3x | 33.33 | |

| 797 | NILKAMAL | 1312.9 | 2x | 50 | |

| 798 | NITINSPIN | 357.45 | 2.86x | 35 | |

| 799 | NIVABUPA | 70 | 3x | 33.33 | |

| 800 | NLCINDIA | 239.75 | 2.5x | 40 | |

| 801 | NMDC | 79.13 | 2.22x | 45 | |

| 802 | NOCIL | 131.51 | 2x | 50 | |

| 803 | NORTHARC | 232.3 | 2.86x | 35 | |

| 804 | NRBBEARING | 255.05 | 2.86x | 35 | |

| 805 | NSLNISP | 37.31 | 2.5x | 40 | |

| 806 | NTPC | 376.25 | 3.33x | 30 | |

| 807 | NTPCGREEN | 86.34 | 3x | 33.33 | |

| 808 | NUVAMA | 1208.4 | 2x | 50 | |

| 809 | NUVOCO | 284.2 | 3x | 33.33 | |

| 810 | NV20IETF | 14.09 | 3x | 33.33 | |

| 811 | NYKAA | 249.7 | 1.54x | 65 | |

| 812 | OAL | 243.3 | 2.5x | 40 | |

| 813 | OBEROIRLTY | 1469.5 | 2x | 50 | |

| 814 | OFSS | 6712.5 | 2x | 50 | |

| 815 | OIL | 474.05 | 2x | 50 | |

| 816 | OILIETF | 11.66 | 3x | 33.33 | |

| 817 | OLECTRA | 891.15 | 1.11x | 90 | |

| 818 | OMINFRAL | 78.7 | 2x | 50 | |

| 819 | ONGC | 270.8 | 1.43x | 70 | |

| 820 | ONMOBILE | 47.93 | 2.5x | 40 | |

| 821 | ORCHPHARMA | 498.95 | 2.5x | 40 | |

| 822 | ORIENTCEM | 140.04 | 2.5x | 40 | |

| 823 | ORIENTELEC | 172 | 2.5x | 40 | |

| 824 | ORIENTHOT | 87.06 | 2.5x | 40 | |

| 825 | ORIENTPPR | 16.66 | 1.54x | 65 | |

| 826 | ORISSAMINE | 3678.5 | 1.18x | 85 | |

| 827 | OSWALGREEN | 24.03 | 2.5x | 40 | |

| 828 | PAGEIND | 31145 | 4x | 25 | |

| 829 | PAISALO | 33.22 | 2x | 50 | |

| 830 | PAKKA | 81.26 | 2x | 50 | |

| 831 | PANAMAPET | 279.3 | 2.86x | 35 | |

| 832 | PARACABLES | 32.33 | 2.5x | 40 | |

| 833 | PARADEEP | 103.19 | 1.18x | 85 | |

| 834 | PARAGMILK | 195.87 | 2.5x | 40 | |

| 835 | PARKHOTELS | 115.39 | 2.5x | 40 | |

| 836 | PATANJALI | 491.05 | 4x | 25 | |

| 837 | PATELENG | 24.89 | 1.18x | 85 | |

| 838 | PAYTM | 1038.7 | 2x | 50 | |

| 839 | PCBL | 268.95 | 2.5x | 40 | |

| 840 | PDSL | 290.9 | 2.5x | 40 | |

| 841 | PENIND | 135.43 | 2.22x | 45 | |

| 842 | PERSISTENT | 4783.1 | 3.33x | 30 | |

| 843 | PETRONET | 278.55 | 2.5x | 40 | |

| 844 | PFC | 392.8 | 2.5x | 40 | |

| 845 | PFIZER | 4769.5 | 2x | 50 | |

| 846 | PFOCUS | 277.2 | 2x | 50 | |

| 847 | PFS | 27.95 | 2.5x | 40 | |

| 848 | PGEL | 522.35 | 2x | 50 | |

| 849 | PGHH | 10604 | 2x | 50 | |

| 850 | PGHL | 4833.4 | 2x | 50 | |

| 851 | PGIL | 1465.6 | 2x | 50 | |

| 852 | PHARMABEES | 23.53 | 2x | 50 | |

| 853 | PHOENIXLTD | 1578.4 | 3.33x | 30 | |

| 854 | PIDILITIND | 1386.4 | 4x | 25 | |

| 855 | PIIND | 3033.2 | 2x | 50 | |

| 856 | PITTIENG | 842.8 | 2.86x | 35 | |

| 857 | PIXTRANS | 1418.5 | 2x | 50 | |

| 858 | PLATIND | 206.33 | 2.5x | 40 | |

