Traders use futures trading, a complex financial instrument, to predict the value of commodities, currencies, and stock market indices. Futures trading offers a unique opportunity to leverage investments and hedge against price fluctuations. It is one of the most lucrative financial instruments in the market, and learning what are futures might just up your game.

Are you intrigued by the concept of futures trading? Are you struggling to begin? This comprehensive guide will provide all the information you need. Deep dive into the world of futures trading. Everything from the fundamentals to the lingo you'll need to know to get started in futures trading is here. The advantages and disadvantages of trading futures, as well as the effective trading strategies, will be covered.

What are Futures?

Futures are contracts to buy or sell an underlying asset at a specific price and date in the future. They are standardized agreements traded on organized exchanges.

Explanation of How Futures Work

- Futures contracts are legal agreements between buyers and sellers to buy or sell the underlying asset at a specified price and date in the future.

- The buyer of a futures contract must buy the underlying asset at the agreed-upon price on the specified date, while the seller is obligated to sell the asset.

- Futures contracts are settled daily, meaning that gains and losses are realized daily as the market price of the underlying asset changes.

- Futures contracts can be used for speculation or hedging purposes.

Example of a Futures Transaction

- A farmer may sell a futures contract for their crop to lock in a price and reduce the risk of price fluctuations.

- A speculator may buy a futures contract for crude oil, hoping to profit from a future increase in price.

- A company may use futures contracts to hedge against potential price changes in commodities or currencies they need for their business.

Key Terms Related to Futures

Contract Size : Futures contracts are standardized agreements that specify the quantity and quality of the underlying asset. The contract size represents the quantity of the underlying asset that is being traded. For example, in the case of crude oil futures, one contract typically represents 1,000 barrels of oil.

Contract Expiration : Futures contracts have a specific expiration date on which the contract is settled. At expiration, the buyer of a futures contract must take delivery of the underlying asset, while the seller is obligated to deliver it.

Underlying Asset : Futures contracts are based on various underlying assets, including commodities, financial instruments, and stock indices. The underlying asset determines the value of the futures contract.

Margin : To trade futures, traders must post a margin, a performance bond that serves as collateral. Margin requirements vary depending on the underlying asset and the trading venue.

Mark-to-Market : Futures traders are required to mark their positions to market daily. This means that the value of their positions is adjusted based on the current market price of the underlying asset. If the position's value falls below a certain level, the trader may be required to post an additional margin.

Open Interest : Open interest refers to the total number of outstanding futures contracts for a particular underlying asset. High open interest is often a sign of market interest and liquidity.

Settlement Price : The settlement price is the final price at which a futures contract is settled at expiration. It is often determined by taking the average prices during a specific period.

Contango and Backwardation : These terms describe the relationship between the spot price of the underlying asset and the futures price. In contango, the futures price is higher than the spot price, while in backwardation, the futures price is lower than the spot price. This relationship can affect traders and investors, particularly in the commodities markets.

Rolling Over : Traders who hold futures contracts approaching expiration may roll over their positions by closing out their current contract and opening a new one with a later expiration date. This can help to avoid the costs and complications of physical delivery.

Benefits of Futures

Leverage: Using futures contracts, traders can control a sizable portion of an underlying asset for a relatively small outlay of capital. Potential gains and losses may be amplified as a result.

Diversification: Futures trading allows investors to diversify their portfolios beyond traditional investments such as stocks and bonds. Futures contracts are available on a wide range of assets, including commodities, currencies, and stock indices.

Hedging: Futures contracts can be used to hedge against potential losses in other investments. For example, a farmer might use a futures contract to lock in a price for his crop before it is harvested, protecting against price declines.

Liquidity: Futures markets are highly liquid, meaning there are many buyers and sellers, and it is easy to enter or exit a position. This allows traders to quickly respond to market changes and adjust their positions as needed.

Price Transparency: Futures markets are highly transparent, with prices publicly available for all to see. This allows traders to make informed decisions based on market conditions and trends.

