Ethanol stocks are having the time of their lives. Ethanol stocks like Praj Industries is up by 62% in the last one year (as on July 20, 2024). Shree Renuka Sugars is another popular ethanol stock that is up by 432% in the last five years (as on July 20, 2024). Dwarikesh Sugar Industries Ltd is also a beloved ethanol stock which has rallied by 206% in the last five years (as on July 20, 2024).

So, what is up with ethanol stocks? Why are they rallying? Is this a temporary upside or will ethanol stocks be able to sustain this rally? If yes, which are the most promising ethanol stocks in India that should be on your watchlist? These are some of the questions that we will answer in this article on ethanol stocks in India. But first, here is the list of ethanol stocks in 2024 listed on the NSE and the BSE.

Ethanol Stocks - Table Of Contents

Loving the valuable content? Invite friends to Samco to explore our informative blogs. Earn voucher rewards for each successful referral. Start referring now and reap the rewards.

List of Ethanol Stocks in 2024

– Ethanol Machinery Manufacturers

Company Name | Closing Prices | Market Capitalization | Debt to Equity | PE | Return on Capital Employed (%) | Return On Equity(%) |

1356.35 | 3200.35 | 0.23 | 41.40 | 12.46 | 9.54 | |

733.15 | 9791.83 | 0.00 | 48.30 | 31.69 | 24.13 |

*Data as on July 5, 2024

List of Ethanol Stocks in 2024 – Ethanol Manufacturing Sugar Companies

Company Name | Year End | Closing Prices | Market Capitalization | Debt to Equity | PE | Return On Equity(%) | Return on Capital Employed (%) |

202303 | 646.45 | 871.20 | 1.20 | 10.10 | 11.78 | 10.69 | |

202303 | 426.60 | 7989.26 | 0.65 | 19.87 | 10.03 | 10.44 | |

202303 | 3185.80 | 3412.30 | 0.37 | 26.23 | 9.64 | 11.94 | |

202403 | 403.00 | 2751.90 | 0.49 | 12.00 | 9.67 | 11.00 | |

202303 | 9.67 | 542.59 | 0.78 | 74.35 | 4.69 | 8.40 | |

202303 | 212.44 | 539.70 | 0.69 | 16.08 | 8.66 | 10.24 | |

Dhampur Bio Organics Ltd. | 202403 | 141.76 | 763.15 | 1.03 | 19.28 | 4.65 | 5.76 |

202303 | 223.61 | 1482.27 | 0.70 | 11.00 | 16.39 | 15.21 | |

Dollex Agrotech Ltd. | 202303 | 37.60 | 65.17 | 0.86 | 13.38 | 15.96 | 12.67 |

202403 | 75.56 | 1308.69 | 0.55 | 16.76 | 10.70 | 13.77 | |

202303 | 759.05 | 8295.46 | 0.20 | 125.82 | 32.10 | 42.65 | |

202303 | 3.60 | 98.54 | 1.23 | 9.60 | 18.01 | 18.23 | |

202303 | 44.63 | 266.79 | 0.50 | 8.99 | 16.64 | 15.69 | |

202403 | 42.51 | 258.24 | 1.20 | 13.92 | 12.29 | 10.96 | |

202303 | 58.66 | 289.28 | 0.15 | 16.49 | 17.56 | 20.57 | |

M.V.K. Agro Food Product Ltd. | 202303 | 54.50 | 0.00 | 6.84 | 11.79 | 32.85 | 16.43 |

202303 | 758.90 | 448.96 | 0.91 | 9.19 | 8.12 | 8.75 | |

202403 | 122.52 | 330.29 | 1.38 | 11.25 | 9.48 | 9.49 | |

202303 | 3.10 | 39.18 | 0.19 | 101.19 | -13.67 | -14.14 | |

202403 | 522.50 | 345.51 | 0.00 | 9.59 | 9.33 | 10.35 | |

Prudential Sugar Corporation Ltd. | 202303 | 22.25 | 0.00 | 0.00 | 20.06 | 5.05 | 7.32 |