| 859 | PNB | 115.07 | 1.67x | 60 | |

| 860 | PNBGILTS | 75.38 | 2.5x | 40 | |

| 861 | PNBHOUSING | 755.5 | 2.5x | 40 | |

| 862 | PNCINFRA | 192.61 | 2.86x | 35 | |

| 863 | PNGJL | 532.35 | 3x | 33.33 | |

| 864 | POCL | 1048.3 | 2x | 50 | |

| 865 | POKARNA | 871.05 | 1.18x | 85 | |

| 866 | POLICYBZR | 1430 | 1.54x | 65 | |

| 867 | POLYCAB | 8228.5 | 1.67x | 60 | |

| 868 | POLYMED | 1318.6 | 2.5x | 40 | |

| 869 | POLYPLEX | 794.7 | 2.5x | 40 | |

| 870 | POONAWALLA | 413.65 | 1.11x | 90 | |

| 871 | POWERGRID | 295.2 | 2.5x | 40 | |

| 872 | POWERINDIA | 25160 | 2x | 50 | |

| 873 | POWERMECH | 1952.4 | 2.5x | 40 | |

| 874 | PPL | 191.2 | 2x | 50 | |

| 875 | PPLPHARMA | 151.4 | 1.43x | 70 | |

| 876 | PRAJIND | 312.75 | 1.18x | 85 | |

| 877 | PRAKASH | 119.25 | 2.5x | 40 | |

| 878 | PRECAM | 123.24 | 2x | 50 | |

| 879 | PRECWIRE | 334.05 | 1.18x | 85 | |

| 880 | PREMIERENE | 721.65 | 2.5x | 40 | |

| 881 | PRESTIGE | 1304.6 | 3.33x | 30 | |

| 882 | PRICOLLTD | 544.15 | 1.11x | 90 | |

| 883 | PRIMESECU | 272.85 | 2.5x | 40 | |

| 884 | PRINCEPIPE | 235.05 | 2.86x | 35 | |

| 885 | PRIVISCL | 2927.9 | 2.5x | 40 | |

| 886 | PRSMJOHNSN | 125.49 | 1.67x | 60 | |

| 887 | PRUDENT | 2181.1 | 2.5x | 40 | |

| 888 | PSB | 23.97 | 2.5x | 40 | |

| 889 | PSPPROJECT | 684.95 | 1.67x | 60 | |

| 890 | PSUBANK | 880.26 | 3x | 33.33 | |

| 891 | PSUBNKBEES | 98.35 | 3.33x | 30 | |

| 892 | PTC | 153.72 | 1.33x | 75 | |

| 893 | PTCIL | 17266 | 2x | 50 | |

| 894 | PUNJABCHEM | 1065 | 2.5x | 40 | |

| 895 | PURVA | 181.06 | 2.5x | 40 | |

| 896 | PVRINOX | 1018 | 1.67x | 60 | |

| 897 | PVSL | 93.14 | 2.86x | 35 | |

| 898 | PVTBANIETF | 26.92 | 3x | 33.33 | |

| 899 | PVTBANKADD | 27.03 | 3x | 33.33 | |

| 900 | QGOLDHALF | 131.41 | 3.33x | 30 | |

| 901 | QPOWER | 795.9 | 2.5x | 40 | |

| 902 | QUESS | 185.08 | 2.86x | 35 | |

| 903 | QUICKHEAL | 151.27 | 2x | 50 | |

| 904 | RADIANTCMS | 36.53 | 2.86x | 35 | |

| 905 | RADICO | 2751.6 | 2.5x | 40 | |

| 906 | RAILTEL | 282.15 | 1.54x | 65 | |

| 907 | RAIN | 115.96 | 2x | 50 | |

| 908 | RAINBOW | 1182.7 | 3x | 33.33 | |

| 909 | RALLIS | 253.8 | 2x | 50 | |

| 910 | RAMASTEEL | 5.92 | 2.5x | 40 | |

| 911 | RAMCOCEM | 1025.4 | 2x | 50 | |

| 912 | RAMCOIND | 262.95 | 2.86x | 35 | |

| 913 | RAMKY | 452.35 | 2.5x | 40 | |

| 914 | RAMRAT | 339.9 | 2.5x | 40 | |

| 915 | RANASUG | 11.9 | 2.86x | 35 | |

| 916 | RANEHOLDIN | 1226.2 | 2.86x | 35 | |

| 917 | RATEGAIN | 469.85 | 2.5x | 40 | |

| 918 | RATNAMANI | 2317.9 | 1.67x | 60 | |

