What is the difference between Demat account and trading account? Aren’t Demat account and trading account the same thing? Can I only open a Demat account without opening a trading account? These are some of the questions that often confuse investors, especially stock market beginners. The problem is that there’s no one to give the right guidance to beginners. This makes them oblivious to the basics of the stock market.

So, while everyone knows that a Demat account is compulsory to trade in the stock markets, they have no clue what a trading account is. Can you trade in the stock market using your Demat account? If you too are overwhelmed by such questions, then we have some good news. We will provide you an in-depth explanation on the difference between Demat account and trading account. Let’s begin this Demat account vs trading account debate by understanding the meaning of Demat and trading accounts.

What is Demat account?

The term Demat is short for Dematerialization, which is the process of converting physical shares into electronic or digital form. A Demat account is like a storage unit or a bank locker in which you can store your financial assets like shares, bonds, treasury bills, mutual funds, and exchange traded funds etc. Remember, you can only store your assets in your Demat account. You cannot buy and sell financial assets using a Demat account.

What is a trading account?

While a Demat account acts like a locker, a trading account provides investors with a platform through which they can buy and sell their financial assets. A trading account is a link between a Demat account and your bank account. For example, imagine you want to buy 100 shares of Infosys Ltd. Which account will you use? Demat account or trading account? Since you want to buy or transact in the stock market, you will use your trading account. Once the buy order is executed, 100 shares of Infosys Ltd will be credited to your Demat account in trading + two working days.

What is the difference between Demat account and trading account?

The biggest difference between Demat account and trading account is the usability of these two accounts. A Demat account is used to store financial assets while a trading account is used buy and sell these financial assets.

Demat account and trading account are like two sides of a coin. But unlike a coin, you can have various combinations of Demat and trading account. Now technically, you can open a Demat account without opening a trading account. But this combination is suitable for those investors who are interested in only long-term investing. Since they will not be selling their shares in the short-term, they have no need for a trading account.

The second option is to only hold a trading account. Now since you do not have a Demat account, you cannot store your financial assets. So, your transactions will be limited to intraday and futures and options, which are cash-settled in India. But unfortunately, the Securities and Exchange Board of India (SEBI) has now made a Demat account compulsory for intraday trading as well. So, even if you do not plan on holding shares for the long-term, you must still have a Demat account.

Now another common question among beginners is if you need to open Demat and trading account with the same broker. The answer is No. You can have Demat and trading accounts with different brokers, but it isn’t recommended.

Demat vs. Trading Account

Demat and trading accounts differ from one another in many ways. Check out the differences between these two financial products, so you can understand how trading and electronic shareholding work.

- Purpose

A demat account is primarily used to hold shares and securities in the dematerialised format. It acts like a digital locker where your shares, bonds and other securities are stored electronically. On the other hand, an online trading account acts as the gateway to the financial markets by allowing you to buy or sell those securities. Simply put, you can’t trade without a trading account and you can’t hold shares electronically without a demat account.

- Transaction Support

A demat account does not offer any transaction support. Instead, it focuses on storing your assets securely in digital form. Meanwhile, a trading account is used purely for transactions like buying and selling securities in the market. While you can view your investments in a demat account, it’s the trading account that actively facilitates market activity.

- Account Updates

Demat accounts and trading accounts are updated differently. Online trading accounts are used to place orders for buying or selling shares. So, they are updated as you execute trades with the click of a button. In contrast, your demat account is updated once your trades are complete to reflect the changes in your holdings.

- Central Authority

Demat accounts are opened with a central depository like the National Securities Depository Limited (NSDL) and the Central Depository Services (India) Limited (CDSL). Trading accounts are opened with the stock exchange.

How does Demat and trading account work?

Let us now look at the flow of events when you trade in the stock markets. Ram wants to buy 100 shares of Infosys Ltd. Its share price is Rs 1,570.35 on May 09, 2022. The total value of the transaction is Rs. 1,57,035. This is how this transaction will take place –

- Ram will transfer Rs 1,57,035 from his bank account to his trading account.

- He will then login from his trading account and place a buy order on the stock exchange.

- The stock exchange will match this order and allocate shares to Ram.

- The exchange will credit 100 shares to Ram’s Demat account in T+2 days.

- Rs. 1,57,035 will be debited from Ram’s trading account and credited to the seller’s trading account.

- The 100 shares of Infosys Ltd will be stored in Ram’s Demat account.

- In the future, if Ram wants to sell his shares, then he will again login to his trading account and place a sell order.

- Once the order is matched, 100 Infosys Ltd shares will be debited (removed) from Ram’s Demat account.

- In return, he will get the sales proceeds in his trading account. He can then transfer this money back to his bank account.

In this entire transaction, stocks were debited (removed) or credited (added) to investor’s Demat account. The money is exchanging hands in the trading account. This is how these three accounts work in tandem effortlessly to execute transactions in the stock market.

How to open a Demat account?

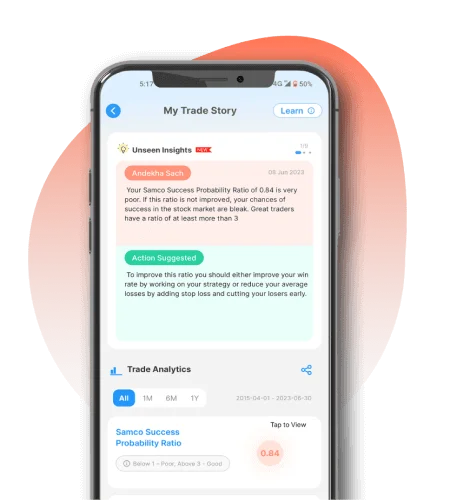

A Demat account is maintained with depositories. The two depositories in India are National Securities Depository Ltd (NSDL) and Central Depository Services Ltd (CDSL). But you don’t interact with these depositories directly. Your broker, also known as a depository participant is the vital link between you and the depository. Now when you open a Demat account, it is critical for you to evaluate your broker on the right parameters. So, don’t fall for the broker that provides the cheapest Demat and trading account. Instead look for a broker that provides you with a world class trading platform, leverage for trading, and value-added services. This is where Samco Demat account trumps all other Demat accounts. Check out the 18 reasons why Samco has the best Demat account in India.

Follow the below steps to open a Demat account with the best stockbroker in India – Samco Securities

- Visit www.samco.in and fill in the Demat account opening form.

- Complete the KYC formalities by providing details such as pancard, Aadhaar, income and occupation details, address and email id etc.

- Upload necessary documents like self-attested pancard and Aadhaar card.

- You can now sign your Demat account opening application digitally using Aadhaar based OTP. So, kindly ensure that your pancard is linked to your Aadhaar card. And that’s it! Your Samco Demat account will be operational in the next 24 hours.

Easy & quick

Easy & quick