The Indian markets kicked off the week on a strong note, with Nifty 50 hitting a fresh high on Monday. However, things took a sharp turn by Friday, as major indices nosedived, closing the week on a bearish note.

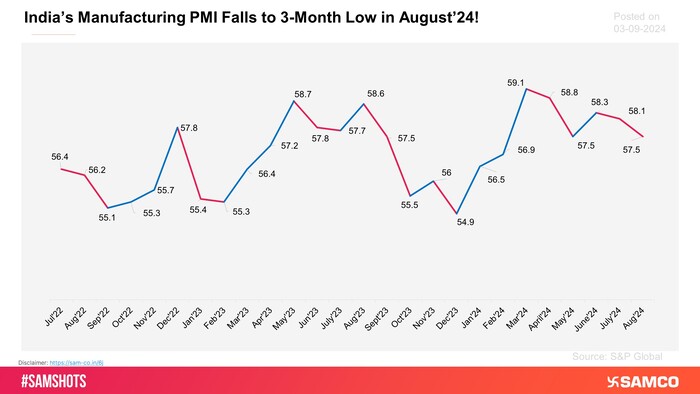

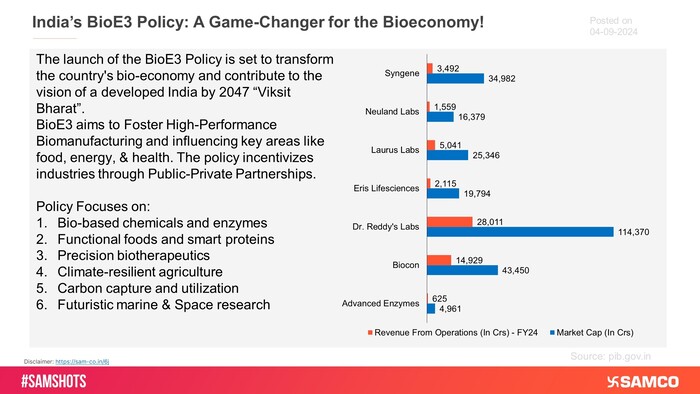

The latter part of the week saw consistent selling pressure. Nifty Smallcap 100 and Nifty Midcap 100 indices declined by 0.16% and 1.32% respectively during the week. India’s Manufacturing PMI for August 2024 dropped to 57.5, a three-month low, missing the expected 58 mark. On a brighter note, the launch of the BioE3 Policy is set to boost high-performance biomanufacturing, influencing sectors like food, energy, and health.

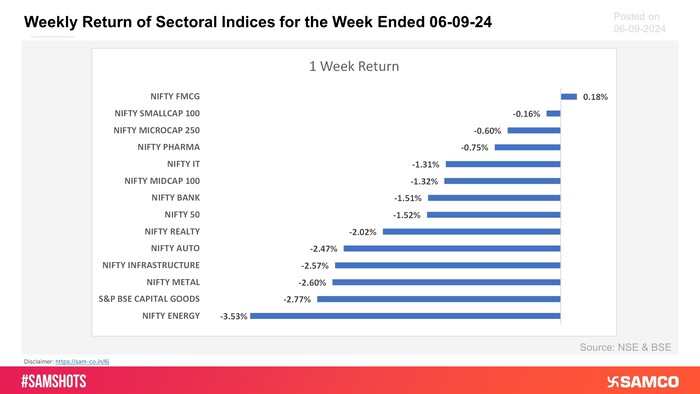

The Nifty 50 ended the week 1.52% lower at 24,852. Nifty PSU Bank and Nifty Energy declined the most by 4.73%, and 3.53% respectively.

Scroll down to understand more of such market news and perspectives for the week gone by in easily understandable charts.