| 919 | RAYMOND | 371.15 | 1.82x | 55 | |

| 920 | RAYMONDLSL | 803.8 | 2.5x | 40 | |

| 921 | RBA | 62.91 | 1.11x | 90 | |

| 922 | RBLBANK | 297.9 | 1.54x | 65 | |

| 923 | RCF | 109.95 | 2.5x | 40 | |

| 924 | RECLTD | 324.4 | 2.5x | 40 | |

| 925 | REDINGTON | 232.35 | 2.5x | 40 | |

| 926 | REDTAPE | 114.68 | 2.5x | 40 | |

| 927 | RELAXO | 311 | 2x | 50 | |

| 928 | RELIANCE | 1424 | 2.5x | 40 | |

| 929 | RELIGARE | 210.03 | 2x | 50 | |

| 930 | RENUKA | 24.79 | 1.11x | 90 | |

| 931 | REPCOHOME | 354.15 | 1.43x | 70 | |

| 932 | RESPONIND | 164.87 | 2.5x | 40 | |

| 933 | RGL | 101.46 | 2.5x | 40 | |

| 934 | RHIM | 381.6 | 1.43x | 70 | |

| 935 | RICOAUTO | 105.31 | 1.43x | 70 | |

| 936 | RIIL | 668.75 | 2.5x | 40 | |

| 937 | RITCO | 185.76 | 2.5x | 40 | |

| 938 | RITES | 200.3 | 1.67x | 60 | |

| 939 | RKFORGE | 553 | 1.43x | 70 | |

| 940 | RKSWAMY | 95.51 | 2x | 50 | |

| 941 | RML | 826.7 | 2.5x | 40 | |

| 942 | ROHLTD | 323.7 | 2.5x | 40 | |

| 943 | ROLEXRINGS | 118.31 | 1.25x | 80 | |

| 944 | ROSSARI | 457.95 | 3.33x | 30 | |

| 945 | ROTO | 53.07 | 1.18x | 85 | |

| 946 | ROUTE | 466.7 | 1.43x | 70 | |

| 947 | RPEL | 668.5 | 2.5x | 40 | |

| 948 | RPGLIFE | 1854.2 | 2.5x | 40 | |

| 949 | RPSGVENT | 607.5 | 2.5x | 40 | |

| 950 | RPTECH | 351.9 | 2.5x | 40 | |

| 951 | RRKABEL | 1491.6 | 1.18x | 85 | |

| 952 | RSYSTEMS | 298.1 | 2.86x | 35 | |

| 953 | RTNINDIA | 24.82 | 2x | 50 | |

| 954 | RUPA | 130.36 | 2.86x | 35 | |

| 955 | RUSTOMJEE | 409.45 | 3x | 33.33 | |

| 956 | RVNL | 276.2 | 2.5x | 40 | |

| 957 | SAFARI | 1668.7 | 3x | 33.33 | |

| 958 | SAGCEM | 180.86 | 2.86x | 35 | |

| 959 | SAIL | 149.52 | 1.43x | 70 | |

| 960 | SAILIFE | 1016.75 | 3x | 33.33 | |

| 961 | SAKHTISUG | 15.5 | 2.5x | 40 | |

| 962 | SAKSOFT | 129.45 | 2.5x | 40 | |

| 963 | SALZERELEC | 571.9 | 1.18x | 85 | |

| 964 | SAMHI | 146.74 | 2.86x | 35 | |

| 965 | SAMMAANCAP | 141.53 | 1.25x | 80 | |

| 966 | SANATHAN | 395.9 | 3x | 33.33 | |

| 967 | SANDHAR | 495.7 | 2.5x | 40 | |

| 968 | SANDUMA | 192.21 | 2x | 50 | |

| 969 | SANGHIIND | 54.12 | 3x | 33.33 | |

| 970 | SANGHVIMOV | 236.45 | 2.22x | 45 | |

| 971 | SANOFI | 3716.7 | 3.33x | 30 | |

| 972 | SANOFICONR | 4423.7 | 3.33x | 30 | |

| 973 | SANSERA | 2096.8 | 1.18x | 85 | |

| 974 | SANSTAR | 85.27 | 2.5x | 40 | |

| 975 | SAPPHIRE | 174.76 | 1.43x | 70 | |

| 976 | SARDAEN | 539.65 | 2.5x | 40 | |

| 977 | SAREGAMA | 323.1 | 1.43x | 70 | |

| 978 | SASKEN | 1094.8 | 2x | 50 | |

| 979 | SATIA | 61.31 | 3x | 33.33 | |

