This week saw the Nifty 50 hitting a fresh high for the fourth straight week, showcasing strong momentum. However, the overall sentiment was cautious ahead of the FOMC meet, keeping traders on edge.

On Wednesday, the FED pulled the trigger on a 50 bps rate cut, which breathed some life into the markets by Thursday and Friday. Bulls held strong in the banking sector as Bank Nifty managed to close on in the green every single day.

Despite this bullish trend in the heavyweights, the broader markets weren’t as lucky. Nifty Smallcap 100 and Nifty Midcap 100 were under pressure, as investors locked in profits during the week. It was a week of mixed signals, with large caps holding the fort while mid and small caps took a breather.

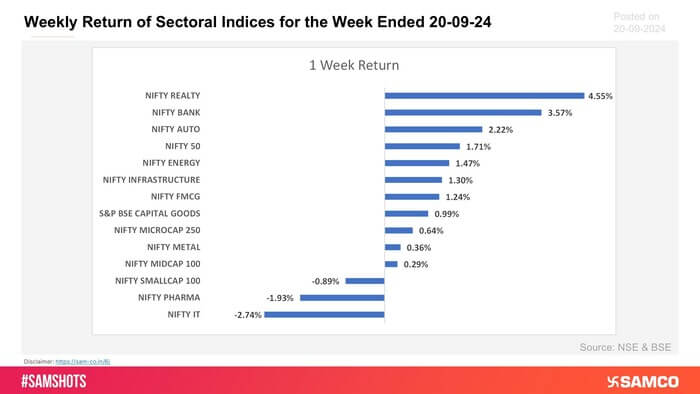

The Nifty 50 ended the week 1.71% higher at 25,791. Nifty Realty and Bank Nifty surged the most with gains of 4.55%, and 3.57% respectively.

Scroll down to understand more of such market news and perspectives for the week gone by in easily understandable charts.