202303 | 75.13 | 127.67 | 1.59 | 18.10 | -3.50 | 5.21 | |

202303 | 24.96 | 338.25 | 0.73 | 13.71 | 13.19 | 13.83 | |

202303 | 480.00 | 21.39 | 4.54 | 8.18 | -60.68 | -6.01 | |

202303 | 37.90 | 239.60 | -78.62 | 3.70 | 0.00 | 70.86 | |

202303 | 82.97 | 1038.38 | 1.57 | 44.15 | 60.16 | 29.62 | |

202303 | 395.15 | 5949.65 | 0.34 | 22.09 | 78.33 | 57.35 | |

202303 | 349.10 | 879.46 | 1.03 | 10.07 | 23.79 | 19.13 | |

202303 | 17.34 | 271.91 | 1.39 | 22.46 | -8.71 | 8.40 |

*Data as on July 5, 2024

Now to understand the future of ethanol stocks, you must first understand what is ethanol. Why is ethanol so important? Why is the government providing subsidies and incentives to ethanol companies? The reason is simple – Ethanol is the new super fuel. It can help the country save billions of dollars in the oil import bill and conserve environment.

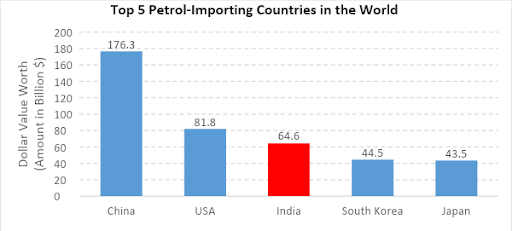

Now, there is no doubt that India is on the fast-track when it comes to economic growth and development. But the question is, at what cost? Do you know India’s current rank in the Environment Protection Index? It’s 177 out of 180! Yes, our economy is growing. But at the same time, we are causing serious damage to the environment. India’s top three cities, Mumbai, Delhi, and Kolkata feature in the list of the top 10 polluted cities in the world. Now, the government thought the answer to our environmental problems is Electric Vehicles. But there is a long way to go before affordable EVs are created. The government cannot expect us to shift to EVs overnight. Since the EV sector is still a work in progress, what is the solution? Well, the government can nip pollution in the bud by curbing the use of petrol. Did you know that India is the third highest importer of crude oil in the world!

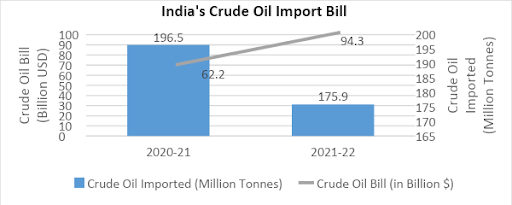

*2021-22 data is till January 2022 **Petroleum Planning and Analysis, Oil Ministry

In 2020-21, India imported 196.5 million tonnes of crude oil. Our crude oil import bill was nearly $62.2 Billion. In contrast, by January 2022, our bill is already worth $94.3 Billion! And the situation is bound to worsen further. The ongoing Russia-Ukraine war has led to a sharp increase in crude oil prices. Add to this, the ban on Russian oil by major economies of the world. The price of crude oil in the international market touched $130 per barrel, which is the highest since 2008. Now please understand this… oil marketing companies import crude oil from the international markets. This crude oil is then refined and processed to extract petroleum and diesel. So, when the price of crude oil increases, it leads to an increase in the price of petrol and diesel. This is where Ethanol comes in the picture.

What is Ethanol?