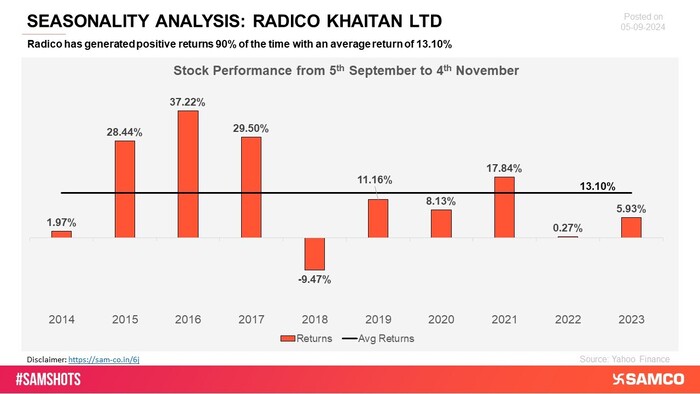

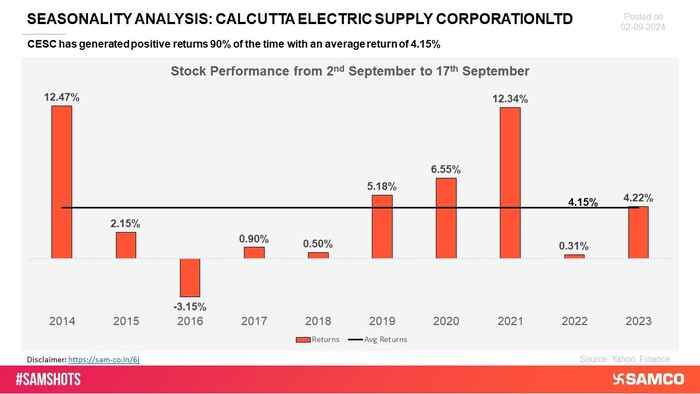

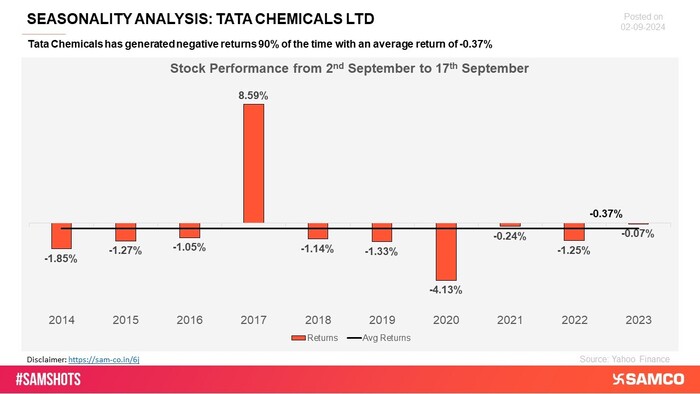

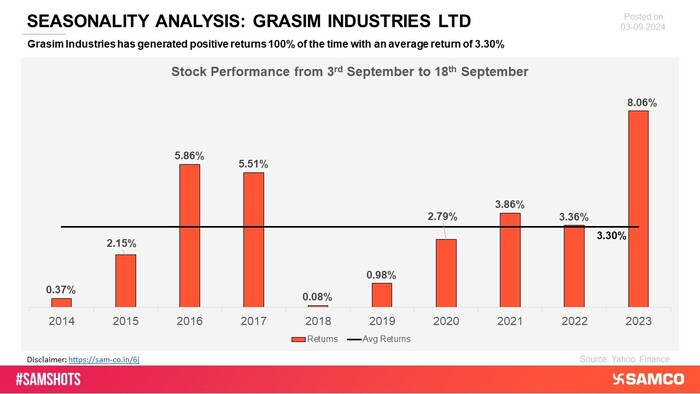

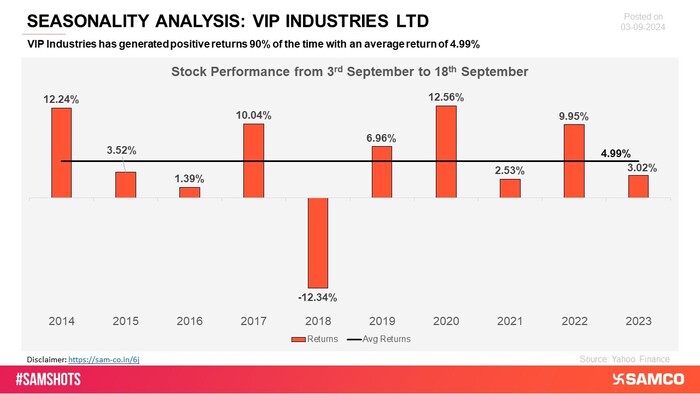

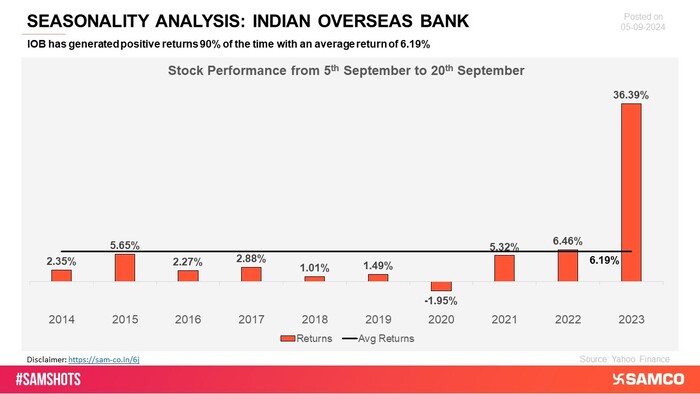

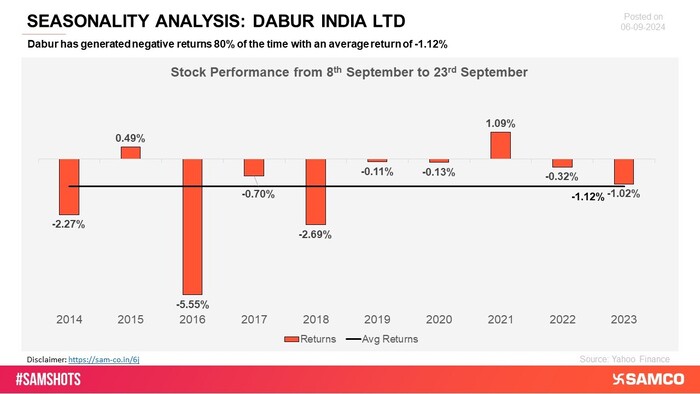

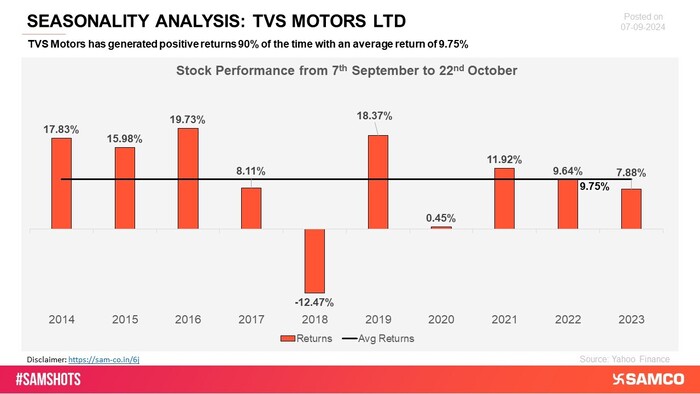

Don’t miss our new insights on seasonality. It is the tendency for stocks to perform better during some periods of the year. Here we have presented stocks that have shown positive or negative performance consistently during the next few days each time in the last 10 years. The bars represent the percentage gains from the date mentioned on their respective chart.

Radico Khaitan has shown a consistent trend of positive returns during various periods, highlighting its strong market presence and reliable growth trajectory.

CESC has demonstrated a strong and consistent seasonality pattern, with positive returns recurring across key periods. This reliable performance highlights the company\'s ability to deliver steady growth, making it a standout in its sector.

