Step By Step Guide on How to Open a Demat Account

How to open a Demat account? What are the documents required to open a Demat account? How to open a Demat account for a minor? How to open a Demat account for a Hindu Undivided Family (HUF)? Were you looking for answers to any of these questions? If your answer is yes, then congratulations as you have stumbled on to the right page. This article shows you how to open a Demat account whether you are a major, minor or a HUF.

But before we tell you how to open a Demat account, the first question you must ask is, ‘why should you open a Demat account?’ The answer is simple – You have to open a Demat account if you want to invest in the Indian stock markets. Yes, you heard that right. You cannot buy or invest in shares of your favorite companies without a Demat account.

So, exactly what does a Demat account do? A Demat or Dematerialised account is a virtual locker that stores all your financial assets in electronic or digital form. A Demat account enables you to buy and sell securities at the click of a button without tedious paperwork. Now you must be wondering that opening a Demat account just to store shares seems a bit much. But a Demat account does much more than that. It also stores assets like - mutual funds, government bonds, debentures, exchange-traded funds, unit-linked insurance policies, etc. So, when you open a Demat account, you get a one-stop-storage for all your financial assets.

Now there is a recurring query relating to how to open a Demat account. Investors want to know if they must also open a trading account. So, when should you open a Demat and trading account? Let’s decipher this.

- When to open only a Demat account – You should only open a Demat account, without a trading account if you never want to sell your shares. So, if you invest in IPOs and want to hold the shares till perpetuity, then you do not need a trading account. A simple Demat account will suffice.

- When to open only a trading account – You can open a trading account without a Demat account, if you never want to take delivery of shares. So, if you trade in the futures and options (F&O) segment only, then you don’t need a Demat account. A trading account will be enough.

But remember, if you want to do intraday trading, then you compulsorily need a Demat account, even though you are not taking delivery of shares.

So, now you understand why and when you need to open Demat and trading accounts. But your job isn’t done yet. The next question important is, ‘who should you open a Demat account with?

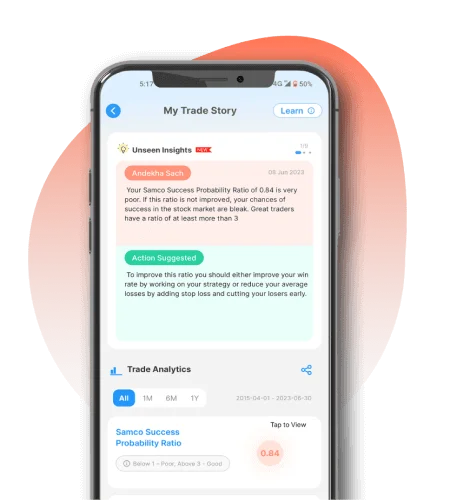

The Indian market is overflowing with so-called ‘best Demat accounts’. Every new broker offers lowest discounts and claims to having the best Demat account. But there is a world of difference between the best Demat account and the cheapest Demat account. And who better to know this than Samco Securities. Samco was awarded the best equity broking house by CNBC – Awaaz.

And do you know what the best part of a Samco Demat account is? The account opening process is as smooth as butter. While most Indian stockbrokers are still stuck with lengthy paperwork and complicated account opening formalities, Samco has designed an efficient 5-minute Demat account opening process. Let us understand how to open a Demat account with Samco, the best equity stock broker in India.

Steps on How to Open a Demat Account

Step 1 - Fill in your KYC details

Visit https://www.samco.in/ and fill in your KYC details like PAN, income and occupation details, address, email ID and mobile number, bank account, and nomination details.

Step 2 - Upload your documents

Upload all the necessary KYC documents for verification.

Step 3 - Digitally sign your application

Once you complete steps 1 and 2, you will be redirected to the UIDAI Aadhaar portal where you will receive an OTP on your Aadhaar linked mobile number and email ID. Once you enter the correct OTP, your application will be automatically signed and the Demat account opening formalities would be complete.

