Whenever you think of opening a Demat account, you are often asked one question… Do you wish to open a demat account with a discount broker or a traditional broker? And instantly you start wondering, what is the difference between a discount broker and a traditional broker? Which type of broker will offer the lowest brokerage? And most importantly, who is the best discount broker in India?

In this article we will find answers to all of these questions and we will also tell you how opening a demat account with a discount broker is beneficial. Let’s begin.

In this article:

» What is a discount broker?

-

» What is the difference between traditional and discount brokers?

-

» How did the concept of discount broking emerge?

-

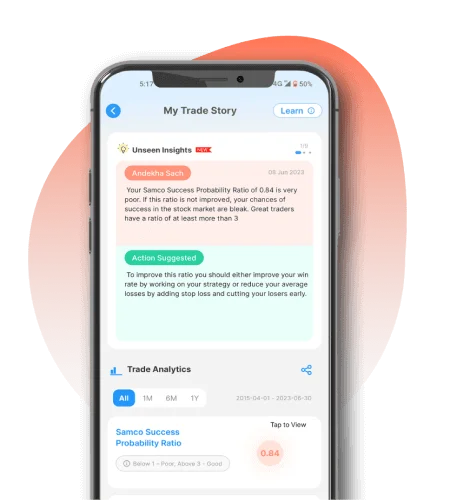

» What makes Samco the best discount broker in India?

The broking industry is broadly divided into two sub-segments:

- Traditional full-service brokers

- Low-cost discount brokers

A traditional broker is one who offers research and advisory services to its customers. As they offer this premium service, they charge percentage based brokerage. Higher the volume of your transaction, higher the brokerage charged. So, when you trade with a traditional broker, you end up paying a big piece of your profit in the form of brokerage.

This is where discount brokers came into existence and changed the entire broking model by charging a nominal flat fee per transaction.

What is a Discount Broker?

A discount broker is the one who executes buy and sell orders at an extremely low or flat brokerage as compared to traditional brokers. They can provide these services at a low cost because they leverage technology, do not invest in branches and use digital platforms to fulfil customer needs. Hence they can easily pass on all the cost saved to the customer in the form of reduced brokerage.

Discount brokers are also known as online discount brokers as they entrust the complete responsibility and authority of the customer’s account to the customer himself. They do this by envisioning and creating sophisticated, efficient, easy-to-use digital platforms. They also eliminate any middlemen leading to reduced costs for the broker and increased savings for the investor.

Since the brokerage charges are low or discounted, they are termed as discount brokers. Since the investment activity can be conducted by the investors online through digital platforms, they are also termed as online discount brokers.

Samco Securities is one of India’s best discount brokers, as awarded by CNBC. Open a free online discount brokerage account with Samco Securities, a leading online discount broker in India, and get unlimited cashback for the 1st month!

[Suggested Reading: Why Trade Stocks at Samco]

Discount brokers have evolved over the years and provided services which are at par or better in some cases from traditional brokers. Online discount brokers also offer a lot of training material and videos to help customers learn, navigate thorough mechanics of digital platforms, and invest without any discrepancies.

Now let’s understand how did discount brokers come into existence?

How did the concept of discount broking emerge?

Before the emergence of technology, people used to open a demat account with a traditional broker and used to trade by visiting the broker’s branch. And obviously, these services used to be costly and hence only the wealthy could afford to invest in the stock market.

However, the internet has bought an explosion of discount brokers that allow individuals to invest in the stock markets with little capital and make good profits by paying low brokerage. As the entire process is hassle free, almost every individual has access to invest in the stock market.

So, on 1st May, 1975, the SEC (Securities Market regulator) in the US permitted free market commission rates for stock trading transactions. Soon, Charles Schwab aligned its business to the new regulations and went on to set up one of the world’s biggest discount brokerage firms.

By 2011, the discount broking model emerged in India as well and then began the disruption of the traditional brokerage industry. Since then many discount brokers have come into existence.

If you are looking to open a Demat account with a discount broker then you don’t need to look far, Samco is the best discount broker in India awarded by CNBC Awaaz!

To open a demat account with Samco – Click here.

How do discount brokerages like Samco charge fees and how are they different from traditional full-service brokers?

Discount brokers like Samco charge a flat fee on the number of transactions or executed orders unlike full service brokers who charge a fee on the value of each transaction.

Let’s take an example to understand this better. Let’s say you wanted to place an order for 1,000 units of Nifty futures and your friend wanted to place an order for 5,000 units of Nifty futures. You both called your traditional broker who placed the order which got executed. The amount of effort required for your broker to place the order does not change for a 1,000 unit or 5,000 units order yet the brokerage charged would be Rs. 2,400 for you and Rs. 12,000 for your friend. Despite the amount of effort involved being the same – your friend paid 5 times the brokerage that you paid. And you would get a shock if I say, you paid 120 times the brokerage that would have been paid by a Samco Client.

