Introduction to open a Free Demat account

Stock market beginners often wonder why they must open a Demat account. What is the need for a Demat account? Can you trade without opening a Demat account? The answer is No. Every investor, even a minor, must open a Demat account if they want to invest in the Indian stock market.

A Demat account is not just your doorway into the world of stock market. When you open a Demat account, you can also store various other financial assets like –

- Unit linked insurance policies,

- Mutual funds,

- Exchange traded funds,

- Sovereign gold bonds etc. all in one place, at a single cost.

But this is not the only benefit of opening a Demat account.

Why should you open a Free Demat account?

When you open a Demat account, you eliminate the chances of theft, forgery and loss of shares. This was a major hurdle before Dematerialisation came into effect in 1996.

When you open a Demat account, you save up on time and money spent on exchanging physical share certificates and stamp duty charges.

When you open a Demat account, you can easily access and assess your financial assets in one place, without running from pillar to post to your broker, especially during tax season.

When you open a Demat account for your minor child, you can easily segregate your investments and plan for your child’s future judiciously.

When you open a Demat account, you can be rest assured of not missing out on dividend payouts, bonus, and stock splits due to errors in company records, usually associated with physical share trading.

When you open a Demat account, you have to compulsorily set a nominee. This helps in easy transfer of shares to the legal heirs in case of an unfortunate event.

When you open a Demat account, you can avail loan against your share holdings from banks or financial institutions. This is only possible when you open a Demat account because banks do not provide loans against physical or non-Demat shares.

If you are a non-resident but want to trade in the Indian stock market, then you have to mandatorily open a Demat account.

When you open a Demat account, you can easily apply for initial public offer (IPO) using ASBA (application supported by blocked amount). This eliminates the paperwork associated with applying for an IPO. You no longer need to fill and courier the IPO application form and cheque to the company. All you need to do is open a Demat account and you are sorted.

When you open a Demat account, you can buy digital gold, gold ETFs and sovereign gold bonds without owning and worrying about storing physical gold.

When you open a Demat account, you can track the latest market value of your ULIPs. This means that you don’t have to call your insurance agent every time to find the latest value of your investment. You can simply check your Demat account statement.

When you open a Demat account, you can invest in mutual funds at one go, without logging onto multiple mutual fund websites.

When you open a Demat account, you can also invest in money market instruments like Treasury Bills, Certificates of Deposits, and Commercial Papers etc. You can also invest in these assets without a Demat account. But then you will have to go through the tedious physical form filling process. So, the best option is to simply open a Demat account.

Key participants of a Demat account

These are a few of the million benefits of opening a Demat account. Now the next natural question is, how do you open this magical thing called a Demat account? We will get to this shortly. But before that, let us look at some key components related to a Demat account.

Depository Participant (DP): This is a fancy term for your broker. You open a Demat account with your broker. He also provides you with a trading platform using which you can place trades in the stock market. A Depository participant or broker links you, an investor, with the depositories.

Depository: A Depository is an entity or institution which holds financial assets in Demat or electronic form. There are two depositories in India – Central Depository Services Ltd. (CDSL) and National Securities Depository Ltd. Between the two of them, they hold and manage nearly 8.9 crore Demat accounts.

Trading Account: This might surprise you but Demat and Trading are not the same. A Demat account can only store your financial assets. To buy and sell these assets, you will need a trading account. Learn other differences between a Demat and Trading account here.

Now that you understand these basics, let us see the steps to open a Demat account

