UTIAMC - UTINEXT50 Price Performance

- Day's Low

- ₹66

- Day's High

- ₹67.72

₹ 67.41

- 52-w low

- ₹59.9

- 52-w high

- ₹83

67.41

- Day's open

₹67.49 - Previous close

₹65.660004 - VWAP

₹67.18 - Lower price band

₹51.71 - Upper price band

₹77.56

Today's Market Action

The last traded share price of UTIAMC - UTINEXT50 was 67.41 up by 2.67% on the NSE. Its last traded stock price on BSE was 62.66 up by 0.38%. The total volume of shares on NSE and BSE combined was 156,796 shares. Its total combined turnover was Rs 1.05 crores.

UTIAMC - UTINEXT50 Medium and Long Term Market Action

UTIAMC - UTINEXT50 hit a 52-week high of 83 on 26-09-2024 and a 52-week low of 59.9 on 03-03-2025.

The stock price of UTIAMC - UTINEXT50 is down by 0% over the last one month. It is down by -0.19% over the last one year. Don't forget to check the full stock price history in the table below.

UTIAMC - UTINEXT50 Fundamentals

-

Market Cap (Cr):

-

Book Value (₹):

-

Stock P/E:

-

Revenue (Cr):

-

Total Debt (Cr):

-

Face Value (₹):

-

Roce (%):

-

ROE (%):

-

Earnings (Cr):

-

Promoter’s Holdings (%):

-

EPS (₹):

-

Debt to Equity:

-

Dividend Yield (%):

-

Cash (Cr):

UTIAMC - UTINEXT50 Mutual fund holdings and trends

| FUND NAME | Quantity | Monthly Change (Qty) |

|---|

Similar Stocks

| Company | Price | Market Cap (Cr) | P/E |

|---|

About UTIAMC - UTINEXT50

Data not available.

UTIAMC - UTINEXT50 FAQ's

What is Share Price of UTIAMC - UTINEXT50?

What is the Market Cap of UTIAMC - UTINEXT50?

What is PE Ratio of UTIAMC - UTINEXT50?

What is PB Ratio of UTIAMC - UTINEXT50?

What is the CAGR of UTIAMC - UTINEXT50?

How to Buy UTIAMC - UTINEXT50 Share?

Financials

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Cash Flow)

Standalone Financial Performace In Graph(Cash Flow)

News

Review

Pros

Pros

- No Data Available

Cons

Cons

- No Data Available

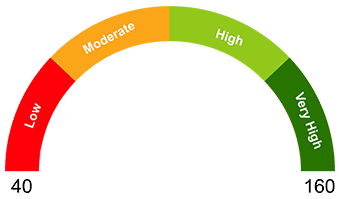

Valuation Analysis

Margin of safety

(15/04/2025)

(15/04/2025)

0

66.67%

66.67%66.67% People are bullish about UTIAMC - UTINEXT50

33.33%

33.33%33.33 % People are bearish about UTIAMC - UTINEXT50

What is your opinion about this Stock?

Historical Data

UTIAMC - UTINEXT50

₹

67.41

+1.75

(2.67%)

Brokerage & Taxes at Samco

Brokerage & Taxes at Other traditional broker

Potential Brokerage Savings with Samco ₹ 49.62()

Top Gainers (NIFTY 50)

Stock Name Change %

Top Losers (NIFTY 50)

Stock Name Change %