Tata Chemicals has exhibited a pattern of negative returns during several key periods, reflecting challenges in maintaining consistent growth. This recurring underperformance raises concerns about the stock\'s ability to achieve steady positive returns. I

Grasim Industries has shown an impressive track record, delivering positive returns in every observed period over the past 10 years. This consistent and strong seasonality pattern underscores the company\'s reliable performance and resilience in the marke

VIP Industries has demonstrated a robust seasonality pattern, consistently achieving positive returns across various periods. This reliable performance highlights the company\'s stability and strength in the market.

Indian Overseas Bank has displayed a steady pattern of positive returns across key periods, reflecting its resilience and improving market performance over time.

Dabur has experienced negative returns across multiple periods, indicating challenges in maintaining consistent growth and stability.

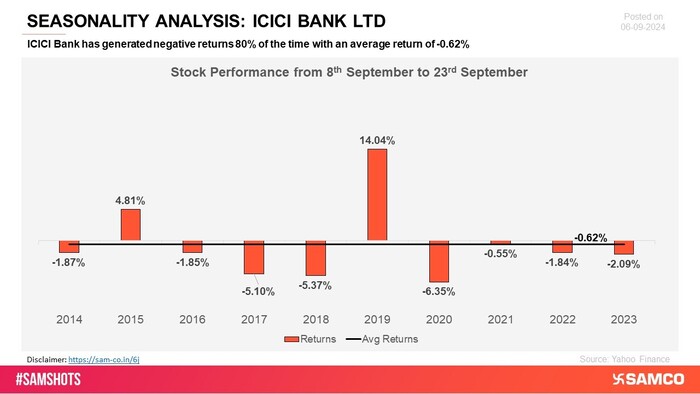

ICICI Bank has faced difficulties, with negative returns recurring in several periods, highlighting inconsistent performance.

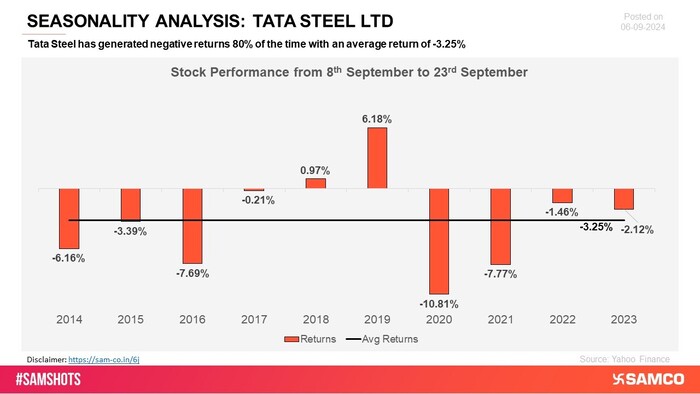

Tata Steel has shown a pattern of negative returns in key periods, reflecting ongoing challenges in achieving steady growth.

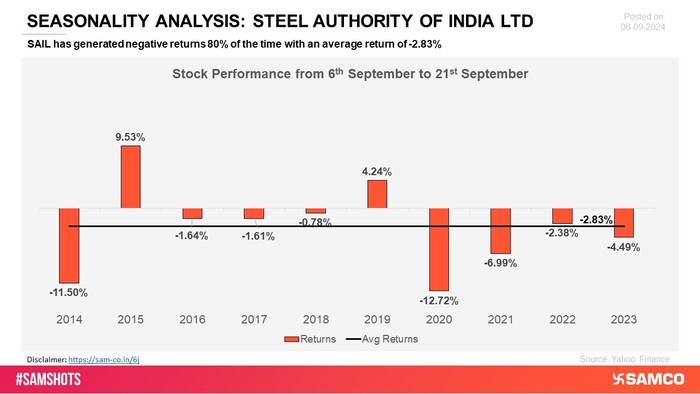

SAIL has struggled with negative returns across numerous periods, pointing to persistent underperformance in recent times.