In today’s technology driven world, the cost borne by the broker for executing transactions is extremely low. And discount brokers like Samco have unbundled complex brokerage services to pass on the cost benefits to customers by lowering the brokerage costs per transaction.

So how would you benefit when you become a Samco customer?

Benefits of Samco’s discount brokerage services!

- Zero percentage Brokerage for Trading and investing.

- Truly discount brokerage with great savings up to 98% on brokerage as you pay Flat Rs. 20 per executed order – irrespective of order size (1 lakh or 1 crore), segment (NSE, BSE, F&O, MCX). Check out our Brokerage Savings Calculator and calculate your savings.

- Super-Fast Trading with Samco – India’s Top-Rated Mobile Trading App

- Trade all instruments – Stocks on NSE, BSE; Equity Derivatives i.e. Futures & Options on NSE; Commodity Derivatives on MCX and Currency Derivatives on NSE

- Up to 100x Leverage for trading index futures like Nifty and Bank Nifty. Check out our margin calculator.

- Up to 20x Leverage for trading options

- Up to 4x Delivery leverage with margin trading facility – one of the only discount brokers to offer this facility!

- Advanced Order types like bracket orders and cover orders.

- Advanced Trading Tools like Charting, Live news feed, price alerts and notifications!

- Multiple Trading Platforms – Mobile, Web, Trading APIs, Desktop EXE’s, etc to choose from

- Research Ideas for trading and Investing on Samco

- Ready-made portfolios for investment for creating long term wealth with StockBasket.

- Invest in IPOs (Initial Public Offering)/ FPOs/ OFS (Offer for Sale) at the click of a button.

- Trusted by over 200000+ traders and investors from over 4000+ cities in India!

- And a lot more! Check out why should you trade stocks at Samco!

What are the service differences between discount brokers & full service brokers?

- Unlike a full-service traditional broker, discount brokers like Samco don't offer dedicated research services to you. But, you can easily analyse stocks using Samco Star Ratings for free!

- Paperless and hassle free 5-minute account opening processes that eliminate paperwork and reduces costs.

Here’s a comparison table between discount brokers like Samco & traditional full-service brokers

| Comparison between discount brokers and full-service brokers | ||

|---|---|---|

| Service aspect | Samco – A Discount Broker | Traditional Full service brokers |

| Brokerage Calculation Method | Flat Fee Trading irrespective of order value | Percentage Brokerage applicable on value of transaction |

| Options Brokerage | Applicable on Executed Order – Flat Rs. 20 per order. Irrespective of quantity traded – 7500 or 75, brokerage shall be flat Rs. 20 only. | Applicable per Lot - usually Rs. 20 per lot. So if 7500 quantity of NIFTY is traded i.e. 100 lots, brokerage would be Rs. 2000/- |

| Brokerage Charges | In case of small trades, brokerage applicable is 0.5% (Delivery) / 0.05% (Intraday or Derivatives) or Rs. 20 – Whichever is lower | Minimum per share or Per Transaction Value: Usually have a minimum per share charge or minimum fee per contract |

| Margin Policies | Standardised margin policies | Relationship-based Margin Policies - Adhoc margin policies that vary from client to client |

| Branches | No Branches Available | Branches are available for offline physical support |

How does Samco operate its business model and survive after levying the lowest brokerage charges in India?

Samco is a technology driven business model with technology at the forefront of its business operations. Our constant endeavour and vision is to be the best online discount broker in India and continuously drive fintech innovation to enhance customer’s wealth creating and trading experience.

In the process, we have built a lean, agile and dynamic customer-centric organisation with low overhead costs (such as branches, expensive relationship managers, etc.) which allows us to operate at low costs and be profitable even after levying the lowest brokerage charges in India.

Also one of the largest costs for a traditional full-service broker are commission expenses that are paid to intermediaries like Authorised Person or Sub-Brokers. In an increasingly online world, access to the markets for customers is now direct and this direct access has allowed us to eliminate the intermediation costs of offering these services and completely pass on the benefit to the customer.

[Suggested Reading: How to Open an Online Share Trading Account?]

In addition to the lowest brokerage charges in India, Samco is one of the best discount brokers in India providing high leverage against a small margin. Open a Samco trading account in less than 5 minutes and enjoy the benefits of online share trading with the best discount broker in India.

By Deepika

KhudeDeepika

Khude

The author is a Certified Financial Planner (CFP) with 5 years

experience in Investment Advisory and Financial Planning. Her strength lies in

simplifying complex financial concepts with real life stories and analogies. Her goal

is to make common retail investors financially smart and

independent., Samco.in | Last Updated: Jun 21, 2022

Frequently Asked Questions on Discount Brokers

Similarly, if you are an intraday trader then your brokerage would be 0.05% or Rs. 20 whichever is lower.

Easy & quick

Easy & quick