Mitsu Chem Plast Ltd Price Performance

- Day's Low

- ₹0

- Day's High

- ₹0

₹ 0

- 52-w low

- ₹0

- 52-w high

- ₹0

0

- Day's open

₹0 - Previous close

₹0 - VWAP

₹0 - Lower price band

₹0 - Upper price band

₹0

Today's Market Action

Its last traded stock price on BSE was 92.19 down by -3.80%. The total volume of shares on NSE and BSE combined was 31,251 shares. Its total combined turnover was Rs 0.29 crores.

Mitsu Chem Plast Ltd Medium and Long Term Market Action

The stock price of Mitsu Chem Plast Ltd is down by -100% over the last one month. Don't forget to check the full stock price history in the table below.

Mitsu Chem Plast Ltd Fundamentals

-

Market Cap (Cr): 156

-

Book Value (₹):

-

Stock P/E:

-

Revenue (Cr):

-

Total Debt (Cr):

-

Face Value (₹):

-

Roce (%):

-

ROE (%):

-

Earnings (Cr):

-

Promoter’s Holdings (%):

-

EPS (₹):

-

Debt to Equity:

-

Dividend Yield (%):

-

Cash (Cr):

Mitsu Chem Plast Ltd Mutual fund holdings and trends

| FUND NAME | Quantity | Monthly Change (Qty) |

|---|

Similar Stocks

| Company | Price | Market Cap (Cr) | P/E |

|---|

About Mitsu Chem Plast Ltd

Data not available.

Mitsu Chem Plast Ltd FAQ's

What is Share Price of Mitsu Chem Plast Ltd?

What is the Market Cap of Mitsu Chem Plast Ltd?

What is PE Ratio of Mitsu Chem Plast Ltd?

What is PB Ratio of Mitsu Chem Plast Ltd?

What is the CAGR of Mitsu Chem Plast Ltd?

How to Buy Mitsu Chem Plast Ltd Share?

Financials

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Cash Flow)

Standalone Financial Performace In Graph(Cash Flow)

News

Review

Pros

Pros

Above Average Sustainable RoE

Cons

Cons

Low Return on Capital Employed

Poor Cash Flow Conversion

Low Interest Coverage

Highly Cyclical Industry

Low Pricing Power & High Competition

Below Average Growth Rate

Poor Corporate Governance

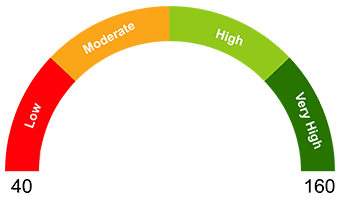

Valuation Analysis

Margin of safety

(12/03/2025)

(12/03/2025)

92

100.00%

100.00%100.00% People are bullish about Mitsu Chem Plast Ltd

0.00%

0.00%0.00 % People are bearish about Mitsu Chem Plast Ltd

What is your opinion about this Stock?

Historical Data

Mitsu Chem Plast Ltd

₹

0

(%)

Brokerage & Taxes at Samco

Brokerage & Taxes at Other traditional broker

Potential Brokerage Savings with Samco ₹ 49.62()

Top Gainers (NIFTY 50)

Stock Name Change %

Top Losers (NIFTY 50)

Stock Name Change %