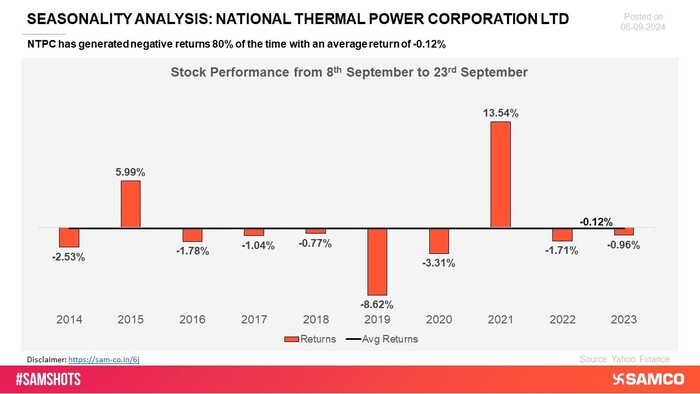

NTPC has exhibited negative returns during several observed periods, signaling challenges in sustaining positive momentum.

TVS Motors, on the other hand, has consistently delivered positive returns in various periods, showcasing its reliable performance and market strength.

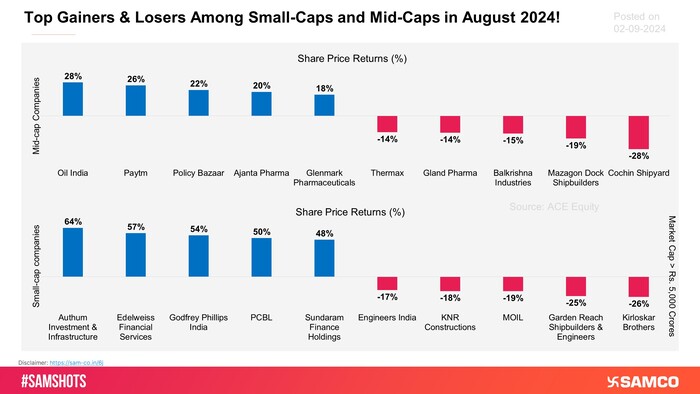

The chart showcases the best and worst-performing mid-cap and small-cap companies in August 2024.

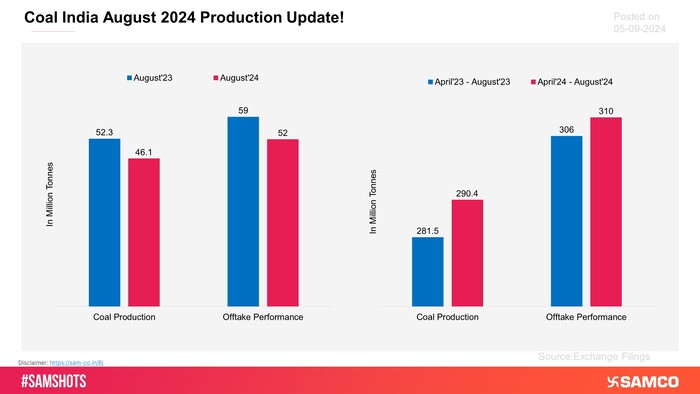

Coal India Ltd. produced 46 million tonnes of coal in August 2024, marking an approximately 12% year-on-year decline.

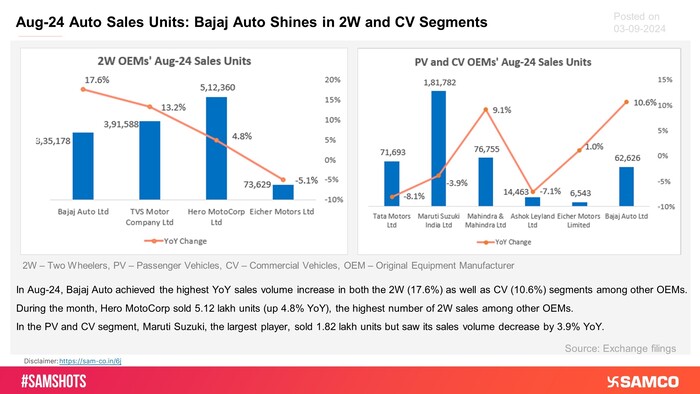

Automobile OEMs’ August month sales volumes are presented below:

