In recent years, derivatives have grown rapidly in India's financial markets. Derivatives are financial instruments that derive value from an underlying asset, such as a commodity, currency, stock, or bond. The importance of derivatives has increased as the country's economy has become more integrated into the global market. Derivatives have become a significant tool for Indian companies and investors to manage risks and gain exposure to various markets. To better understand the concept of derivatives, one must ask: what are derivatives?

What are Derivatives?

Derivatives are financial instruments that derive value from an underlying asset, such as stocks, bonds, commodities, or currencies. They are contracts between two parties that agree to buy or sell the underlying asset at a specified price and time in the future.

The underlying asset's price determines the value of derivatives, and they are used for various purposes, including managing risk, speculating on price movements, and taking advantage of arbitrage opportunities.

In India, derivatives trading is regulated by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). With the growth of the Indian economy and financial markets, derivatives have become increasingly important in the country's financial landscape.

Types of Derivatives

Many investors are interested in derivatives trading but often ask the question: what are derivatives and their types? The most common types of derivatives are forwards, futures, options, and swaps. This section will explain how each of these types of derivatives works, and examples will be provided of how they are used in the Indian financial market.

1. Forwards and Futures

Forwards and futures are agreements between two parties to buy or sell an underlying asset at a specified price and time in the future. The main difference between the two is that futures are traded on an exchange, while forwards are traded over-the-counter (OTC) between two parties.

Forwards work by locking in a price for the underlying asset at a future date. For example, a farmer might enter into a forward contract to sell his wheat crop at a fixed price in three months' time. This helps the farmer manage his risk by ensuring that he will receive a certain price for his crop, regardless of any fluctuations in the market price.

Futures contracts work in the same way as forwards, but they are standardized and traded on an exchange. This means that they are more liquid than forwards and can be easily bought and sold. Futures contracts also require a margin deposit, a small percentage of the total contract value the buyer or seller must pay upfront.

Futures contracts are traded on commodities such as gold, silver, and crude oil and agricultural products like wheat, soybean, and cotton. Futures contracts are also traded on currencies like the US dollar, Euro, and Japanese yen.

Options

Options give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price and time in the future. There are two types of options:

Call Options - It gives the buyer the right to buy the underlying asset.

Put options - It gives the buyer the right to sell the underlying asset.

Options work by giving the buyer the flexibility to choose whether or not to exercise the option. For example, an investor might buy a call option on a stock, giving them the authority to buy it at a fixed price in three months. If the stock price increases, the investor can exercise the option and buy the stock at the lower price specified in the option contract. If the stock price decreases, the investor can choose not to exercise the option and simply let it expire.

Options are traded on stocks, stock indices, and currencies. The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are the main exchanges where options are traded.

Swaps

Swaps are agreements between two parties to exchange cash flows based on different financial instruments. The most common types of swaps are interest rate swaps and currency swaps.

Interest rate swaps involve two parties exchanging fixed and floating interest rate payments. For example, an Indian company might enter into an interest rate swap with a bank to exchange its floating-rate debt for fixed-rate debt. This helps the company manage its interest rate risk by locking in a fixed interest rate, regardless of any fluctuations in the market interest rate.

Currency swaps involve two parties exchanging cash flows denominated in different currencies. For example, a company might enter into a currency swap with a foreign company to exchange Indian rupees for US dollars. This helps the company manage its currency risk by locking in a fixed exchange rate.

Banks, corporates, and financial institutions commonly use interest rate swaps and currency swaps to manage their risk. The RBI regulates the use of swaps in India and has issued guidelines on their use.

How do Derivatives Work?

As the Indian economy grows and develops, more investors are turning to derivatives trading. But before diving in, it's important to ask: what are derivatives, and how do they work?

- Farmers and agricultural companies use derivatives to manage their risk. For example, a farmer might enter into a futures contract for his crop to lock in a price, ensuring that he receives a certain amount for his harvest, regardless of any fluctuations in the market price. Similarly, an agricultural company might use derivatives to hedge its exposure to commodity prices, ensuring it can purchase the necessary raw materials at a predictable price.