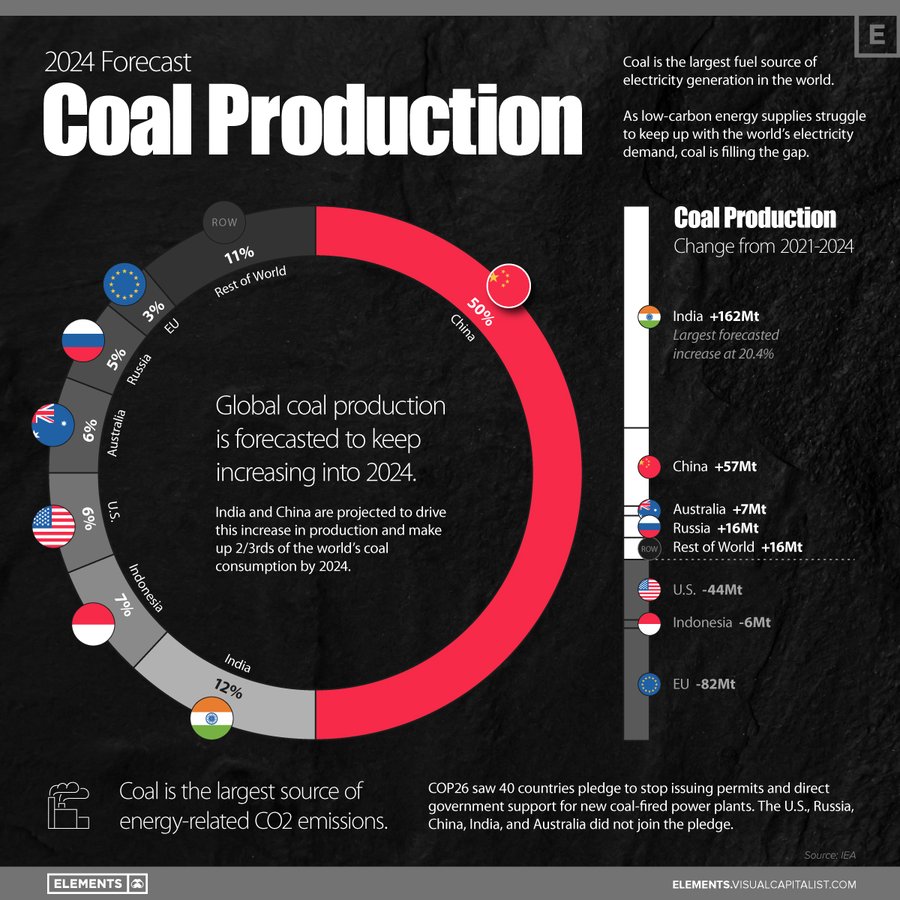

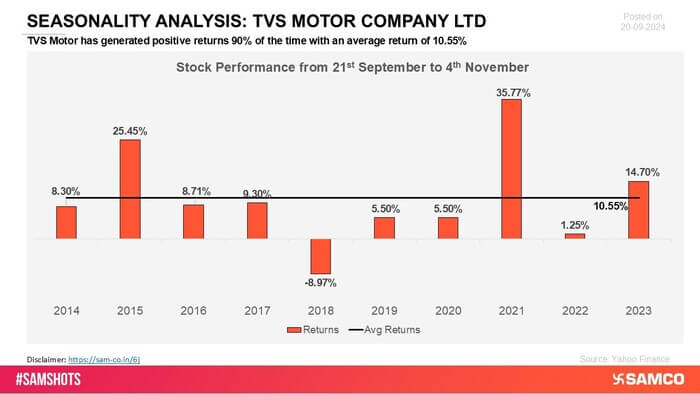

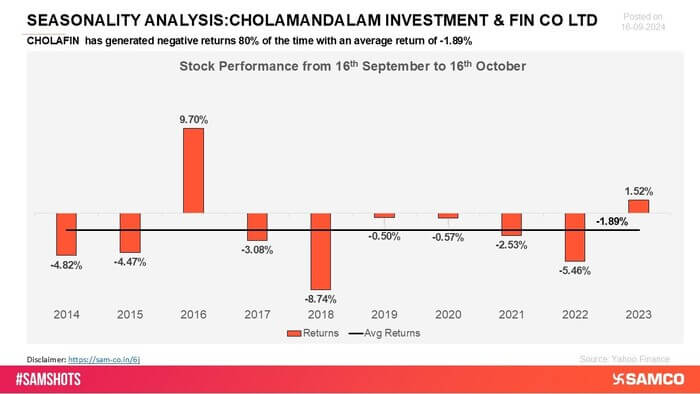

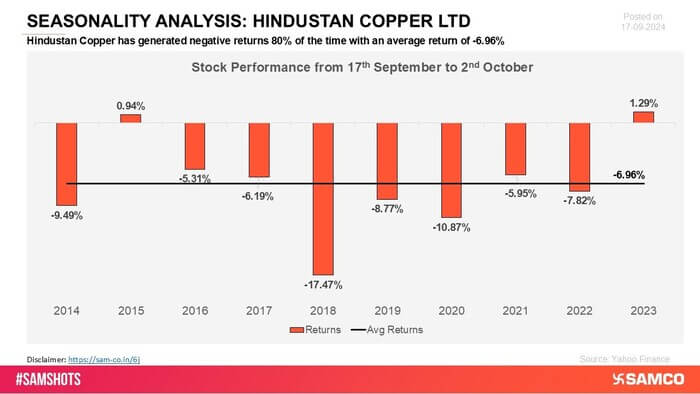

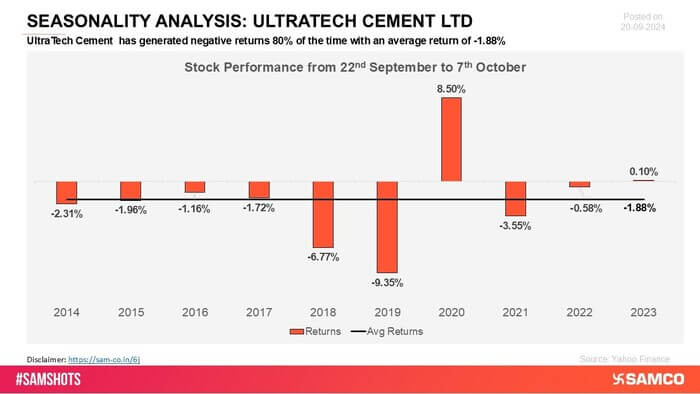

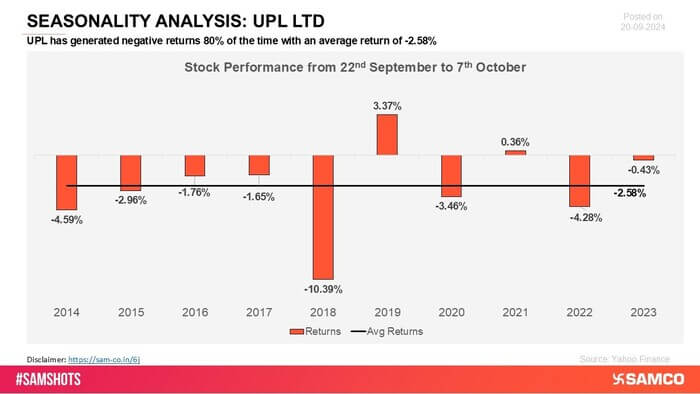

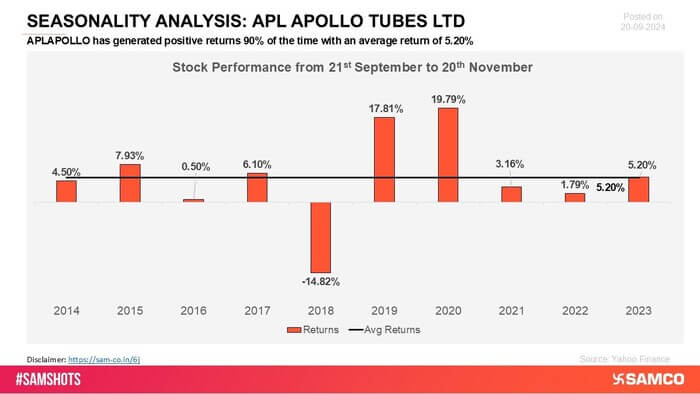

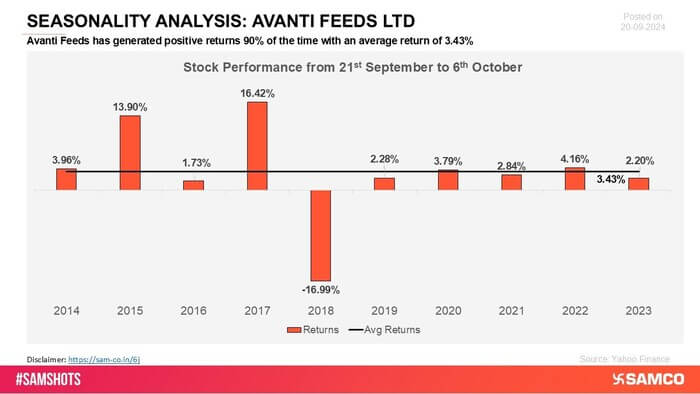

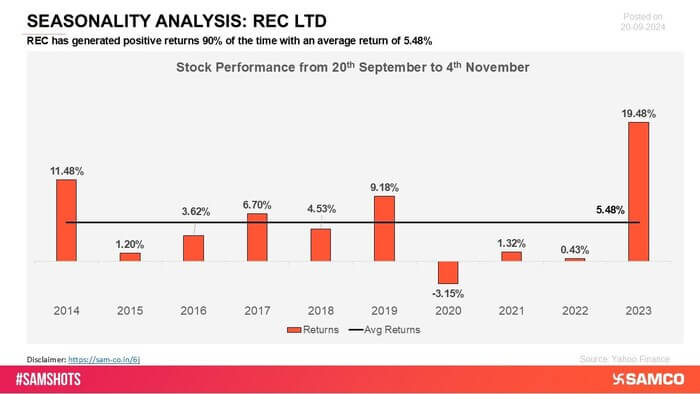

Don’t miss our new insights on seasonality. It is the tendency for stocks to perform better during some periods of the year. Here we have presented stocks that have shown positive or negative performance consistently during the next few days each time in the last 10 years. The bars represent the percentage gains from the date mentioned on their respective chart.

TVS Motors has maintained positive returns over several periods, highlighting its reliable growth and market strength. The company’s consistent performance has been a key factor in its sustained success.

Cholamandalam Finance has experienced negative returns in various periods, struggling to sustain consistent performance. The stock has faced challenges in maintaining upward momentum, leading to recurring dips in its returns.

NLC India has shown a consistent pattern of positive returns across several periods, reflecting steady growth and strong market performance. The company\'s resilience has contributed to its ability to maintain investor confidence.