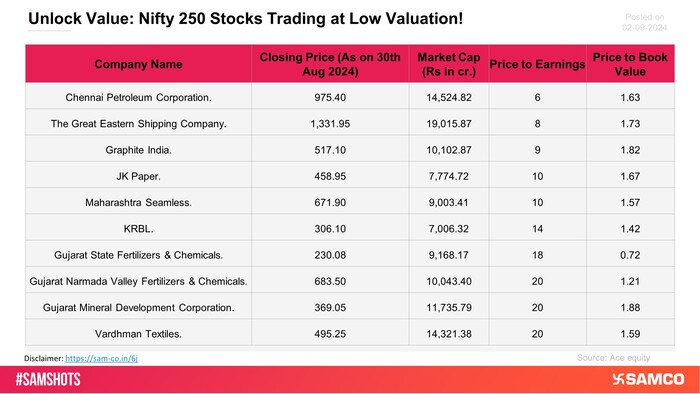

The below list shows Nifty 250 companies which are trading below price to book multiple of 2 and at price to earnings ratio of 20 or below.

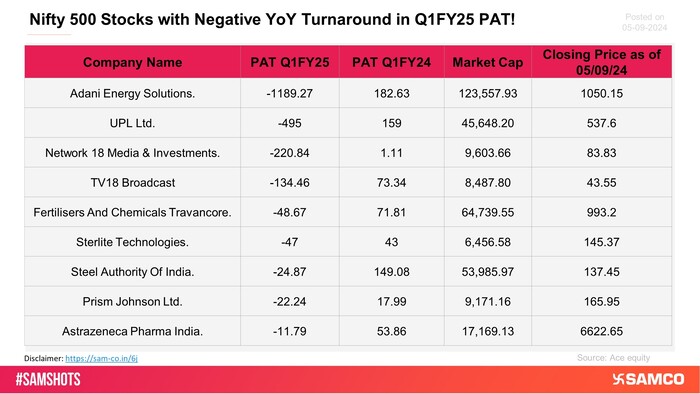

The chart highlights Nifty 500 companies that reported losses in Q1FY25, compared to being profitable in Q1FY24.

Presented below weekly return of sectoral indices for this week:

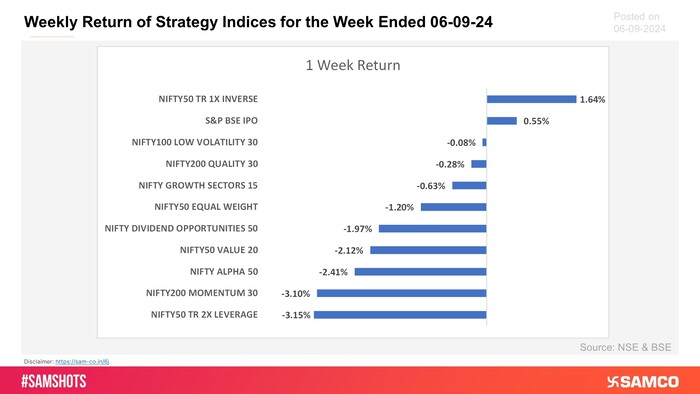

Presented below weekly return of strategy indices for this week:

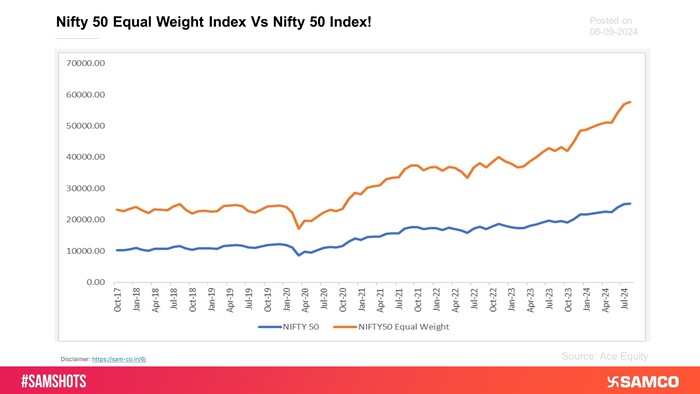

Here’s the gap in returns between the Nifty 50 & Nifty Equal Weighted Index. Nifty 50 equal weight Index Outperforms Nifty 50 in Long Run.

