Margin money is a word used in finance to describe the sum of money an investor must deposit with a broker or exchange to cover all or part of the counterparty credit risk. In the stock market, using margin money has several implications, such as when funding the purchase of shares on the secondary market or the IPO market, when starting a futures trade or an option sell, or when traders start positions in intraday trading.

Margin money is a portion of the price that traders pay to the exchange as caution money or an earnest deposit to demonstrate their dedication to the trade and their commitment to keeping their word. The idea behind gathering margin money is to lower the risk. To calculate the margin against the margin account and the margin call, as well as to establish how much of the capital is supported by the broker and how much needs to be put in as margin, it is crucial to comprehend margin money.

Understanding Margin Money

Understanding margin money is essential in various financial contexts, as it plays a significant role in financing investments and protecting lenders or brokers. It differs from margin trading, which is the strategy of leveraging borrowed funds. By comprehending the concept and purpose of margin money, individuals can make informed decisions when engaging in financial transactions and managing their investment portfolios.

In real estate financing, the margin money, or down payment, demonstrates the buyer's commitment to the property purchase. It also helps determine the loan amount and interest rates offered by the lender. A higher margin money percentage generally results in lower loan amounts and better loan terms.

In securities trading, margin money enables investors to trade on borrowed funds, expanding their investment opportunities. The margin money acts as collateral for the borrowed funds and protects the broker against potential losses if the investments do not perform well. Margin money allows investors to leverage their positions and potentially earn higher returns but also exposes them to increased risks.

Difference between Margin Money and Margin Trading

While margin money and margin trading are related, they are not the same concept. Margin money refers to the initial capital or down payment provided by the borrower or trader, whereas margin trading refers to the practice of trading with borrowed funds from a broker or exchange.

Margin money is the trader's contribution or collateral, while margin trading is the strategy of utilizing leverage to amplify potential returns. Margin trading involves borrowing funds against the margin money to increase buying power, while margin money is the initial investment made by the trader.

Factors Influencing Margin Money Requirements

Margin money requirements are determined by several factors that influence the amount of initial capital or collateral needed in a financial transaction. Understanding these factors is crucial for borrowers, investors, and traders to assess the margin money requirements involved. The main factors influencing margin money requirements are:

Risk Profile of the Investment

The risk associated with an investment significantly affects margin money requirements. Higher-risk investments generally require larger margin money to mitigate potential losses. For example, investing in volatile stocks or speculative ventures may necessitate a higher margin requirement compared to investing in stable, low-risk assets.

Regulatory Guidelines and Industry Standards

Regulatory authorities and industry organizations often establish guidelines and standards for margin money requirements to maintain financial stability and protect investors. These guidelines may vary across different sectors, such as real estate, securities trading, or business financing. Compliance with these regulations ensures transparency and safeguards against excessive leverage.

Lender or Broker Policies

Lenders and brokers have their own margin money policies that dictate the requirements for borrowing or margin trading. These policies can differ based on the institution, the type of financing or trading involved, and the risk appetite of the lender or broker. Some institutions may have more lenient or stringent margin money requirements based on their risk management strategies and the specific assets being financed or traded.

Calculating Margin Money

To determine the margin money required for a transaction, a formula known as the margin requirement calculation is used. The margin requirement calculation helps establish the percentage or amount of initial capital needed as collateral. The specific formula and calculations may vary depending on the context, but a common approach involves the following steps:

Formula for Determining Margin Requirement

Margin Requirement = (Total Value of Investment) x (Margin Requirement Percentage)

The margin requirement percentage is usually determined by the lender, broker, or regulatory guidelines. It represents the portion of the total investment that must be covered by the borrower or traders margin money.

Risks Associated with Margin Money

Margin money carries certain risks that borrowers, investors, and traders need to be aware of. Understanding these risks is crucial for making informed decisions and managing potential challenges. The main risks associated with margin money are:

Magnified Losses in Case of Market Downturn

One of the primary risks of margin money is the potential for amplified losses during market downturns. When investing with borrowed funds, any decline in the value of the investment can result in greater losses than if only personal capital were at stake. Margin trading can expose traders to significant losses that exceed their initial margin money investment. It is important to consider the volatility and potential downside of the assets being traded before engaging in margin trading.

