A phrase that is frequently used in the world of finance and option trading is implied volatility. It is a calculated prediction of the possible volatility of a financial asset that underlies it, such as a stock or a commodity. Although implied volatility is sometimes misinterpreted by new traders , it is a crucial idea for those who want to trade options successfully. Implied volatility plays a crucial role in setting the price of options contracts in the world of finance and options trading. It is an estimate of the range in which the price of an underlying asset might vary, given the market price of the option.

Options traders utilize thiskey indicator to evaluate the market's expectations for the future movement of an asset's price. Options traders use implied volatility to estimate their chances of making money or a favorable risk-reward ratio. It also reveals if the market considers an underlying asset to be overbought or oversold.

Calculating Implied Volatility

To assess what the market anticipates the future volatility of the underlying asset to be, implied volatility is calculated using data on options pricing. To value European-style options, a mathematical method called the Black-Scholes model is applied. This model is based on a number of factors, such as the price of the underlying asset, the time until the option expires, the strike price, the interest rate, and the dividend return. The model can figure out the possible price of an options contract based on these inputs. In doing this, the model gives a lot of weight to how volatile the underlying asset is.

Options pricing can also be used to figure out the implied volatility of the underlying asset. For this process, you need to use the Black-Scholes model to figure out how volatile the option is. If all other inputs are known, the only thing that isn't known in the Black-Scholes formula is implied volatility, which can be found by using numerical methods or models that go through a series of steps.

It's important to remember that market predictions are a big part of how implied volatility is calculated. If market expectations are high, suggested volatility will be high, and if they are low, it will be low. Several variables, like economic news, company statements, and analyst ratings, can change what people expect from the market.

Factors Affecting Implied Volatility

The level of implied volatility can be influenced by various factors, including:

Supply and Demand of Options Contracts

One of the most significant factors that can change the amount of implied volatility is the supply and demand of options contracts. When there is a lot of interest in options contracts, their prices can go up. This can make implied volatility go up. This happens because the demand for options contracts is often linked to how volatile the market thinks the underlying product will be in the future. In the same way, when there isn't much demand for options contracts, it can cause their prices to go down and implied volatility to decrease further.

Economic and Political News Affecting the Underlying Asset

Economic and political news can have a big effect on implied volatility. Positive economic news or news that has a positive effect on the underlying asset can cause more people to want the asset, which can cause its expected volatility to go up. On the other hand, negative reports about economic conditions can make things worse. In the same way, political news that affects the underlying asset, such as changes in political leadership or government policies, can also affect its implied volatility.

Company Announcements, Earnings Reports, and Analyst Ratings

Essential factors that affect an underlying asset's implied volatility are company statements, earnings reports, and analyst ratings. Positive or negative news, reports, and reviews can change how investors feel about a company, which can change the demand for its stock and, in the end, options contracts. When good news comes out, like when a company's earnings beat expectations or when it makes a big purchase, demand for the company's stock and options contracts can go up. Due to this, options contracts can have more potential volatility.

On the other hand, bad news, like bad earnings reports, product recalls, or bad analyst reviews, can make people less interested in a company's stock and options contracts. This can cause expected volatility to drop.

How Implied Volatility Affects Options Trading?

The level of implied volatility can have a significant impact on the premiums for call and put options and can influence the success of certain options trading strategies. These include:

The price of options contracts is based on implied volatility, which is a crucial component of options trading. The level of implied volatility can have a substantial impact on call and put option premiums, as well as the performance of certain options trading methods.

Relationship between Options Premiums and Implied Volatility

The options volatility smile refers to the link between option premiums and implied volatility. It is a graphical illustration of how options premiums move in relation to underlying asset volatility. When implied volatility is low, the options volatility smile is relatively flat because both in-the-money and out-of-the-money options are cheaper. As implied volatility rises, option premiums for out-of-the-money options rise faster than in-the-money options, leading the options volatility smile to widen. This is because the market expects big price volatility in the asset.

Higher Implied Volatility Indicating Higher Option Prices

Option prices rise as implied volatility rises. This is because the market anticipates larger price changes in the underlying asset, making options more lucrative. When implied volatility rises, call option prices rise and put option prices fall.

The effect of increased implied volatility on the price of an option is referred to as "vega." Vega is a measure of an option's sensitivity to changes in implied volatility. Vega is greatest for at-the-money options with longer expiration durations, and it diminishes for options that are deeper in or out of the money or have shorter expiration times.

Impact of Implied Volatility on Option Spreads and Strategies

The impact of implied volatility on option spreads and strategies can be significant. Options spread strategies like the butterfly spread and iron condor are intended to profit from variations in implied volatility. Depending on market conditions, these methods entail purchasing and selling options contracts with varying strike prices and expiration dates. Selling a call and put options when implied volatility is high and purchasing when it is low, for example, may result in lower premium costs.

Implied Volatility Strategies

Long Straddle Strategy

Buying a call and put options simultaneously at the same strike price and the expiration date is known as the straddle, and it is a common trading method. Profiting from substantial price moves in either direction is the rationale behind the straddle. If the stock price increases or decreases more than the total cost of the options, the trader benefits. When traders have strong anticipation that the stock price will experience significant volatility, the straddle approach is suitable.

Long Strangle Strategy

The difference between a strangle and a straddle is the strike price difference between the call and put options, with the put option often having a lower strike price than the call option. Traders that use the strangle method can profit from huge price changes, but because there are more possible outcomes, they are also willing to assume higher losses risks.

Iron Condor Strategy

A strategy known as an iron condor combines a bear call spread and a bull put spread. The investor often buys a cheaper call option and a cheaper put option while concurrently selling a cheaper call option and a cheaper put option that is both out of the money. The goal of this strategy is to earn a net credit from the sell options while minimizing possible losses in the event that the stock price deviates from the pre-specified range.

Butterfly Spread

A butterfly spread is a trading method in which four options with the same expiration and strike price are concurrently bought and sold. The trader purchases one in-the-money option (ITM), sells two at-the-money options (ATM), and purchases one out-of-the-money option (OTM). When the stock price is essentially static, this method is profitable. This strategy's main advantage is that it minimizes potential losses while offering substantial gains.

Conclusion

Implied volatility is a critical concept in the options market that measures market expectations for future stock price movements. Investors use implied volatility to create various strategies that can help them profit from changes in stock prices. Some of the most popular implied volatility strategies include the straddle, strangle, iron condor, and butterfly spread. However, it is important to consider market expectations, risk tolerance, time horizon, and trading costs when selecting an implied volatility strategy.

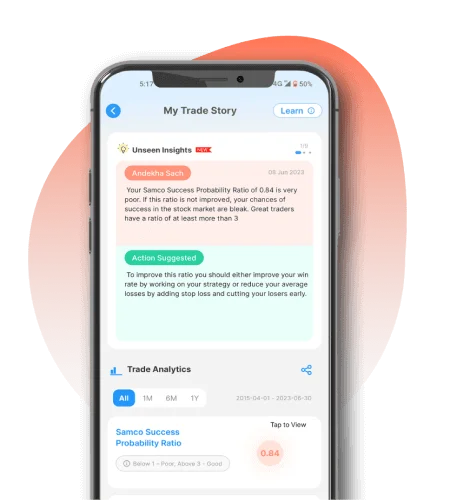

As for the Samco app, it is a popular online trading platform in India that offers a variety of features and tools to help investors make informed trading decisions. Whether you are a novice or an experienced trader, Samco offers a user-friendly interface and powerful tools to help you achieve your trading goals.Open a Demat account with Samco.

Easy & quick

Easy & quick