You will soon receive the official confirmation from Samco and within 24 hours your Demat and trading account will become functional.

Documents required to open a Demat account - Individual

- PAN Card

- Photograph

- Proof of Address – Any one of driver’s license, Aadhaar card, recent electricity or telephone bill, voter ID card, or rent/lease agreements

- Bank Proof (Cancelled cheque or front page of the passbook)

- Income Proof – Bank Statement/ Demat Holdings Statement/ Form-16

- Signature (matching the signature on your Pancard)

Watch this video to understand on how to open a Demat Account

Now that we understand how to open a Demat account, let us look at the documents required by companies, HUF, and partnership firms to open a Demat account.

Documents required to open a Demat account - Non-individual investors

A Hindu Undivided Family is a separate entity wherein the assets of the family members are pooled together and the tax is paid collectively. Apart from Hindus, Jains, Buddhists and Sikhs can also form a HUF. As per taxation, the assets of the members and the HUF are taxed separately.

Documents required to open a Demat account - Hindu Undivided Family (HUF)

- PAN of HUF

- Bank pass-book/bank statement of the HUF

- KYC Details of the Karta of the HUF – PAN, Proof of Address, Photograph

- In case, derivatives segment needs to be activated for HUF - 6 months bank statement / Latest ITR Copy of HUF

- A HUF account cannot be opened online and a physical application needs to be submitted. Download the physical Demat account opening form for a HUF Account here.

Important Points to note:

- Signature of all coparceners shall be required on the POA page.

- Signature of Karta shall be required on all pages of the account opening form and across photograph on form.

- Documents required to open a Demat account - Partnership firm

- Comprehensive financial statements of the firm for the past 2 years consisting of balance sheet, profit and loss statement and Income tax returns.

- For registered firms, certificate of registration is mandatory.

- Self-certified copy of partnership deed.

- List of authorised signatories along with specimen signatures on the letterhead of the partnership firm.

- KYC documents of all partners – PAN Card, Proof of address, photographs.

- Bank proof of partnership firm – Statement should be in the name of the firm.

Important Points to note:

- Signature of all partners shall be required on the POA (power of attorney) page.

- Signature of all authorised signatories shall be required on all pages of the account opening form and across photograph on form.

- A Partnership firms Demat account cannot be opened online and a physical application needs to be submitted. Download the physical account Demat Account opening form for a partnership firm from https://www.samco.in/samco-resources

Documents required to open a Demat account - Company

- Comprehensive financial statements of the Company for the past 2 years consisting of balance sheet, profit and loss statement and Income tax returns.

- Certified copy of the latest shareholding pattern of the company including details of ultimate beneficial owner (UBO) duly certified by the company secretary/full-time director/MD.

- KYC documents of full-time directors and PAN Card, Proof of address, photographs of at least 2 directors.

- KYC documents of promoters and ultimate beneficial owners – PAN Card, Proof of address, photographs.

- Certificate of incorporation.

- Memorandum and Articles of Association.

- List of authorised signatories along with specimen signatures on the letterhead of the Company.

- Certified copy of Board Resolution enabling investment in securities markets and authorizing signatories to operate the account.

- Latest Bank statement in the name of the company.

Documents required to open a Demat account - Company

- Signature of all authorised signatories shall be required on POA (power of attorney) page.

- Signature of all authorised signatories shall be required on all pages of the account opening form and across photograph on form.

- Companies’ Demat account cannot be opened online and a physical application needs to be submitted. Download the physical account Demat Account opening form for a company from https://www.samco.in/samco-resources

[ Suggested Reading: 17 Reasons Why Samco is the Best Demat Account in India ]

By Deepika Khude

Deepika Khude

The author is a Certified Financial Planner (CFP) with 5 years experience in Investment Advisory and Financial Planning. Her strength lies in simplifying complex financial concepts with real life stories and analogies. Her goal is to make common retail investors financially smart and independent.

, Samco.in | Last Updated: Jun 21, 2022

Easy & quick

Easy & quick