Margin Calls and Potential Liquidation of Assets

Margin calls are another risk associated with margin money. When the value of the investment declines to a certain point, known as the maintenance margin level, the lender or broker may issue a margin call. A margin call requires the borrower or trader to deposit additional funds into the account to restore the margin level or reduce exposure by selling some assets. Failure to meet a margin call can lead to the forced liquidation of assets by the lender or broker, potentially resulting in significant losses and a loss of control over one's investments.

Risk Management Strategies

To mitigate the risks associated with margin money, implementing effective risk management strategies is crucial. Here are two key risk management strategies to consider:

Setting Personal Risk Tolerance Levels

Establishing personal risk tolerance levels is an important step in managing margin money risks. It involves assessing one's financial situation, investment objectives, and comfort with potential losses. By understanding personal risk tolerance, borrowers, investors, and traders can determine an appropriate margin money amount and avoid taking on excessive leverage. It is crucial to consider one's financial capacity to handle potential losses and align investments with individual risk preferences.

Diversification and Monitoring of Investments

Diversification is a fundamental risk management strategy that can help mitigate the impact of market downturns and reduce exposure to individual assets or sectors. By spreading investments across different asset classes, industries, or geographical regions, investors can lower the risk of a single investment significantly affecting their portfolio. Regular monitoring of investments is also essential to stay informed about market conditions, evaluate performance, and make timely adjustments when necessary. Monitoring helps identify potential risks and take proactive measures to protect investments.

By implementing these risk management strategies, borrowers, investors, and traders can reduce the potential impact of market fluctuations and margin calls. They provide a framework for prudent decision-making and help safeguard against unforeseen losses.

Importance of Margin Call in Trading

A margin call is an important concept in trading, and it is crucial to understand its definition, meaning in trading, and significance. A margin call refers to a demand from a broker for a trader to deposit more funds into their margin account. It is a risk associated with margin trading. In this section, we will discuss the precise definition of a margin call, its implications in trading, and why understanding it is important.

Definition of a Margin Call

A margin call occurs when the equity percentage in an investor's margin account falls below the required amount set by the broker. In a margin account, the investor utilizes a combination of their own funds and borrowed money from the broker to purchase securities. When the equity value in the account drops below the maintenance requirement specified by the broker, a margin call is triggered. The margin call demands the trader to deposit additional funds or securities into the account to restore the equity value to the minimum level required.

Meaning in Trading

Margin trading enables investors to borrow funds to make larger investments, typically in securities such as stocks. While margin trading can potentially increase returns, it also involves significant risks due to borrowed money. The primary risk in margin trading is the possibility of a margin call. A margin call serves as a warning to investors that they need to rectify their margin account status. They may be required to deposit cash or additional securities into the account, or they may need to sell securities to increase the ratio of owned assets to the borrowed amount.

Conclusion

Understanding the concept of margin money is essential in trading, and it is crucial to grasp its meaning, benefits, and drawbacks. Utilizing margin allows investors to potentially increase their returns by buying securities with borrowed funds in addition to their own cash. However, margin trading amplifies both profits and losses, making it a riskier and more volatile strategy compared to cash-only investing. It is important for investors to be fully aware of the risks associated with using margin money and to only engage in margin trading if they have a clear understanding of these risks and are comfortable with assuming the additional risk.

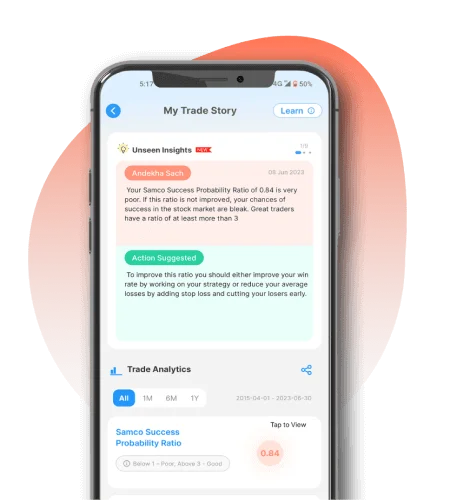

Samco app offers its clients the necessary tools and resources to manage their margin accounts and make well-informed investment choices effectively. Open a Demat account with Samco.

Easy & quick

Easy & quick