SAMCO Risk Adviser

Rule Number Two: Don't Forget Rule Number 1

– Warren Buffett

SAMCO Risk Adviser acts as a friend, philosopher and guide to portray a honest picture of risk and its degrees of concentration or dispersion so that our clients can correct the imbalances, if any, in the portfolio, so that they can always think patiently and confidently for the prosperity in financial market and take correct decisions without unnecessarily giving thought energy to fear, loss and anxiety. We believe a balanced portfolio or appropriate asset allocation will bring in necessary unbiased, unemotional decision making ability for creating a joyful and prosperous experience in financial world.

SAMCO Risk Adviser after scanning all the securities in the client Demat account, impartially displays a true graphical picture of asset allocation, sectorial allocation and % components of each stocks in the portfolio.

Prominent Features:

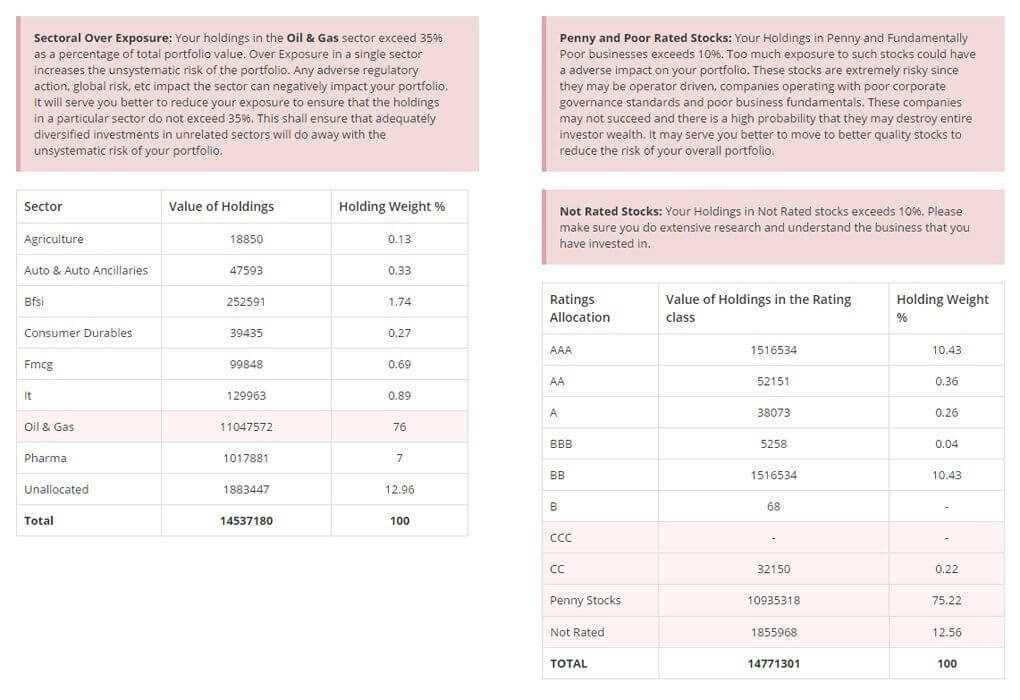

Sectorial Allocation: Risk Adviser scans the portfolio and warns you in case of high exposure to a single sector where one adverse regulation can destroy the portfolio.

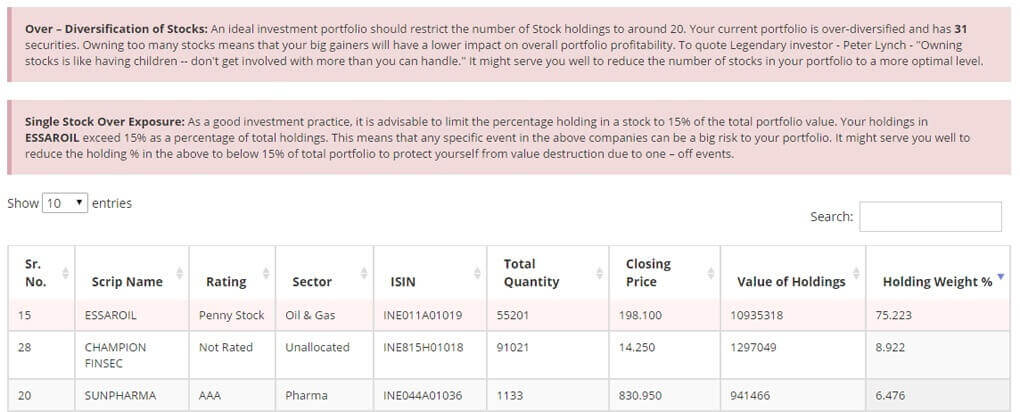

Over Diversification: An ideal portfolio consists of around 20 stocks, after which it becomes difficult to track the portfolio and people become careless and end up losing money.

Unrated Stocks: We have rated a majority of stocks listed on the NSE and warn you in case your portfolio consists of many unrated stocks.

Single Stock Exposure: The virtue of not putting all your eggs in one basket is also applicable in the stock markets. In case you have a high exposure to a single stock, the Risk Adviser will warn you.

It shows you the weakness of your portfolio whether it be over diversification, highly concentrated positions or high exposure to a single sector. The Risk Adviser aims to show you a true picture of where your portfolios weaknesses lie and can help you to take corrective action.

The Risk Adviser will help you find balance in the portfolio.

You can view the video tutorial here.

You can view a Screenshot below :

Easy & quick

Easy & quick