The full form of IDFC is the Infrastructure Development Finance Company. IDFC Limited was established in 1997 to finance infrastructure projects in India. In the year 2005, the company listed its shares on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). In 2014, IDFC received the approval to set up a private sector bank by the Reserve Bank of India. IDFC Bank is known for its treasury management system and expert management of client operations. To enhance its scale, IDFC bank was looking for opportunities for merger with a specialised partner. Around the same time, Capital First Ltd., a leading non-banking financial company (NBFC) leveraged India’s largest management buyout and got fresh equity of Rs 100 crores. Using this capital, they came up with a small commercial bank named Capital First Bank. To accelerate the growth of both the banks, a merger of IDFC Bank Ltd and Capital First Ltd took place in 2018. It was named as IDFC First Bank. Post-merger the bank has disbursed more than Rs 1,10,400 crores of loan. Out of which 37% of loan is provided to the retail segment. Its Net Interest Margin expanded from 1.9% to 3.0%. And has a customer base of 7.3 million.

IDFC First Bank provides the following facilities across various segments:

- Home loans, personal loans, vehicle loans, loans against property, gold loans and consumer durable loans

- Consumer banking products

- Business loans, micro enterprises loans

- Credit cards, debit cards

- Savings accounts

- Fixed deposits

- NRI banking

- Private banking

- Wealth management

- Investment banking

- Corporate banking

- Wholesale banking

- Sovereign gold bond investment

Key Personnel of IDFC First Bank:

- Managing Director and CEO: Mr. V. Vaidyanathan

- Managing Director: Vishal Mahadevia

- Independent Directors: Dr. (Mrs.) Brinda Jagirdar, Mr. Hemang Raja, Mr. Pravir Vohra, Mr. Sanjeeb Chaudhuri, Mr. S Ganesh Kumar.

Corporate Social Responsibility (CSR) by IDFC First Bank:

The bank also encourages philanthropic activities to support social causes.

- Karma First Donation program which allows customers to donate a small amount towards a social cause. The bank, in partnership with various NGOs, supports vocational training to people.

- Apart from this the bank is also extending its support to the ones who are serving the country during Covid-19 pandemic. They have started an Ask for Mask programme. This initiative provides free masks to 1.5 Lakh essential workers.

- Under the Shramik Sahayata Program they are providing financial aid to 625 daily wage workers by transferring Rs 3,000 in their bank accounts.

- They also have started a share a meal program through which they distribute 1 lakh meal packets to slum dwellers and children.

- Lastly, through their warriors on wheel program, the bank provides free commute to staff doctors, nurses etc.

Let’s look at the financial statements of IDFC First Bank.

Shareholding Pattern of IDFC First Bank:

| % | Jun 2020 | Sep 2020 | Dec 2020 | Mar 2021 |

| Promoters | 40 | 40 | 40 | 39.98 |

| FIIs | 11.31 | 11.23 | 11.57 | 11.88 |

| DIIs | 11.25 | 11.11 | 11.33 | 11.23 |

| Government | 4.61 | 4.61 | 4.61 | 4.61 |

| Public | 32.83 | 33.05 | 32.49 | 32.31 |

Profit & Loss Account of IDFC First Bank Ltd. (Figures in Rs. Crores):

| Mar 2018 | Mar 2019 | Mar 2020 | TTM | |

| Revenue | 9,098 | 12,204 | 16,240 | 15,968 |

| Expenses | 1,788 | 4,701 | 9,760 | 9,118 |

| Financing Profit | 185 | -1,240 | -3,748 | -1,735 |

| Financing Margin | 2 | -10 | -23 | -11 |

| Other Income | 1,119 | 823 | 1,722 | 2,254 |

| Interest | 7,126 | 8,743 | 10,228 | 8,585 |

| Depreciation | 168 | 2,820 | 320 | 0 |

| Profit before tax | 1,135 | -3237 | -2346 | 519 |

| Tax | 16 | 41 | -21 | 7 |

| Net Profit | 880 | -1,908 | -2,843 | 483 |

Recommended Read: Learn to Analyse Income Statement of a Company

Balance Sheet of IDFC First Bank Ltd. (Figures in Rs. Crores):