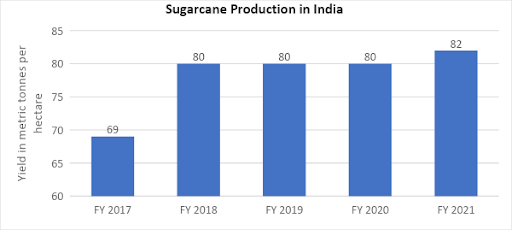

Ethanol is a renewable fuel made from plant materials called bio-mass. Food grains, grass, trees, sawdust, agricultural and forestry residues etc. are used to produce ethanol fuel. But the easiest way to create ethanol fuel is by using crops with high sugar content like sugarcane, corn, sorghum, barley, sugar beets etc. Now earlier, sugar companies would extract the juice from sugarcane and the cane would go to waste. But now, this cane is passed through distilleries to create ethanol. So, sugar and sugar companies are critical to the production of ethanol. Now the great news is that sugarcane production in India is on the rise. In the financial year 2017, India’s annual yield of sugarcane was 69 metric tonnes per hectare. This increased to 82 metric tonnes per hectare in FY 2021. This signals a 3.51% annual increase in sugarcane production.

*Source: Statista

This positive growth in the production of sugarcane is doing wonders for the ethanol producing companies. In 2016-17, nearly 66.5 crore litres of ethanol was produced in India. This number increased to 173 crore litres by 2019-20. In 2021, roughly 335 crore litres of ethanol was produced in India. As per a report by the International Energy Agency, India is set to become the third-largest producer of ethanol in the world by 2026. And who will benefit from this growth? Ethanol and sugar companies! While we are on the topic of sugar stocks, check out this video on sugar stocks and the reason behind their recent rally in them. Now we believe that ethanol stocks will be a big theme playing out in the coming years. Why do we think so? Well, mostly because of the government and its efforts to lower the crude oil import bill. The government is now aggressively looking for solutions to reduce our carbon emissions. The government plans to go net zero emissions by 2070. And who will help the government achieve this target? The Electric Vehicle, Ethanol and Sugar Sector. We have already covered the EV sector in detail in our previous article. Did you read it yet? If not, here’s the link to our comprehensive coverage of the EV sector in India.

Here are a few measures taken by the government to uplift the ethanol sector in India. The government is pushing to replace petroleum with Ethanol Blended Petrol (EBP). In 2014, the government had set an ethanol blending target of 1%. This was mandatorily increased to 5% in 2018-19. But now the government has launched an E-20 fuel program. The aim is to achieve 20% ethanol blending by 2025. To ensure that these targets are met on time, the government has announced special subsidies for ethanol and sugar companies.

- Sugar companies can now set up ethanol pumps to utilise their cane stock.

- In 2021, subsidies worth Rs 3,000 - Rs 6,000 were given to ethanol and sugar companies.

- The government is helping sugar and oil marketing companies in setting up distilleries to produce 1st generation ethanol.

- The government is also providing capital subsidy of 25% of investment made in fixed capital - up to Rs 10 crore for Micro Small and Medium Enterprises (MSMEs) and Rs 50 crore for non-MSMEs.

- The government has also asked car manufacturers to start producing Flex Fuel Vehicles (FFV), which can run on 100% petrol or 100% bio-ethanol. In fact, Bajaj Auto and TVS Motors have already started working on FFVs and might launch them in the coming six months to a year.

With such enticing government incentives, ethanol stocks will be a big theme in the coming years. So, now the only question left is, which ethanol stocks should you buy in 2024? Well the wait is finally over. Here are the four ethanol stocks that could be big in the coming years.

Check out our video on the 4 best ethanol stocks in 2024

List of Best Ethanol Stocks in 2024

Ethanol Stock #1: Praj Industries Ltd.

Praj Industries Ltd is one of the most promising ethanol stock in 2024. It is a market leader in the domestic ethanol plant and distilleries installation business. The company also has international presence with over 750 references in more than 70 countries. Praj industries is in the process of launching India’s first 2nd generation ethanol plant for Indian Oil Corporation Ltd. The company has recently launched its patented technology, which will allow it to store sugarcane juice for 12 months. So, sugar companies will be able to produce ethanol throughout the year. The company even managed to commission 11 ethanol plans during the lockdown.

