Bharat Immunological Biological Corporation Ltd Price Performance

- Day's Low

- ₹0

- Day's High

- ₹0

₹ 0

- 52-w low

- ₹0

- 52-w high

- ₹0

0

- Day's open

₹0 - Previous close

₹0 - VWAP

₹0 - Lower price band

₹0 - Upper price band

₹0

Today's Market Action

Its last traded stock price on BSE was 21.83 down by -1.80%. The total volume of shares on NSE and BSE combined was 67,149 shares. Its total combined turnover was Rs 0.15 crores.

Bharat Immunological Biological Corporation Ltd Medium and Long Term Market Action

The stock price of Bharat Immunological Biological Corporation Ltd is down by -100% over the last one month. Don't forget to check the full stock price history in the table below.

Bharat Immunological Biological Corporation Ltd Fundamentals

-

Market Cap (Cr): 101

-

Book Value (₹):

-

Stock P/E:

-

Revenue (Cr):

-

Total Debt (Cr):

-

Face Value (₹):

-

Roce (%):

-

ROE (%):

-

Earnings (Cr):

-

Promoter’s Holdings (%):

-

EPS (₹):

-

Debt to Equity:

-

Dividend Yield (%):

-

Cash (Cr):

Bharat Immunological Biological Corporation Ltd Mutual fund holdings and trends

| FUND NAME | Quantity | Monthly Change (Qty) |

|---|

Similar Stocks

| Company | Price | Market Cap (Cr) | P/E |

|---|

About Bharat Immunological Biological Corporation Ltd

Data not available.

Bharat Immunological Biological Corporation Ltd FAQ's

What is Share Price of Bharat Immunological Biological Corporation Ltd?

What is the Market Cap of Bharat Immunological Biological Corporation Ltd?

What is PE Ratio of Bharat Immunological Biological Corporation Ltd?

What is PB Ratio of Bharat Immunological Biological Corporation Ltd?

What is the CAGR of Bharat Immunological Biological Corporation Ltd?

How to Buy Bharat Immunological Biological Corporation Ltd Share?

Financials

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Cash Flow)

Standalone Financial Performace In Graph(Cash Flow)

News

Review

Pros

Pros

- No Data Available

Cons

Cons

Low Sustainable RoE

Low Return on Capital Employed

Poor Cash Flow Conversion

Negative operating earnings and interest coverage

Low Pricing Power & High Competition

Capital Intensive Business

Poor Working Capital Cycle

Poor Corporate Governance

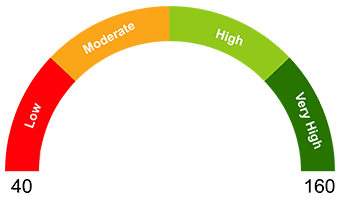

Valuation Analysis

Margin of safety

(12/03/2025)

(12/03/2025)

96

50.00%

50.00%50.00% People are bullish about Bharat Immunological Biological Corporation Ltd

50.00%

50.00%50.00 % People are bearish about Bharat Immunological Biological Corporation Ltd

What is your opinion about this Stock?

Historical Data

Bharat Immunological Biological Corporation Ltd

₹

0

(%)

Brokerage & Taxes at Samco

Brokerage & Taxes at Other traditional broker

Potential Brokerage Savings with Samco ₹ 49.62()

Top Gainers (NIFTY 50)

Stock Name Change %

Top Losers (NIFTY 50)

Stock Name Change %