- In the financial sector, derivatives are commonly used by banks, insurance companies, and other financial institutions to manage their risk. For example, a bank might enter into an interest rate swap to manage its exposure to changes in interest rates, while an insurance company might use derivatives to hedge its exposure to fluctuations in the stock market.

- Individual investors also use derivatives to manage risk and gain exposure to different asset classes. For example, an investor might buy a call option on a stock to gain exposure to the stock market while limiting their downside risk.

Risk and Reward of Using Derivatives

The question on many investors' minds is: what are derivatives, and what are their risks and rewards in the Indian finance industry? While derivatives can be useful for managing risk and gaining exposure to different asset classes, they also come with risks. The main risk associated with derivatives is counterparty risk, which is the risk that the other party in the transaction will not fulfill their obligations. This risk can be mitigated by using reputable counterparties and clearinghouses.

Another risk associated with derivatives is market risk, which is the risk that the underlying asset's value will change. This risk can be mitigated by carefully selecting the underlying asset and monitoring market conditions.

Despite the risks associated with derivatives, they can offer significant rewards. For example, derivatives can be used to hedge against losses, potentially saving a company or investor from financial ruin. Derivatives can also offer significant returns, allowing investors to gain exposure to different asset classes and potentially profit from market movements.

Common Uses of Derivatives

From managing risk to speculating on price movements, derivatives have become popular for various market participants.

1. Hedging

One of the most common uses of derivatives is hedging. Companies use derivatives to hedge against price or currency fluctuations. For example, a company might use a futures contract to lock in a price for a commodity, ensuring that it can purchase the commodity at a predictable price. This can be particularly useful for companies exposed to fluctuations in commodity prices, such as those in the manufacturing or agriculture sectors.

Similarly, companies exposed to currency fluctuations may use derivatives to hedge against currency risk. For example, a company that exports goods may use a currency swap to lock in an exchange rate, ensuring that it receives a predictable amount of rupees for its exports.

2. Speculation

Speculation is another common use of derivatives. Traders use derivatives to speculate on price movements with the aim of making a profit. For example, a trader might buy a call option on a stock if they believe the stock price will rise or sell a put option on a stock if they believe the stock price will remain stable or rise.

However, it is important to note that speculation in derivatives can be risky, and traders must be prepared to lose money if their predictions do not come to fruition.

3. Arbitrage

Arbitrage is the practice of taking advantage of price differences in different markets. Traders use derivatives for arbitrage opportunities, particularly in the futures markets. For example, an investor might notice that the price of a particular commodity is lower in the futures market than in the spot market. They could then buy the commodity in the futures market and sell it in the spot market for a profit.

However, arbitrage opportunities can be short-lived, and investors must be prepared to take advantage of them quickly.

Conclusion

Derivatives have become an important part of Indian finance, offering investors a range of opportunities to manage risk and potentially generate profits. As the Indian economy continues to grow and develop, derivatives will likely play an increasingly important role in the country's financial landscape.

The future outlook for derivatives in Indian finance is promising, with continued growth and innovation in the derivatives market expected. However, it is important for investors to consider the risks and rewards associated with derivatives carefully and to follow regulatory guidelines to ensure that derivatives are traded fairly and transparently.

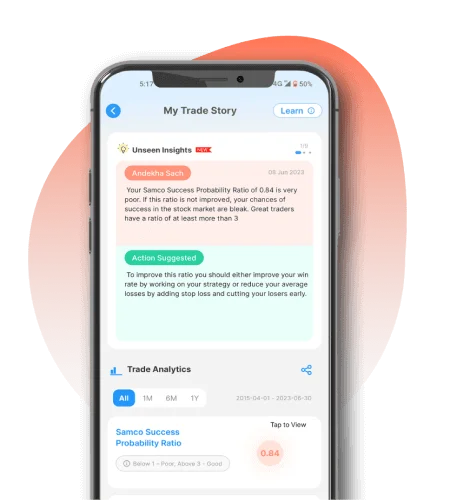

If you are interested in trading derivatives, consider using Samco as your platform. Samco offers a wide range of derivatives trading services, including futures, options, and currency derivatives, with low brokerage fees and excellent customer support.

Open a Demat account with Samco and start trading derivatives.

Easy & quick

Easy & quick