Key Financials of Praj Industries as on July 5, 2024

Market Cap (Cr): Rs 9,901 | Face Value (₹): 2 | EPS (₹): 14.77 |

Book Value (₹): 60.6 | ROCE (%): 31 | Debt to Equity: 0.03 |

Stock P/E: 36.5 | ROE (%): 23.7 | Dividend Yield (%): 0.84 |

Ethanol Stock #2: ISGEC Heavy Engineering Ltd.

ISGEC Heavy Engineering Ltd is another ethanol stock which has been making news. It is engaged in manufacturing and installation of sugar plants, distilleries, boilers etc. The company generated a total revenue of 248 crore in FY 2021. This is a 71% increase from its net profit of Rs 145 crore in March 2020. The good news is that the company’s revenue from sugar sector is 34% in March 2021. This was a mere 5% in March 2020. It has generated 10% ROE in the last three years.

Key Financials of ISGEC Heavy Industries Ltd. as on July 5, 2024

Market Cap (Cr): Rs 7,508 | Face Value (₹): 1 | EPS (₹): 35.29 |

Book Value (₹): 326 | ROCE (%): 10.7 | Debt to Equity: 0.40 |

Stock P/E: 28.9 | ROE (%): 8.83 | Dividend Yield (%): 0.29 |

Ethanol Stock #3: Dwarikesh Sugar Industries Ltd

Dwarikesh Sugar Industries Ltd. is involved in the manufacturing of sugar, ethanol, power, and sanitizers sector. It is also investing heavily in the ethanol business. In July 2021, Dwarikesh Sugar Industries announced a new ethanol plant in Uttar Pradesh. In the financial year 2020-21, it generated a revenue of Rs 16,067 crores from the ethanol business. The revenue from the distillery business increased to 187% in March 2021 from 54% in March 2020. It has managed to generate a healthy ROE of 18% in the last three years.

Key Financials of Dwarikesh Sugar Industries Ltd. as on July 5, 2024

Market Cap (Cr): Rs 1,625 | Face Value (₹): 1 | EPS (₹): -0.56 |

Book Value (₹): 42 | ROCE (%): 15.5 | Debt to Equity: 0.34 |

Stock P/E: 15 | ROE (%): 14.9 | Dividend Yield (%): 2.69 |

Ethanol Stock #4: Balrampur Chini Mills

Balrampur Chini Mills Ltd is one of the largest sugar companies in India with a market capitalization of Rs 7,864 crore (as of July 5, 2024). It owns and operates 10 manufacturing plants in Uttar Pradesh. Their four distilleries have a combined capacity of 520 KLPD. It is also setting up a fifth distillery of 320 KLPD at the Maizapur unit. The distillery business contributes to 10% of the company’s total revenue. In January 2021, it invested nearly Rs 2 Billion to scale up its distillery business.

Key Financials of Balrampur Chini Mills Ltd. as on July 5, 2024

Market Cap (Cr): Rs 7,864 | Face Value (₹): 1 | EPS (₹): 26.76 |

Book Value (₹): 156 | ROCE (%): 10.4 | Debt to Equity: 0.17 |

Stock P/E: 14.6 | ROE (%): 10 | Dividend Yield (%): 0.77 |

This concludes our discussion on the top ethanol stocks in 2024. With the government’s financial incentives and the overall increase in the demand for ethanol, Indian ethanol companies might just be the dark horse in the coming years. Comment and tell us what you think of ethanol stocks and their future. To know which ethanol stocks you should invest in, check out Samco Stock Page.

Open a FREE Demat account with India’s best broker Samco Securities now to enjoy best in class trading and investment ideas.

Loving the valuable content? Invite friends to Samco to explore our informative blogs. Earn voucher rewards for each successful referral. Start referring now and reap the rewards

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?