Hindustan Copper has exhibited negative returns across multiple periods, reflecting ongoing challenges in maintaining consistent growth. The stock has struggled with performance, facing repeated downturns in key periods.

UltraTech Cement has encountered negative returns across several periods, indicating difficulties in sustaining consistent growth. The stock has faced recurring challenges in maintaining market momentum.

UPL has shown a pattern of negative returns in various periods, struggling to deliver steady performance. The company has faced fluctuations, resulting in inconsistent market results.

APL Apollo has consistently delivered positive returns, demonstrating strong market resilience. The stock’s reliable performance highlights its ability to maintain steady growth across periods.

Avanti Feeds has shown a track record of positive returns, reflecting its robust market presence. The company’s consistent performance has contributed to its reputation for stability and growth.

REC Ltd has experienced positive returns in multiple periods, showcasing its ability to deliver consistent growth. The stock has maintained a steady upward trajectory, indicating strong performance.

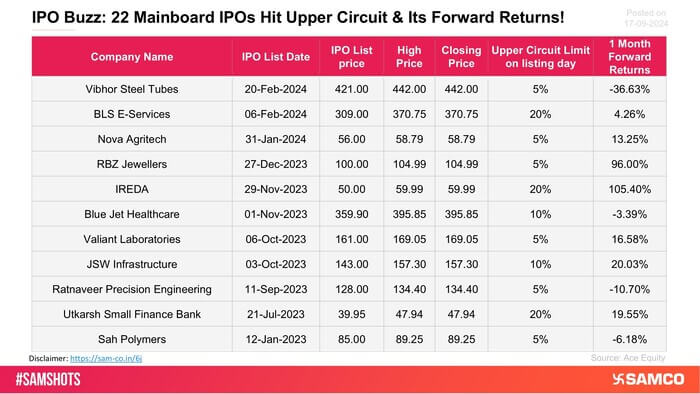

The list presents the companies listed since January 2023 till 17th September 2024 which closed at its upper circuit on their listing day.