| 980 | SATIN | 146.2 | 3x | 33.33 | |

| 981 | SAURASHCEM | 61.48 | 2.5x | 40 | |

| 982 | SBC | 31.89 | 2.86x | 35 | |

| 983 | SBCL | 413.6 | 2.5x | 40 | |

| 984 | SBFC | 92.37 | 1.18x | 85 | |

| 985 | SBICARD | 720.7 | 2.5x | 40 | |

| 986 | SBIETFQLTY | 212.32 | 5x | 20 | |

| 987 | SBILIFE | 1912.5 | 2x | 50 | |

| 988 | SBIN | 1098.5 | 2x | 50 | |

| 989 | SBISILVER | 252.9 | 3x | 33.33 | |

| 990 | SCHAEFFLER | 4172.6 | 2x | 50 | |

| 991 | SCI | 232.65 | 1.67x | 60 | |

| 992 | SCILAL | 42.79 | 2.5x | 40 | |

| 993 | SDBL | 75.57 | 2.5x | 40 | |

| 994 | SDL26BEES | 136.87 | 5x | 20 | |

| 995 | SENORES | 741 | 3x | 33.33 | |

| 996 | SENSEXBETA | 853.54 | 5x | 20 | |

| 997 | SENSEXIETF | 885.28 | 5x | 20 | |

| 998 | SEPC | 6.37 | 2x | 50 | |

| 999 | SERVOTECH | 66.33 | 2.5x | 40 | |

| 1000 | SETF10GILT | 259.58 | 5x | 20 | |

| 1001 | SETFGOLD | 135.51 | 3.33x | 30 | |

| 1002 | SETFNIF50 | 257.78 | 5x | 20 | |

| 1003 | SETFNIFBK | 574.71 | 3.33x | 30 | |

| 1004 | SETFNN50 | 704.48 | 5x | 20 | |

| 1005 | SFL | 506.95 | 3x | 33.33 | |

| 1006 | SHALBY | 143.68 | 2.86x | 35 | |

| 1007 | SHALPAINTS | 50.65 | 2.5x | 40 | |

| 1008 | SHANTIGEAR | 443.5 | 2.86x | 35 | |

| 1009 | SHARDACROP | 1014.9 | 2x | 50 | |

| 1010 | SHARDAMOTR | 813 | 2x | 50 | |

| 1011 | SHAREINDIA | 128.94 | 2.5x | 40 | |

| 1012 | SHIVALIK | 280.3 | 2x | 50 | |

| 1013 | SHK | 129.71 | 2.5x | 40 | |

| 1014 | SHOPERSTOP | 301.6 | 2.5x | 40 | |

| 1015 | SHREDIGCEM | 62.17 | 3x | 33.33 | |

| 1016 | SHREECEM | 23590 | 4x | 25 | |

| 1017 | SHREEPUSHK | 300 | 2x | 50 | |

| 1018 | SHRIRAMFIN | 987.2 | 1.43x | 70 | |

| 1019 | SHRIRAMPPS | 72.65 | 2.5x | 40 | |

| 1020 | SHYAMMETL | 770.65 | 1.18x | 85 | |

| 1021 | SIEMENS | 3228.9 | 2.5x | 40 | |

| 1022 | SIGACHI | 18.77 | 1.11x | 90 | |

| 1023 | SIGNATURE | 874.55 | 3x | 33.33 | |

| 1024 | SILVER | 257.33 | 1.11x | 90 | |

| 1025 | SILVER1 | 25.19 | 3x | 33.33 | |

| 1026 | SILVERADD | 249.05 | 3x | 33.33 | |

| 1027 | SILVERBEES | 247 | 1.54x | 65 | |

| 1028 | SILVERBETA | 249.15 | 3x | 33.33 | |

| 1029 | SILVERIETF | 257.58 | 3x | 33.33 | |

| 1030 | SINDHUTRAD | 24 | 2x | 50 | |

| 1031 | SIRCA | 432.55 | 3x | 33.33 | |

| 1032 | SIS | 286.15 | 2.5x | 40 | |

| 1033 | SIYSIL | 493.5 | 2.5x | 40 | |

| 1034 | SJS | 1599.5 | 2.5x | 40 | |

| 1035 | SJVN | 68.97 | 2x | 50 | |

| 1036 | SKFINDIA | 1636.9 | 3.33x | 30 | |

| 1037 | SKIPPER | 330.4 | 1.18x | 85 | |

| 1038 | SMALLCAP | 39.9 | 5x | 20 | |

| 1039 | SMCGLOBAL | 68.44 | 1.18x | 85 | |

| 1040 | SMLMAH | 3989.8 | 2x | 50 | |