India’s Manufacturing PMI for August 2024 fell to 57.5, marking a three-month low and missing the market expectations of 58.

The gist of recent financial commitments given to the Agri Sector.

The accompanying chart presents the details of India’s ambitious BioE3 policy.

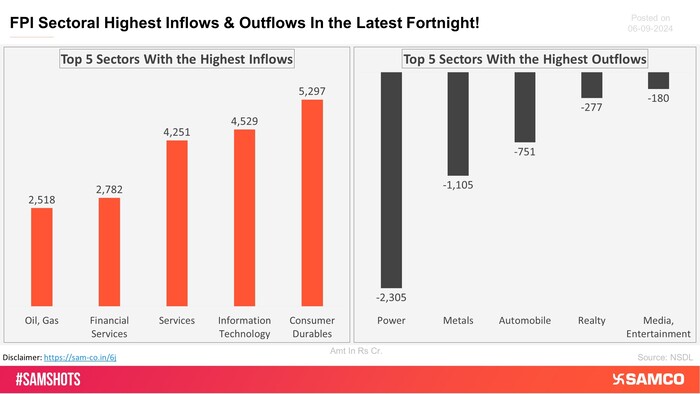

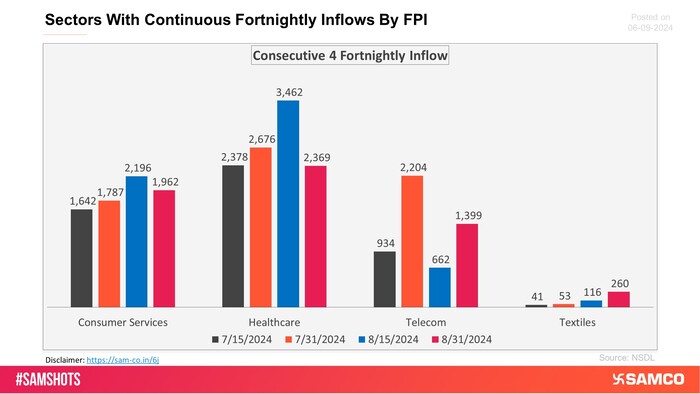

The below chart shows the highest & lowest sectoral investment made by FPI in the latest fortnight.

The sectors shown in the chart have witnessed consecutive 4 fortnightly inflows of FPI money.

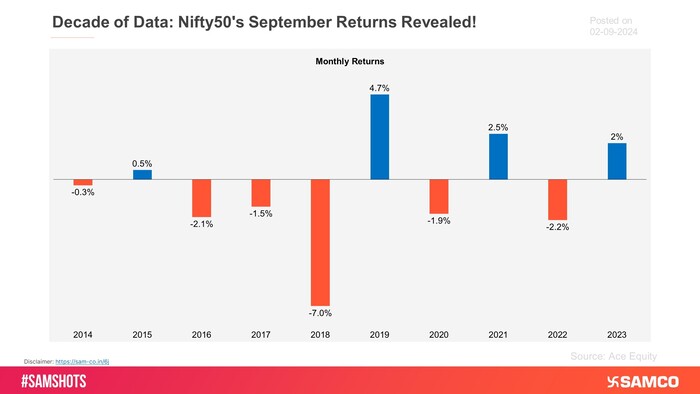

Here’s how Nifty 50 performed in the September month from last 1 decade:

