What is Rollover in Futures Trading? Definition, Importance & Strategy Introduction

In the world of derivatives trading, futures contracts are widely used by traders and investors to speculate or hedge against price movements in stocks, indices, and commodities. However, unlike shares, futures contracts come with an expiry date, typically on the last Thursday of every month in India. This creates a recurring situation where traders must decide whether to exit their positions or roll them over to the next contract cycle.

Rollover is a vital mechanism that ensures continuity of a trading position beyond the expiry of the current month’s futures contract. It is particularly important for positional traders who want to maintain exposure to an asset without disruption. Whether you're trading Nifty Futures, Reliance, or Tata Motors, understanding rollover is essential to manage risk, interpret market sentiment, and capitalize on arbitrage opportunities.

This article explores what rollover in futures trading means, how it works, why it matters, and how traders can use it to their advantage.

What is Rollover in Futures?

Rollover refers to the process of shifting an open futures position from the current month (near-month) contract to a future month (next-month or far-month) contract before the current contract expires.

Futures contracts in India are available in three series at any given point:

- Near-month (current month)

- Next-month (following month)

- Far-month (third month)

When traders want to maintain their positions beyond the expiry of the current contract, they exit the existing position and enter a new position in the next available month. This is called rolling over the position.

Let’s say you hold a long position in Nifty Futures (May contract) and don’t want to square off at expiry. You can sell the May futures before expiry and simultaneously buy the June contract — this transition is the rollover.

This process ensures:

- No physical settlement occurs (as Indian stock futures are cash-settled)

- Position continuity without exposure lapse

- Flexibility in trading strategy across contract months

Rollovers happen actively in the last 3-5 days of expiry week, especially on the expiry day when liquidity is high.

Why is Rollover Done?

Rollover in futures trading is done for several practical reasons:

1. Avoiding Physical or Cash Settlement

In India, futures contracts are cash-settled. However, traders often prefer to continue their exposure in a stock or index. By rolling over, they avoid settling the contract and can maintain the position seamlessly into the next expiry cycle.

2. Maintaining Exposure

Investors or traders with a bullish or bearish outlook may not want to close their trades just because the contract is expiring. Rollover helps them retain exposure to price movements without disruption.

3. Institutional and FII Activity

Many institutional traders and foreign institutional investors (FIIs) roll over positions to adjust portfolio exposure across monthly cycles. The rollover data from these participants often acts as a market sentiment indicator.

4. Liquidity Benefits

Rolling over close to expiry allows traders to take advantage of the highest liquidity, ensuring minimal slippage and better bid-ask spreads.

In essence, rollover is a strategy to extend positions without any break and is a critical part of futures market behavior in India.

How Rollover Works – Step-by-Step

Let’s break down the rollover process in steps:

Step 1: Monitor Expiry Date

Futures contracts in India expire on the last Thursday of every month. Traders typically begin evaluating rollover 3–5 days prior to expiry.

Step 2: Close Current Position

To roll over, the trader closes their existing position in the near-month contract (e.g., May).

For example, if you’re long May Nifty Futures, you will sell the May contract.

Step 3: Open Position in Next Month

Simultaneously, the trader opens the same position in the next-month contract (e.g., June).

So, in the above case, you would buy June Nifty Futures.

Step 4: Consider Rollover Cost

There is typically a price difference between near-month and next-month contracts. This is known as the rollover cost or cost of carry.

Example:

- May Nifty Futures: ₹25,000

- June Nifty Futures: ₹25,120

- → Rollover cost = ₹120

This difference reflects the interest, dividend expectations, and demand-supply dynamics for the next contract.

Step 5: Use Calendar Spread (Optional)

Some traders execute rollover using calendar spreads, which involves simultaneous buying and selling of futures in different expiries to minimize cost and slippage.

Understanding this mechanism is essential for effective futures trading and positioning in the Indian derivatives market.

What is Rollover Percentage?

The rollover percentage indicates the proportion of outstanding positions (Open Interest or OI) that have been rolled over to the next-month contract.

Formula:

Rollover % = (OI in Next-Month Contract / Total OI on Expiry) × 100

Example:

Rollover % = (OI in Next-Month Contract / Total OI on Expiry) × 100

- Open Interest in May contract on expiry: 1 crore shares

- OI in June contract on expiry: 80 lakh shares

- → Rollover % = (80,00,000 / 1,00,00,000) × 100 = 80%

Interpretation:

- High rollover (%) typically reflects that traders intend to carry their positions forward — potentially a sign of strong conviction.

- Low rollover (%) could mean position unwinding or a shift in sentiment.