| 1041 | SMSPHARMA | 383.7 | 2x | 50 | |

| 1042 | SNOWMAN | 36.21 | 2.5x | 40 | |

| 1043 | SOBHA | 1283.9 | 1.82x | 55 | |

| 1044 | SOLARA | 449.55 | 2x | 50 | |

| 1045 | SOLARINDS | 14977 | 2x | 50 | |

| 1046 | SOMANYCERA | 338.5 | 1.11x | 90 | |

| 1047 | SONACOMS | 500.7 | 1.54x | 65 | |

| 1048 | SONATSOFTW | 247 | 2.5x | 40 | |

| 1049 | SOTL | 345.05 | 2.86x | 35 | |

| 1050 | SOUTHBANK | 38.6 | 1.33x | 75 | |

| 1051 | SPAL | 662.65 | 2.5x | 40 | |

| 1052 | SPARC | 121.11 | 2.5x | 40 | |

| 1053 | SPENCERS | 31.05 | 2.5x | 40 | |

| 1054 | SPIC | 59.27 | 2.5x | 40 | |

| 1055 | SPLPETRO | 688.55 | 2.86x | 35 | |

| 1056 | SPORTKING | 106.52 | 2.5x | 40 | |

| 1057 | SRF | 2552.4 | 4x | 25 | |

| 1058 | SRHHYPOLTD | 422.75 | 2.5x | 40 | |

| 1059 | SSWL | 187.57 | 3x | 33.33 | |

| 1060 | STANLEY | 145.77 | 2.5x | 40 | |

| 1061 | STAR | 866.35 | 2.5x | 40 | |

| 1062 | STARCEMENT | 198.17 | 2.86x | 35 | |

| 1063 | STARHEALTH | 447.3 | 1.54x | 65 | |

| 1064 | STEELCAS | 230.83 | 2.5x | 40 | |

| 1065 | STEELXIND | 8.08 | 2.5x | 40 | |

| 1066 | STERTOOLS | 195.1 | 2.5x | 40 | |

| 1067 | STLTECH | 174.24 | 2x | 50 | |

| 1068 | STOVEKRAFT | 467 | 2.5x | 40 | |

| 1069 | STYLAMIND | 2212.6 | 2.5x | 40 | |

| 1070 | STYRENIX | 1884 | 3x | 33.33 | |

| 1071 | SUBROS | 692.55 | 2x | 50 | |

| 1072 | SUDARSCHEM | 795.85 | 2.5x | 40 | |

| 1073 | SULA | 160.49 | 1.11x | 90 | |

| 1074 | SUMICHEM | 382.85 | 2.5x | 40 | |

| 1075 | SUMMITSEC | 1573.9 | 2.5x | 40 | |

| 1076 | SUNCLAY | 1285.7 | 2.5x | 40 | |

| 1077 | SUNDARMFIN | 5413.5 | 2.86x | 35 | |

| 1078 | SUNDRMFAST | 834.55 | 3.33x | 30 | |

| 1079 | SUNPHARMA | 1807.4 | 2.5x | 40 | |

| 1080 | SUNTECK | 351.95 | 2.5x | 40 | |

| 1081 | SUNTV | 578.2 | 1.43x | 70 | |

| 1082 | SUPRAJIT | 412.4 | 3x | 33.33 | |

| 1083 | SUPREMEIND | 3815.6 | 4x | 25 | |

| 1084 | SUPRIYA | 580.85 | 2.5x | 40 | |

| 1085 | SURAJEST | 206 | 2.5x | 40 | |

| 1086 | SURAKSHA | 260.55 | 3x | 33.33 | |

| 1087 | SURYAROSNI | 205.97 | 1.11x | 90 | |

| 1088 | SURYODAY | 131.04 | 1.11x | 90 | |

| 1089 | SUZLON | 39.62 | 2x | 50 | |

| 1090 | SWANCORP | 346.55 | 1.43x | 70 | |

| 1091 | SWARAJENG | 3389.1 | 1.67x | 60 | |

| 1092 | SWIGGY | 301.25 | 2x | 50 | |

| 1093 | SYMPHONY | 766.95 | 1.67x | 60 | |

| 1094 | SYNGENE | 398.65 | 2x | 50 | |

| 1095 | SYRMA | 729.1 | 1.43x | 70 | |

| 1096 | TAJGVK | 317.3 | 2.5x | 40 | |

| 1097 | TALBROAUTO | 244.85 | 2.5x | 40 | |

| 1098 | TANLA | 433.4 | 2.5x | 40 | |

| 1099 | TARSONS | 191.79 | 2.5x | 40 | |