Lower Transaction Costs: Unlike other types of trading, futures trading typically has lower transaction costs, such as commissions and fees. This can make it an attractive option for traders looking to keep their costs down.

Strategies for Trading Futures

Long Futures Strategy: A long futures strategy is used when an investor believes that the underlying asset's price will rise in the future. The investor buys a futures contract at the current market price and holds it until the contract expires, at which point they can sell the contract for a profit if the price has risen.

Short Futures Strategy: A short futures strategy is used when an investor believes that the underlying asset's price will fall in the future. The investor sells a futures contract at the current market price and buys it back at a lower price before the contract expires, earning a profit from the price difference.

Spreads: Futures spreads are trading strategies that involve buying and selling two or more futures contracts simultaneously. The purpose of a spread is to profit from the price difference between the two contracts. Examples of spread trading strategies include calendar spreads, intercommodity spreads, and intra-market spreads.

Hedging: Hedging is a strategy to reduce or eliminate the risk of adverse price movements in an underlying asset. Futures contracts are often used as a hedging tool to protect against price fluctuations in commodities, currencies, and other assets. For example, a farmer might use a futures contract to lock in a price for their crop, protecting against potential price declines in the future.

Other strategies for trading futures may include breakout strategies, trend-following strategies, and mean reversion strategies. Each strategy has its own unique approach and risk profile, and traders should carefully consider their goals and risk tolerance before choosing a strategy.

How to Trade Futures?

Choosing a broker: The first step in trading futures is to select a broker. Choosing a broker registered with the relevant regulatory bodies and with a good reputation in the industry is important. Some factors to consider when selecting a broker include the broker's fees, trading platforms, research and analysis tools, customer support, and educational resources.

Placing an order: Once you have selected a broker, you can place an order to buy or sell futures contracts. Futures orders can be placed using a variety of order types, including market orders, limit orders, stop orders, and more advanced order types like bracket orders and OCO (one-cancels-other) orders. It is important to understand the different order types and how they work before placing your first trade.

Monitoring your trade: After placing a trade, it's important to monitor it closely to ensure it performs as expected. This involves keeping an eye on the market conditions and the underlying asset's price movements and monitoring any news or events that could impact the market. It's also important to manage your risk by setting stop-loss orders or using other strategies. Finally, it's important to keep track of your trades and analyze your performance over time to identify areas for improvement.

Conclusion

Understanding futures and their potential is crucial for any trader or investor interested in maximizing profits and minimizing risks. By learning about the key terms and strategies involved in futures trading, traders can take advantage of the benefits that futures offer, such as leverage, diversification, hedging, and liquidity. It is important to consider the risks involved, including the potential for significant losses, before making any trades.

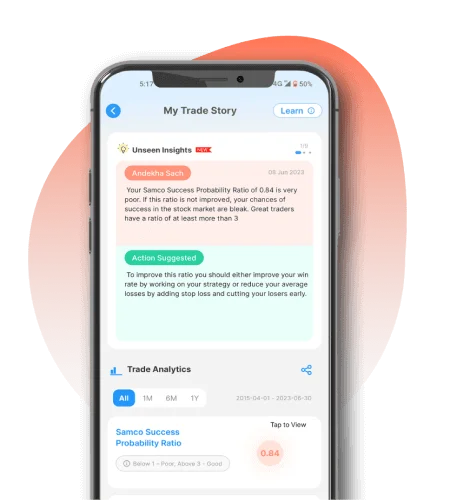

For readers interested in trading futures, we recommend choosing a reputable broker and staying up-to-date on market trends and news that could affect futures prices. And for those looking for a reliable trading app to start trading futures, Samco is an excellent choice. With its user-friendly interface, low fees, and extensive research and analysis tools, Open a Demat account with Samco as we are in top choice for traders looking to enter the futures market.

Easy & quick

Easy & quick