Bullish vs Bearish Signal:

- High rollover with price increase → Bullish sentiment

- High rollover with price drop → Bearish rollover (short positions carried forward)

- Low rollover + price fall → Weak sentiment or exit

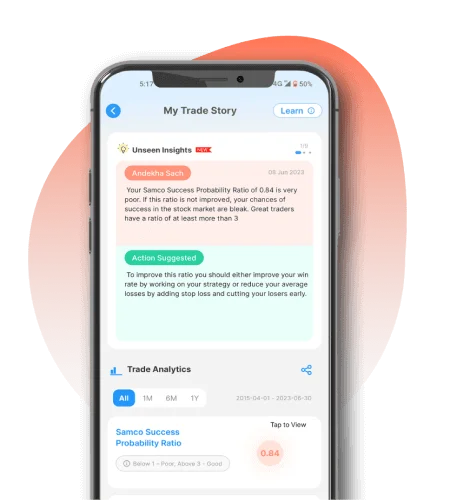

Rollover data is tracked keenly on platforms like Samco, NSE, and Moneycontrol, especially during expiry week, to gauge institutional activity and market mood.

Rollover in Index vs Stock Futures

Rollover behavior differs between index futures (like Nifty, Bank Nifty) and stock futures (like Reliance, Infosys).

Index Futures:

- Typically show high rollover percentages (70–85%)

- Dominated by FIIs and proprietary desks

- Considered liquid and less volatile

Stock Futures:

- Rollover varies by stock and sentiment

- May range from 50% to 90%

- Impacted by corporate events (results, dividends)

- See more retail and HNI activity

For example:

- Nifty may show consistent rollover near 75%

- Tata Steel may show lower rollover if corporate results or dividend events are around the corner

Understanding these differences helps in identifying institutional vs retail interest, sector rotation, and event-based positioning.

What Traders Should Know About Rollover

Here are key insights every futures trader in India should know about rollover:

1. Watch for Volatility

Expiry week and rollover days often see increased volatility due to high trading volumes and shifting positions.

2. Follow Open Interest Trends

Sharp changes in OI during rollover week can signal new position building or profit booking. Monitor OI with price movement for clearer signals.

3. Understand Cost of Carry

The premium (or discount) of the next-month contract over the near-month contract reflects the cost of carry. This can vary based on interest rates, dividends, and demand-supply.

4. Institutional Behavior

FIIs and proprietary traders dominate rollover activity in index futures. Their rollover behavior often sets the tone for the next series.

5. Arbitrage and Strategy Shifts

Rollover may also indicate strategy shifts, such as moving from bullish to neutral, or vice versa. This is particularly useful when analyzing sector rollovers.

6. Liquidity Focus

Always roll over in liquid contracts. Illiquid next-month contracts may cause slippage and widened spreads.

Being aware of these aspects helps traders make better entry, exit, and strategy decisions around expiry.

Strategies Involving Rollover

Several trading strategies revolve around or incorporate rollover:

1. Arbitrage Opportunities

When the cost of carry is unusually high or low, arbitrage traders exploit the mispricing between spot and futures or between expiry cycles.

2. Managing Long/Short Positions

Positional traders use rollover to continue directional trades without disruption. For example, rolling over a short position in Bank Nifty if bearish outlook remains.

3. Spread Trading (Calendar Spreads)

This strategy involves buying and selling futures of different expiries (e.g., long June Nifty, short July Nifty) to profit from changes in cost of carry or market view across time.

4. Event-Based Positioning

Traders often roll over positions ahead of major events like Union Budget, RBI policy, or company results, expecting volatility in the next series.

These strategies require good understanding of liquidity, slippage, and margin requirements, especially when executed close to expiry.

Platforms like Samco’s trading terminals allow seamless rollover through calendar spread features and real-time data insights.

Common Mistakes to Avoid

1. Misreading Rollover Data

A high rollover is not always bullish. Consider the price trend alongside rollover to interpret sentiment correctly.

2. Ignoring Liquidity in Next Contract

Not all contracts are liquid enough. Rolling over into a thinly traded contract can result in slippage and poor execution.

3. Overlooking Expiry Volatility

The expiry day sees high price swings due to last-minute squaring off. Avoid impulsive trades based on expiry volatility.

4. Not Accounting for Cost of Carry

Some traders roll over blindly without analyzing if the next contract offers a reasonable cost of carry or if exiting is more logical.

Avoiding these pitfalls can improve trade execution and reduce risk.

Conclusion

Understanding rollover in futures trading is crucial for anyone active in India’s derivatives market. Whether you’re managing long-term directional views or short-term trading strategies, rollover ensures continuity, flexibility, and positioning efficiency.

Beyond just a mechanical process, rollover offers deep insights into market sentiment, trader confidence, and institutional behavior. Learning to interpret rollover data — alongside open interest, cost of carry, and price action — can significantly improve your decision-making.

Samco encourages traders to use rollover analytics and expiry-week tools available on its platform to make smarter and more informed trades. With proper knowledge and strategy, rollover can be a powerful part of your futures trading toolkit.

Easy & quick

Easy & quick