A demat account is a digital space where your shares, bonds and other securities are stored electronically. It works like a bank account, which holds your money instead of securities. Demat accounts have replaced physical share certificates. They have also made it faster, safer and more convenient to buy, sell and hold investments. This is the basic idea behind what a demat account is.

In today’s digital-first investing environment, having a demat account is mandatory. But before you open one, you must weigh both the benefits and the drawbacks. This article explores the advantages and disadvantages of a demat account, so you can make a well-informed decision.

What is a Demat Account?

A demat account is an electronic account that holds your financial securities. It can hold stocks, ETFs and mutual funds in digital form. Its main purpose is to eliminate the risks and inefficiencies of paper-based certificates. Simply put, it is a must-have if you want to trade. You need to learn how to use a demat account for modern investing.

While a demat account stores your shares and other securities, a trading account is used to purchase and sell them on the stock exchange. Both accounts work together. The trading account places orders, and the demat account stores what you own. Understanding this difference is key when weighing the pros and cons of a demat account.

Importance of a Demat Account

When you want to invest in the stock market, having a demat account is more than just useful — it is mandatory. To understand what the benefits of opening a demat account are, check out the key reasons it matters:

- It is Mandatory for Some Investments: Gone are the days of paperwork and physical share certificates. A demat account lets you buy, sell and hold securities entirely online. This convenience is one of the biggest advantages of a demat account for today’s tech-savvy investors.

- It Promotes Transparency and Security: With digital records, your holdings are always visible and traceable. Each transaction is logged, thus reducing the risk of fraud or loss. So, if you are wondering whether a demat account is safe, this level of security is a key part of the answer.

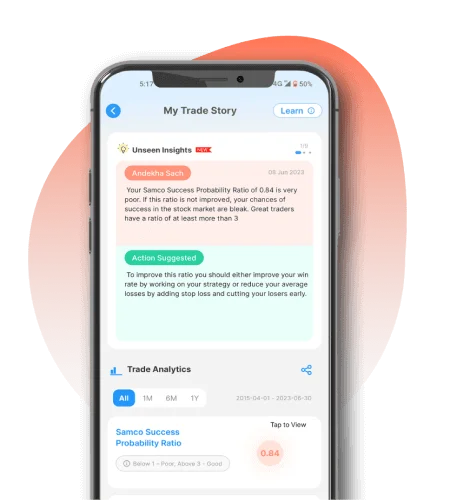

- It Helps Monitor Your Holdings: You can view your entire portfolio at a glance using your demat account and trading app. You do not need any files or folders. Real-time updates and performance tracking also make portfolio management easier, especially if you own shares across multiple sectors or asset classes.

Advantages of a Demat Account

A demat account offers multiple benefits that go beyond just storing shares digitally. From convenience to enhanced security, the advantages of a demat account make it a smart choice for any modern investor. Here are the key benefits you should know of:

- Convenience & Paperless Transactions: With a demat account, buying and selling shares is completely online. No more signing cheques or handling physical documents. For example, you can invest in stocks using your phone in just minutes. No courier or signatures are needed.

- Quick Settlements: Transactions are processed within T+1 days, depending on market rules. This means if you sell 100 shares today, the money is reflected in your account by the next working day. This ultimately makes liquidity possible more than ever before.

- Reduced Risk of Theft or Loss: With securities stored electronically, there is no risk of losing physical share certificates or facing the issue of forgery. For instance, even if you misplaced your phone or laptop, your investments can still be safe as long as you do not have your account passwords saved.

- Consolidation of Investments: You can hold all your shares, ETFs and bonds in a single demat account. This means if you have bought stocks through different brokers, they can all be monitored in one place. This makes portfolio tracking simpler.

- Easy Loan Against Securities: Banks and NBFCs allow you to pledge securities in your demat account for quick loans. For example, say you have a stock portfolio worth Rs. 5 lakhs. If you need funds urgently for a major unexpected expense, you can use your portfolio to raise capital without liquidating your assets.

- Accessibility through Multiple Devices: Your demat account is accessible from your laptop, tablet or mobile app. Whether you are travelling or working remotely, you can execute trades and track holdings from anywhere — a major advantage of a demat account for busy professionals.

- Automatic Updates: Dividends, stock splits and bonus issues are credited automatically to your demat account. For example, if a company announces a bonus issue of 1 additional share for every 2 held, it reflects in your demat account right away. There is no need to fill out extra forms or track paperwork.

Disadvantages of a Demat Account

While a demat account offers plenty of benefits, it also has some limitations. Every financial tool comes with trade-offs. To give you a balanced view of the advantages and disadvantages of a demat account, here are some downsides you should consider:

- Annual Maintenance Charges (AMC): You will need to pay a yearly fee to keep your demat account active, even if you do not use it often. This can be a burden for small or occasional investors.

- Technology Dependency: Operating a demat account requires basic comfort with online platforms and apps. If you are not tech-savvy, this could lead to mistakes or a lack of control over your investments.

- Risk of Fraud or Hacking: While regulated platforms are generally safe, digital systems are never 100% immune to cyber threats. Weak passwords or phishing scams can lead to loss of access.

- Hidden Charges: Some brokers may not clearly disclose certain transaction fees or add-on costs. If you are unaware of such hidden charges in a demat account, your actual trading cost would increase.

- Complexity for New Users: If you are just getting started, understanding how a demat and trading account work together can be confusing. Terms like DP charges, pledging and settlement often overwhelm beginners.

- Penalties for Inactive Accounts: If your account remains unused for an extended period, it may be frozen or attract penalty charges. Reactivating it often requires paperwork and extra verification formalities.

These drawbacks do not make demat accounts bad. They simply mean you need to choose your broker wisely, stay informed and understand the fee structure clearly. Knowing the pros and cons of a demat account ensures that you are not caught off guard.

Comparison Table: Demat Account vs Physical Shares

This is how physical shares and demat accounts compare with one another.

| Particulars | Demat Account | Physical Shares |

|---|---|---|

| Safety | High safety due to encrypted digital storage | Low safety as shares are prone to theft, loss and damage |

| Speed | Quick settlements in the T+1 cycle | Slower settlements due to manual processing |

| Cost | Low over the long term | High due to stamp duty and handling fees |

| Accessibility | Online access via apps and portals | Needs physical handling and submission |

| Risk | Minimal, with SEBI-regulated security layers | High, especially over long holding periods |

Who Should Open a Demat Account?

Not everyone needs to open a demat account right away. For many, however, it is a key step toward building wealth. If you are wondering who should open a demat account in India, here are the types of investors it is best suited for:

- Long-term investors

- Active traders

- SIP and mutual fund investors

- Young and digital-savvy investors

Conclusion

All in all, a demat account simplifies investing, offers security and suits various investor profiles. However, it is important to weigh the pros and cons of a demat account to make smarter choices.

Looking for a secure, easy-to-use demat account? Check out what Samco Securities offers and start your investment journey today.

Easy & quick

Easy & quick