| 1100 | TASTYBITE | 7047 | 2x | 50 | |

| 1101 | TATACHEM | 697.95 | 1.67x | 60 | |

| 1102 | TATACOMM | 1483.4 | 2.5x | 40 | |

| 1103 | TATACONSUM | 1102.5 | 4x | 25 | |

| 1104 | TATAELXSI | 4303.7 | 2x | 50 | |

| 1105 | TATAGOLD | 15.39 | 3x | 33.33 | |

| 1106 | TATAPOWER | 372.9 | 2.5x | 40 | |

| 1107 | TATASTEEL | 191.01 | 2.5x | 40 | |

| 1108 | TATATECH | 566.1 | 1.18x | 85 | |

| 1109 | TATVA | 1095.6 | 2.5x | 40 | |

| 1110 | TBOTEK | 1190 | 2.5x | 40 | |

| 1111 | TBZ | 130.5 | 2.5x | 40 | |

| 1112 | TCI | 961.2 | 3x | 33.33 | |

| 1113 | TCIEXP | 514.5 | 1.67x | 60 | |

| 1114 | TCPLPACK | 2532.4 | 2.5x | 40 | |

| 1115 | TCS | 2527.4 | 2.86x | 35 | |

| 1116 | TDPOWERSYS | 845.4 | 1.18x | 85 | |

| 1117 | TEAMLEASE | 1103.3 | 2x | 50 | |

| 1118 | TECHM | 1336.3 | 2.5x | 40 | |

| 1119 | TECHNOE | 1077 | 1.18x | 85 | |

| 1120 | TEGA | 1688.9 | 2.86x | 35 | |

| 1121 | TEJASNET | 426.1 | 1.43x | 70 | |

| 1122 | TEXINFRA | 89.87 | 2.5x | 40 | |

| 1123 | TEXMOPIPES | 42.51 | 2.5x | 40 | |

| 1124 | TEXRAIL | 95.86 | 1.11x | 90 | |

| 1125 | TFCILTD | 63.68 | 2x | 50 | |

| 1126 | THERMAX | 3064.5 | 1.82x | 55 | |

| 1127 | THOMASCOOK | 87.99 | 2.5x | 40 | |

| 1128 | THYROCARE | 375.15 | 2.5x | 40 | |

| 1129 | TI | 438.8 | 2.22x | 45 | |

| 1130 | TIIL | 2107 | 2.5x | 40 | |

| 1131 | TIINDIA | 2608.6 | 2.5x | 40 | |

| 1132 | TIMETECHNO | 166.71 | 2.5x | 40 | |

| 1133 | TIMKEN | 3285.7 | 2.5x | 40 | |

| 1134 | TIPSMUSIC | 499.35 | 2.86x | 35 | |

| 1135 | TIRUMALCHM | 162.03 | 2.5x | 40 | |

| 1136 | TITAGARH | 654.7 | 1.43x | 70 | |

| 1137 | TITAN | 4159.2 | 2.5x | 40 | |

| 1138 | TMB | 593.9 | 3.33x | 30 | |

| 1139 | TMPV | 332 | 4x | 25 | |

| 1140 | TNPL | 137.89 | 2.5x | 40 | |

| 1141 | TOP10ADD | 89.98 | 3x | 33.33 | |

| 1142 | TORNTPHARM | 4373.7 | 4x | 25 | |

| 1143 | TORNTPOWER | 1428.9 | 2x | 50 | |

| 1144 | TRACXN | 33.14 | 2.86x | 35 | |

| 1145 | TRANSRAILL | 502.4 | 3x | 33.33 | |

| 1146 | TRANSWORLD | 128.35 | 2.5x | 40 | |

| 1147 | TREL | 24.03 | 2.86x | 35 | |

| 1148 | TRENT | 3689.4 | 1.67x | 60 | |

| 1149 | TRIDENT | 22.98 | 1.11x | 90 | |

| 1150 | TRITURBINE | 468.4 | 1.67x | 60 | |

| 1151 | TRIVENI | 374.65 | 1.11x | 90 | |

| 1152 | TSFINV | 377.15 | 2.5x | 40 | |

| 1153 | TTKPRESTIG | 451.8 | 2x | 50 | |

| 1154 | TVSMOTOR | 3627.8 | 4x | 25 | |

| 1155 | TVSSRICHAK | 3508.2 | 2.86x | 35 | |

| 1156 | TVTODAY | 111.34 | 1.43x | 70 | |

| 1157 | UBL | 1721.5 | 2.22x | 45 | |

| 1158 | UCOBANK | 26.17 | 2x | 50 | |

| 1159 | UDS | 149.28 | 2.5x | 40 | |