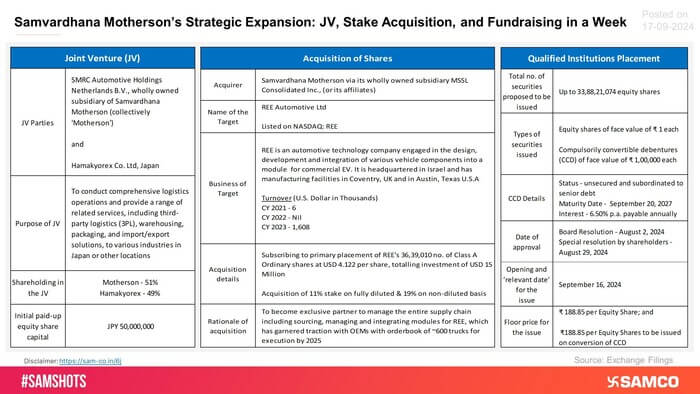

Highlights of Motherson’s recent business expansion Initiatives are presented below:

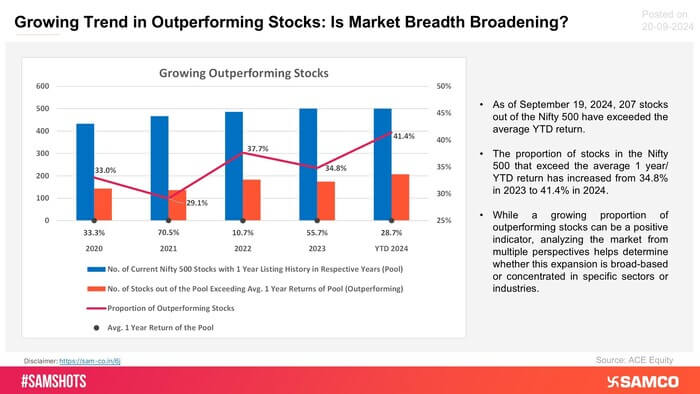

Is the market upmove led by a broad-based increase or is it concentrated? Here’s a data point:

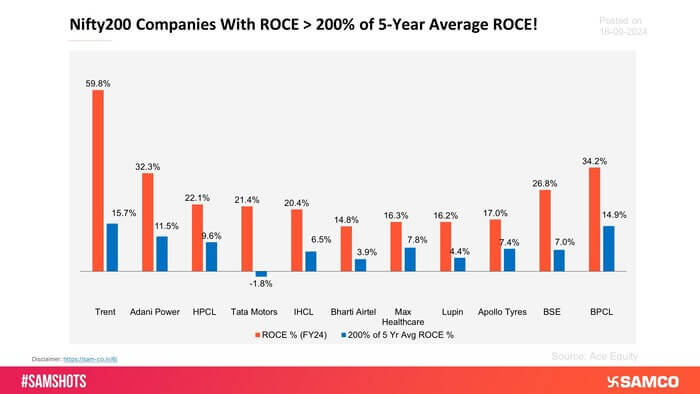

The chart below presents the companies that have strengthened their efficiency ratio (ROCE) in the last 5 years.

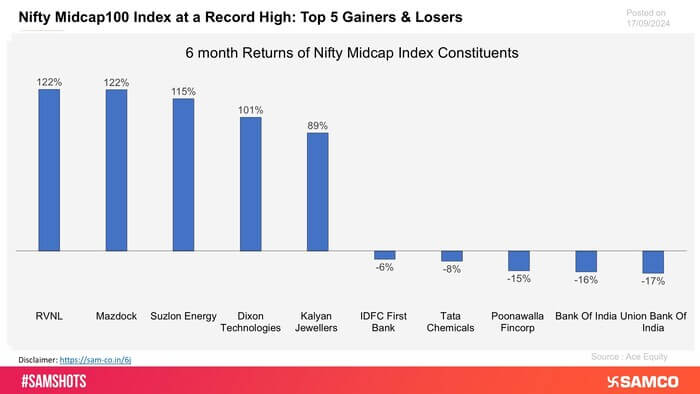

The chart displays the top 5 gainers and top 5 losers of the Nifty Midcap 100 as it reached a new high.

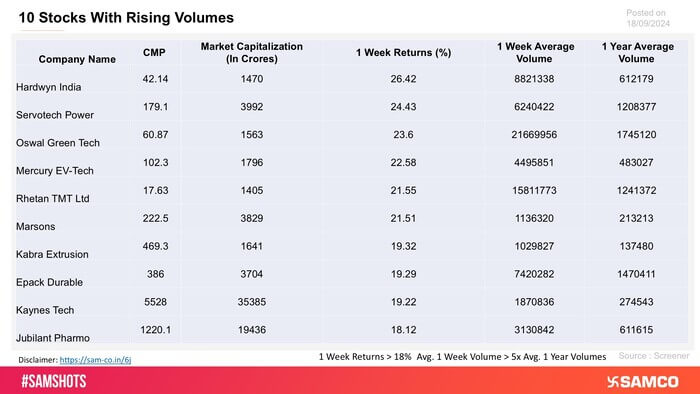

The chart displays the list of stocks which witnessed a fivefold rise in weekly volume compared to yearly volume.