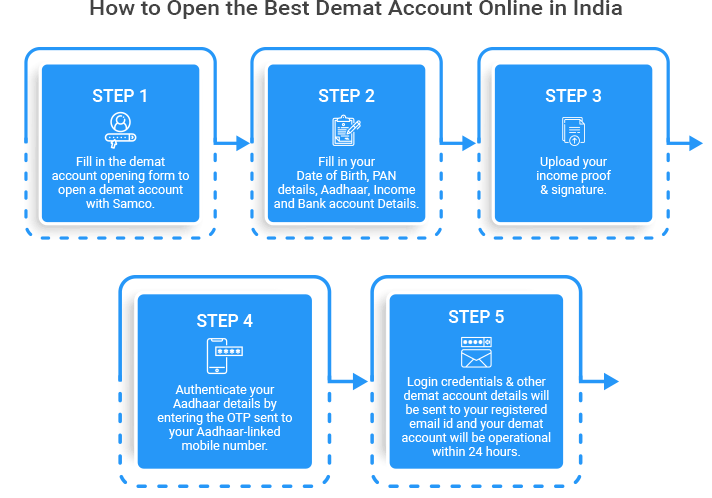

Steps to Open a Free Demat Account

Step 1: Select a depository participant: Selecting a broker is very crucial. It is a little more complicated than just selecting the cheapest broker. You must also check if your broker provides you value-added services alongside low brokerage. For example – Samco Securities is one of the best brokers in India. This is because with a Samco Demat account you get free access to StockBasket, RankMF etc. You also get detailed research and stock rating with Samco Stock Ratings. That too for FREE! So, select your broker and Demat account wisely..

Step 2: Complete the enrollment formalities: To open a Demat account, you need to fill in the account opening form and provide self-attested documents. A pancard is mandatory for opening a Demat account in India.

Step 3: IPV Verification: Post completing the enrollment formalities, you will have to undergo an ‘in-person-verification’ process. You will also be provided with the detailed terms and conditions, brokerage charges for your approval and records.

Step 4: Account is opened and functional: On successful processing of all the documents, your Demat account will be opened within 24-48 hours and you will be provided with a client id and other details to access your Demat account.

Documents Required to Open a Demat Account

- Mandatory document: Pancard

- Identity proof: Aadhaar card

- Income proof: 3-month salary slip or 6 months bank statements or Income tax return if you want to trade in the futures and options segment.

- Bank proof: Cancelled cheque

- Verification: Signature

Samco - The Leading Equity Broker in India

A Demat account has multiple hidden charges, annual maintenance charges etc. which can erode your overall portfolio returns. Hence it is important to select a broker that provides the best Demat account with the lowest brokerage.

[ Suggested Reading: 18 Reasons Why Samco provides the best Demat account in India ]

Let us understand how Samco increases your portfolio returns by offering one of the lowest brokerage charges in India.

| Brokerage & other charges | What Others charge | |

|---|---|---|

| Buy Price | 500 | 500 |

| Sell Price | 510 | 510 |

| Quantity purchased | 1,000 | 1,000 |

| Profit Earned | 10,000 | 10,000 |

| Brokerage Paid | 5,050 | 40 |

| GST | 914.91 | 13.11 |

| Total GST + Charges | 7,110.75 | 1,198.95 |

| Net Profit | 2,889.25 | 8,801.05 |

| Brokerage Saved | NIL | 5,010 |

As evident in the above table, due to Samco’s low brokerage charges, your net profit rose from Rs 2,889.25 to Rs 8,801.05, a saving of a whopping Rs 5,010.

Open a free Demat account with Samco today and get started on your wealth creation journey now!

Key Features of Opening a Free Demat Account with Samco

Samco is one of India’s leading equity brokers and provides the best Demat account in India. The benefits of opening a Demat account with India’s best equity broker Samco are:

- Free online trading account linked to Demat account

- Free annual maintenance charge for the first year

- Rated India’s Best Equity Stockbroker by CNBC-Awaaz

- Get Margin against shares held in Demat account with StockPlus.

- Low cost zero % brokerage with trading at flat Rs.20 per order.

- Investing in mutual funds in Demat form

- Equity delivery leverage – 4x equity delivery leverage

- Intraday leverage – 33x for equity & equity derivatives, 100x for currency derivatives

- Trading and investing ideas with Samco – India's best mobile trading app

- Instant updates for all stock holdings with Samco App.

- Margin pledging for trading limits.

- Expert-curated ready-made portfolios with StockBasket for FREE!

- Expert, unbiased advice on which are the best mutual funds in India with RankMF.

- Real-time trading and investment ideas with KyaTrade.

By Deepika

KhudeDeepika

Khude

The author is a Certified Financial Planner (CFP) with 5 years

experience in Investment Advisory and Financial Planning. Her strength lies in

simplifying complex financial concepts with real life stories and analogies. Her goal

is to make common retail investors financially smart and

independent., Samco.in | Last Updated: Jun 21, 2022

Easy & quick

Easy & quick