| Mar 2018 | Mar 2019 | Mar 2020 | |

| Share Capital | 3,404 | 4,782 | 4,810 |

| Reserves | 11,870 | 13,418 | 10,594 |

| Borrowings | 1,05,327 | 1,40,337 | 1,22,476 |

| Other Liabilities | 5,781 | 8,563 | 11,279 |

| Total Liabilities | 1,26,382 | 1,67,099 | 1,49,159 |

| Fixed Assets | 797 | 940 | |

| Cwip | 3 | 34 | 74 |

| Investments | 60,904 | 58,245 | 45,174 |

| Other Assets | 64,677 | 107,880 | 102,911 |

| Total Assets | 1,26,382 | 1,67,099 | 1,49,159 |

| Inventories | 0 | 0 | 0 |

| Trade Receivables | 0 | 0 | 0 |

| Cash & Bank | 4,877 | 9,526 | 4,163 |

| Loans and Advances | 7,823 | 12,155 | 13,228 |

| Trade Payables | 0 | 0 | 0 |

Recommended Read: How to Analyse a Balance Sheet of a Company

IDFC First Bank Ltd. ‘s Key Financial Ratios:

| Market Cap (Cr): Rs 35,184 | Face Value (₹): 10 | EPS (₹): 0.85 |

| Book Value (₹): 24.8 | Roce (%): 6.6 | Debt to Equity: 0.00 |

| Stock P/E: 72.8 | ROE (%): 3.14 | Dividend Yield (%): 0 |

| Revenue (Cr): 15,540 | Earnings (Cr): 0 | Cash (Cr): 0 |

| Total Debt (Cr): 0 | Promoter’s Holdings (%): 0 |

IDFC First Bank Ltd. Mutual Funds and Holdings:

| Schemes | Quantity | As on | Prev. Qty | Change (Qty) |

| Aditya Birla sun life tax relief 96-idcw payout | 38,566 | 31-05-2021 | 36,061 | +2,505 |

| Nippon India money market fund – growth plan growth option | 24,999 | 31-05-2021 | 0 | +24,999 |

| Aditya Birla sun life MNC fund-growth | 21,096 | 31-05-2021 | 19,726 | +1,370 |

| Sundaram mid cap fund regular growth | 10,681 | 31-05-2021 | 9,987 | +694 |

| Tata large and mid cap fund regular plan growth | 4,096 | 31-05-2021 | 3,830 | +266 |

| Kotak equity arbitrage fund – regular plan – growth | 2,290 | 31-05-2021 | 0 | +2,290 |

| Aditya Birla sun life bal bhavishya yojna wealth plan regular growth | 1,173 | 31-05-2021 | 1,097 | +76 |

| Edelweiss arbitrage fund growth option | 1,029 | 31-05-2021 | 0 | +1,029 |

| Quant active fund regular plan – growth | 820 | 31-05-2021 | 493 | +327 |

| Aditya Birla sun life retirement fund – the 30s plan regular growth | 566 | 31-05-2021 | 530 | +36 |

Samco’s Ratings for IDFC First Bank Ltd.: 0.5 out of 5 stars

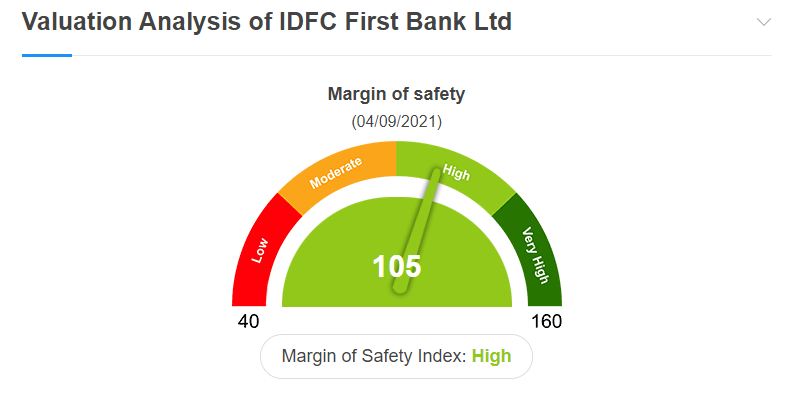

Valuation analysis:

You can easily analyse if the stock is overvalued or undervalued using margin of safety index. You can analyse the margin of safety of a stock by visiting samco’s share price page.

- High margin of safety indicates that the share price of a share is lower than its intrinsic value.

- Low margin of safety indicates that the share price is higher than its intrinsic value.

IDFC First bank has a high margin of safety.

Peer Comparison of IDFC First Bank Ltd.:

| Company | Market Cap (Rs. Cr) | P/E | Roce (%) | ROE (%) | Dividend Yield (%): |

| IDFC Bank | 35,184 | 72.8 | 6.6 | 3.14 | 0 |

| HDFC Bank | 8,21,685 | 25.8 | 6.31 | 16.5 | 0.44 |

| ICICI Bank | 4,36,866 | 23.8 | 6.04 | 15 | 0 |

| SBI | 3,75,191 | 17.4 | 4.53 | 8.21 | 0.95 |

For more information visit Samco’s share price page. Recommended reading: How to analyse banking stock? A complete guide.

Easy & quick

Easy & quick

Leave A Comment?