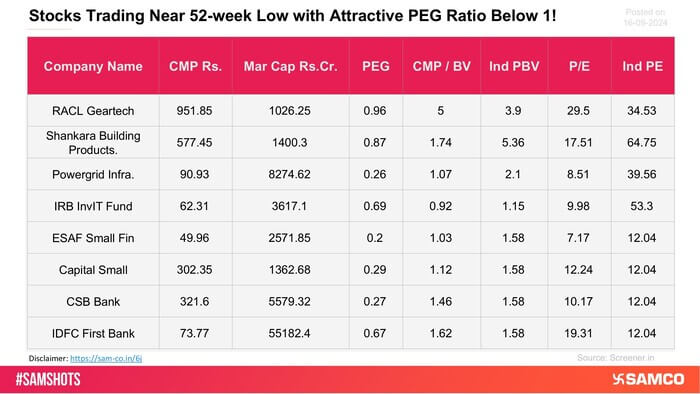

Here’s the list of stocks which are currently trading near 52 weeks low along with PEG ratio below 1.

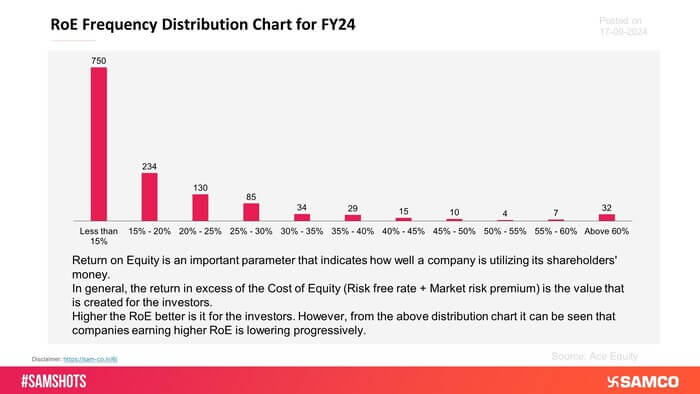

The accompanying chart presents the frequency distribution of Return on Equity (RoE):

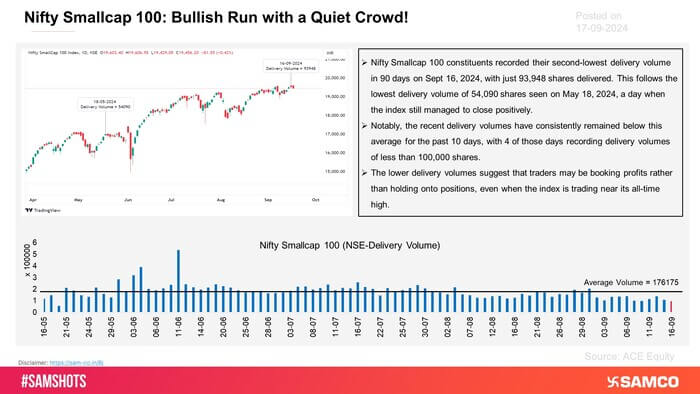

The chart above provides key insights into the recent performance and trends of the Nifty Smallcap 100 index, specifically in terms of delivery volumes of the index’s constituents.

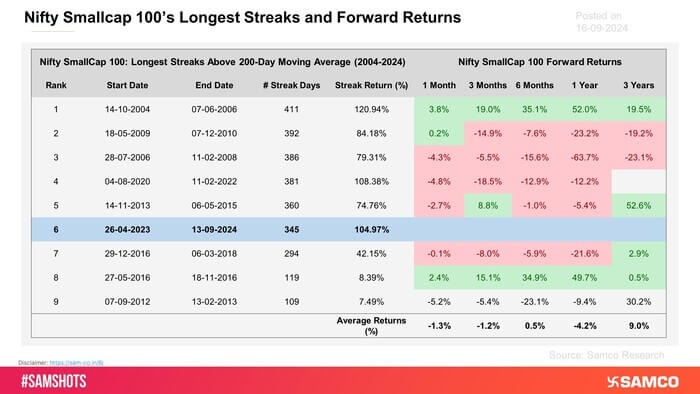

The table highlights the longest periods where the Nifty Smallcap 100 index stayed above its 200-day moving average for over 100 days. The forward return analysis shows that while the index has experienced strong gains during these long bullish stretches,

Presented below weekly return of sectoral indices for this week:

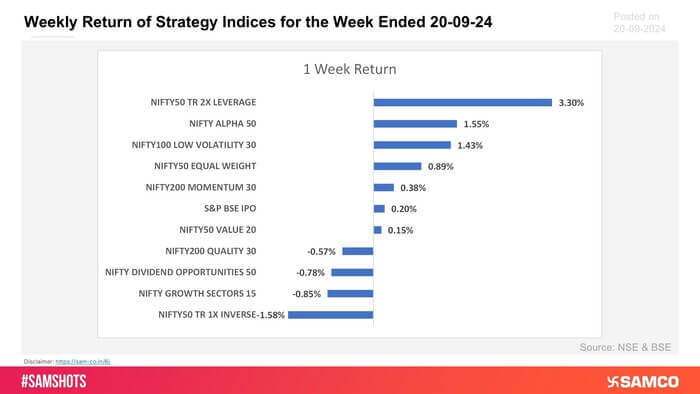

Presented below weekly return of strategy indices for this week:

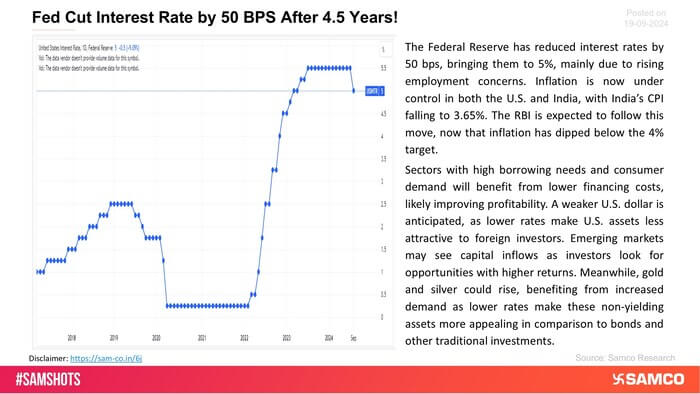

Fed cut interest rate by 50 BPS here a short summary how it will impact on the overall market.

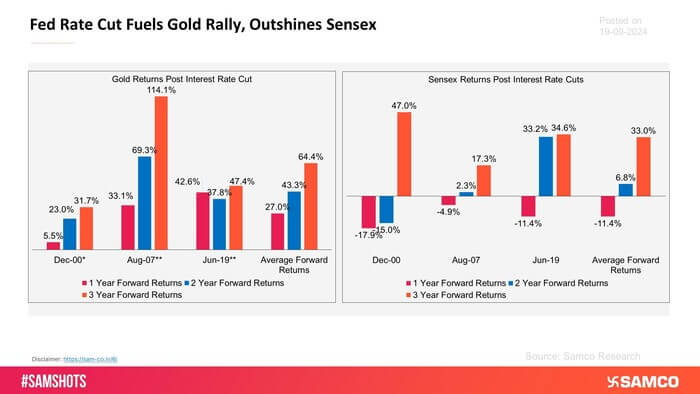

The effect of Interest rate cut on the returns of gold and Sensex is depicted below:

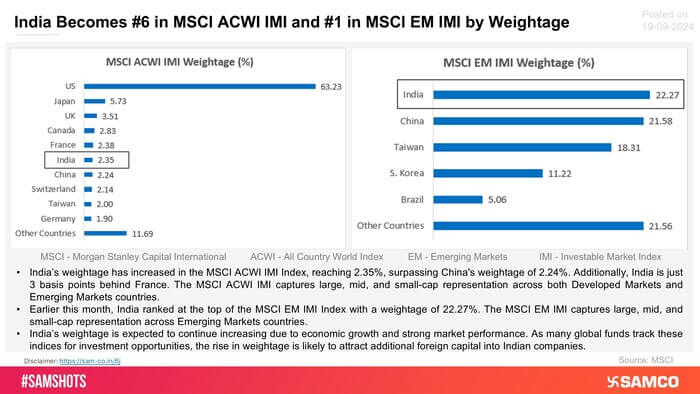

Strengthening of India’s position in MSCI Key Global indices is depicted below:

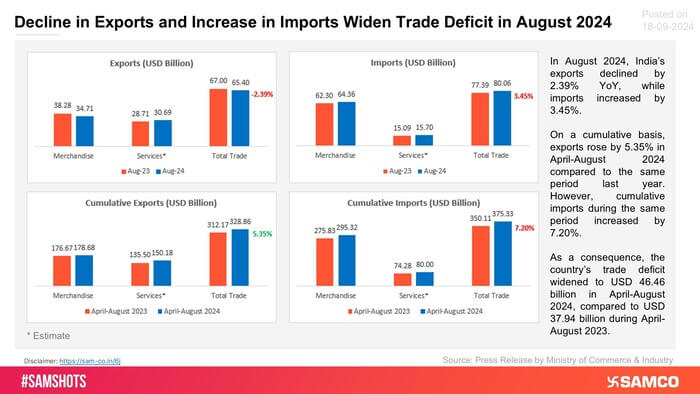

Take a look below to know how India fared in the foreign trade in August 2024:

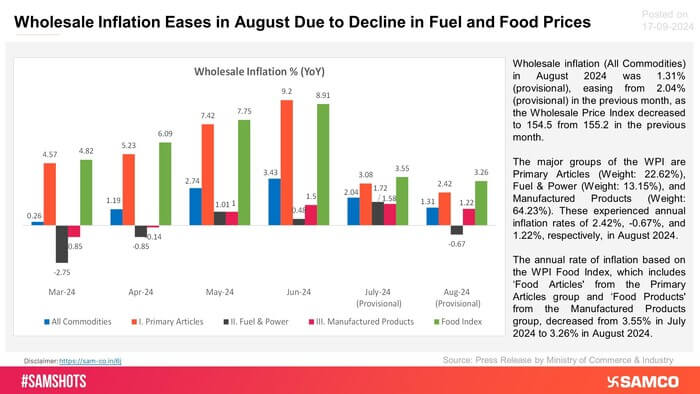

Monthly trend in Wholesale Inflation and in groups of WPI are presented below:

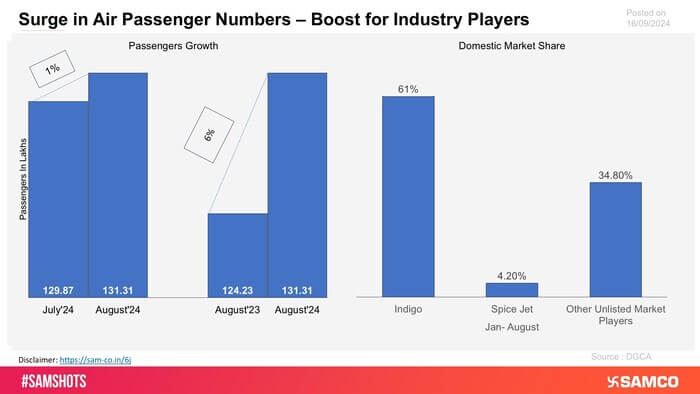

The chart displays the rise in air passenger traffic along with the market share of industry players.

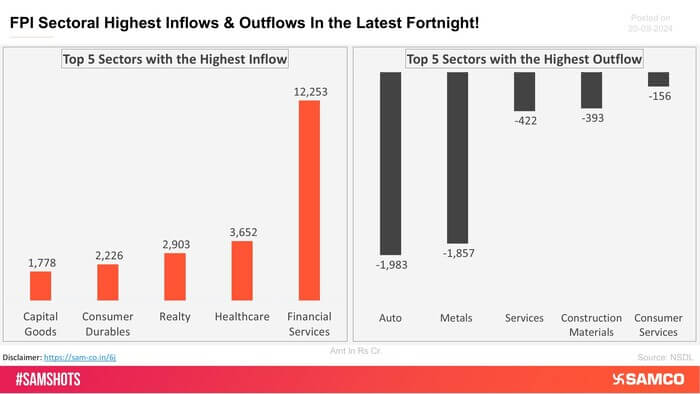

The below chart shows the highest & lowest sectoral investment made by FPI in the latest fortnight.

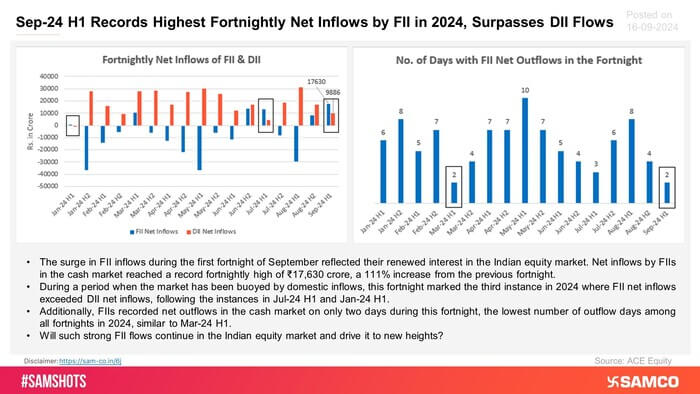

Here are fortnightly FII and DII flows in the Indian equity market:

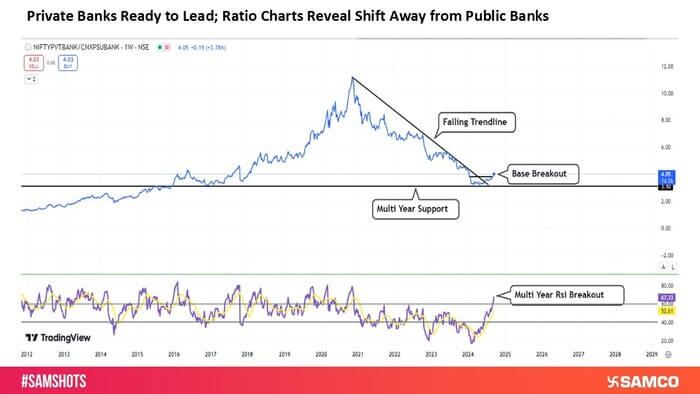

Private Banks on the Rise: Ratio Charts Highlight Shift Away from Public Banks

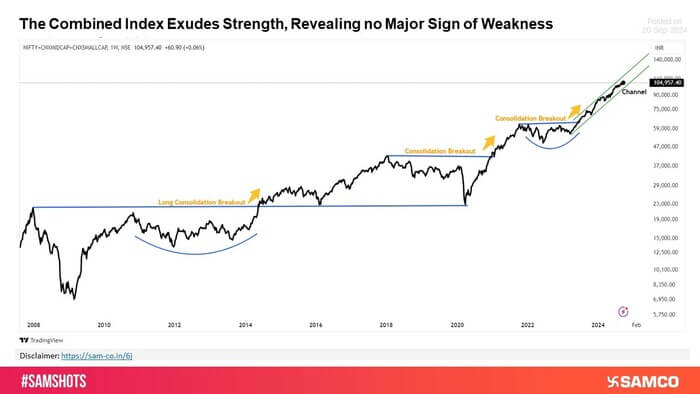

Nifty Combined Index on an Upward Ascend

Rounding Bottom Powers Bullish Momentum in IEX

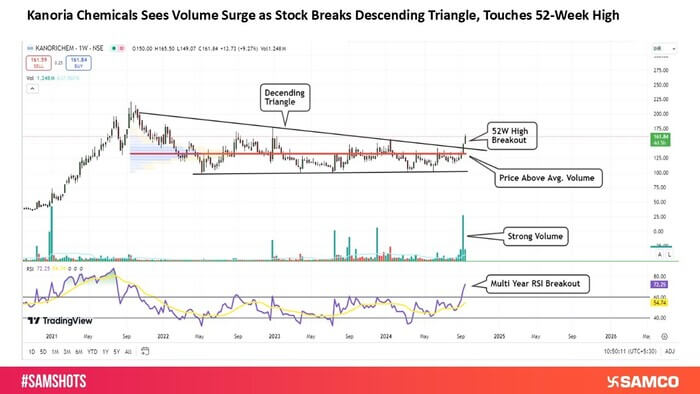

Kanoria Chemicals Hits 52-Week High as Volume Soars Following Breakout from Descending Triangle

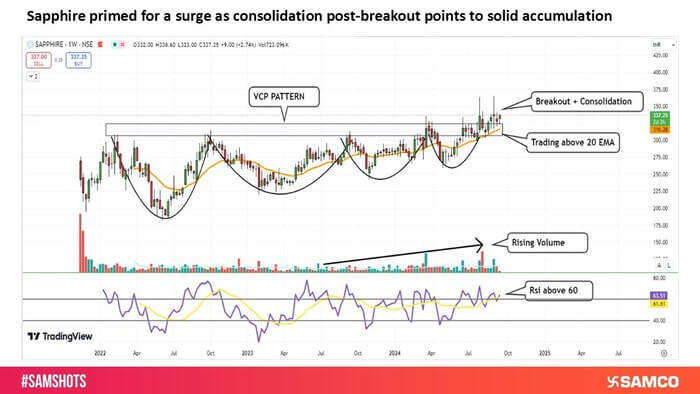

Sapphire Positioned for Upswing: Strong Accumulation Follows Post-Breakout Consolidation

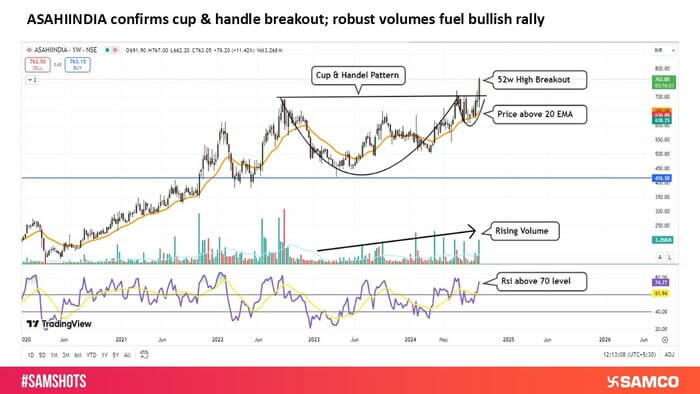

Asahi India Breaks Cup & Handle Pattern: Strong Volumes Signal Ongoing Upside Potential

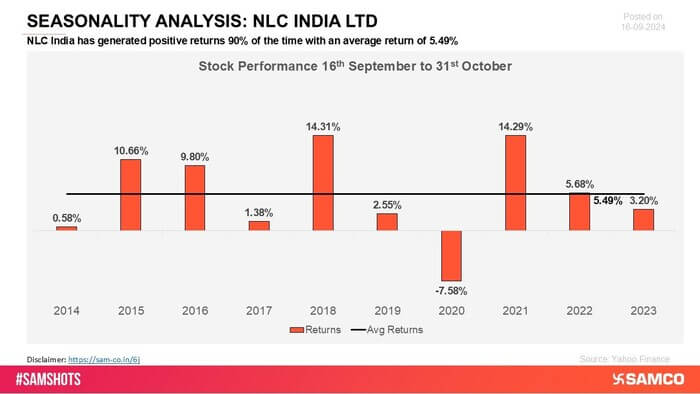

Image Source: @VCElements (Twitter)