| 1160 | UFBL | 231.3 | 2.86x | 35 | |

| 1161 | UFLEX | 448.7 | 2.5x | 40 | |

| 1162 | UGROCAP | 100.46 | 2.86x | 35 | |

| 1163 | UJJIVANSFB | 53.37 | 2.5x | 40 | |

| 1164 | ULTRACEMCO | 11378 | 4x | 25 | |

| 1165 | UNICHEMLAB | 310.8 | 1.67x | 60 | |

| 1166 | UNIECOM | 95.89 | 2.5x | 40 | |

| 1167 | UNIONBANK | 179.06 | 2x | 50 | |

| 1168 | UNIPARTS | 445.55 | 2.86x | 35 | |

| 1169 | UNITDSPR | 1355.8 | 2x | 50 | |

| 1170 | UNIVCABLES | 649.65 | 2.5x | 40 | |

| 1171 | UNOMINDA | 1082.1 | 1.43x | 70 | |

| 1172 | UPL | 625 | 2.22x | 45 | |

| 1173 | USHAMART | 405.1 | 1.43x | 70 | |

| 1174 | UTIAMC | 949.05 | 3x | 33.33 | |

| 1175 | UTKARSHBNK | 12.51 | 1.11x | 90 | |

| 1176 | UTTAMSUGAR | 196.91 | 2.5x | 40 | |

| 1177 | VADILALIND | 4966.8 | 2.5x | 40 | |

| 1178 | VAIBHAVGBL | 208.7 | 2x | 50 | |

| 1179 | VARROC | 483.5 | 2.86x | 35 | |

| 1180 | VASCONEQ | 33.02 | 1.18x | 85 | |

| 1181 | VBL | 437.75 | 2.5x | 40 | |

| 1182 | VEDL | 709.4 | 1.54x | 65 | |

| 1183 | VEEDOL | 1300.5 | 3x | 33.33 | |

| 1184 | VENKEYS | 1263.6 | 2x | 50 | |

| 1185 | VENTIVE | 682.25 | 2x | 50 | |

| 1186 | VENUSPIPES | 991.5 | 2.5x | 40 | |

| 1187 | VERANDA | 152.36 | 2x | 50 | |

| 1188 | VESUVIUS | 490.45 | 2x | 50 | |

| 1189 | VGUARD | 307.55 | 3.33x | 30 | |

| 1190 | VIDHIING | 301.1 | 2.86x | 35 | |

| 1191 | VIJAYA | 946.7 | 2.5x | 40 | |

| 1192 | VINATIORGA | 1369.5 | 3.33x | 30 | |

| 1193 | VINCOFE | 129.1 | 2x | 50 | |

| 1194 | VINDHYATEL | 1006.1 | 2.5x | 40 | |

| 1195 | VIPIND | 354.15 | 2x | 50 | |

| 1196 | VISHNU | 498.05 | 2.5x | 40 | |

| 1197 | VISHWARAJ | 5.15 | 2.86x | 35 | |

| 1198 | VLSFINANCE | 233.4 | 2.5x | 40 | |

| 1199 | VMART | 510.75 | 2.5x | 40 | |

| 1200 | VMM | 108.65 | 3x | 33.33 | |

| 1201 | VOLTAMP | 8609.5 | 2x | 50 | |

| 1202 | VOLTAS | 1436.5 | 4x | 25 | |

| 1203 | VPRPL | 39.64 | 1.18x | 85 | |

| 1204 | VRLLOG | 267.35 | 3x | 33.33 | |

| 1205 | VSSL | 240.3 | 2.5x | 40 | |

| 1206 | VSTIND | 219.37 | 2x | 50 | |

| 1207 | VSTTILLERS | 5098.5 | 2.5x | 40 | |

| 1208 | VTL | 540.55 | 2.5x | 40 | |

| 1209 | WAAREEENER | 2599 | 3x | 33.33 | |

| 1210 | WABAG | 1179.4 | 2x | 50 | |

| 1211 | WCIL | 98.19 | 2.86x | 35 | |

| 1212 | WEL | 139.75 | 2x | 50 | |

| 1213 | WELCORP | 779.95 | 2.86x | 35 | |

| 1214 | WELENT | 448.9 | 2.5x | 40 | |

| 1215 | WELSPUNLIV | 115.8 | 1.43x | 70 | |

| 1216 | WENDT | 6304 | 2.5x | 40 | |

| 1217 | WESTLIFE | 469.05 | 2x | 50 | |

| 1218 | WHEELS | 917 | 2.86x | 35 | |

| 1219 | WHIRLPOOL | 871.85 | 1.43x | 70 | |