CEAT Ltd Poised for a Major Breakout: Momentum Builds for a Bullish Surge

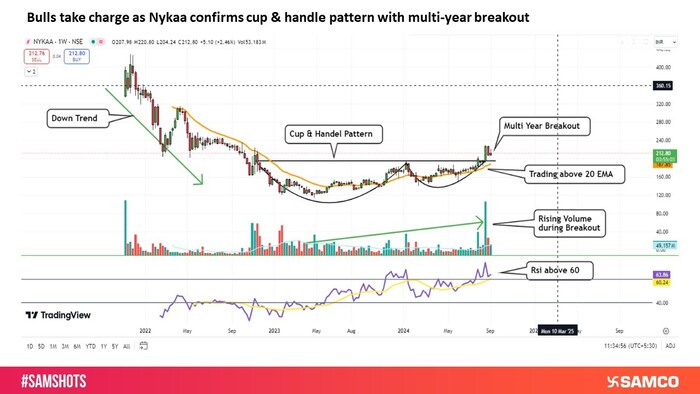

Bulls drive momentum as Nykaa confirms cup & handle pattern with multi-year breakout

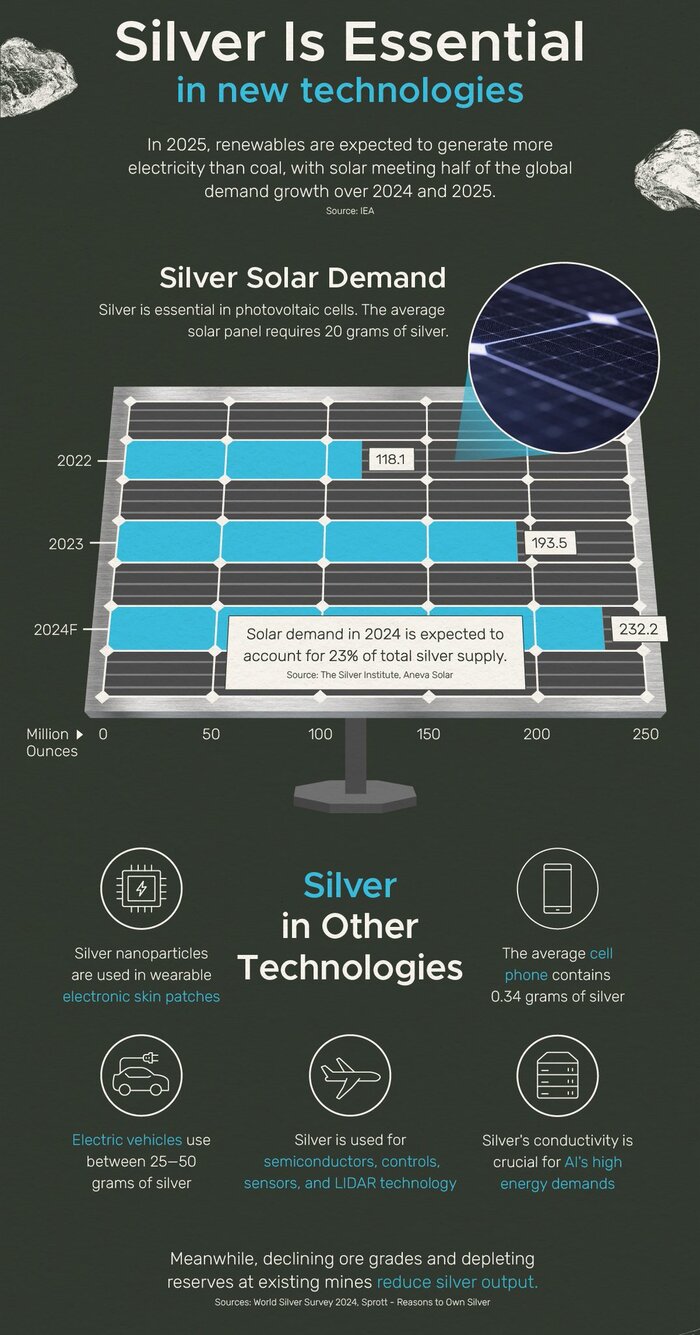

Image Source: @VisualCap (Twitter)