| 1220 | WINDLAS | 731.5 | 2.5x | 40 | |

| 1221 | WINDMACHIN | 237.8 | 2x | 50 | |

| 1222 | WIPRO | 198.75 | 1.82x | 55 | |

| 1223 | WOCKPHARMA | 1269.2 | 2x | 50 | |

| 1224 | WONDERLA | 497.15 | 3x | 33.33 | |

| 1225 | WSTCSTPAPR | 381.3 | 2.86x | 35 | |

| 1226 | XCHANGING | 60.63 | 2.86x | 35 | |

| 1227 | XPROINDIA | 899.15 | 2x | 50 | |

| 1228 | YASHO | 1440.9 | 2x | 50 | |

| 1229 | YATHARTH | 664.8 | 2.86x | 35 | |

| 1230 | YATRA | 111.89 | 1.18x | 85 | |

| 1231 | YESBANK | 19.65 | 2x | 50 | |

| 1232 | ZEEL | 80.05 | 1.67x | 60 | |

| 1233 | ZENSARTECH | 544.35 | 1.11x | 90 | |

| 1234 | ZFCVINDIA | 14004 | 3x | 33.33 | |

| 1235 | ZYDUSLIFE | 908.85 | 2.5x | 40 | |

| 1236 | ZYDUSWELL | 373.5 | 3x | 33.33 |

The securities are quoted as an example and not as a recommendation.

Free account opening and ₹20 Brokerage For Equity, F&O, Commodity and Currency Trades

Demat, Trading, & Platform Fees

Account Maintenance Charges for 1st Year

0.25% or ₹20 whichever is lower

Maximum Brokerage Per Order

More than 500k+ users love their financial journey

One of the best trading apps out there! Thanks to samco's daily stock update, i was always in the loop. The app provided timely information that influence my trading decisions.

Sonali Priya

Sonali Priya

A truly beginner-friendly app for options trading. I’ve used several platforms, but Samco gives the most detailed and easy-to-understand coverage of equity, index, and currency options. It’s made trading feel much more approachable.

Om Dongare

Om Dongare

I’ve tried several trading apps, but Samco stands out with its seamless experience and trustworthy market updates. It really helped me trade with confidence.

Hiya

Hiya

A go-to trading app for staying informed. The real-time news alerts from Samco have been a game-changer for how I track and respond to market developments.

Gaurav Varma

Gaurav Varma

A trustworthy share market app that delivers accurate real-time market data. Samco’s updates help me understand market trends and make better trading decisions.

Chandan Singh

Chandan Singh

Best stock market app that’s really helped me stay on top of the market. The real-time info and alerts make it easier to make smart investment decisions.

Kusum

Kusum

Be a part of a vibrant community where people live the markets! Engage with like-minded users and request features that you want

Experience seamless investing and trading at your fingertips. Stay updated, explore expert recommendations, and manage your portfolio anytime, anywhere.